When it comes to trading on the App.1inch platform, slippage tolerance is a crucial factor to consider. Slippage refers to the difference between the expected price of a trade and the executed price. In other words, it is the cost that traders incur when they are unable to execute a trade at the desired price.

The significance of slippage tolerance lies in its impact on the overall profitability of a trade. If a trader has a low tolerance for slippage, they may miss out on profitable opportunities as they wait for their desired price to be met. On the other hand, a high slippage tolerance can lead to significant losses if the executed price deviates too much from the expected price.

One of the ways in which the App.1inch platform addresses this issue is through its advanced algorithm that optimizes trades by splitting them across multiple decentralized exchanges. By doing so, the platform minimizes slippage and increases the likelihood of executing trades at or close to the desired price.

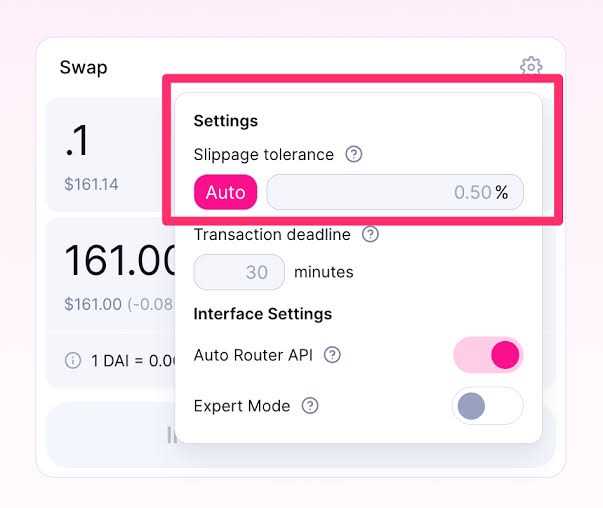

Furthermore, App.1inch also provides users with the option to manually adjust their slippage tolerance. This allows traders to customize their trading strategies based on their risk appetite and market conditions. By setting a higher slippage tolerance during periods of high volatility, traders can take advantage of price movements without being overly concerned about minor deviations from the expected price.

In conclusion, slippage tolerance is a critical factor in trading on the App.1inch platform. It can significantly impact the profitability of trades and is influenced by various factors such as market conditions and individual risk appetite. By utilizing the platform’s advanced algorithm and customizable slippage tolerance, traders can optimize their trading strategies and increase their chances of executing profitable trades.

The Significance of Slippage Tolerance

Slippage is a common occurrence in trading, especially in volatile markets. It refers to the difference between the expected price of a trade and the actual price at which it is executed. Slippage can occur due to various factors, such as market liquidity, trading volume, and network delays.

Slippage tolerance is the maximum allowed deviation from the expected trade price that a trader is willing to accept. It is an important parameter to consider when executing trades, as it can significantly impact the overall profitability of a trading strategy.

One of the main reasons why slippage tolerance is significant is its impact on trade execution. If a trader sets a low slippage tolerance, it means that they are not willing to accept a significant deviation from the expected trade price. As a result, the trading algorithm may have to wait for a more favorable price, resulting in missed trading opportunities.

On the other hand, setting a high slippage tolerance can result in executing trades at less favorable prices, leading to increased transaction costs and reduced profits. Therefore, finding the right balance between slippage tolerance and trade execution is crucial for successful trading.

Another important aspect of slippage tolerance is risk management. By setting a proper slippage tolerance level, traders can control the potential losses that may occur due to slippage. A low slippage tolerance can help minimize the risk of significant losses, while a high slippage tolerance can expose the trader to higher risks.

Moreover, slippage tolerance plays a role in establishing realistic expectations for trading strategies. By considering slippage tolerance, traders can avoid unrealistic profit expectations and better analyze the profitability of their strategies based on real-world conditions.

In conclusion, slippage tolerance is a crucial parameter to consider in trading. It affects trade execution, risk management, and the overall profitability of trading strategies. Traders should carefully determine their slippage tolerance level to achieve the desired balance between trade execution and risk management.

