The world of decentralized finance (DeFi) is rapidly evolving, and investors are constantly seeking ways to make informed decisions about their investments. One project that has gained significant attention is 1inch, a decentralized exchange (DEX) aggregator that aims to provide the best possible prices for crypto traders across multiple DEXs.

However, to truly understand the potential of 1inch, it is essential to grasp the concept of tokenomics – the economic model behind the project. Tokenomics refers to the way tokens are distributed, used, and valued within a specific ecosystem. By understanding 1inch’s tokenomics, investors can gain insights into the project’s potential for growth and long-term viability.

1inch employs a unique token model, with its native token, 1INCH, playing a central role in the platform’s functioning. Holding 1INCH allows users to participate in various activities within the 1inch ecosystem, such as voting on protocol updates and earning rewards. Additionally, 1INCH can be used to pay for transaction fees and to stake in liquidity pools, further incentivizing token holders to actively engage with the platform.

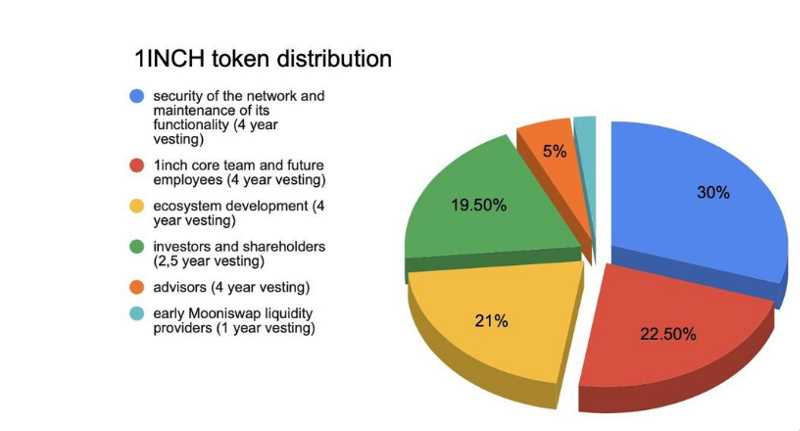

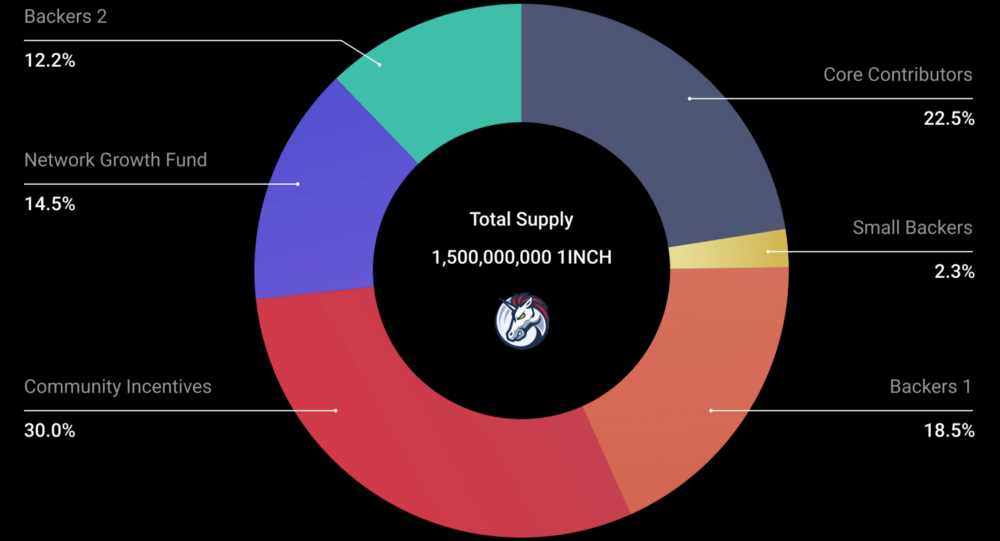

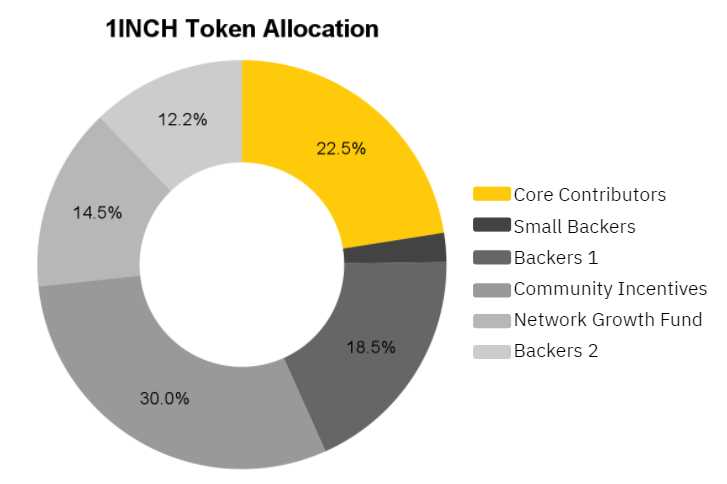

The 1INCH token’s supply is fixed at 1.5 billion tokens, with 30% reserved for the initial distribution to users and liquidity providers. The remaining tokens are allocated for the platform’s growth, development, and community incentives. This limited supply ensures scarcity, which can potentially drive up the token’s value over time.

