Decentralized exchanges have revolutionized the way we trade cryptocurrencies. These platforms enable users to swap tokens directly from their wallets, without the need for intermediaries or third parties. This eliminates the risks associated with centralized exchanges, such as hacking and theft, and provides users with greater control over their assets. As decentralized exchanges continue to gain popularity, it is important to explore the future of this technology and the potential it holds.

1inch is one of the leading decentralized exchange protocols, known for its innovative approach to liquidity aggregation. The co-founders of 1inch have shared their insights on the future of decentralized exchanges, and their vision is both inspiring and exciting. They believe that decentralized exchanges will play a crucial role in the mainstream adoption of cryptocurrencies, as they provide a more secure and transparent way to trade.

One of the key trends that the co-founders of 1inch foresee is the integration of decentralized exchanges with other DeFi protocols. They believe that this integration will create a more seamless user experience and enable users to access a wider range of financial services. For example, decentralized exchanges could be integrated with lending platforms, allowing users to borrow and lend directly from their wallets. This would eliminate the need for users to transfer their assets between different platforms, reducing transaction costs and increasing efficiency.

In addition to integration with other DeFi protocols, the co-founders of 1inch see a future where decentralized exchanges become more user-friendly and accessible to a wider audience. They believe that improving the user experience will be crucial in driving mainstream adoption of decentralized exchanges. This includes simplifying the process of connecting wallets, providing better liquidity options, and offering more intuitive and user-friendly interfaces. By making decentralized exchanges more user-friendly, they can attract a larger user base and facilitate greater participation in the decentralized finance ecosystem.

The future of decentralized exchanges is bright, and 1inch is at the forefront of driving innovation in this space. With their focus on liquidity aggregation and their vision for the future of decentralized finance, they are well positioned to shape the future of the industry. As decentralized exchanges continue to evolve and improve, we can expect to see a more secure, transparent, and user-friendly trading experience for the crypto community.

Revolutionizing the Trading Landscape

Decentralized exchanges (DEXs) have emerged as a game-changer in the world of cryptocurrency trading. With the rise of blockchain technology, DEXs offer a new way for traders to conduct transactions without relying on traditional intermediaries.

One of the key advantages of DEXs is that they provide users with full control over their funds. Unlike centralized exchanges, where users have to deposit their funds into a third-party wallet, DEXs allow users to trade directly from their own wallets. This eliminates the risk of hacks and thefts, as users are not required to trust centralized exchanges with their funds.

Furthermore, DEXs offer a high level of privacy and anonymity. Transactions on DEXs are conducted directly between traders, without the need for users to disclose their personal information or undergo KYC (Know Your Customer) procedures. This allows individuals to trade freely without the fear of their transaction history being tracked or their identity being exposed.

Another significant advantage of DEXs is their ability to offer a wide range of trading pairs. Unlike centralized exchanges that often limit the number of available trading pairs, DEXs allow users to trade any token listed on the platform. This opens up opportunities for traders to explore new markets and invest in a diverse range of assets.

1inch: Pioneering Innovation in DEXs

1inch has emerged as one of the leading innovators in the field of DEXs. Their unique aggregation protocol allows users to access multiple liquidity sources and find the best trading rates across different DEXs. By aggregating liquidity from various exchanges, 1inch ensures that traders get the most favorable prices for their trades.

Moreover, 1inch has introduced their own governance and utility token, 1INCH, which allows users to participate in the governance of the platform and earn rewards for their contributions. This creates a sense of community ownership and incentivizes users to actively engage with the platform.

The Future of DEXs

The future of DEXs looks promising, with potential for further growth and development. As more investors and traders become aware of the benefits of DEXs, we can expect to see an increase in adoption and liquidity. Additionally, advancements in blockchain technology will likely lead to improved scalability and lower transaction fees, making DEXs even more attractive to users.

In conclusion, DEXs are revolutionizing the trading landscape by offering a decentralized and secure way for traders to conduct transactions. With their advantages of user control, privacy, and access to a wide range of trading pairs, DEXs are setting a new standard for the cryptocurrency trading industry.

Overcoming Challenges and Maximizing Opportunities

In the world of decentralized exchanges (DEXs), there are several challenges that need to be overcome in order to maximize the opportunities for growth and success. One of the main challenges is liquidity. Without sufficient liquidity, users will not be able to execute trades efficiently, leading to a poor user experience and limited adoption.

Another challenge is scalability. As the popularity of DEXs continues to grow, it is important to ensure that the underlying infrastructure can handle the increasing volume of transactions. Scalability solutions, such as layer 2 protocols, can help to address this challenge and enable DEXs to handle a larger number of users and trades.

Security is also a significant challenge in the world of DEXs. With no central authority overseeing transactions, it is crucial to ensure that all trades are secure and that users’ funds are protected. This requires robust security measures, including advanced encryption techniques and rigorous auditing processes.

Interoperability is another challenge that needs to be overcome. As the number of DEXs continues to increase, it is important to establish standards and protocols that allow different platforms to communicate and interact with each other seamlessly. This will enable users to access a wider range of liquidity and trading options, ultimately enhancing the overall user experience.

Despite these challenges, there are also significant opportunities for growth and innovation in the world of decentralized exchanges. One of the main opportunities is the ability to democratize access to financial services. DEXs enable anyone with an internet connection to trade digital assets without needing to rely on traditional intermediaries or meet minimum account requirements.

Another opportunity is the potential for cost savings. By eliminating the need for intermediaries, DEXs can significantly reduce transaction costs, making trading more affordable and accessible for users. This can be particularly beneficial for individuals in developing countries who may not have access to traditional banking services.

