How Regulation Affects the Value and Adoption of 1inch Tokens and Its Market Impact

Discover the Future of Decentralized Finance with 1inch Tokens!

Are you ready to embark on a journey into the world of decentralized finance? Look no further than 1inch Tokens, the cutting-edge digital currency that is revolutionizing the way we transact and invest.

With the rise of blockchain technology and the increasing popularity of decentralized exchanges, it is crucial to understand the impact of regulation on the value and adoption of digital assets like 1inch Tokens.

Why does regulation matter?

Regulation plays a pivotal role in shaping the future of cryptocurrencies and ensuring their widespread acceptance. As governments around the world recognize the immense potential of decentralized finance, they are stepping up their efforts to establish a clear regulatory framework for digital assets.

The value of regulation:

Regulation provides investors and users with a sense of security, knowing that their transactions and investments are protected. It fosters trust and confidence, ultimately driving the value of 1inch Tokens and other cryptocurrencies.

The role of 1inch Tokens:

As a leading decentralized exchange aggregator, 1inch Tokens are at the forefront of the regulatory landscape. With their innovative technology and commitment to compliance, 1inch Tokens are well-positioned to thrive in a regulated environment.

Don’t miss out on the opportunity to be part of the future of decentralized finance!

Invest in 1inch Tokens today and join the revolution!

The Impact of Regulation

Regulation plays a crucial role in the value and adoption of 1inch tokens. As the cryptocurrency market continues to evolve, governments and regulatory bodies are grappling with how to effectively oversee and regulate this new digital asset class. The decisions they make can have a significant impact on the value and adoption of 1inch tokens.

1. Clarity and Legal Certainty

One of the key factors that can impact the value and adoption of 1inch tokens is regulatory clarity and legal certainty. When regulations are unclear or constantly changing, it creates uncertainty for investors, businesses, and users of 1inch tokens. This uncertainty can lead to hesitation and a lack of confidence in the market, which can ultimately suppress the value and adoption of 1inch tokens. Therefore, clear and well-defined regulations that provide legal certainty are essential for the growth of the 1inch ecosystem.

2. Compliance and Trust

Regulatory compliance is another important aspect that can influence the value and adoption of 1inch tokens. When businesses and individuals comply with regulations, it helps to build trust within the market. Trust is a vital component for the widespread adoption of 1inch tokens and the overall success of the 1inch platform. By adhering to regulatory requirements, businesses can demonstrate their commitment to operating ethically and responsibly, which can attract more users and investors to the 1inch ecosystem.

| Regulation | Impact on 1inch Tokens |

|---|---|

| Anti-Money Laundering (AML) Regulations | Enhanced security measures and increased user trust. |

| KYC (Know Your Customer) Requirements | Reduced anonymity, but increased credibility and legitimacy. |

| Taxation Policies | Potential impact on token holders’ profits and incentives. |

| Securities Regulations | Potential classification as securities, affecting trading and investment opportunities. |

In conclusion, the impact of regulation on the value and adoption of 1inch tokens cannot be overstated. Clear and well-defined regulations provide legal certainty, while regulatory compliance builds trust and confidence in the market. As the regulatory landscape continues to evolve, it is crucial for the 1inch ecosystem to adapt and comply with these regulations in order to thrive and attract more users and investors.

Value of 1inch Tokens

1inch Tokens are a valuable asset that play a crucial role in the 1inch Network. These tokens serve multiple purposes and have the potential to provide significant benefits to token holders.

