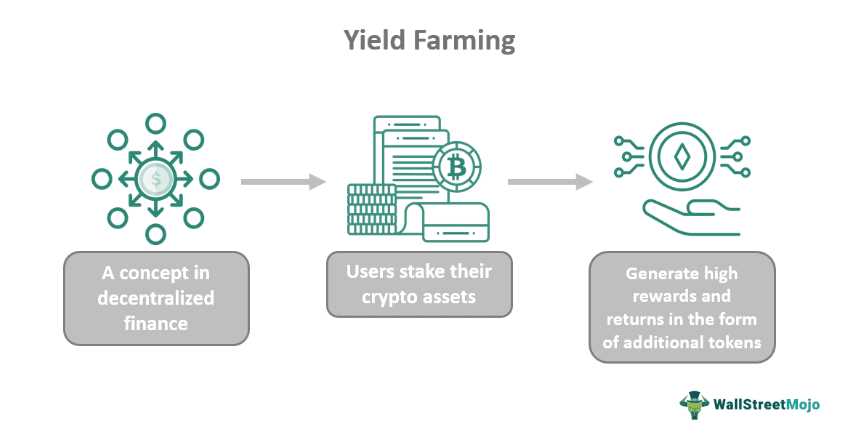

Looking to boost your cryptocurrency holdings? Yield farming on 1inch Crypto might just be the answer you’ve been searching for. It’s a revolutionary way to earn passive income and maximize your profits in the rapidly growing decentralized finance (DeFi) ecosystem.

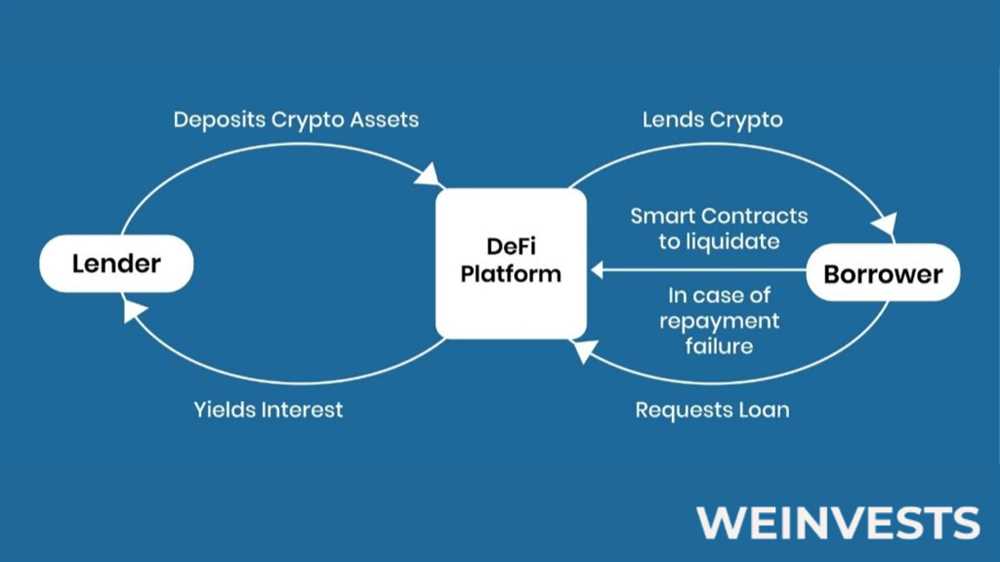

Yield farming allows you to put your crypto assets to work by lending them or providing liquidity to various decentralized platforms. It’s like staking, but with potentially higher returns and added risks. By participating in yield farming on 1inch, you can earn impressive yields on your investments and take advantage of the lucrative opportunities within the DeFi space.

But with great rewards come great risks. Yield farming is not without its challenges and potential pitfalls. The volatility of the cryptocurrency market, smart contract vulnerabilities, and impermanent loss are just a few of the risks you need to be aware of. However, with proper research, risk management, and careful selection of projects, you can mitigate these risks and make the most of your yield farming endeavors.

So, whether you’re a seasoned crypto investor or just dipping your toes into the DeFi world, yield farming on 1inch Crypto can offer you exciting opportunities for growth and financial rewards. Stay informed, be cautious, and embrace the potential rewards of this innovative investment strategy.

The Benefits and Risks of Yield Farming

Yield farming has become a popular strategy in the crypto world, offering participants the opportunity to earn passive income by staking and lending their digital assets. However, like any investment strategy, yield farming comes with its own set of benefits and risks.

Benefits:

1. High Yield Potential: Yield farming can offer significantly higher returns compared to traditional investment options. By participating in decentralized finance (DeFi) platforms, users can earn interest rates that are often much higher than what traditional banks offer.

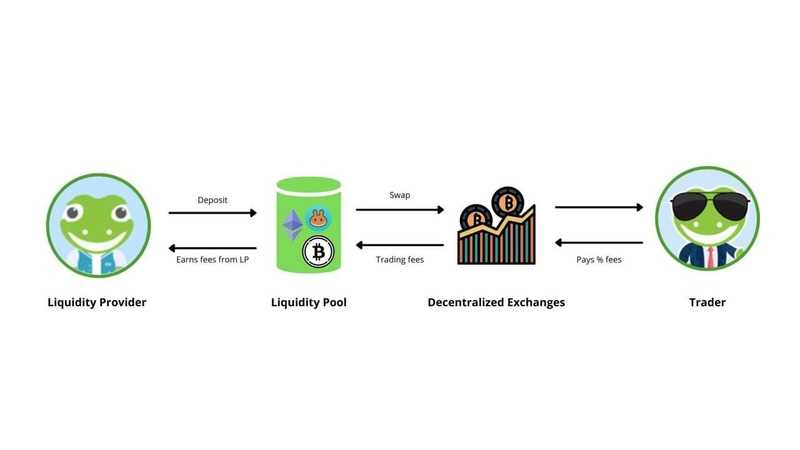

2. Liquidity Provision: Yield farming can help improve the liquidity of a cryptocurrency by incentivizing users to provide liquidity to decentralized exchanges. This increased liquidity benefits the overall market and allows for smoother trading experiences.

