Introduction

Decentralized exchanges (DEXs) have gained significant popularity in the cryptocurrency space due to their ability to provide users with a peer-to-peer trading experience without relying on intermediaries. Among the top DEXs available, 1inchswap stands out as a prominent player. This article aims to compare 1inchswap with other leading DEXs in terms of features, liquidity, fees, and user experience.

Features

1inchswap boasts a wide range of features that differentiate it from other DEXs. One notable feature is its automated market maker (AMM) which allows users to participate in on-chain liquidity pools. Additionally, 1inchswap offers multi-chain capability, supporting transactions on various blockchains such as Ethereum, Binance Smart Chain, and Polygon. This versatility sets 1inchswap apart and expands its reach to a wider user base.

Other Top DEXs

While 1inchswap is a strong contender in the DEX landscape, other platforms like Uniswap and SushiSwap have their own unique features. Uniswap, for example, was one of the first DEXs to introduce the concept of AMM and has a large number of liquidity providers. SushiSwap, on the other hand, offers yield farming opportunities and innovative token offerings through its decentralized autonomous organization (DAO).

Liquidity

Liquidity is a crucial aspect of any DEX as it ensures that users can easily trade their assets. 1inchswap has experienced significant growth in liquidity, largely due to its integration with multiple networks. The platform aggregates liquidity from various sources, including other DEXs, to provide users with the best possible trading experience. However, both Uniswap and SushiSwap still dominate the market in terms of liquidity and trading volume.

Fees

When it comes to fees, 1inchswap is known for its competitive pricing. The platform offers low trading fees and allows users to optimize their transactions by selecting the best route across different DEXs. Uniswap and SushiSwap, while widely used, have higher fees due to their popularity and the demand they generate.

User Experience

User experience is a critical aspect of any DEX, as it determines how easy and intuitive it is for users to navigate and execute trades. 1inchswap provides a user-friendly interface that simplifies the process of trading and swapping tokens. The platform offers a seamless experience with real-time pricing and efficient order routing. Uniswap and SushiSwap also offer user-friendly interfaces, but they may lack some of the advanced features that 1inchswap provides.

Conclusion

1inchswap has proven to be a strong contender among the top DEXs, offering unique features, competitive fees, and an intuitive user experience. However, it still faces tough competition from established platforms like Uniswap and SushiSwap, which have a larger user base and higher liquidity. As the DEX landscape continues to evolve, it will be interesting to see how these platforms innovate and adapt to meet the growing demands of the cryptocurrency community.

Features and Benefits

1inchswap offers a range of features and benefits that set it apart from other top decentralized exchanges (DEXs) in the market. These features and benefits include:

1. Efficient trading

1inchswap leverages the power of its smart contract routing technology to find the best possible trading routes across multiple DEXs, reducing slippage and optimizing trade results. This ensures that users can trade their tokens efficiently and at the best possible prices.

2. Aggregated liquidity

1inchswap aggregates liquidity from various DEXs, allowing users to access a wider pool of liquidity and providing better trading opportunities. This increased liquidity helps to minimize the impact of large trades on the market and improves overall trading conditions.

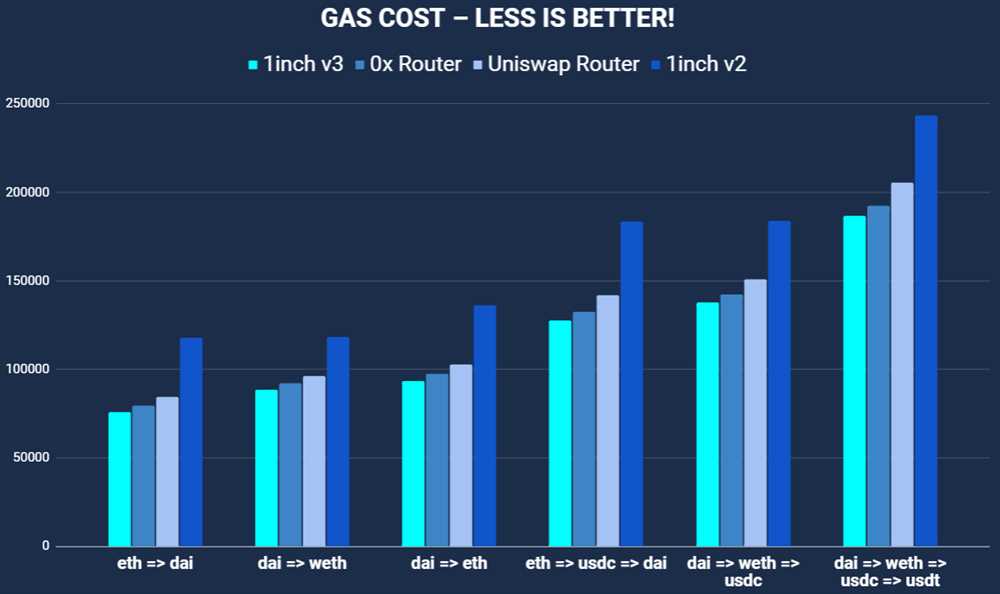

3. Gas optimization

Gas fees on the Ethereum network can be high, especially during periods of high congestion. 1inchswap utilizes gas optimization techniques to minimize transaction costs for users, making trading more affordable and accessible.

4. Security and transparency

1inchswap is built on Ethereum, a well-established and secure blockchain network. The platform also ensures transparency by providing users with detailed information about their trades, including the route taken and associated fees.

5. User-friendly interface

1inchswap offers a user-friendly and intuitive interface that makes it easy for both experienced traders and newcomers to navigate and use the platform. The platform also provides helpful tools and guides to assist users in making informed trading decisions.

In conclusion, 1inchswap stands out from other DEXs with its efficient trading, aggregated liquidity, gas optimization, security, transparency, and user-friendly interface. These features and benefits make 1inchswap a top choice for decentralized trading on the Ethereum network.

Question-answer:

How does 1inchswap compare to other top decentralized exchanges (DEXs)?

1inchswap is a decentralized exchange aggregator that allows users to find the best prices and execute trades across multiple DEXs. It differs from other DEXs in that it provides a more efficient way to swap tokens by combining liquidity from various sources. This means that users can potentially get better prices and lower fees on 1inchswap compared to using individual DEXs.

What are the advantages of using 1inchswap compared to other top DEXs?

There are several advantages of using 1inchswap compared to other top DEXs. Firstly, 1inchswap provides access to a wider range of liquidity as it aggregates multiple DEXs. This means that users can potentially get better prices and trade with lower slippage. Secondly, 1inchswap offers a user-friendly interface with advanced features, such as the ability to set custom slippage tolerances. Additionally, 1inchswap has a native token, 1INCH, which can be earned through liquidity mining and used for governance and fee discounts.

What are some limitations or risks of using 1inchswap compared to other top DEXs?

While 1inchswap offers several advantages, there are also some limitations and risks to consider. Firstly, as an aggregator, 1inchswap relies on the underlying liquidity of the DEXs it integrates with. This means that if the liquidity on these DEXs is low, users may not be able to find sufficient liquidity for their trades. Secondly, 1inchswap is built on the Ethereum blockchain, which can be subject to high transaction fees and network congestion. This can result in higher costs and slower transaction times compared to DEXs built on other blockchains. Lastly, while 1inchswap has implemented various security measures, there is always a risk of smart contract vulnerabilities or external attacks that could result in the loss of funds.