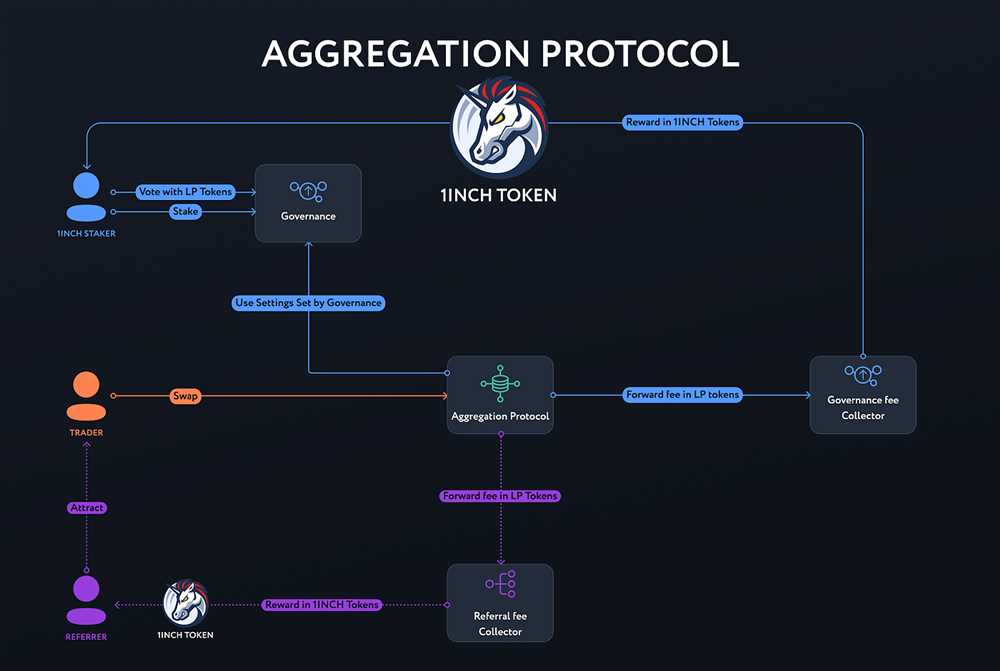

The 1inch Protocol has revolutionized the way we trade cryptocurrencies. With its innovative technology, users can now swap tokens at the best possible rates across various decentralized exchanges (DEXs) with just a single transaction. But have you ever wondered how this cutting-edge protocol actually works? Let’s dive into the technology behind 1inch and explore its inner workings.

At its core, the 1inch Protocol is built on the principles of algorithmic trading and decentralized finance (DeFi). It leverages the power of smart contracts on the Ethereum blockchain to execute trades seamlessly and efficiently. Through the use of complex algorithms and advanced liquidity aggregation strategies, the protocol is able to split a user’s trade across multiple DEXs to achieve the best possible outcome.

One of the key components of the 1inch Protocol is its Pathfinder algorithm. This algorithm plays a crucial role in finding the optimal trading routes for users, taking into account various factors such as liquidity, slippage, and gas fees. By analyzing real-time data from multiple DEXs, the Pathfinder algorithm is able to determine the most efficient path for executing a trade, ensuring users get the best possible price for their tokens.

Another important feature of the 1inch Protocol is its Chi Gastoken mechanism. Gas fees on the Ethereum network can be a significant barrier to trading, especially during times of high network congestion. The Chi Gastoken mechanism helps users save on gas fees by optimizing the use of Ethereum’s gas tokens. By batching multiple transactions together and utilizing contract calls more efficiently, the protocol is able to reduce gas costs, making trading more accessible and affordable for users.

In conclusion, the 1inch Protocol is a game-changer in the world of decentralized trading. By leveraging cutting-edge technology, it is able to provide users with the best possible trading experience, ensuring optimal execution of trades and minimizing costs. Whether you’re a seasoned trader or new to the world of DeFi, 1inch offers a user-friendly platform that puts the power of decentralized finance at your fingertips.

Understanding the 1inch Protocol

The 1inch Protocol is a decentralized exchange aggregator that enables users to find the best prices across multiple liquidity sources. By splitting trades across multiple DEXs, the protocol ensures that users get the most favorable rates for their transactions.

At its core, the 1inch Protocol relies on the use of smart contracts to execute trades. These smart contracts are designed to interact with different DEXs and liquidity protocols, allowing users to access a wide range of trading options from a single platform.