Furthermore, DEXs have the potential to provide increased transparency and accountability. With all transactions recorded on a public blockchain, users can easily verify the integrity of trades and ensure that there is no manipulation or fraudulent activity taking place. This can help to build trust and confidence in the decentralized finance ecosystem.

In conclusion, while there are challenges that need to be overcome, the future of decentralized exchanges is full of opportunities for growth, innovation, and the democratization of financial services. By addressing issues such as liquidity, scalability, security, and interoperability, DEXs can pave the way for a more inclusive and accessible financial system.

Driving the Next Wave of Innovation

In the world of decentralized exchanges (DEXs), innovation is the driving force that propels the industry forward. As the market continues to evolve and mature, it is crucial for DEXs to stay at the forefront of technological advancements and push the boundaries of what is possible.

1inch co-founders, Sergej Kunz and Anton Bukov, understand the importance of innovation in shaping the future of decentralized finance (DeFi). They believe that innovation is not just about creating new features or products, but about fundamentally redefining the way we think about financial systems.

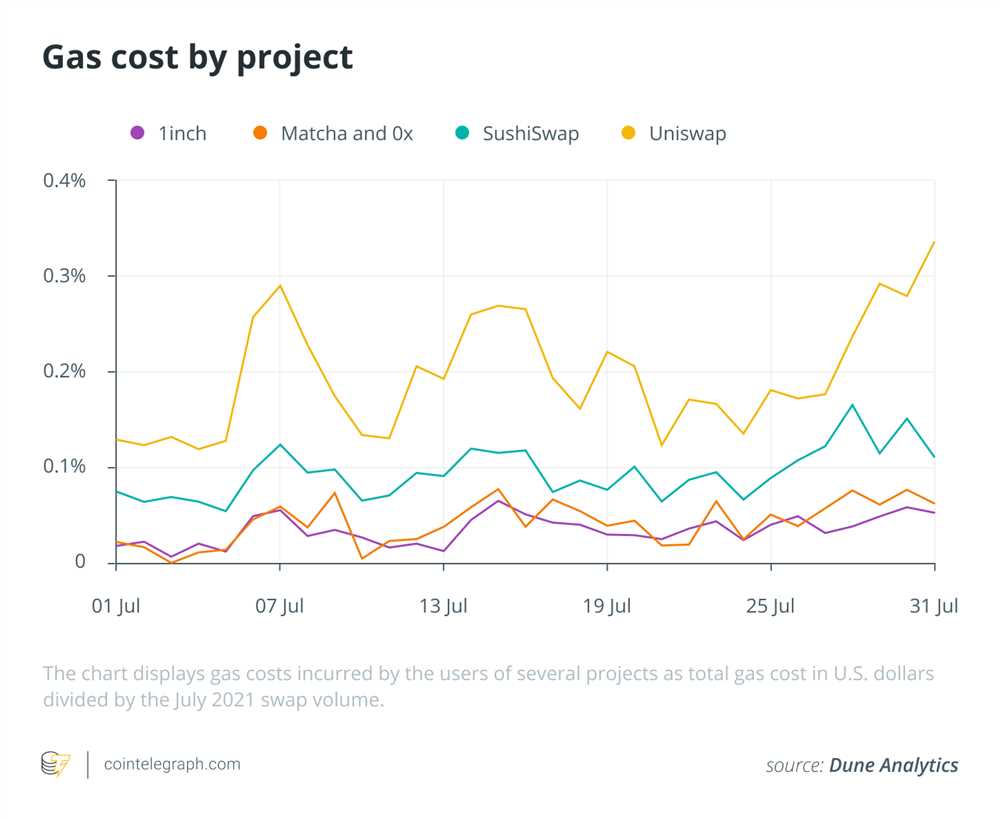

One area where innovation is particularly crucial for DEXs is user experience. As more and more users start to embrace DeFi, it is essential to provide them with a seamless and intuitive experience. This means developing user-friendly interfaces, improving transaction speeds, and reducing gas fees.

Another area of innovation is in the liquidity aggregation space. 1inch has been at the forefront of this innovation, pioneering the idea of splitting a trade across multiple DEXs to achieve the best possible price. By tapping into multiple liquidity sources, 1inch ensures that users get the most competitive rates and deepest liquidity pools.

Furthermore, the future of decentralized exchanges lies in automation and programmability. Smart contracts enable DEXs to execute trades automatically, removing the need for intermediaries and reducing the risk of human error. This opens up a world of possibilities for developers to create complex trading strategies and execute them with precision.

The driving force behind innovation in the DEX space is the relentless pursuit of decentralization. DEXs aim to eliminate the need for trusted intermediaries, allowing users to trade directly from their wallets. This not only enhances security but also promotes financial inclusivity by providing access to anyone with an internet connection.

In conclusion, driving the next wave of innovation in the DEX space is essential for the continued growth and success of decentralized finance. By focusing on user experience, liquidity aggregation, automation, and decentralization, DEXs like 1inch are shaping the future of finance and revolutionizing the way we trade.

Question-answer:

What is a decentralized exchange?

A decentralized exchange is a type of cryptocurrency exchange that operates on a distributed ledger, such as a blockchain, and allows users to trade cryptocurrencies directly with each other without the need for intermediaries.

How does a decentralized exchange differ from a centralized exchange?

A decentralized exchange differs from a centralized exchange in that it does not rely on a central authority to facilitate trades. Instead, it operates using smart contracts and peer-to-peer technology, which allows for greater transparency, security, and control over one’s funds.