When it comes to decentralized exchanges (DEXs), the 1inch Exchange has emerged as one of the most popular platforms in the crypto community. Offering users the ability to trade a wide range of tokens directly from their wallets, this DEX has garnered attention for its user-friendly interface and extensive selection of supported tokens. However, what sets the 1inch Exchange apart from other DEXs is its unique and powerful limit order functionality.

So, what exactly is a limit order? In simple terms, a limit order allows users to place an order to buy or sell a specific token at a predetermined price. Unlike market orders, which are executed immediately at the current market price, limit orders give users more control over their trades. With a limit order, users can set the price at which they are willing to buy or sell a token, and the trade will only be executed if the market reaches that price.

The 1inch Exchange takes this concept a step further by integrating limit orders directly into its platform. Users can easily access this functionality through the 1inch Exchange app and take advantage of the benefits it offers. With the limit order functionality, users can set their desired price for a token, and the 1inch Exchange will automatically execute the trade when the market reaches that price.

Not only does the 1inch Exchange’s limit order functionality provide users with more control over their trades, but it also helps them take advantage of market opportunities. By setting a limit order, users can capture favorable price movements even when they are not actively monitoring the market. This feature is especially useful for traders who want to implement specific trading strategies or for those who prefer not to constantly monitor the market for price fluctuations.

Understanding the Limit Order Functionality

The 1inch exchange app offers a powerful feature known as the limit order functionality. This functionality allows users to set specific conditions for executing their trades, ensuring that they get the best possible price for their transactions.

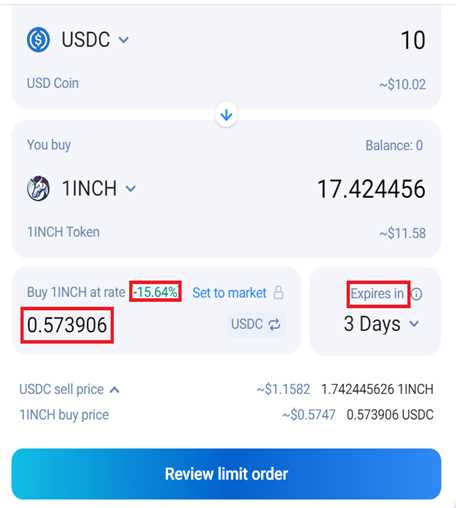

When placing a limit order, users can specify the desired price at which they want to buy or sell a particular cryptocurrency. If the market price reaches the specified limit, the order will be executed automatically. Until then, the order remains open and pending.

Limit orders are particularly useful for active traders who want to take advantage of price fluctuations and set specific entry or exit points for their trades. By using limit orders, traders can avoid the need to constantly monitor the market and manually execute their trades.