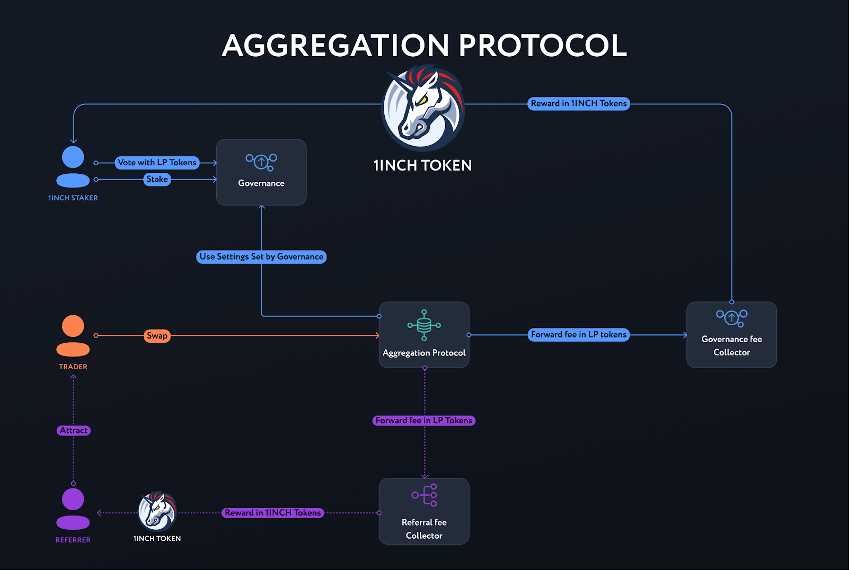

1. Governance Rights

One of the key benefits of holding 1inch Tokens is the ability to participate in the governance of the 1inch Network. Token holders have the power to vote on important decisions such as protocol upgrades, fee structures, and other key governance matters. This gives token holders a say in the future development and direction of the network, making 1inch Tokens a valuable tool for those who want to actively contribute to the ecosystem.

2. Liquidity Mining Rewards

Another way in which 1inch Tokens hold value is through the liquidity mining program. By staking their tokens on the 1inch Network, users can earn additional tokens as a reward. This incentivizes users to provide liquidity to the network, which in turn helps increase the overall liquidity and efficiency of the 1inch protocol. Liquidity mining rewards can be a lucrative way for token holders to earn passive income and increase the value of their 1inch Tokens.

| Value drivers of 1inch Tokens | Benefits |

|---|---|

| Supply and demand dynamics | Potential for price appreciation |

| Network adoption | Increased token utility and demand |

| Partnerships and integrations | Expanded ecosystem and user base |

| Regulatory developments | Strengthened market confidence and stability |

In addition to these specific benefits, 1inch Tokens also hold value as a tradable asset on various decentralized exchanges. This allows token holders to buy, sell, and trade their tokens, giving them the flexibility to take advantage of market opportunities and potentially generate profits.

Overall, the value of 1inch Tokens goes beyond their market price. They offer token holders the ability to actively participate in the governance of the 1inch Network, earn liquidity mining rewards, and take advantage of market opportunities. As the 1inch Network continues to grow and evolve, the value of 1inch Tokens is expected to increase, making them an attractive asset for investors and users alike.

Adoption of 1inch Tokens

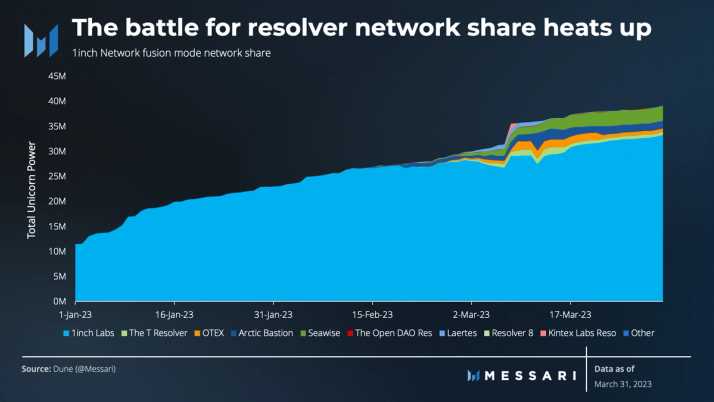

The adoption of 1inch tokens has been steadily increasing in recent years, as more and more users recognize the unique value proposition they offer in the decentralized finance (DeFi) ecosystem. With their ability to provide liquidity and optimize trades across multiple protocols, 1inch tokens have become an essential component of any diversified DeFi portfolio.

Benefits of 1inch Tokens

1inch tokens offer several key benefits that have contributed to their growing adoption:

-

Improved Liquidity: By staking 1inch tokens in liquidity pools, users can earn passive income through transaction fees generated by trades on the 1inch platform. This incentivizes users to hold and utilize 1inch tokens, which improves the overall liquidity of the ecosystem.

-

Reduced Slippage: The advanced algorithm utilized by 1inch tokens ensures that trades are executed at the best possible price across multiple decentralized exchanges. This reduces slippage and maximizes returns for traders.

-

Governance Rights: 1inch token holders have the power to influence platform decisions through voting rights. This allows users to actively participate in the governance of the 1inch ecosystem and shape its future development.

Integration with Other DeFi Projects

1inch tokens have gained significant traction due to their seamless integration with other DeFi projects. Several prominent decentralized exchanges, lending platforms, and yield farming protocols have integrated 1inch’s liquidity aggregator, allowing users to access 1inch’s optimized trading capabilities directly from their preferred platforms.

This integration not only increases the utility of 1inch tokens but also extends their reach to a wider audience within the DeFi community. As more projects recognize the value of 1inch tokens, their adoption is expected to continue growing.

