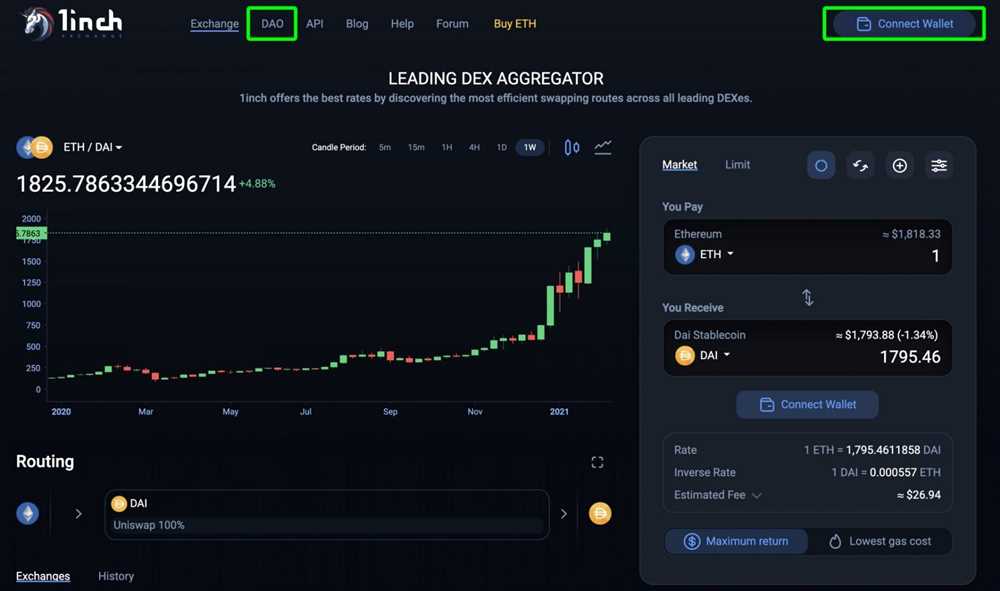

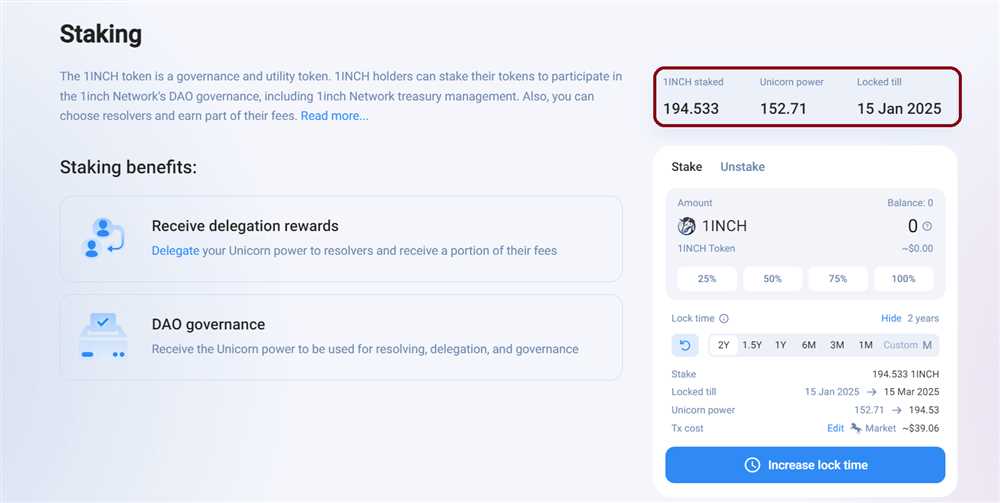

When it comes to staking your cryptocurrencies, diversification is a crucial strategy that can help minimize risks and maximize potential rewards. One platform that offers staking services is 1inch, a decentralized exchange aggregator that allows users to swap tokens at the best possible prices from various liquidity sources.