3. Diversification: Yield farming allows users to diversify their crypto holdings by participating in various DeFi protocols. This can help mitigate risks and potentially increase overall portfolio returns.

Risks:

1. Smart Contract Risk: Yield farming typically involves interacting with smart contracts, which are not immune to bugs or vulnerabilities. Users should be aware that there is a risk of potential hacks or exploits that could result in the loss of their funds.

2. Impermanent Loss: When providing liquidity to decentralized exchanges, there is a possibility of experiencing impermanent loss. This occurs when the value of the underlying assets in a liquidity pool fluctuates, resulting in a loss compared to holding the assets individually.

3. Market Volatility: The crypto market is known for its volatility, and yield farming is not exempt from this. Changes in the price of cryptocurrencies can impact the overall returns of yield farming strategies, potentially leading to significant losses.

It is important for participants in yield farming to thoroughly understand the risks involved and conduct proper due diligence before committing their assets. By staying informed and being cautious, individuals can make informed decisions and potentially benefit from the opportunities offered by yield farming.

Benefits of Yield Farming

Yield farming, also known as liquidity mining, offers numerous benefits to crypto investors and enthusiasts. Here are some of the key advantages:

1. High Yield Potential: Yield farming allows individuals to earn attractive yields on their cryptocurrency holdings. By providing liquidity to decentralized finance (DeFi) protocols, users can earn lucrative rewards in the form of additional tokens.

2. Passive Income: Yield farming provides an opportunity to generate passive income. Once users have deposited their funds into a liquidity pool, they can sit back and earn rewards without actively engaging in trading or other activities.

3. Diversification: Yield farming allows investors to diversify their cryptocurrency portfolio. By participating in various liquidity pools and farming strategies, individuals can spread their risk and potentially maximize their returns.

4. Access to Exclusive Tokens: Many DeFi protocols offer their own native tokens as rewards for providing liquidity. By yield farming, users can gain access to these exclusive tokens before they are listed on exchanges, allowing them to potentially benefit from early price appreciation.

5. Community Voting Rights: Some DeFi protocols provide governance tokens to yield farmers. These tokens grant holders voting rights, allowing them to participate in the decision-making process of the protocol and shape its future development.

6. Innovation and Experimentation: Yield farming encourages innovation in the DeFi space. Users can experiment with different strategies, test new protocols, and contribute to the development and improvement of decentralized finance.

Overall, yield farming offers an attractive way for crypto enthusiasts to earn rewards, diversify their portfolios, and actively participate in the growing DeFi ecosystem.

Risks of Yield Farming

While yield farming can be a lucrative investment strategy with potential high returns, it is not without its risks. It is important for investors to be aware of the potential downsides and take necessary precautions.

1. Impermanent Loss

One of the biggest risks of yield farming is the concept of impermanent loss. Impermanent loss occurs when the value of the underlying assets changes while they are staked or provided as liquidity. This can result in a loss of funds when compared to simply holding the assets. It is important to understand this risk before participating in yield farming and carefully assess the potential returns.

2. Smart Contract Risks

Yield farming often involves interacting with smart contracts, which can be vulnerable to coding bugs and security vulnerabilities. Hackers can exploit these weaknesses and potentially steal funds. It is crucial to only participate in yield farming protocols that have been thoroughly audited and are considered secure. Additionally, keeping up with the latest security practices and conducting your own research is important to mitigate this risk.

3. Market Volatility

Yield farming is highly dependent on the volatility of the market. Fluctuations in the price of the assets being farmed can impact the overall profitability. Sudden market crashes or price manipulations can result in significant losses. It is important to be prepared for market volatility and only invest what you can afford to lose.

In conclusion, while yield farming can offer potentially high returns, it is essential for investors to understand and mitigate the risks involved. By being diligent in research, understanding impermanent loss, and evaluating the security of the protocols being used, investors can reduce their exposure to risks and make more informed decisions in their yield farming endeavors.

Question-answer:

What is yield farming?

Yield farming is a cryptocurrency investment strategy that involves lending or locking up funds in decentralized finance (DeFi) platforms to earn high-interest rates or token rewards.

How does yield farming work on 1inch Crypto?

On 1inch Crypto, yield farming works by utilizing liquidity pools to provide liquidity for decentralized exchanges. Users can deposit their tokens into these pools and earn yield in the form of trading fees or governance tokens.

What are the benefits of yield farming on 1inch Crypto?

The benefits of yield farming on 1inch Crypto include the potential for high returns on investment, the ability to earn token rewards, and the opportunity to support the decentralized finance ecosystem.

Are there any risks associated with yield farming on 1inch Crypto?

Yes, there are risks associated with yield farming on 1inch Crypto. These can include impermanent loss, smart contract vulnerabilities, and potential rug pulls from fraudulent projects.

How can I mitigate the risks of yield farming on 1inch Crypto?

To mitigate the risks of yield farming on 1inch Crypto, it is important to conduct thorough research on the projects and protocols involved, diversify your investments, and stay updated on the latest developments and security measures in the decentralized finance space.