1inch is a leading decentralized exchange aggregator that allows users to access the deepest liquidity and best swap rates across multiple protocols. With the introduction of Arbitrum, a Layer 2 scaling solution for Ethereum, using 1inch has become even more beneficial for optimized DeFi portfolio management.

Arbitrum brings faster transaction speeds and significantly lower fees compared to the Ethereum mainnet. By using 1inch on Arbitrum, users can enjoy instant swaps and reduced transaction costs, enabling them to make the most efficient use of their capital.

1inch on Arbitrum also offers enhanced security and scalability. As a Layer 2 solution, Arbitrum leverages Ethereum’s security while providing faster and more scalable transactions. This means users can manage their DeFi portfolio with peace of mind, knowing that their assets are protected by the robustness of the Ethereum network.

In addition, using 1inch on Arbitrum opens up access to a wide range of DeFi protocols and liquidity pools. Users can seamlessly trade, provide liquidity, and utilize various DeFi strategies across multiple platforms, all through the intuitive and user-friendly interface of 1inch.

Optimizing your DeFi portfolio management has never been easier. Experience the benefits of using 1inch on Arbitrum today and take full control of your DeFi investments.

Greater Efficiency and Lower Costs

Using 1inch on Arbitrum for optimized DeFi portfolio management can bring about greater efficiency and lower costs for users. By leveraging the speed and scalability of the Arbitrum network, 1inch is able to provide lightning-fast transactions and minimize gas fees.

Traditional DeFi platforms often face scalability issues and high transaction costs due to the congestion on the Ethereum network. However, by utilizing the layer 2 solution offered by Arbitrum, 1inch is able to significantly improve the user experience.

With reduced transaction times and lower gas fees, users can execute trades and manage their portfolios more efficiently. This enables them to take advantage of time-sensitive opportunities in the market and optimize their returns without being hindered by slow transaction speeds or steep transaction costs.

Additionally, 1inch on Arbitrum allows users to access a wider range of DeFi protocols and liquidity pools, further enhancing the diversification and optimization of their portfolios. With increased options and reduced costs, users can make better-informed decisions and achieve their investment goals more effectively.

| Benefits of Using 1inch on Arbitrum |

|---|

| Greater efficiency in executing trades due to fast transaction speeds |

| Lower transaction costs thanks to reduced gas fees |

| Access to a wider range of DeFi protocols and liquidity pools for better portfolio optimization |

| Improved user experience with minimal network congestion |

| Ability to capitalize on time-sensitive opportunities in the market |

Overall, using 1inch on Arbitrum provides users with greater efficiency and lower costs, allowing them to have a competitive edge in managing their DeFi portfolios.

Increased Liquidity and Reduced Slippage

When it comes to managing your DeFi portfolio, one of the key factors to consider is liquidity. Having access to a highly liquid market is crucial for executing trades at the best price possible and minimizing slippage.

At 1inch on Arbitrum, you can benefit from increased liquidity and reduced slippage. By aggregating liquidity from various decentralized exchanges (DEXs), 1inch ensures that you have access to the deepest pools of liquidity available for your trades.

This increased liquidity not only allows you to execute larger trades without significantly impacting the market price, but it also helps to reduce slippage. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed. By accessing highly liquid pools of assets, you can reduce slippage and achieve better trade execution.

The Benefits of Increased Liquidity and Reduced Slippage

- Better trade execution: By accessing deeper pools of liquidity, you can execute trades at the best possible price, resulting in improved trade execution.

- Minimized impact on the market: Increased liquidity allows you to execute larger trades without causing significant price movements, reducing the impact on the market.

- Reduced slippage: By aggregating liquidity from multiple DEXs, 1inch helps to reduce slippage, ensuring that your trades are executed closer to the expected price.

- Opportunity for larger trades: With increased liquidity, you have the opportunity to execute larger trades and take advantage of market opportunities without causing excessive price fluctuations.

Overall, by using 1inch on Arbitrum for optimized DeFi portfolio management, you can benefit from increased liquidity and reduced slippage, leading to better trade execution and improved portfolio performance.

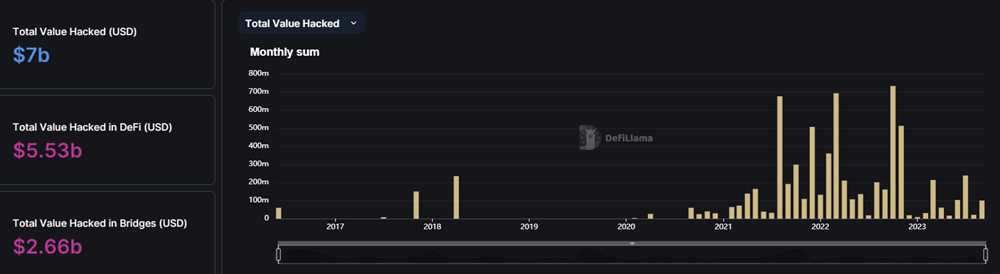

Enhanced Security and Trustworthiness

When it comes to managing your DeFi portfolio, security and trustworthiness are of paramount importance. With 1inch on Arbitrum, you can rest assured that your assets are well protected.

Arbitrum is built on Ethereum, one of the most secure and established blockchain networks. It provides robust security measures, including cryptographic algorithms and smart contract audits, to prevent unauthorized access and ensure the integrity of your transactions.

1inch, on the other hand, is a leading decentralized exchange aggregator that has gained a reputation for its focus on security. It utilizes cutting-edge technology and multiple audits to guarantee the safety of your funds while providing seamless and efficient transactions.

By combining the security features of both Arbitrum and 1inch, you can confidently manage your DeFi portfolio without worrying about potential security breaches or unauthorized access to your assets. Whether you are swapping tokens, providing liquidity, or using any other DeFi services, your transactions will be executed securely and reliably.

With enhanced security and trustworthiness, using 1inch on Arbitrum is the ideal choice for optimizing your DeFi portfolio management.

Question-answer:

What is 1inch on Arbitrum?

1inch on Arbitrum is a decentralized finance (DeFi) platform that provides optimized portfolio management services. It is built on the Arbitrum network, which is a layer 2 scaling solution for Ethereum. With 1inch on Arbitrum, users can access various DeFi protocols and manage their portfolios more efficiently.

How does 1inch on Arbitrum optimize DeFi portfolio management?

1inch on Arbitrum optimizes DeFi portfolio management by providing users with access to numerous DeFi protocols in a single platform. It aggregates liquidity from multiple sources, including decentralized exchanges and lending platforms, to offer the best rates and minimize slippage. It also provides advanced trading features like limit orders and gas optimization, allowing users to execute trades more efficiently.