When a user initiates a trade on the 1inch Protocol, the smart contract algorithmically determines the best trading route based on available liquidity and prices on various DEXs. The protocol takes into account factors such as slippage, gas fees, and order book depth to optimize the trade execution for the user.

The 1inch Protocol also incorporates a unique feature known as Pathfinder. This feature enables the protocol to discover the most efficient trading paths by analyzing different routes and liquidity sources. Pathfinder uses various algorithms, including the Dijkstra’s algorithm, to find the optimal path for a trade.

In addition to the aggregation of liquidity, the 1inch Protocol also incorporates multiple security measures to ensure the safety of user funds. The protocol integrates with different wallet providers, such as MetaMask and WalletConnect, to allow users to securely interact with the platform.

| Key Features of the 1inch Protocol: |

|---|

| Decentralized exchange aggregation |

| Smart contract-based trade execution |

| Pathfinder algorithm for finding the best trading routes |

| Integration with popular wallet providers for enhanced security |

In summary, the 1inch Protocol is a powerful tool for traders that enables them to access the best prices across multiple decentralized exchanges. By leveraging smart contracts and innovative algorithms, the protocol optimizes trade execution while ensuring the safety of user funds.

Revolutionizing Token Swaps

The 1inch Protocol is revolutionizing the way token swaps are done in the decentralized finance (DeFi) space. Traditionally, users would have to manually search for the best prices across different decentralized exchanges (DEXs) and execute multiple transactions to achieve the desired token swap. This process is time-consuming and often results in suboptimal outcomes due to slippage and high fees.

With the 1inch Protocol, users can swap tokens in a more efficient and cost-effective manner. The protocol aggregates liquidity from various DEXs, including Uniswap, Kyber Network, and Balancer, to provide users with the best possible rates for their token swaps. By tapping into multiple liquidity sources, the protocol minimizes slippage and maximizes the value users receive from their trades.

Key Features of the 1inch Protocol

- PathFinder: The PathFinder algorithm developed by 1inch Protocol ensures that trades are routed through the most cost-effective paths across different DEXs. This helps users achieve better rates and reduces transaction costs.

- Aggregation: The protocol aggregates liquidity from various DEXs, allowing users to access deep pools of liquidity and obtain better prices for their token swaps.

- Gas Optimization: 1inch Protocol optimizes gas usage by splitting the user’s trade into multiple smaller trades across different DEXs. This reduces gas costs and improves the overall efficiency of the token swap.

Benefits of Using the 1inch Protocol

- Improved Price Execution: By aggregating liquidity from multiple DEXs, the 1inch Protocol ensures that users get the best prices for their token swaps, reducing slippage and maximizing the value obtained.

- Cost Savings: The protocol’s gas optimization techniques help users save on transaction costs by reducing gas fees. Additionally, users can save on fees that would have been incurred by executing multiple transactions across different DEXs.

- Accessibility to Deep Liquidity: By tapping into liquidity from various DEXs, the 1inch Protocol provides users with access to deep pools of liquidity, enabling larger trades to be executed with minimal slippage.

Overall, the 1inch Protocol is revolutionizing token swaps by providing users with a more efficient and cost-effective way to swap tokens in the DeFi space. With its innovative features and benefits, the protocol has gained popularity among DeFi traders looking for optimal trades and improved liquidity.

Decentralized Liquidity on Ethereum

One of the key features of the 1inch Protocol is its ability to provide decentralized liquidity on the Ethereum network. Liquidity refers to the availability of assets that can be easily bought or sold without significantly affecting their market price.

In the traditional financial system, liquidity is typically provided by centralized exchanges that act as intermediaries between buyers and sellers. However, these centralized exchanges often suffer from issues such as high fees, lack of transparency, and the risk of being hacked or manipulated.

The 1inch Protocol addresses these issues by leveraging decentralized liquidity pools on the Ethereum network. These pools are created and maintained by liquidity providers who deposit their assets into smart contracts. These smart contracts ensure that the assets are stored securely and can be easily traded by users.

When a user wants to trade a particular asset, the 1inch Protocol scans multiple decentralized exchanges and liquidity pools to find the best possible price. It then automatically routes the user’s trade through the most favorable option, ensuring that they get the best deal possible.

This decentralized approach to liquidity provides several benefits. First, it allows users to trade assets without relying on a centralized authority. This enhances privacy and eliminates the risk of censorship or manipulation. Second, by aggregating liquidity from multiple sources, the 1inch Protocol ensures that users can access the best prices and deepest pools of liquidity.

