The Crucial Role played by 1inch in Facilitating Interoperability in the DeFi Ecosystem

Decentralized Finance (DeFi) has revolutionized the way we think about traditional financial systems. With its promise of open access, transparency, and potential for high returns, DeFi has attracted a growing number of participants from all over the world. However, the fragmented nature of blockchain networks has posed a major challenge for the seamless movement of assets across different chains. This is where 1inch, a decentralized exchange aggregator, comes into play.

1inch acts as a bridge between different blockchain networks, facilitating the transfer of assets and enabling cross-chain transactions in DeFi. By integrating with various liquidity sources and decentralized exchanges, 1inch is able to find the best prices for a particular trade across multiple chains. This not only helps users to save on fees and slippage, but also reduces the complexity and time required for executing cross-chain transactions.

One of the key features of 1inch is its Pathfinder algorithm, which is designed to intelligently route trades across different liquidity sources and decentralized exchanges based on the best prices and lowest fees. This algorithm takes into account factors such as liquidity depth, gas prices, and transaction fees to ensure that users get the best possible deal. By optimizing trade execution and reducing the need for multiple transactions, 1inch is able to provide a seamless and cost-effective experience for users looking to engage in cross-chain transactions.

Furthermore, 1inch is constantly expanding its network of supported chains and liquidity sources, ensuring that users have access to a wide range of trading options. The platform has already integrated with popular chains such as Ethereum, Binance Smart Chain, and Polygon, with plans to support more chains in the future. With its focus on interoperability and accessibility, 1inch is playing a crucial role in bridging the gap between different blockchain networks and enabling cross-chain transactions in the world of DeFi.

The Importance of 1inch in Enabling Cross-Chain Transactions in DeFi

As the decentralized finance (DeFi) ecosystem continues to grow, the ability to seamlessly transact across different blockchains has become crucial. One of the key players in enabling cross-chain transactions is 1inch.

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) and protocols to provide users with the best possible trading rates. It operates across different blockchains, including Ethereum, Binance Smart Chain, and Polygon, making it an ideal platform for cross-chain transactions.

The Significance of Cross-Chain Transactions in DeFi

The decentralized finance space consists of various blockchains, each with its own set of protocols and tokens. Cross-chain transactions allow users to interact with different DeFi protocols, trade tokens, and access a wider range of investment opportunities.

By enabling cross-chain transactions, 1inch opens up a world of possibilities for DeFi users. They can seamlessly move assets between different blockchains, taking advantage of the unique offerings and opportunities in each ecosystem.

How 1inch Enables Cross-Chain Transactions

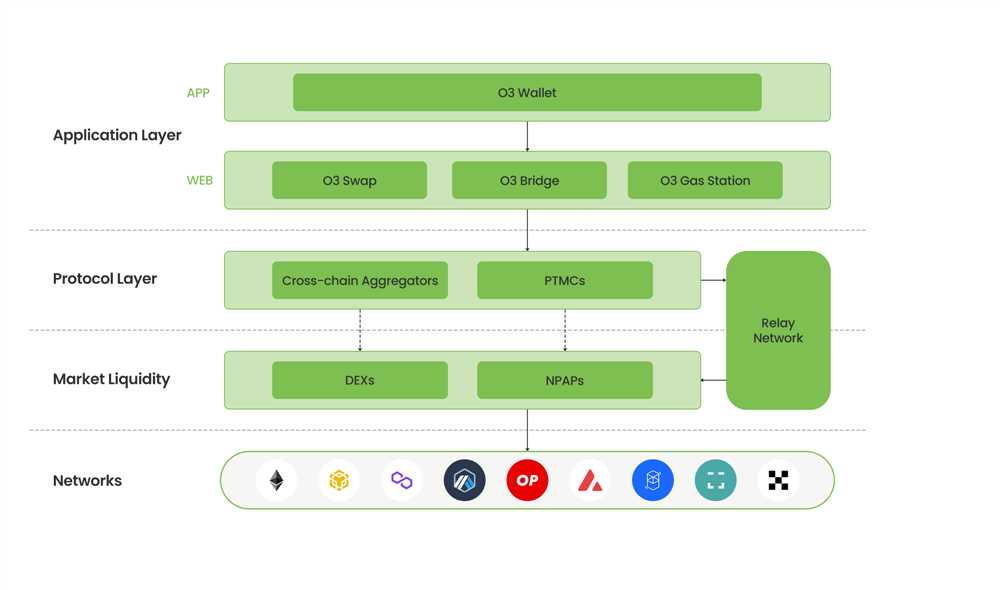

1inch achieves cross-chain compatibility through its robust infrastructure and integration with multiple blockchains. Its smart contract architecture allows for interoperability between different chains, enabling users to transfer assets and execute trades across various platforms.