In this investor’s guide, we will dive deeper into the intricacies of 1inch’s tokenomics, exploring how the token functions within the ecosystem and its potential for long-term success. By understanding these fundamental aspects, investors can make more informed decisions regarding their involvement with 1inch and potentially capitalize on the promising opportunities it presents in the ever-expanding world of DeFi.

Understanding 1inch Tokenomics: A Comprehensive Overview

1inch is a decentralized exchange aggregator that optimizes trading by splitting orders among multiple DEXes. To understand the 1inch tokenomics, it is important to delve into how the platform operates and the role of the native token, 1INCH, within the ecosystem.

How 1inch Works

1inch combines multiple decentralized exchanges (DEXes) to provide users with the best possible trading rates. By splitting orders across different DEXes, 1inch reduces slippage and ensures users get the most favorable prices. The platform utilizes sophisticated algorithms to determine the optimal routing for each trade.

Users can connect their wallets to 1inch and execute trades seamlessly. Behind the scenes, 1inch interactively exchanges tokens across various DEXes to fulfill the trade order. This process eliminates the need for users to manually navigate multiple platforms and provides a streamlined trading experience.

The Role of 1INCH Token

The 1INCH token serves multiple purposes within the 1inch ecosystem. It is a utility token that rewards users for participating in the platform and provides access to various benefits. Here are some key roles of the 1INCH token:

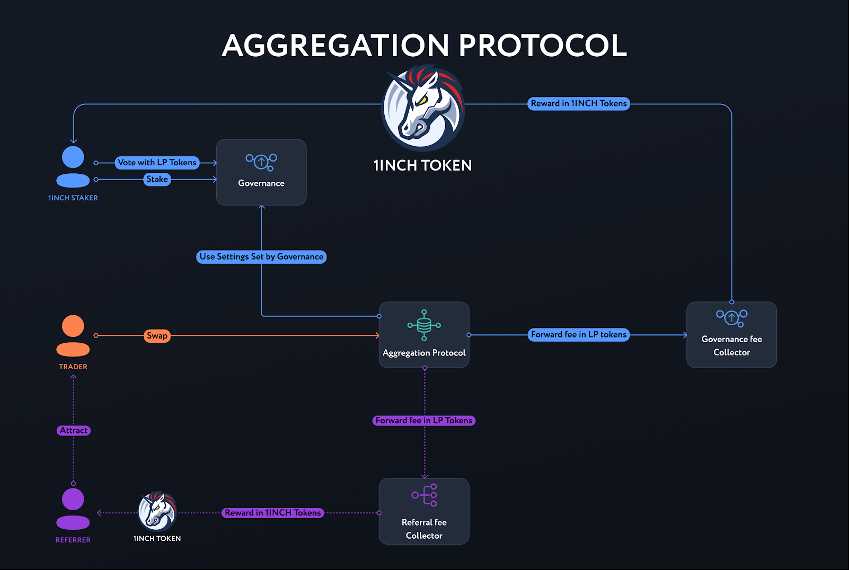

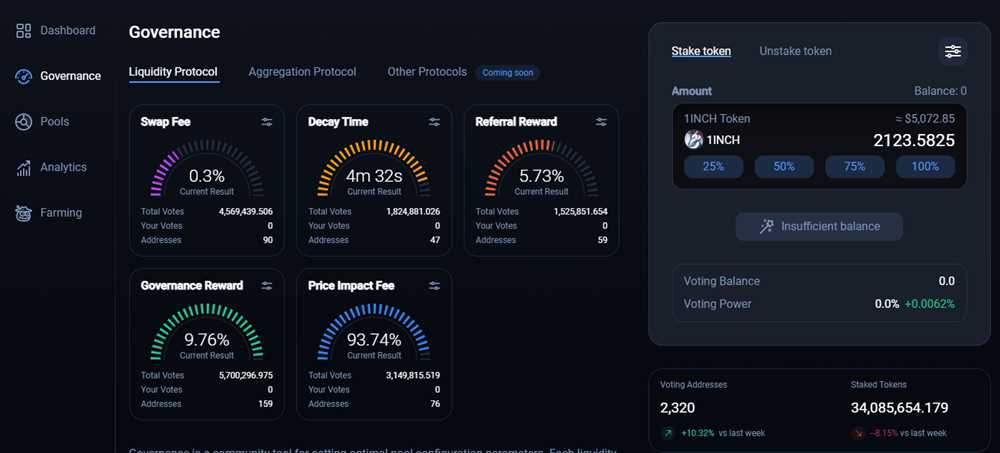

- Governance: 1INCH token holders have the right to participate in the governance of the 1inch platform. They can vote on proposals and decisions that may impact the ecosystem, such as protocol upgrades, fee structures, and platform enhancements.

- Liquidity Mining: The 1inch platform offers liquidity mining programs where users can stake their 1INCH tokens and earn rewards. By participating in liquidity pools, users contribute to the liquidity of the platform and receive additional 1INCH tokens as incentives.

- Protocol Upgrades: The 1INCH token plays a crucial role in protocol upgrades. The platform uses a decentralized governance mechanism where proposals for protocol upgrades are voted upon by 1INCH token holders. This ensures that the platform evolves in a decentralized and community-driven manner.

- Fee Discounts: Holding and staking 1INCH tokens can provide users with fee discounts on trades executed through the 1inch platform. This incentivizes users to hold and utilize the native token, creating a self-sustaining ecosystem.

These are just a few examples of the roles the 1INCH token plays within the 1inch ecosystem. As the platform continues to expand and evolve, the tokenomics may undergo further development to incentivize and reward participants.

In conclusion, the 1inch tokenomics are designed to create a vibrant ecosystem where users are incentivized to participate, provide liquidity, and actively contribute to the governance of the platform. By leveraging the decentralized nature of blockchain technology, 1inch aims to revolutionize the way users trade and interact with decentralized exchanges.

The Importance of Tokenomics in the Crypto Space

The concept of tokenomics, which refers to the study of how tokens function within a particular blockchain ecosystem, is of utmost importance in the crypto space. Tokenomics plays a crucial role in shaping the success and sustainability of a cryptocurrency project.

Tokenomics encompasses various aspects, such as the token distribution model, token utility, token supply, and token economics. These factors determine the value and utility of a token and can greatly influence its adoption and overall market performance.

One key aspect of tokenomics is the token distribution model. This pertains to how tokens are initially distributed and allocated to various parties, including developers, early investors, and the community. A well-designed distribution model can ensure fair distribution and prevent concentration of tokens in the hands of a few entities, which could lead to market manipulation. Transparency and fairness in token distribution are paramount for building trust and credibility within the crypto community.

