In the world of decentralized finance (DeFi), 1inch has emerged as a leading platform for efficient and cost-effective cryptocurrency trades. But what sets 1inch apart from other decentralized exchanges? One answer lies in its unique tokenomics, which play a crucial role in the platform’s success and growth.

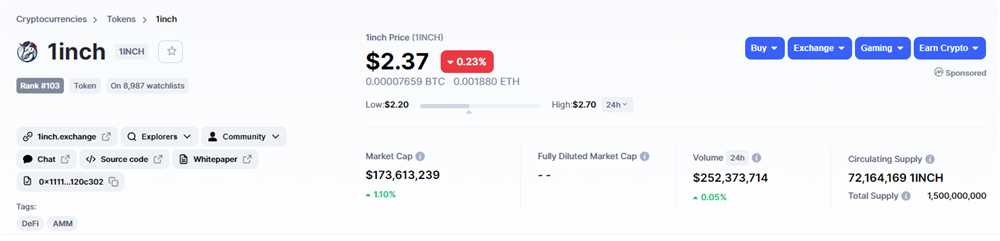

1inch’s native token, also called 1inch, serves as the fuel that powers the platform. It plays a crucial role in facilitating transactions and incentivizing liquidity providers. With a limited supply of 1.5 billion tokens, the demand and scarcity help drive the value of the token.

One of the main features of 1inch’s tokenomics is its governance system. Holders of the 1inch token have the power to shape the future of the platform by participating in its decentralized governance. This allows token holders to vote on important decisions, such as protocol upgrades and fee changes, ensuring a democratic and community-driven approach to platform development.

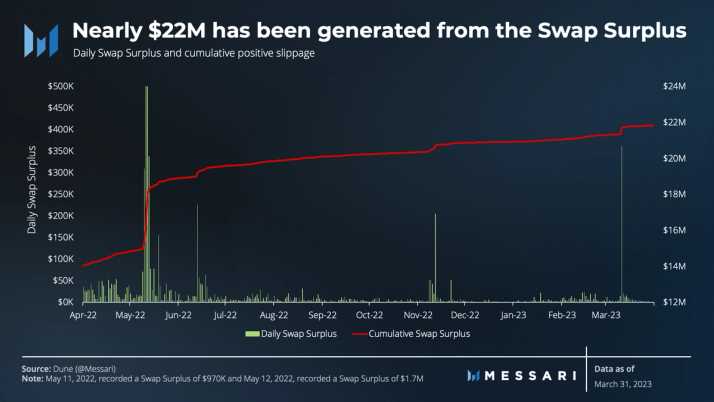

Additionally, 1inch has implemented a unique “pathfinder” algorithm, which enables users to find the most efficient route for their trades across multiple decentralized exchanges. This algorithm is an integral part of the platform’s tokenomics, as it incentivizes users to hold and use 1inch tokens to access the best possible prices and minimize slippage. By encouraging token usage, 1inch ensures a healthy ecosystem for its native cryptocurrency.

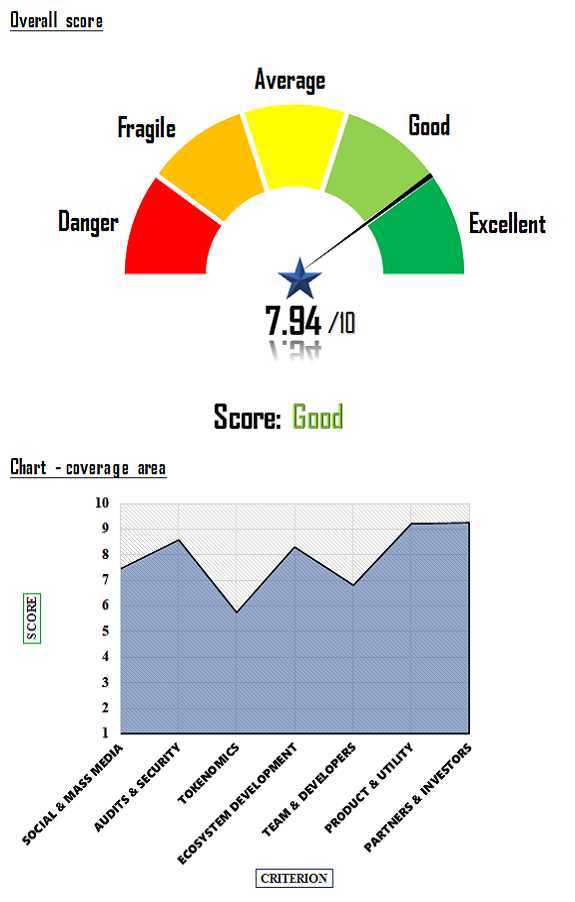

The success of 1inch’s tokenomics can also be attributed to its partnership with major players in the DeFi space. By collaborating with other platforms and protocols, 1inch expands its reach and user base, further driving demand for its token. This strategic approach to partnerships, combined with its innovative tokenomics, solidifies 1inch’s position as a key player in the ever-growing DeFi landscape.