Furthermore, 1inch employs cutting-edge technologies, such as cross-chain bridges and wrapped tokens, to facilitate the movement of assets between different blockchains. This ensures that users can access a diverse selection of assets and utilize them in DeFi protocols regardless of the underlying blockchain.

| Benefits of 1inch in Enabling Cross-Chain Transactions |

|---|

| 1. Enhanced liquidity: By aggregating liquidity from multiple DEXs, 1inch provides users with access to deep pools of liquidity, resulting in better trading rates and reduced slippage. |

| 2. Improved user experience: 1inch’s intuitive interface and user-friendly features make it easy for users to navigate and execute cross-chain transactions without the need for complex technical knowledge. |

| 3. Lower costs: By leveraging multiple blockchains, 1inch enables users to optimize their gas fees and transaction costs, resulting in cost savings for traders and investors. |

| 4. Diverse investment opportunities: With cross-chain transactions, users can tap into a wide range of DeFi protocols, tokens, and investment strategies across different blockchains, maximizing their potential returns. |

Overall, 1inch plays a crucial role in enabling cross-chain transactions in the decentralized finance ecosystem. Its integration with multiple blockchains and advanced technologies empower users to seamlessly transact and explore the vast landscape of DeFi opportunities.

The Role of 1inch in Enabling Cross-Chain Transactions

With the rapid growth of decentralized finance (DeFi) and the increasing number of blockchain networks, the need for seamless cross-chain transactions has become more essential than ever. Cross-chain transactions allow users to transfer assets between different blockchains, enabling liquidity and accessibility across multiple platforms.

1inch, a decentralized exchange (DEX) aggregator, plays a crucial role in enabling cross-chain transactions in DeFi. By integrating with various blockchain networks, including Ethereum, Binance Smart Chain, Polygon, and others, 1inch allows users to access liquidity across different chains.

How does 1inch enable cross-chain transactions?

1inch achieves cross-chain compatibility by utilizing various technologies and protocols. It leverages bridge mechanisms, such as token wrapping, to facilitate the transfer of assets between different chains.

When a user wants to perform a cross-chain transaction, 1inch identifies the optimal bridges and liquidity sources across multiple chains to maximize efficiency and minimize costs. The platform automatically routes the transaction through the most favorable paths, leveraging its smart contract technology and liquidity pools.

The benefits of cross-chain transactions enabled by 1inch

The ability to perform cross-chain transactions through 1inch brings several benefits to DeFi users:

- Increased liquidity: 1inch aggregates liquidity from multiple DEXs across different blockchains, providing users with access to a broader pool of assets and improving liquidity.

- Cost efficiency: By routing transactions through the most optimal paths, 1inch minimizes transaction costs, reducing slippage and maximizing the value users receive.

- Improving accessibility: Cross-chain transactions allow users to access DeFi applications and assets that are native to different blockchains, expanding their choices and opportunities in the decentralized finance ecosystem.

- Enhanced security: 1inch prioritizes security by conducting audits and integrating with trusted bridge protocols, ensuring that cross-chain transactions are conducted safely and transparently.

In conclusion, 1inch plays a significant role in enabling cross-chain transactions in DeFi. By integrating with various blockchain networks and leveraging efficient routing mechanisms, 1inch provides users with increased liquidity, cost efficiency, accessibility, and security, ultimately driving innovation and growth in the decentralized finance space.

Benefits of Using 1inch for Cross-Chain Transactions in DeFi

1inch is a decentralized exchange aggregator that plays a crucial role in enabling cross-chain transactions in the rapidly evolving world of decentralized finance (DeFi). By utilizing 1inch, users can benefit from several advantages when it comes to conducting cross-chain transactions on various blockchain networks.

1. Enhanced Liquidity

One of the key benefits of using 1inch for cross-chain transactions in DeFi is the access to enhanced liquidity. 1inch aggregates liquidity from multiple decentralized exchanges, allowing users to tap into a larger pool of funds and obtain better prices for their transactions. This can significantly reduce slippage and ensure more cost-effective cross-chain transfers.

2. Optimal Trading Routes

1inch leverages advanced algorithms to identify and select the optimal trading routes for cross-chain transactions. By analyzing various liquidity sources across different blockchain networks, 1inch can determine the most efficient path to execute a transaction. This ensures that users can achieve the best possible outcomes in terms of prices and fees.

3. Reduced Complexity

Using 1inch for cross-chain transactions simplifies the process for users. Instead of having to navigate multiple DeFi platforms and perform manual transactions on different blockchains, users can rely on 1inch to handle the complexity of cross-chain transfers. This streamlines the user experience and reduces the risk of errors or delays.

4. Increased Security

1inch prioritizes the security of users’ funds during cross-chain transactions. By utilizing well-audited smart contracts and collaborating with trusted decentralized exchanges, 1inch ensures that users can safely transfer their assets across different blockchain networks. This helps to mitigate the risks associated with cross-chain transactions in the DeFi space.

5. Cost Savings

Using 1inch for cross-chain transactions can result in cost savings for users. By aggregating liquidity and optimizing trading routes, 1inch helps to minimize fees and reduce the overall costs of conducting cross-chain transfers. This makes it more affordable for users to participate in DeFi activities across different blockchain networks.

In conclusion, 1inch offers several benefits for users looking to engage in cross-chain transactions in the fast-growing realm of DeFi. By providing enhanced liquidity, optimal trading routes, simplified processes, increased security, and cost savings, 1inch plays a crucial role in enabling seamless and efficient cross-chain transactions in the decentralized finance ecosystem.

Question-answer:

What is 1inch?

1inch is a decentralized exchange (DEX) aggregator that aims to provide the best possible trading rates for users by sourcing liquidity from different DEXs.

How does 1inch enable cross-chain transactions in DeFi?

1inch utilizes cross-chain technology, such as bridges and relays, to facilitate the transfer of assets between different blockchains. This allows users to access liquidity and trade tokens across multiple chains.