Conclusion: The adoption of 1inch tokens continues to rise as users recognize their unique benefits and seamless integration with other DeFi projects. With their ability to improve liquidity, reduce slippage, and provide governance rights, 1inch tokens have become an integral part of the DeFi ecosystem. As the DeFi space continues to evolve, the adoption of 1inch tokens is likely to accelerate, further solidifying their position as a leader in the DeFi industry.

Regulation and Market Dynamics

Regulation plays a crucial role in shaping the dynamics of the market for 1inch tokens. The cryptocurrency industry operates in a relatively new and rapidly evolving regulatory landscape, which affects the value and adoption of tokens such as 1inch.

The Impact of Regulatory Measures

Regulatory measures, such as government regulations and policies, can have a significant impact on the value and adoption of 1inch tokens. These measures can range from restrictions on cryptocurrency exchanges, to KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, to tax regulations.

When a regulatory environment is favorable, it can foster innovation, attract investments, and increase adoption of cryptocurrencies. On the other hand, strict regulations may hinder the growth and development of the industry, leading to a decrease in the value and adoption of tokens.

The Importance of Compliance

Compliance with regulatory measures is crucial for the 1inch token ecosystem to thrive. By complying with applicable regulations, 1inch and its ecosystem participants can build trust with users, investors, and regulators. This can lead to increased adoption, liquidity, and overall market value of the token.

Non-compliance, on the other hand, can have severe consequences, such as legal actions, financial penalties, or even the shutdown of operations. Therefore, it is essential for the 1inch token ecosystem to stay updated with the latest regulatory developments and ensure full compliance.

Regulatory Uncertainty

One of the challenges in the cryptocurrency industry is the regulatory uncertainty that exists in many jurisdictions. Different countries have adopted various approaches towards cryptocurrencies, with some embracing them as a means of innovation and economic growth, while others have opted for stricter regulations or even outright bans.

This regulatory uncertainty can create volatility in the market for 1inch tokens, as investors and users may be hesitant to engage with a token that operates in an unclear regulatory landscape. It also poses challenges for businesses and projects built on the 1inch platform, as they need to navigate through the regulatory requirements of multiple jurisdictions.

In conclusion, regulation plays a crucial role in shaping the value and adoption of 1inch tokens. The impact of regulatory measures, the importance of compliance, and the challenges of regulatory uncertainty are all factors that influence the market dynamics for 1inch and the wider cryptocurrency industry.

Question-answer:

What is the impact of regulation on the value and adoption of 1inch tokens?

The impact of regulation on the value and adoption of 1inch tokens can be significant. If regulations are favorable and supportive of the cryptocurrency industry, it can lead to increased adoption and demand for 1inch tokens as investors and users feel more confident and comfortable engaging with the platform. On the other hand, if regulations are stringent or unfavorable, it can restrict the growth and adoption of 1inch tokens, potentially affecting their value negatively.

How do regulations affect the value of 1inch tokens?

Regulations can have a direct impact on the value of 1inch tokens. If regulations are favorable and create a conducive environment for the cryptocurrency industry, it can attract more investors and users to the platform, increasing demand and driving up the value of 1inch tokens. Conversely, if regulations create barriers or uncertainty, it can discourage participation in the market, leading to a decrease in demand and potentially lowering the value of 1inch tokens.

Are there any specific regulations that are currently affecting the value of 1inch tokens?

Specific regulations that currently affect the value of 1inch tokens vary depending on the jurisdiction. Different countries have different regulatory frameworks for cryptocurrencies, and any changes or updates to these regulations can impact the value of 1inch tokens. It is important for investors and users to stay informed about the regulatory landscape to understand how it may affect the value and adoption of 1inch tokens.

How can regulations impact the adoption of 1inch tokens?

Regulations play a crucial role in shaping the adoption of 1inch tokens. If regulations are favorable and provide clarity and legal certainty, it can encourage individuals and businesses to adopt 1inch tokens as a means of payment or investment. Conversely, if regulations are restrictive or uncertain, it can create barriers to adoption, as potential users may be hesitant to engage with a platform that operates in a regulatory gray area.

What can the 1inch platform do to mitigate the potential impact of regulations?

The 1inch platform can take several measures to mitigate the potential impact of regulations. This may include working closely with regulators and policymakers to ensure compliance with existing and upcoming regulations, implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, and actively engaging in industry advocacy to shape favorable regulations. By taking a proactive approach to regulatory compliance, the 1inch platform can minimize disruptions and maintain the value and adoption of its tokens.