Token utility is another crucial aspect of tokenomics. A token’s utility refers to its functionality within the blockchain ecosystem. Tokens can serve various purposes, such as facilitating transactions, accessing certain features or services, and participating in governance decisions. The more utility a token has, the more value it can potentially accrue. Therefore, projects that focus on developing compelling and useful token applications are more likely to gain adoption and succeed in the competitive crypto market.

Token supply is also a critical aspect of tokenomics. The total supply of tokens and the rate at which new tokens are minted or burned can directly impact the token’s scarcity and value. A well-balanced token supply mechanism can create a sense of scarcity and demand, driving up the token’s value. On the other hand, an excessive token supply can result in dilution and devaluation of the token, potentially undermining investor confidence and market stability.

Lastly, token economics involves the study of supply and demand dynamics, as well as market forces that influence the price and value of a token. Factors such as token circulation, trading volume, and market liquidity all play a role in determining a token’s price. Understanding the economic fundamentals of a token can help investors make informed decisions and navigate the volatile crypto market with more confidence.

In conclusion, tokenomics is a vital component of the crypto space. It determines the value, utility, and overall success of a cryptocurrency project. By focusing on creating a fair distribution model, developing useful token applications, and balancing token supply, projects can build a strong foundation and attract investors and users alike. Additionally, understanding the economic dynamics of a token can help investors make sound investment decisions and contribute to the overall growth and stability of the crypto market.

Exploring the 1inch Token’s Utility and Functionality

The 1inch token serves multiple purposes within the 1inch ecosystem, providing various utilities and functionalities for its holders. Understanding the token’s role can help investors assess its value and potential for growth.

1. Governance

One of the key functions of the 1inch token is its use in governance mechanisms. Token holders can participate in the decision-making process of the 1inch protocol by voting on proposals and protocol upgrades. This gives them the power to influence the direction of the project and ensure its continuous improvement.

2. Liquidity Mining

1inch token holders can also participate in liquidity mining programs to earn additional tokens. Liquidity mining involves providing liquidity to the 1inch exchange and receiving rewards in return. This incentivizes token holders to contribute to the liquidity pool, facilitating efficient trading and deep liquidity on the platform.

Furthermore, liquidity mining helps distribute tokens to a wider audience, decentralizing ownership and promoting community engagement.

3. Incentives for Protocol Usage

The 1inch token is used to incentivize users to interact with the 1inch protocol. By using the token for transactions and paying fees, users can access various benefits, including reduced fees and priority access to new features and services. This creates a demand for the 1inch token, increasing its value and utility.

Additionally, users can stake their 1inch tokens to earn rewards, adding another layer of incentive for token utilization.

4. Fee Discounts and Benefits

Holders of the 1inch token can enjoy fee discounts on certain services and transactions within the 1inch ecosystem. This provides an additional utility to the token, making it more appealing for traders and investors.

Furthermore, the token may offer other benefits such as access to exclusive features, airdrops, or early access to new products or projects associated with the 1inch ecosystem.

Overall, the 1inch token plays a fundamental role in the functionality and growth of the 1inch ecosystem. Its governance capabilities, liquidity mining opportunities, incentives for protocol usage, and fee discounts make it an essential component for both users and investors alike.

Investment Opportunities and Potential Returns with 1inch Token

The 1inch token presents exciting investment opportunities for those looking to capitalize on the growth of decentralized finance (DeFi). As an integral part of the 1inch Network, the token offers various ways for investors to participate in the platform’s success and potentially earn substantial returns.

First and foremost, holding 1inch tokens allows individuals to become active participants in the governance of the protocol. Token holders can vote on proposals and shape the future direction of the platform. This grants them a voice in decision-making and enables them to influence the development and evolution of 1inch.

