Understanding How 1inch Aggregator’s Smart Contracts are Executed: An In-Depth Analysis of the Mechanisms Involved

In the world of decentralized finance (DeFi), 1inch has emerged as one of the most popular aggregators for traders and liquidity providers. But how does their smart contract execution work?

At its core, the 1inch aggregator is a decentralized exchange (DEX) aggregator, meaning it scans multiple DEXs to find the best prices for users. By utilizing a combination of smart contract technology and liquidity pools, 1inch is able to route trades efficiently and cost-effectively.

One of the key features of the 1inch aggregator is its use of Pathfinder, a proprietary algorithm that optimizes trade execution. Pathfinder analyzes the available liquidity on various DEXs and selects the most advantageous route for each trade. This ensures that users get the best possible prices and minimal slippage.

Underneath the hood, 1inch relies on a series of smart contracts to execute trades. These smart contracts interact with the Ethereum blockchain and other DeFi protocols to facilitate the movement of assets. By relying on smart contracts, 1inch ensures that trades are executed in a trustless and secure manner.

In addition to smart contracts, 1inch also utilizes liquidity pools to source liquidity for trades. Liquidity pools are pools of funds provided by liquidity providers, who in turn earn fees from the trades executed with their funds. By tapping into multiple liquidity pools, 1inch is able to access deep liquidity and provide users with optimal trading conditions.

Overall, the mechanisms behind 1inch aggregator’s smart contract execution are complex and intricate. By combining smart contracts, liquidity pools, and a powerful optimization algorithm, 1inch is able to offer users a seamless and efficient trading experience in the world of decentralized finance.

Understanding the Fundamentals

The 1inch Aggregator’s smart contract execution is based on a solid foundation of fundamental principles. By understanding these principles, users can gain a deeper understanding of how the aggregator works and how to leverage its capabilities.

Decentralization

At its core, the 1inch Aggregator is built on the principles of decentralization. This means that it operates on a network of nodes that work together to execute smart contracts. By distributing the execution of contracts across multiple nodes, the aggregator ensures that no single entity has control over the entire process.

Decentralization provides several benefits, including increased security, resistance to censorship, and improved reliability. By removing the need for a central authority, the 1inch Aggregator can operate in a trustless and transparent manner.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In the context of the 1inch Aggregator, smart contracts are used to enable the execution of complex transactions across multiple decentralized exchanges.

The smart contracts used by the 1inch Aggregator are designed to optimize trade execution by splitting orders across multiple liquidity sources. This allows users to achieve the best possible price for their trades by accessing liquidity from multiple decentralized exchanges.

Smart contracts are also responsible for handling the on-chain transactions involved in executing trades. By using smart contracts, users can trust that their trades will be executed according to the agreed-upon terms, without the need for intermediaries or centralized exchanges.

Smart contracts are powered by Ethereum, a decentralized blockchain platform that enables the execution of code in a secure and transparent manner. Ethereum’s decentralized nature ensures that the execution of smart contracts is not controlled by any single entity, providing trust and security to users.

In summary, understanding the fundamentals of the 1inch Aggregator’s smart contract execution involves grasping the concepts of decentralization and smart contracts. By operating on a decentralized network and utilizing smart contracts, the aggregator provides a trustless and efficient way to execute complex trades across multiple decentralized exchanges.

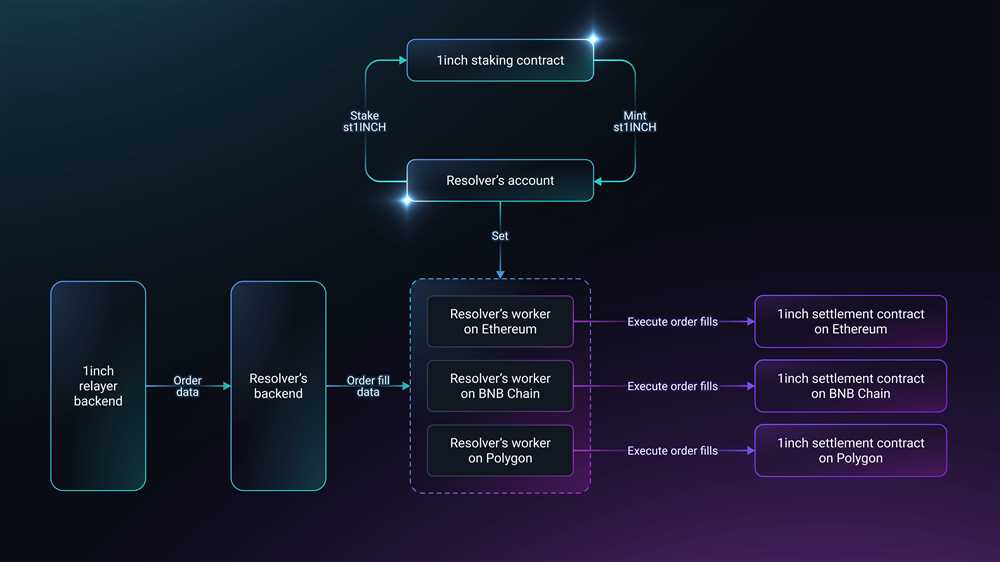

inch Aggregator’s Architecture

The architecture of the 1inch Aggregator’s smart contract execution is designed to provide efficient and secure decentralized trading services. The main components of the architecture include:

1. Smart Contract:

The 1inch Aggregator’s smart contract acts as the central piece of the architecture. It is responsible for executing transactions on behalf of users and interacting with various decentralized exchanges (DEXs). The smart contract is designed to ensure fairness, transparency, and security in the trading process.