Overall, the 1inch Protocol’s decentralized liquidity functionality is a core component of its value proposition. By leveraging the power of the Ethereum network, it provides users with a secure, transparent, and efficient way to trade assets and access liquidity.

The Role of Smart Contracts

Smart contracts play a critical role in the functionality of the 1inch Protocol. These self-executing contracts are created using programming code that defines the rules and conditions for the execution of a transaction. By utilizing smart contracts, the 1inch Protocol ensures transparency, security, and automation in its operations.

Transparency

Smart contracts provide a level of transparency that traditional financial systems cannot match. The code of a smart contract is publicly available, allowing anyone to view and verify its contents. This transparency eliminates the need for intermediaries, such as banks or brokers, and allows users to have direct control over their funds and transactions.

Security

The use of smart contracts significantly enhances the security of the 1inch Protocol. Since smart contracts are executed on decentralized networks, they are resistant to hacking and tampering. The immutability of the blockchain ensures that once a smart contract is deployed, its code cannot be altered, providing a high level of trust and security to users.

Smart contracts also eliminate the risk of fraud or malicious behavior. The predefined rules and conditions within the contract ensure that transactions are executed precisely as intended, without any possibility of human error or manipulation. Users can rely on the integrity of the smart contracts to facilitate their transactions safely.

Furthermore, smart contracts eliminate the need to trust third parties with sensitive information, such as personal data or financial details. All information relating to a transaction is stored on the blockchain, ensuring the privacy and security of user data.

Automation

Smart contracts automate various processes in the 1inch Protocol, making it more efficient and convenient for users. Once a smart contract is deployed, it can execute transactions automatically based on predefined conditions. This eliminates the need for manual intervention and speeds up the transaction process.

For example, when a user wants to swap one token for another on the 1inch Protocol, the smart contract will automatically execute the trade based on the current market conditions, ensuring the best possible outcome for the user.

Automation also eliminates the need for intermediaries, reducing costs and increasing transaction speed. Smart contracts enable peer-to-peer transactions, allowing users to transact directly with each other without the need for intermediaries such as exchanges. This not only saves time but also lowers transaction fees.

In conclusion, smart contracts play a vital role in the 1inch Protocol, providing transparency, security, and automation. By utilizing smart contracts, the protocol ensures the efficient and secure execution of transactions, allowing users to have full control over their funds.

The Benefits of Aggregation

Aggregation is a fundamental feature of the 1inch Protocol that brings numerous benefits to users and the decentralized finance (DeFi) ecosystem as a whole.

1. Improved Liquidity

By aggregating liquidity from multiple decentralized exchanges (DEXs), 1inch Protocol is able to offer users access to a larger pool of available liquidity. This means that trade orders can be executed at better prices and with lower slippage.

2. Cost Savings

Aggregation allows users to save on gas fees by optimizing the routing of their trades. Instead of manually checking prices and executing trades across multiple DEXs, users can rely on 1inch Protocol to find the most cost-efficient path to their desired trade.

3. Reduced Complexity

With a growing number of decentralized exchanges and liquidity sources in the DeFi space, it can be overwhelming for users to navigate and keep track of all the available options. Aggregation simplifies the user experience by presenting a unified interface that consolidates liquidity from multiple sources.

4. Access to More Trading Opportunities

By aggregating liquidity from different DEXs, 1inch Protocol enables users to access a wider range of trading opportunities. Users can benefit from arbitrage opportunities and find the best rates for their trades across various liquidity pools.

5. Improved Security

Aggregation reduces the risk of price manipulation and front-running attacks by spreading trades across multiple liquidity sources. By diversifying trade execution, 1inch Protocol enhances the security and integrity of trades.

In conclusion, aggregation is a key feature of the 1inch Protocol that brings liquidity, cost savings, simplicity, more trading opportunities, and improved security to users in the DeFi ecosystem.

Question-answer:

What is the 1inch Protocol?

The 1inch Protocol is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to offer users the best possible prices for their trades.

How does the 1inch Protocol work?

The 1inch Protocol uses an algorithm called Pathfinder to split user trades across multiple DEXs to ensure the best prices. It also employs smart contract technology to execute trades securely and transparently.

What are the advantages of using the 1inch Protocol?

Using the 1inch Protocol allows users to access the best possible prices by taking advantage of liquidity from different DEXs. It also reduces the risk of slippage and offers improved trade execution.