Furthermore, individuals who hold 1inch tokens may benefit from various incentive programs and token distribution mechanisms. These programs reward users for participating in liquidity mining, yield farming, or staking activities. By actively engaging with the platform and contributing to its liquidity or security, investors can earn additional 1inch tokens as rewards.

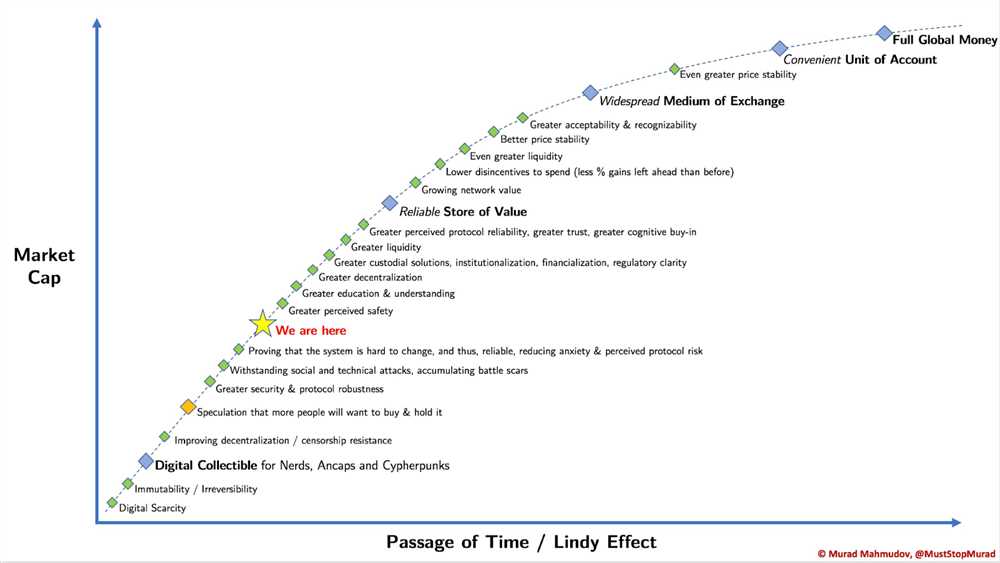

The potential returns from investing in 1inch tokens extend beyond these participation benefits. As the ecosystem grows and adoption increases, the demand for 1inch tokens is likely to rise. This increased demand, coupled with a limited supply, may drive the token’s price upward, potentially resulting in capital gains for early investors.

Additionally, 1inch has a history of introducing innovative features and partnerships, which can further enhance the token’s value. For example, collaborations with other DeFi projects or the implementation of new protocols can contribute to the growth and adoption of 1inch, potentially leading to increased token prices.

However, it is important to note that investing in cryptocurrency tokens, including 1inch, comes with inherent risks. The cryptocurrency market is highly volatile and can experience significant price fluctuations. Investors should carefully assess their risk tolerance and conduct thorough research before making any investment decisions.

Overall, the 1inch token presents promising investment opportunities for those interested in the DeFi space. By participating in governance, engaging in incentive programs, and potentially benefiting from price appreciation, investors may have the chance to earn attractive returns with 1inch tokens. Nevertheless, due diligence and an understanding of the associated risks are crucial for making informed investment decisions.

Question-answer:

What is 1inch Tokenomics?

1inch Tokenomics refers to the economic model and distribution of the 1inch token. It includes details such as the total supply of tokens, the initial distribution to the team and investors, the allocation for community incentives, and the planned token release schedule.

How is the 1inch token distributed?

The 1inch token initially had a fair launch distribution, with no pre-sale or ICO. The tokens were distributed to early users of the 1inch DEX aggregator and liquidity providers on various decentralized exchanges. Additionally, a portion of the tokens are allocated for community incentives, partnerships, and the development team.

What is the purpose of the 1inch token?

The 1inch token serves multiple purposes within the 1inch ecosystem. It can be used to pay for transaction fees, participate in governance decisions, and receive rewards through various incentive programs. The token also provides liquidity mining opportunities and allows users to stake their tokens to earn rewards.