2. API Integration:

The 1inch Aggregator integrates with multiple DEXs through their APIs. This allows users to access a wide range of liquidity and trading options from different DEXs using a single interface. The integration also enables the aggregation of prices and liquidity across multiple DEXs to provide users with the best possible trading rates.

3. Liquidity Provider (LP) Networks:

The 1inch Aggregator connects to different LP networks, such as Uniswap, Balancer, and Sushiswap, to access liquidity for trading. The connection to multiple LP networks allows for better liquidity aggregation and improved trading execution.

4. Price Oracle:

The Price Oracle is used to provide accurate and up-to-date price information for different tokens and pairs. The 1inch Aggregator relies on reliable price oracles to ensure fair and competitive trading rates for users.

5. Routing and Execution:

The routing and execution component of the architecture is responsible for determining the most efficient trading route and executing the transaction on the selected DEX. It considers factors such as price, liquidity, and fees to ensure optimal trading outcomes for users.

6. User Interface (UI):

The user interface provides an intuitive and user-friendly experience for traders. It allows users to view and compare different trading options, select preferred settings, and execute trades. The UI also displays relevant information, such as price charts, transaction history, and estimated fees.

In summary, the 1inch Aggregator’s architecture combines smart contract technology, API integration, LP networks, price oracles, routing and execution algorithms, and a user interface to deliver efficient and secure decentralized trading services to users.

Simplified Overview of Smart Contract Execution

Smart contract execution in the 1inch Aggregator involves a series of steps that ensure transparency, security, and efficiency in the process. This section provides a simplified overview of how smart contracts are executed within the 1inch Aggregator ecosystem.

Step 1: User Interaction

Users interact with the 1inch Aggregator platform through a web interface or a decentralized application (DApp). They initiate a transaction by requesting a trade or swapping tokens, specifying the input and output tokens, desired exchange rate, and other parameters.

Step 2: Querying Data

The 1inch Aggregator smart contract retrieves relevant data from multiple decentralized exchanges (DEXs) and liquidity pools. It gathers information such as token balances, exchange rates, and transaction fees from these sources to determine the most optimal path for the trade.

Step 3: Path Calculation

Using the gathered data, the smart contract algorithm calculates the best possible path for the trade. It considers factors like token availability, exchange rates, and transaction costs to identify the optimal route for executing the trade.

Step 4: Smart Contract Deployment

The 1inch Aggregator smart contract is deployed on the Ethereum blockchain, enabling trustless and decentralized execution of trades. The smart contract code is open source, ensuring transparency and audibility of the execution process.

Step 5: Trade Execution

Once the optimal path is determined, the smart contract executes the trade by interacting with multiple DEXs and liquidity pools. It performs token swaps and liquidity provision operations to fulfill the user’s trade request.

Step 6: Transaction Settlement

After the trade is executed, the smart contract settles the transaction by distributing the swapped tokens to the user’s wallet address. It also deducts transaction fees, if any, and updates the relevant token balances and transaction records.

By following this simplified overview of smart contract execution, the 1inch Aggregator ensures efficient and secure token trades for its users. Users can rest assured that their trades are being executed in a trustless and decentralized manner, without the need for intermediaries or centralized entities.

Exploring the Execution Process

When a user initiates a transaction on the 1inch Aggregator, the smart contract execution process begins. This process involves multiple steps that are essential for the proper functioning of the aggregator.

The execution process can be broken down into the following steps:

| Step | Description |

|---|---|

| Step 1 | Verification of user’s transaction details and assets |

| Step 2 | Retrieval of the best available rates and liquidity from different decentralized exchanges |

| Step 3 | Comparison and selection of the optimal route for the transaction |

| Step 4 | Execution of the transaction on the selected decentralized exchanges |

| Step 5 | Confirmation and settlement of the transaction |

During the execution process, the smart contract interacts with various external protocols and APIs. These interactions are crucial for obtaining accurate and up-to-date information about the available rates and liquidity. The smart contract also ensures that the transaction is executed securely and efficiently.

By exploring the execution process of the 1inch Aggregator’s smart contract, we can gain insights into how the aggregator achieves its goal of providing users with the best possible rates and liquidity for their transactions.