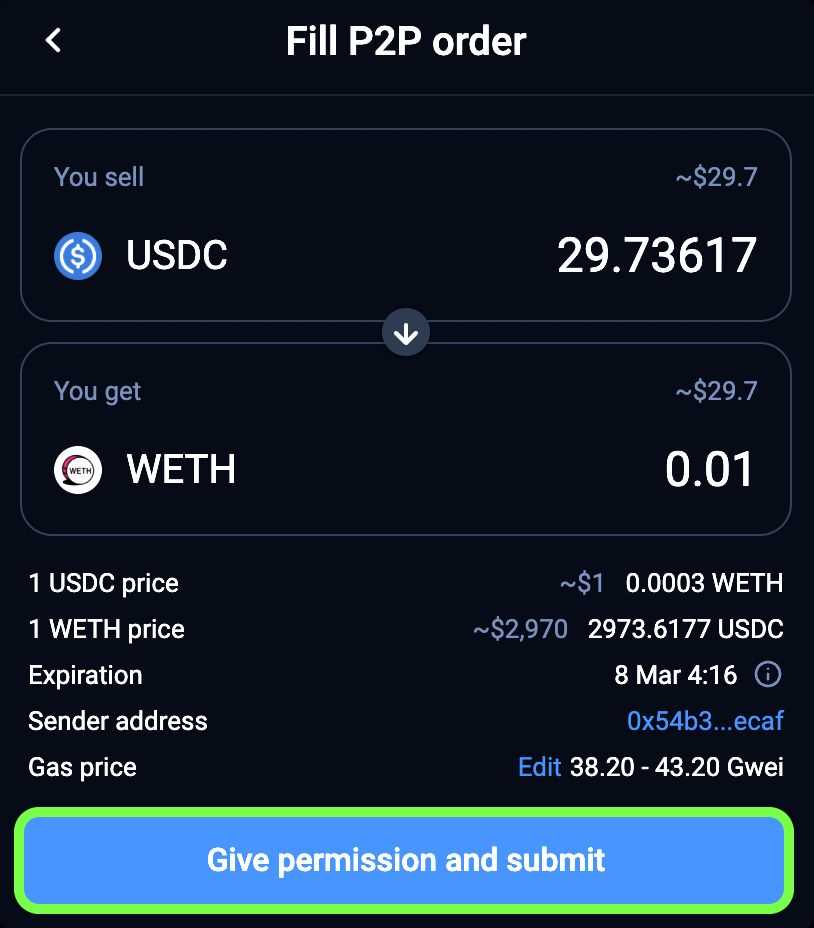

When placing a limit order, users can also set additional parameters such as the order type (buy or sell), the quantity of cryptocurrency they want to trade, and the duration for which the order should remain active. The duration can be specified as a specific time period or until canceled.

The 1inch exchange app also provides users with the option to view and manage their limit orders through a user-friendly interface. Traders can easily track the status of their orders, modify or cancel them if necessary, and monitor their trading activities in real time.

| Benefits of Using Limit Orders: |

|---|

| 1. Increased control: Users have full control over the price at which their trades are executed. |

| 2. Avoidance of market fluctuations: Limit orders allow users to avoid buying or selling at undesirable prices due to market volatility. |

| 3. Flexibility: Traders can set specific conditions for their trades, allowing for more customized and tailored trading strategies. |

| 4. Time-saving: By automating their trades with limit orders, users can save time and effort. |

In summary, the limit order functionality of the 1inch exchange app provides users with a powerful tool for executing trades at specific prices. By setting limit orders, traders can increase their control over their trading activities, avoid undesirable prices, and save time and effort in the process.

What Are Limit Orders?

A limit order is a type of order placed by a trader to buy or sell a specific asset at a specified price or better. Unlike a market order, which executes immediately at the prevailing market price, a limit order allows traders to set their own price, thereby potentially getting a better or more favorable price.

When placing a limit order to buy, the trader specifies the maximum price they are willing to pay for the asset. If the market price reaches or goes below this specified price, the order is triggered, and the trade is executed. Similarly, when placing a limit order to sell, the trader specifies the minimum price they are willing to sell the asset for. If the market price reaches or goes above this specified price, the limit order is triggered, and the asset is sold.

Limit orders are commonly used by traders who want more control over their trades and are willing to wait for the market to move in their favor. By setting their own price, they can avoid buying or selling at unfavorable prices that may occur due to sudden market fluctuations or volatility.

When using the 1inch Exchange app, traders can take advantage of the limit order functionality to set their desired price for buying or selling assets. This allows them to potentially get better prices and optimize their trading strategies.

Note: It’s important to keep in mind that while limit orders offer price control, there is a possibility that the order may not be executed if the market price does not reach the specified level. Additionally, there may be fees associated with placing and executing limit orders.

How Does the 1inch Exchange App Support Limit Orders?

The 1inch Exchange App is a decentralized exchange aggregator that allows users to trade cryptocurrencies across multiple liquidity sources. In addition to its advanced swapping functionality, the app also supports limit orders, which provide users with more control over their trading strategies.

What is a Limit Order?

A limit order is a type of order that allows users to set a specific price at which they are willing to buy or sell a cryptocurrency. Unlike market orders, which are executed at the current market price, limit orders are only executed when the market price reaches the specified limit price.

For example, let’s say you want to buy 1 ETH but only if the price drops below $2000. You can set a limit order with a limit price of $2000. Once the market price reaches or falls below $2000, your limit order will be executed, and you will get your desired amount of ETH at the specified price.