Why Slippage Tolerance Matters in App.1inch Trading

In App.1inch trading, slippage tolerance plays a crucial role in ensuring optimal trading outcomes. Slippage refers to the difference between the expected price of an asset and the executed price when a trade is executed. It often occurs in volatile markets or when there is low liquidity.

Slippage can have a significant impact on the profitability of a trade. If the slippage is too high, traders may end up buying or selling assets at unfavorable prices, resulting in reduced returns or even losses. Therefore, having a slippage tolerance allows traders to set a maximum acceptable deviation from the expected price.

By determining the slippage tolerance, traders can effectively manage their risks and maximize their potential gains. A higher slippage tolerance may allow for faster execution of trades, but it also carries a higher risk of significant price deviations. On the other hand, a lower slippage tolerance may protect traders from unfavorable price movements but may result in slower execution or missed opportunities.

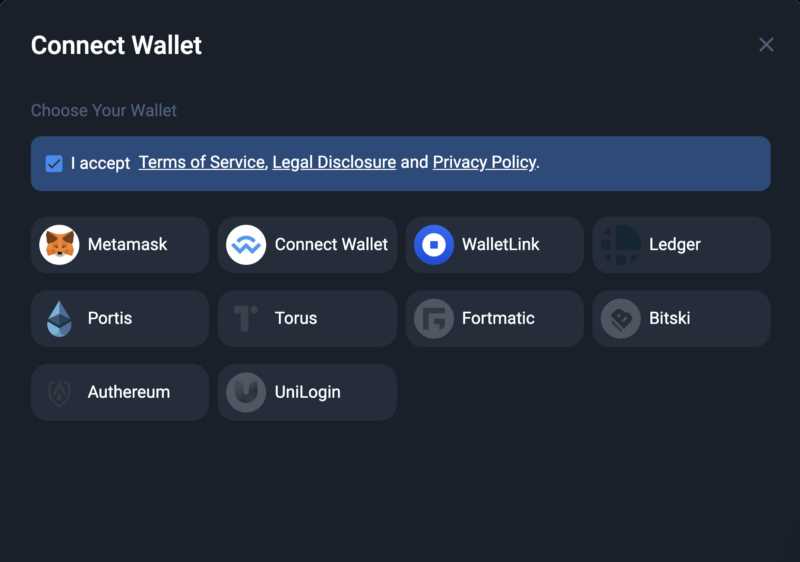

Understanding the importance of slippage tolerance is especially essential in decentralized finance (DeFi) platforms like App.1inch. In these platforms, trades are often executed using automated market makers (AMMs) such as decentralized exchanges (DEXs). These AMMs rely on liquidity pools, and the prices are determined based on the ratio of the assets in these pools.

Due to constantly changing prices and liquidity conditions, slippage can be more prevalent in decentralized trading environments. By setting an appropriate slippage tolerance, traders can account for these dynamics and minimize the impact of slippage on their trading strategies.

Furthermore, App.1inch provides users with advanced tools to customize their trading experience, including the ability to specify slippage tolerance. This feature empowers traders to have greater control over their trades, allowing them to decide how much price deviation they are willing to accept based on their risk appetite and trading objectives.

In conclusion, slippage tolerance matters in App.1inch trading as it allows traders to manage the risk of price deviations. By setting an appropriate slippage tolerance, traders can optimize their trading strategies and improve their overall trading outcomes in decentralized finance.

How Slippage Tolerance Affects Trading Performance

Slippage tolerance refers to the degree to which a trader is willing to accept price deviations when executing a trade. It is an important factor that can significantly impact trading performance.

When a trade is executed, the actual price at which the order is filled may differ from the expected price due to market volatility and liquidity constraints. This difference is known as slippage. Traders with high slippage tolerance are more willing to accept larger price deviations, while those with low tolerance aim for minimal slippage.