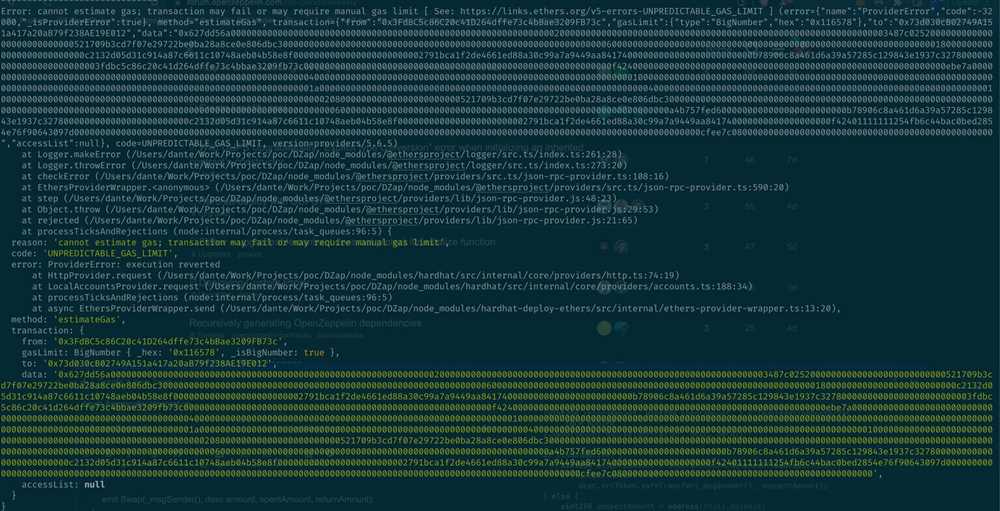

Optimization Techniques Used

1. Gas optimization:

One of the main challenges in executing smart contracts is minimizing gas costs. The 1inch Aggregator’s smart contract execution process implements several gas optimization techniques to reduce transaction costs.

Firstly, the smart contract uses efficient data structures and algorithms to maintain and process data. This helps to minimize the gas consumption required for storage and computation.

Secondly, the contract avoids unnecessary external calls by caching relevant data and reusing it whenever possible. This reduces the gas costs associated with external calls and improves overall performance.

Thirdly, the contract optimizes the order in which operations are executed to minimize gas costs. This includes grouping together similar operations and minimizing repetitive computations.

2. Code optimization:

The contract’s code is also optimized to improve efficiency and reduce gas costs.

Firstly, the code is written in a way that reduces redundancy and eliminates unnecessary operations. This helps to minimize gas consumption and improves execution speed.

Secondly, the contract uses inline assembly code for certain operations that can be executed more efficiently at the lower-level. This allows for fine-grained control over gas usage and improves overall performance.

3. Security optimization:

In addition to gas and code optimization, the contract also incorporates security optimization techniques to mitigate potential risk factors.

Firstly, the contract implements various security checks and validations to ensure the integrity of the system. This includes input validation, authorization checks, and data integrity checks.

Secondly, the contract leverages the latest security best practices and follows industry standards to protect against potential vulnerabilities.

Lastly, the contract undergoes regular security audits and testing to identify and address any security issues proactively.

Overall, the 1inch Aggregator’s smart contract execution process combines gas optimization, code optimization, and security optimization techniques to provide efficient and secure execution of transactions on the platform.

Key Factors Influencing Performance

The performance of the 1inch Aggregator’s smart contract execution is influenced by several key factors. These factors affect the speed and efficiency of the execution, as well as the overall user experience.

One of the most important factors is the network congestion. During periods of high congestion, the execution speed may be slower due to delays in transaction processing. This can result in longer wait times and potentially higher gas fees.

Another factor is the complexity of the transaction. More complex transactions require more computational resources and can take longer to execute. This can be especially true for transactions involving multiple token swaps or complex routing paths.

The gas price is also a significant factor. Higher gas prices incentivize miners to prioritize a transaction, leading to faster execution. However, higher gas prices can also increase the cost of executing a transaction, which can impact the overall user experience.

The choice of blockchain network can also impact performance. Different networks have different transaction processing times and capacities. Some networks may be more congested or have higher gas fees, while others may offer faster execution speeds.

Finally, the efficiency of the smart contract code itself plays a crucial role. Well-written code that minimizes unnecessary computations and optimizes gas usage can significantly improve performance. Regular audits and optimizations of the code can help ensure optimal execution.

| Factor | Influence |

|---|---|

| Network Congestion | Slower execution, longer wait times, potentially higher gas fees |

| Transaction Complexity | Increased computational resources, longer execution times |

| Gas Price | Higher gas prices incentivize faster execution, impact user experience |

| Blockchain Network | Different networks have different speeds, fees, and capacities |

| Smart Contract Efficiency | Well-written code minimizes computation, optimizes gas usage |

Question-answer:

What is the purpose of the 1inch Aggregator’s smart contract execution mechanism?

The purpose of the 1inch Aggregator’s smart contract execution mechanism is to efficiently and securely execute trades across multiple decentralized exchanges (DEXs) to ensure the best possible prices for users.

How does the 1inch Aggregator’s smart contract execution mechanism work?

The 1inch Aggregator’s smart contract execution mechanism uses various techniques such as batch swapping, gas token usage, and other optimizations to route trades through different DEXs and achieve the most favorable rates for users.