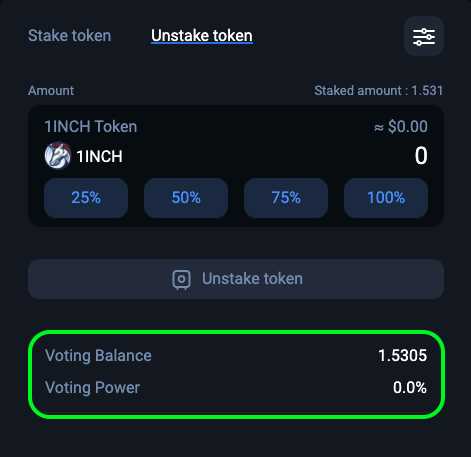

Staking on 1inch offers users the opportunity to earn passive income by supporting the platform’s operations and securing the network. However, it’s important to understand that staking comes with its own set of risks. By diversifying your staked assets, you can spread out the risk and potentially minimize the impact of any unexpected events.

One of the main benefits of diversification in 1inch staking is mitigating the risk of concentrated exposure to a single asset. By staking different tokens, you reduce the chances of suffering significant losses if one particular asset experiences a decline in value. Diversification allows you to spread out your investments across multiple assets, increasing the likelihood of having at least some of them perform well over time.

Furthermore, diversification can also help you take advantage of potential opportunities in the market. By holding a diversified portfolio of staked assets, you are better positioned to benefit from the performance of different tokens. This can lead to a more balanced and stable return on your staked assets, reducing the overall volatility of your investment portfolio.

The Power of Diversification in 1inch Staking

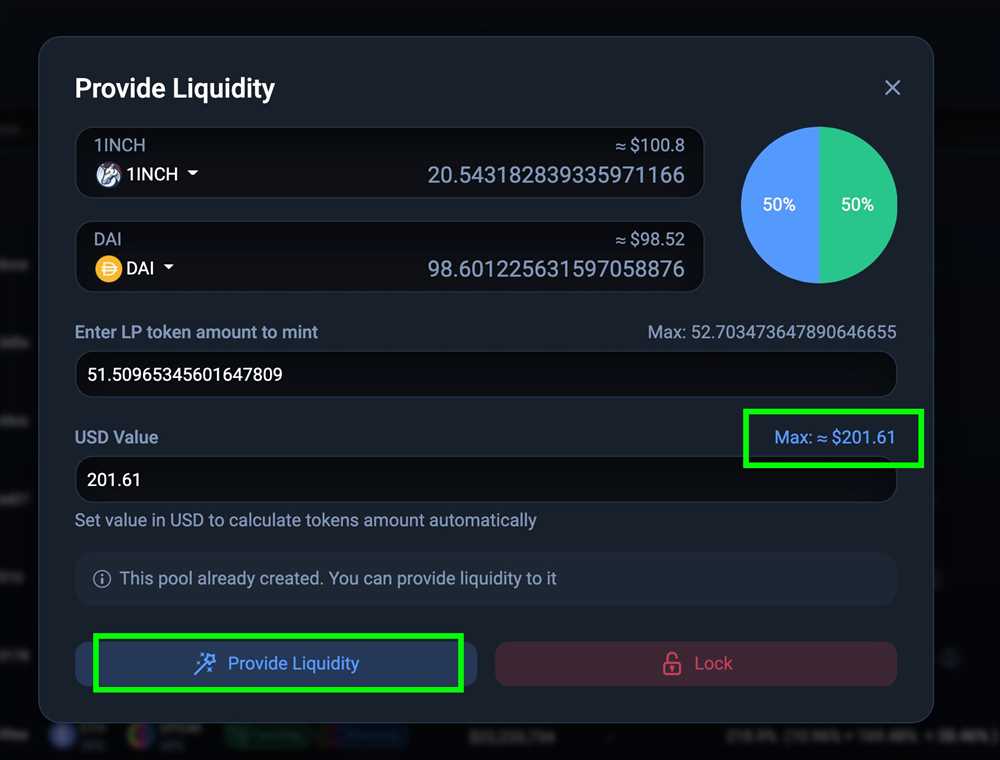

When it comes to staking your assets on the 1inch platform, diversification is a powerful strategy that can help you reduce risk and maximize returns. By spreading out your investments across a range of different pools and assets, you can protect yourself from potential losses and take advantage of opportunities for growth.