In conclusion, 1inch’s tokenomics serve as a key driver of its success in the DeFi space. With a limited supply, decentralized governance, and innovative algorithms, the 1inch token ensures a thriving and efficient ecosystem for cryptocurrency trades. As the DeFi market continues to evolve, 1inch’s tokenomics will likely play an even greater role in shaping the future of decentralized finance.

The Role of Tokenomics in the Crypto Industry

Tokenomics, a term derived from “token” and “economics,” refers to the study of the economic implications and incentives surrounding cryptocurrencies and blockchain-based tokens. In the crypto industry, tokenomics plays a crucial role in shaping the success and sustainability of a particular crypto project.

Creating Incentives for Participation

One of the primary goals of tokenomics is to create incentives for users to actively participate in the ecosystem of a crypto project. By offering rewards and incentives through tokens, projects can encourage users to contribute their resources, such as computing power or liquidity, and actively engage with the platform. This participation not only helps in the growth of the project but also enhances its network effects and overall value proposition.

Ensuring Token Liquidity

Tokenomics also focuses on ensuring the liquidity of a project’s tokens. By designing tokenomics that incentivize liquidity providers, projects can ensure that their tokens are readily available for trading and exchange. This liquidity is essential for maintaining a vibrant and active market, allowing users to easily buy and sell tokens without significant price fluctuations.

Moreover, tokenomics strategies can include mechanisms such as staking and yield farming that enable users to earn passive income by locking up their tokens, thereby providing liquidity to the market. These strategies not only benefit token holders but also contribute to the overall liquidity and stability of the project.

Governing the Decentralized Ecosystem

In decentralized ecosystems, tokenomics often plays a vital role in governance. By allocating voting rights or decision-making power based on token ownership, projects can ensure that the community actively participates in the decision-making process. This democratic approach not only fosters a sense of ownership and decentralization but also helps in achieving consensus and avoiding conflicts of interest.

Additionally, tokenomics can also be used to align the incentives of different stakeholders within a crypto project. For example, projects can reward developers and contributors with tokens that vest over time, incentivizing long-term commitment and aligning their interests with the project’s success.

In conclusion, tokenomics is a crucial aspect of the crypto industry. It serves as the economic framework that governs various aspects of a crypto project, including user participation, token liquidity, and decentralized governance. By carefully designing and implementing tokenomics strategies, projects can create sustainable and successful ecosystems that benefit all participants.

Understanding 1inch Crypto

1inch is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXs to provide users with the best possible trading rates. The platform was developed to address the issue of fragmented liquidity in the decentralized finance (DeFi) ecosystem.

1inch Crypto operates on the Ethereum blockchain and offers users the ability to swap tokens at the most favorable rates across different DEXs. By aggregating liquidity from multiple sources, 1inch helps users avoid the need for manual searching and trading on different platforms to find the best rates. This saves time and reduces costs for traders.

The 1inch Token (1INCH) is the native utility token of the 1inch network. Holders of the 1INCH token have various benefits within the ecosystem. They can participate in governance decisions, such as protocol upgrades and improvements. Additionally, token holders can stake their 1INCH tokens to earn a portion of the network’s trading fees as rewards.

Furthermore, 1inch regularly conducts token burns to reduce the overall token supply, increasing the scarcity and potential value of the remaining tokens. This token burning mechanism is implemented to create a deflationary model for the 1INCH token.

Overall, 1inch Crypto is designed to offer a more efficient and cost-effective way for users to trade tokens across various DEXs. The platform leverages its aggregation algorithm to provide users with the best available rates, while the 1INCH token provides additional benefits and incentives for participation in the ecosystem.

An Overview of 1inch Protocol

1inch is a decentralized exchange (DEX) aggregator that was created to optimize trading strategies and minimize slippage for users. The protocol operates by combining liquidity from various DEXs to provide users with the best possible trading rates.

