Are you looking for a decentralized finance (DeFi) platform that can offer you unmatched liquidity? Look no further than 1inch. With its innovative use of automated market makers (AMMs), 1inch is revolutionizing the way users can access liquidity in the decentralized ecosystem.

1inch’s AMM protocol allows users to trade assets seamlessly and without the need for traditional order books. This means that you can easily swap your tokens without worrying about market depth or price slippage.

How does it work? By leveraging multiple liquidity sources, such as decentralized exchanges and liquidity pools, 1inch ensures that users always get the best possible rates for their trades. The protocol splits orders across various platforms to achieve optimal prices and low trading fees.

Not only does 1inch provide unparalleled liquidity, but it also offers users a range of features designed to enhance their trading experience. With its advanced algorithm, 1inch automatically finds the most efficient paths for your trades, saving you time and gas fees.

So whether you’re a DeFi enthusiast or a professional trader, 1inch’s AMM protocol is the perfect solution for accessing liquidity in a fast, secure, and cost-effective way. Join the decentralized revolution and start using 1inch today!

About 1inch

1inch is a decentralized exchange aggregator that operates on the Ethereum blockchain. It was launched in 2020 with the goal of providing users with the best possible prices and low slippage for their trades. The platform taps into various decentralized exchanges (DEXs) and liquidity sources to find the most favorable rates.

1inch combines multiple liquidity protocols and uses smart contract technology to offer its users the highest levels of liquidity and security. The platform automatically splits user orders across different DEXs to optimize trading outcomes. It also constantly monitors market conditions and adjusts strategies to ensure users get the best rates and can execute trades quickly.

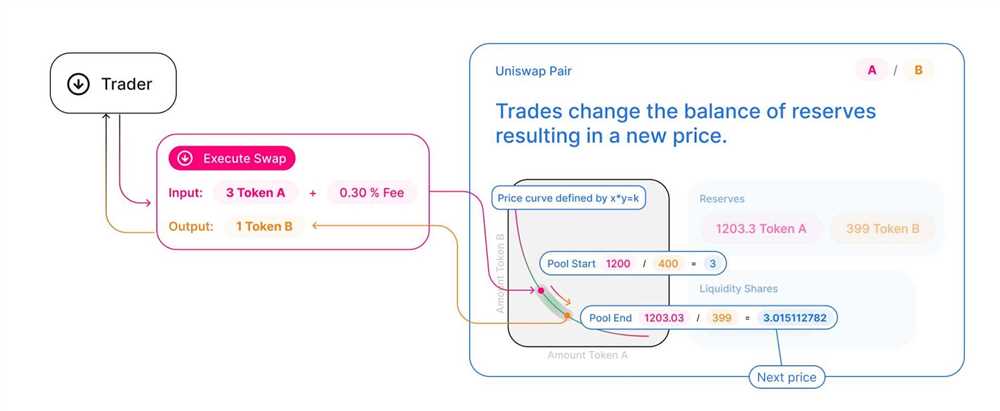

One of the key features of 1inch is its automated market maker (AMM) technology. AMMs are smart contracts that use mathematical formulas to determine an asset’s price based on supply and demand. This allows for seamless and efficient token swapping on the platform. 1inch leverages AMMs to provide users with a wide range of trading options and to enhance overall liquidity.

1inch has gained popularity in the decentralized finance (DeFi) space due to its innovative and user-friendly platform. It offers a simple and intuitive interface for traders to access a large number of DEXs and liquidity sources seamlessly. The platform also provides advanced features such as limit orders and gas optimization tools to enhance the trading experience.

Through its unique combination of automated market makers, liquidity sources, and smart contract technology, 1inch is revolutionizing the way users trade and interact with decentralized exchanges. It is driving the growth of the DeFi industry and empowering individuals to have more control and freedom over their financial assets.

The Importance of Automated Market Makers (AMMs)

Automated Market Makers (AMMs) play a crucial role in the world of decentralized finance (DeFi), and 1inch understands their importance. As the DeFi ecosystem continues to grow and evolve, AMMs have become an integral part of providing liquidity for various digital assets.