Reducing Risk

One of the key benefits of diversification in 1inch staking is its ability to reduce risk. By investing in multiple pools and assets, you are not putting all your eggs in one basket. This means that if one pool or asset performs poorly, you have other investments that can help offset those losses. Diversification helps to spread out your risk and protect your overall staking portfolio.

It’s important to note that diversification does not guarantee profit or eliminate all risk, but it can help to mitigate the impact of any potential losses.

Maximizing Returns

Diversification also allows you to take advantage of different opportunities for growth. By investing in a range of pools and assets, you can benefit from the potential rewards offered by each one. Some pools may offer higher returns in the short term, while others may provide more stable, long-term growth. By diversifying, you can tap into multiple revenue streams and potentially increase your overall staking returns.

It’s essential to carefully analyze each pool and asset to determine their potential risks and rewards. By diversifying your investments, you can create a well-balanced staking portfolio tailored to your specific goals and risk appetite.

Conclusion

The power of diversification in 1inch staking cannot be overstated. By spreading your investments across multiple pools and assets, you can reduce risk and increase the potential for maximizing your returns. However, it’s crucial to conduct thorough research and consider the unique characteristics and risks associated with each pool and asset before diversifying your staking portfolio. With a well-diversified approach, you can make the most of the opportunities available on the 1inch platform and enhance your staking experience.

Maximizing Returns through Diverse Investments

When it comes to investing, one of the key strategies for success is diversification. Diversifying your investments can help minimize risks and maximize returns. By spreading your investment across different assets, industries, or geographic regions, you can reduce the impact of any single investment’s performance on your overall portfolio.

The Benefits of Diversification

Diversification is often referred to as the only free lunch in investing. By diversifying, you can potentially improve your investment returns without taking on additional risk. This is because different asset classes tend to perform differently at different times. So if one investment is underperforming, others may be doing well, helping to offset any losses.

Furthermore, diversification can protect you from random events or shocks to the financial markets. For example, if you have a large portion of your portfolio invested in a single industry and that industry experiences a downturn, your entire investment could suffer. However, by diversifying across multiple industries, you can reduce the impact of a downturn in any single sector.

How to Diversify Your Investments

Diversifying your investments can be achieved in several ways. One approach is to invest in different asset classes such as stocks, bonds, real estate, or commodities. Each asset class has its own unique risk and return characteristics, so by spreading your investments across these different classes, you can reduce the overall risk of your portfolio.

Another way to diversify is by investing in different geographic regions. By investing in both domestic and international markets, you can tap into different economies and industries, reducing your exposure to any particular country’s economic performance.

Furthermore, within each asset class or region, you can also diversify by investing in a variety of individual securities or funds. For example, in the stock market, you could invest in different sectors or companies across different industries. In the bond market, you could invest in bonds with different maturities or from different issuers.

It’s important to note that diversification does not guarantee profits or protect against losses. However, it can help reduce the volatility of your portfolio and potentially improve your long-term returns. By diversifying your investments, you can create a more resilient portfolio that is better positioned to weather market fluctuations and take advantage of opportunities.

In conclusion, diversification is a key strategy for maximizing returns in your investment portfolio. By spreading your investments across different asset classes, industries, or geographic regions, you can reduce risk and increase your chances of achieving long-term financial success.

Reducing Risks with a Well-balanced Portfolio

Diversification is an essential strategy for reducing risks in the world of investing. When it comes to staking on 1inch, having a well-balanced portfolio can help protect against volatility and potential losses.

By spreading your investments across different assets, you reduce the impact of any single asset’s performance on your overall portfolio. This means that if one asset experiences a downturn, the positive performance of other assets can help offset the losses, minimizing the impact on your investment.

A well-balanced portfolio typically includes a mix of assets with different risk levels and returns. This could include a combination of stablecoins, cryptocurrencies, and other assets. By diversifying your portfolio across different asset classes, you can potentially achieve better risk-adjusted returns.

Furthermore, diversification can also help reduce the risk of concentration. Concentration risk occurs when a large portion of your portfolio is invested in a single asset or a few assets. By diversifying, you can spread your investments across multiple assets, reducing the risk of being heavily impacted by the performance of just one or a few assets.

However, diversification does not guarantee profits or protect against losses. It is important to carefully research and select your assets, considering factors such as their historical performance, market trends, and potential risks.