The 1inch protocol connects to multiple liquidity sources, including decentralized exchanges such as Uniswap, Sushiswap, Balancer, Kyber Network, and more. By doing so, it ensures that users get the best price execution for their trades, taking into account fees, liquidity, and other factors.

One of the key features of the 1inch protocol is the Pathfinder algorithm, which determines the most efficient route for executing trades across different DEXs. This algorithm helps to reduce slippage and optimize trading strategies, ultimately saving users money on their trades.

Another important aspect of the 1inch protocol is its governance token, also called 1inch. The 1inch token plays a crucial role in the ecosystem, allowing users to participate in the governance of the protocol and earn rewards for providing liquidity.

Users who hold and stake 1inch tokens have the ability to vote on protocol upgrades, parameter changes, and other governance decisions. In return for participating in governance, users are rewarded with a portion of the fees generated by the protocol.

The tokenomics of the 1inch protocol are designed to incentivize participation and provide benefits to token holders. By owning and staking 1inch tokens, users can not only influence the direction of the protocol but also earn passive income through fees and rewards.

Conclusion

The 1inch protocol is a decentralized exchange aggregator that aims to provide users with the best possible trading rates across multiple DEXs. With its Pathfinder algorithm and governance token, 1inch offers a unique and efficient way for users to trade cryptocurrencies while also participating in the protocol’s governance and earning rewards.

Key Components of 1inch Tokenomics

One of the major components of 1inch tokenomics is the utility of the 1inch token within the 1inch ecosystem. The token is used for various purposes, such as paying for transaction fees, participating in the governance of the protocol, and receiving rewards through liquidity mining.

Transaction Fees

When users interact with the 1inch platform, they are required to pay transaction fees. These fees can be paid using the 1inch token, providing a use case and demand for the token. By using the 1inch token for transaction fees, users can also benefit from reduced fees or additional benefits on the platform.

Governance

Token holders of 1inch also have the ability to participate in the governance of the protocol. They can propose and vote on changes, upgrades, or additions to the platform. This gives token holders a voice in shaping the future of 1inch and helps ensure the decentralized nature of the protocol.

A decentralized autonomous organization (DAO) is responsible for managing the governance process, and token holders can stake their tokens in order to participate and earn rewards for their involvement in the governance process.

Liquidity Mining

1inch also utilizes liquidity mining as a way to incentivize users to provide liquidity on the platform. Liquidity providers can earn rewards in the form of 1inch tokens by supplying liquidity to supported pools. These rewards are distributed based on a proportional share of the total liquidity provided.

This incentivizes users to provide liquidity, which in turn improves the overall liquidity and efficiency of the 1inch protocol. By rewarding liquidity providers with 1inch tokens, the platform creates a positive feedback loop that benefits both the platform and its users.

In conclusion, the key components of 1inch tokenomics include the use of the 1inch token for transaction fees, governance participation, and liquidity mining. These features create a strong incentive for users to hold and use the 1inch token within the 1inch ecosystem.

The Role of 1inch Token (1INCH)

The 1inch token (1INCH) plays a central role in the 1inch ecosystem. It is the native governance token of the platform and is used to incentivize and align the interests of users, liquidity providers, and protocol stakeholders.

Utility within the Protocol

1INCH token holders have the ability to participate in the governance of the platform, which includes voting on key protocol parameters, proposals, and upgrades. This gives token holders the power to shape the future development and direction of the protocol.

In addition to governance, holding 1INCH tokens can offer various benefits within the protocol ecosystem. This includes accessing features such as instant liquidity aggregation and trading fee discounts. Users who hold a certain amount of 1INCH tokens may also be eligible for airdrops and other exclusive benefits.

Liquidity Provision and Rewards

1INCH tokens also play a crucial role in incentivizing liquidity providers within the 1inch ecosystem. Liquidity providers who contribute to the liquidity pools are rewarded with 1INCH tokens as a way to encourage their participation. These rewards help to ensure the availability of liquidity and improve the efficiency of trading on the platform.

The distribution of rewards to liquidity providers is determined by various factors, including the amount of liquidity provided, the duration of the liquidity provision, and the overall performance of the liquidity pool. This incentivizes liquidity providers to contribute more to the ecosystem and helps to create a vibrant and liquid market.

Overall, the 1inch token (1INCH) plays a vital role in the governance, utility, and incentivization within the 1inch ecosystem. It empowers users to actively participate in decision-making processes, access exclusive features, and contribute liquidity to the platform. As the ecosystem continues to grow and evolve, the 1INCH token will continue to be a key component in driving its success.