Traditionally, liquidity in financial markets has been provided by centralized institutions such as banks and financial intermediaries. However, with the advent of blockchain technology and the rise of DeFi, decentralized liquidity solutions have emerged.

AMMs, such as those used by 1inch, are decentralized protocols that allow users to trade digital assets in a permissionless manner. These protocols use a combination of smart contracts and mathematical algorithms to automatically provide liquidity and determine the price of assets without the need for intermediaries.

One of the key advantages of AMMs is their ability to operate 24/7 without relying on traditional market hours or intermediaries. This provides users with uninterrupted access to liquidity and the convenience to trade at any time.

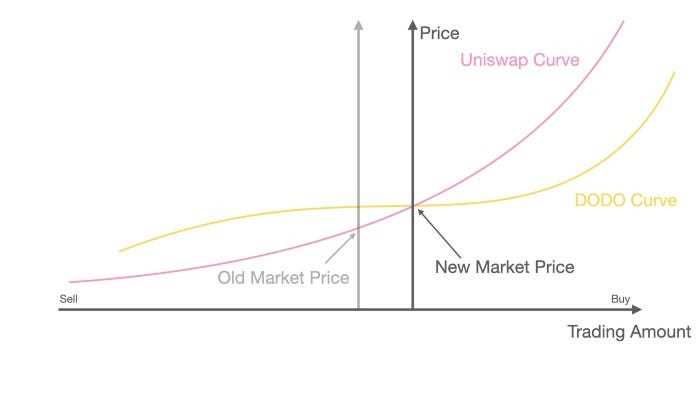

AMMs also offer users improved price discovery and reduced slippage. In traditional order book exchanges, large orders can cause price slippage as they are executed across multiple price levels. AMMs, on the other hand, use a constant function to determine prices, ensuring that trades can be executed with minimal slippage.

Another significant benefit of AMMs is their decentralized nature. Unlike centralized exchanges, where users have to trust a single entity with their funds, AMMs allow users to maintain control of their assets throughout the trading process. This trustless nature aligns well with the principles of blockchain technology, providing users with enhanced security and reducing the risk of hacking or manipulation.

Overall, the importance of AMMs in the DeFi ecosystem cannot be overstated. They provide users with efficient and decentralized liquidity, enabling the seamless trading of digital assets. 1inch recognizes the value of AMMs and continues to pave the way in leveraging these protocols to democratize access to liquidity and revolutionize the world of decentralized finance.

|

|

Image source: Unsplash |

Enhancing Liquidity

1inch is committed to enhancing liquidity in decentralized finance (DeFi) by utilizing automated market makers (AMMs). By leveraging AMMs, 1inch is able to provide users with a seamless and efficient trading experience, ensuring that liquidity is always available.

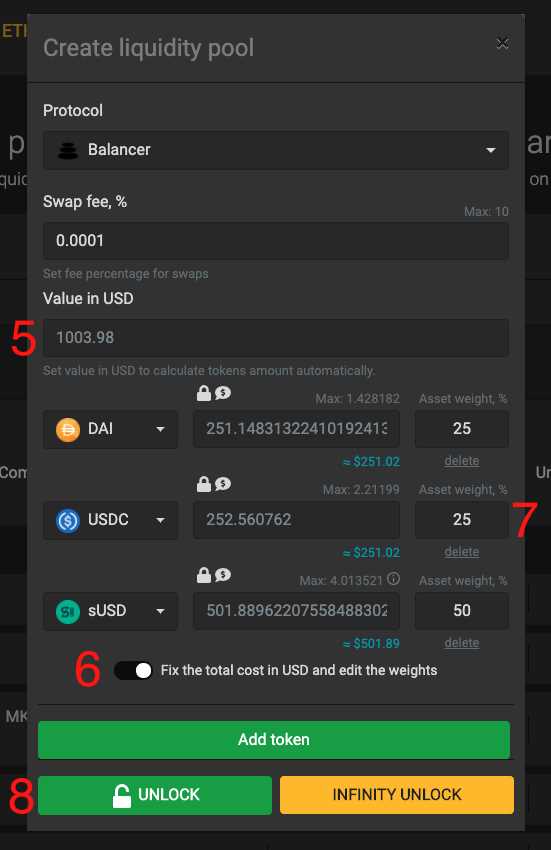

Through the use of smart contract technology, 1inch is able to aggregate liquidity from multiple AMMs, such as Uniswap, SushiSwap, and Balancer, to ensure the best possible trading rates for users. This enables users to access a larger pool of liquidity and enhances their ability to execute trades at optimal prices.