Slippage tolerance can have a direct impact on trading performance for several reasons. Firstly, it affects the execution speed of trades. Traders with low slippage tolerance may place limit orders to ensure they are filled at specific prices. However, limit orders may take longer to fill, especially in volatile markets. On the other hand, traders with high slippage tolerance may choose market orders for faster execution, potentially exposing themselves to larger price deviations.

Secondly, slippage tolerance affects the overall profitability of trades. If a trader has a low tolerance and aims for minimal slippage, they may miss out on potential profitable opportunities. This is because market conditions can change rapidly, and waiting for the perfect entry price may result in missed trades or reduced profit margins.

Lastly, slippage tolerance can impact risk management strategies. Traders with high slippage tolerance may be more prone to accepting larger losses as they are willing to withstand greater price deviations. In contrast, traders with low tolerance may set tighter stop-loss orders to limit potential losses. Both approaches have their pros and cons and should be considered based on individual risk appetite and trading goals.

Overall, slippage tolerance plays a crucial role in trading performance. It is a balance between minimizing price deviations and ensuring swift execution. Traders should assess their risk tolerance, market conditions, and trading objectives to determine their optimal slippage tolerance level.

Tips for Managing Slippage Tolerance in App.1inch Trading

When trading on the App.1inch platform, managing slippage tolerance is crucial to ensure that you get the best possible price for your transactions. Slippage refers to the difference between the expected price of a trade and the price at which the trade is actually executed.

Here are a few tips to help you effectively manage slippage tolerance in your App.1inch trading:

- Set a reasonable slippage tolerance: It’s important to set a realistic and appropriate slippage tolerance that aligns with your trading goals and risk appetite. Setting a higher slippage tolerance may result in faster execution, but it also increases the risk of getting a less favorable price.

- Consider market conditions: Slippage can vary depending on market conditions, such as high volatility or low liquidity. Before executing a trade, it’s important to take into account the current market conditions and adjust your slippage tolerance accordingly.

- Monitor the market: Keep a close eye on the market and track the prices of the assets you’re interested in trading. By staying informed about any price movements, you can make more informed decisions and adjust your slippage tolerance if necessary.

- Utilize limit orders: Consider using limit orders instead of market orders to have more control over the execution price. With a limit order, you can specify the maximum price at which you are willing to buy or sell, helping you avoid excessive slippage.

- Use stop-loss orders: Implementing stop-loss orders can help limit potential losses if the market moves against your trade. By setting a stop-loss order, you can automatically sell or buy an asset at a pre-determined price, reducing the impact of slippage.

- Practice risk management: As with any trading activity, it’s crucial to have a risk management strategy in place. This includes setting stop-loss levels, diversifying your portfolio, and not investing more than you can afford to lose. By managing your risk effectively, you can minimize the impact of slippage on your overall trading performance.

By following these tips, you can better manage slippage tolerance in your App.1inch trading and increase the likelihood of achieving optimal trade execution.

Question-answer:

What is slippage tolerance in app trading?

Slippage tolerance refers to the maximum difference between the expected price and the actual execution price when trading on the 1inch app. It is a measure of how much price slippage a user is willing to accept in their trades.

Why is slippage tolerance important in app trading?

Slippage tolerance is important because it helps users manage their expectations in volatile markets. By setting a slippage tolerance, users can control the maximum amount of price slippage they are willing to accept, thereby minimizing the potential impact of unexpected price movements.

How does slippage tolerance affect trading on the 1inch app?

Slippage tolerance has a direct impact on the execution of trades on the 1inch app. By setting a slippage tolerance, users can ensure that their trades are only executed if the price difference between the expected and actual execution price falls within their tolerance level. If the slippage exceeds the set tolerance, the trade will not be executed.

What factors should be considered when setting slippage tolerance?

When setting slippage tolerance, users should consider the liquidity of the market, the volatility of the asset being traded, and their risk tolerance. Higher liquidity and lower volatility generally warrant lower slippage tolerance, while lower liquidity and higher volatility may require a higher tolerance level to ensure trade execution.