Token Distribution and Allocation

The 1inch token (1INCH) is the native utility token of the decentralized exchange aggregator 1inch. The token is used for governance, staking, and utility purposes within the 1inch ecosystem.

Token Distribution

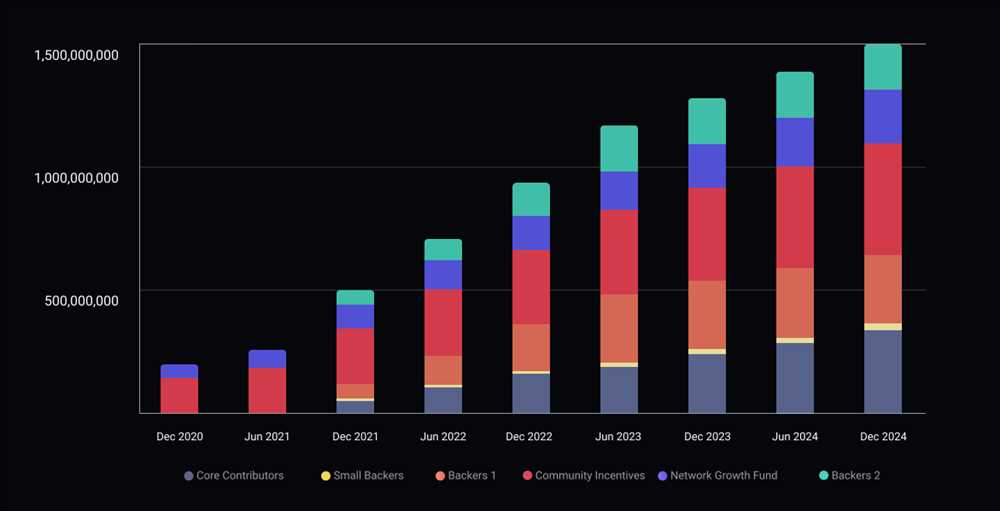

The total supply of 1INCH tokens is capped at 1.5 billion. The tokens were distributed through various mechanisms. Here is a breakdown of the token distribution:

- 30% of the total supply was distributed to the community through an airdrop.

- 14.5% of the total supply was allocated to the team and founders, with a vesting period of four years.

- 17.5% of the total supply was allocated to the 1inch Foundation, which is responsible for the development and growth of the protocol.

- 22.5% of the total supply was allocated to the 1inch Liquidity Protocol reserve.

- 6% of the total supply was allocated to the 1inch Network Growth Fund, which aims to support the growth of the 1inch network.

- 3.5% of the total supply was allocated to advisors and partners.

- 6% of the total supply was allocated to the early investors.

Token Allocation

The allocation of 1INCH tokens is essential for the sustainable growth of the ecosystem. Here is a breakdown of the token allocation:

- Governance: 1INCH token holders have the power to vote on proposals and changes to the 1inch protocol.

- Staking: 1INCH token holders can stake their tokens to earn staking rewards and participate in the governance of the protocol.

- Utility: The 1INCH token will be used as a utility token within the 1inch ecosystem, providing various benefits and discounts to users.

Overall, the token distribution and allocation of 1INCH tokens aim to ensure a fair and decentralized governance system while incentivizing participation and growth within the 1inch ecosystem.

Question-answer:

What is 1inch Crypto?

1inch is a decentralized cryptocurrency exchange aggregator that sources liquidity from various exchanges and allows users to access the best prices for their trades.

What is tokenomics?

Tokenomics refers to the economic design and structure of a cryptocurrency token. It includes factors such as the token’s supply, distribution, inflation rate, utility, and governance mechanisms.

How does the 1inch token work?

The 1inch token (1INCH) serves multiple purposes within the 1inch ecosystem. It can be used for governance, allowing token holders to participate in the decision-making process. Additionally, 1INCH holders can stake their tokens to earn a portion of the protocol’s fees, and they can also use 1INCH to access certain protocol features and services.

What is the total supply of 1INCH?

The total supply of 1INCH is 1.5 billion tokens. However, only around 6% of the total tokens were initially distributed to the community. The remaining tokens are intended to be distributed over the course of the next four years through various mechanisms, including liquidity mining and ecosystem rewards.

How is 1inch different from other decentralized exchanges?

1inch is unique in that it aggregates liquidity from multiple decentralized exchanges, allowing users to find the best prices for their trades. This helps users save on gas fees and slippage. Additionally, 1inch has implemented several innovative features, such as Pathfinder, which dynamically routes trades across multiple liquidity sources to optimize execution.