1inch also employs various liquidity strategies, such as liquidity mining and liquidity pools, to incentivize users to provide liquidity to the platform. By doing so, users are rewarded with additional tokens, encouraging the growth of liquidity and ensuring a vibrant and active ecosystem.

Furthermore, 1inch continuously monitors and adjusts its liquidity sources to ensure the highest level of liquidity at all times. This includes regularly assessing the performance and quality of different AMMs and liquidity providers, and making necessary optimizations to improve overall liquidity.

In conclusion, 1inch is actively working towards enhancing liquidity in DeFi through the use of AMMs, smart contract technology, and innovative liquidity strategies. By providing users with access to a wide range of liquidity sources and continuously optimizing their liquidity offerings, 1inch is able to ensure a seamless and efficient trading experience for all users.

Efficient Price Discovery

One of the key advantages of 1inch’s automated market makers (AMMs) is their ability to enable efficient price discovery. Traditional order book exchanges rely on buy and sell orders from traders to set prices, which can lead to inefficiencies and potential manipulation.

With 1inch’s AMMs, on the other hand, prices are determined algorithmically based on the ratio of token reserves in the liquidity pool. This means that prices are determined by the market itself, rather than relying on individual trader orders.

This automated price discovery mechanism helps to ensure that prices on the 1inch platform are fair and transparent. It also reduces the risk of price manipulation and enables a more efficient trading experience for users.

In addition to efficient price discovery, 1inch’s AMMs also offer other benefits such as improved liquidity, reduced slippage, and lower transaction fees. By leveraging the power of decentralized finance (DeFi) and algorithmic trading, 1inch is able to provide a seamless and user-friendly trading experience for its users.

| Benefits of 1inch’s AMMs: |

|---|

| Efficient price discovery |

| Improved liquidity |

| Reduced slippage |

| Lower transaction fees |

How 1inch Utilizes Automated Market Makers

1inch, the decentralized exchange aggregator, has successfully incorporated Automated Market Makers (AMMs) into its innovative platform. This cutting-edge technology allows 1inch to provide traders with fast and efficient access to liquidity across multiple decentralized exchanges.

Efficient Trading with AMMs

1inch leverages the power of AMMs to offer users a seamless trading experience. By utilizing smart contract protocols, 1inch can facilitate trades without the need for a traditional order book. Instead, AMMs use liquidity pools to provide sufficient liquidity for traders.

These liquidity pools consist of a variety of assets locked within smart contracts. Users can trade between these assets without needing to find a counterparty for their trades. This eliminates the need for order matching and reduces the risk of slippage.

Optimal Pricing with Pathfinding Algorithms

1inch takes advantage of sophisticated pathfinding algorithms to ensure traders get the best possible prices. These algorithms analyze multiple liquidity sources and find the optimal trading route, taking into account factors such as gas costs and exchange fees.

Through the use of AMMs and pathfinding algorithms, 1inch is able to offer traders competitive prices and low slippage, enhancing the overall trading experience.

Experience the power of 1inch’s automated market makers and revolutionize your trading experience.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges and protocols in order to provide the best possible rates for users.

How does 1inch provide liquidity?

1inch uses automated market makers (AMMs) to provide liquidity. AMMs are smart contracts that enable users to trade assets directly with a liquidity pool, rather than relying on traditional order book matching.

What are the benefits of using automated market makers?

Using AMMs allows for instant and cheaper trading, as there is no need for order book matching or waiting for trades to be executed. AMMs also provide liquidity to markets that may not have enough trading volume for traditional order book exchanges.