In conclusion, diversification is a key strategy to reduce risks when staking on 1inch. By creating a well-balanced portfolio with a mix of different assets, you can potentially mitigate the impact of any one asset’s performance and achieve better risk-adjusted returns.

Expanding Opportunities with Diversified Staking Strategies

Staking has become a popular investment strategy in the cryptocurrency world, allowing individuals to earn passive income by holding and securing digital assets. While staking offers attractive rewards, it also comes with its own risks. That’s why diversification is key in maximizing the potential benefits of staking.

Diversification refers to spreading out investments across multiple assets or platforms to reduce risk and increase flexibility. In the context of staking, diversification means allocating staked assets to different projects or networks. By diversifying your staking strategies, you can expand your opportunities and minimize the impact of potential losses.

One of the main benefits of diversification in staking is the ability to participate in multiple networks or platforms. Each blockchain project or network has its own unique features and potential for growth. By diversifying your staking assets, you can tap into different networks and increase the likelihood of earning rewards. This also allows you to hedge against the failure or underperformance of a single project.

Another advantage of diversified staking strategies is the ability to adapt to changing market conditions. Cryptocurrency markets are highly volatile, and the value of individual assets can fluctuate dramatically. By spreading your staking assets across different projects or networks, you can reduce the impact of market volatility and increase your chances of earning consistent rewards. This also gives you the flexibility to adjust your staking allocations based on market trends and opportunities.

Diversification also helps mitigate the risk of technical issues or security breaches in a single project or network. While blockchain technology is generally secure, there is always a possibility of vulnerabilities or attacks. By diversifying your staking holdings, you can mitigate the risk of losing all your assets in the event of a security breach. This adds an extra layer of protection and peace of mind.

When it comes to diversified staking strategies, it’s important to carefully research and assess the projects or networks you’re considering. Look for projects with strong fundamentals, active development teams, and a track record of delivering on their promises. Consider factors such as token economics, community support, and the overall vision of the project. By selecting reliable and promising projects, you can maximize the potential rewards of your diversified staking strategy.

In conclusion, diversification is a crucial aspect of successful staking. By diversifying your staking strategies, you can expand your opportunities, mitigate risks, and increase your chances of earning consistent rewards. Remember to carefully research and select projects or networks that align with your investment goals and risk tolerance. With a well-diversified staking strategy, you can navigate the ever-changing cryptocurrency market and unlock the full potential of staking.

Question-answer:

What is diversification and why is it important in 1inch staking?

Diversification is the practice of spreading investments across different assets or projects to reduce risk. In the case of 1inch staking, diversification is important because it helps to mitigate the risk associated with staking in a single project. By diversifying your stake across multiple projects, you can decrease the potential negative impact of any one project failing or underperforming.

How can diversification in 1inch staking help to reduce risk?

Diversification in 1inch staking reduces risk by spreading your stake across multiple projects instead of concentrating it all in one. This means that if one project fails or performs poorly, the negative impact on your overall stake will be minimized because you have other projects that may perform well and offset the losses.

What are the potential risks of not diversifying in 1inch staking?

If you do not diversify your stake in 1inch staking and instead invest all your funds in a single project, you are exposed to the risk of that project failing or underperforming. If the project does not generate the expected returns or collapses completely, you could lose a significant portion, if not all, of your stake.

Are there any specific strategies or guidelines to follow when diversifying in 1inch staking?

There are several strategies you can consider when diversifying in 1inch staking. One approach is to invest in projects that have different underlying technologies, such as decentralized exchanges, lending platforms, and liquidity protocols. Another strategy is to allocate your stake across projects with different levels of risk and potential returns. It is important to conduct thorough research and due diligence before investing in any projects to ensure they align with your investment goals and risk tolerance.

What are the potential benefits of diversification in 1inch staking?

Diversification in 1inch staking offers several potential benefits. Firstly, it helps to reduce the overall risk of your stake by spreading it across multiple projects. Secondly, diversification can increase the potential for higher returns as you are exposed to different projects with varying levels of performance. Additionally, diversification allows you to take advantage of opportunities in different sectors or technologies within the cryptocurrency market.