How to Use Limit Orders on the 1inch Exchange App

The 1inch Exchange App allows users to easily create and execute limit orders. To use this functionality, follow these steps:

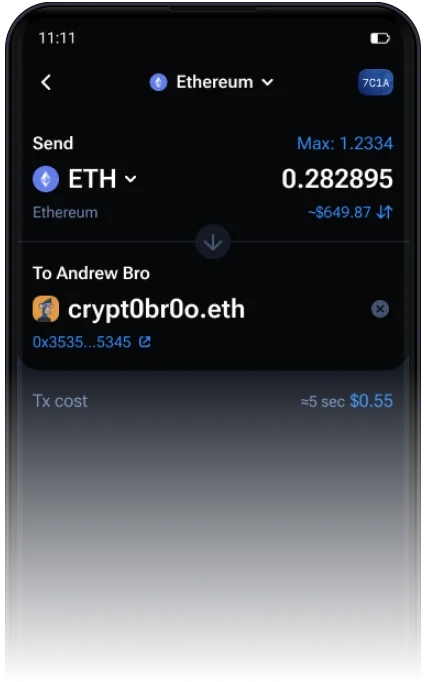

1. Connect Your Wallet

Start by connecting your wallet to the 1inch Exchange App. The app supports various wallets, including MetaMask and WalletConnect.

2. Select the Token Pair

Choose the token pair you want to trade. The app supports a wide range of tokens, and you can easily search for the desired pair.

3. Set the Order Details

Enter the order details, including the amount of tokens you want to buy or sell and the limit price at which you want the order to be executed.

4. Review and Confirm

Double-check all the order details and ensure they are correct. Once you are satisfied, click on the “Confirm” button to submit your limit order.

5. Monitor and Manage Your Orders

After placing the limit order, you can monitor its status on the “Orders” tab of the app. You can also cancel or modify the order if needed.

By supporting limit orders, the 1inch Exchange App provides users with more flexibility and control over their trading activities. This functionality enables users to take advantage of favorable market conditions and execute their trades at specific price levels, helping them optimize their trading strategies.

Benefits of Using Limit Orders on the 1inch Exchange App

1. Price Control: By using limit orders on the 1inch Exchange App, users have the ability to set a specific price at which they want to buy or sell a cryptocurrency. This allows traders to have more control over their orders and ensures that they will only execute a trade at their desired price.

2. Eliminates Emotional Decision Making: Limit orders remove the need for traders to make quick and emotional decisions in the heat of the moment. Instead, users can take their time to carefully consider and analyze market conditions before setting a limit order. This helps prevent impulsive trading decisions based on short-term price fluctuations.

3. Maximizes Trading Opportunities: With the 1inch Exchange App’s limit order functionality, users can take advantage of potential price movements even when they are not actively monitoring the market. By setting a limit order to buy or sell at a specific price, traders can automatically execute trades if the market reaches their desired level. This allows users to capitalize on price swings and trading opportunities, even while they are away from their computer or mobile device.

4. Reduces the Risk of Slippage: Slippage is a common issue in volatile markets, where the execution price of a trade differs from the expected price due to market fluctuations. By using limit orders on the 1inch Exchange App, traders can reduce the risk of slippage by specifying the exact price at which they want to trade, ensuring that their orders are executed at their intended price.

5. Flexibility and Customization: The 1inch Exchange App’s limit order functionality offers users a range of customization options. Traders can specify the order type (buy or sell), the quantity of the cryptocurrency they want to trade, and the price at which they want to execute the order. This flexibility allows users to tailor their trading strategies to their individual preferences and risk tolerance.

6. Enhanced Privacy: The 1inch Exchange App prioritizes user privacy and security. By using limit orders, traders can minimize their exposure to the market and reduce the amount of time their funds are held on the exchange. This can help protect against potential security breaches or hacks.

Overall, using limit orders on the 1inch Exchange App provides traders with greater control, flexibility, and customization over their trading activities. It helps eliminate emotional decision making, maximizes trading opportunities, reduces the risk of slippage, and enhances privacy and security. By taking advantage of the limit order functionality, users can optimize their trading strategies and potentially increase their profitability.

Question-answer:

What is the 1inch Exchange app?

The 1inch Exchange app is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates.

How does the Limit Order functionality work on the 1inch Exchange app?

The Limit Order functionality on the 1inch Exchange app allows users to set specific price and quantity parameters for their desired trade. Once the market conditions meet the specified parameters, the trade is automatically executed on the user’s behalf.