Decentralized finance has revolutionized the way we think about traditional financial systems. With its promise of increased transparency, security, and accessibility, DeFi has opened up a world of opportunities for individuals to participate in financial activities in a truly decentralized manner. However, for DeFi platforms to operate effectively, they must rely on accurate and reliable sources of data to ensure the validity of transactions and the integrity of the system as a whole. This is where decentralized oracles come into play.

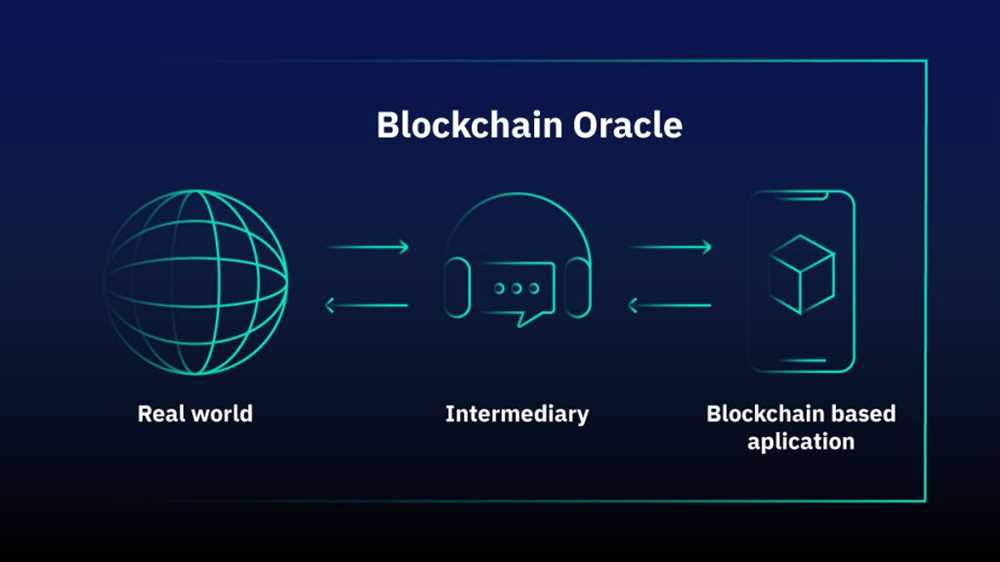

In the context of 1inch.exchange, one of the leading decentralized exchanges in the market, decentralized oracles play a crucial role in providing real-time and accurate data feeds that enable the platform to operate seamlessly. Decentralized oracles act as intermediaries between the blockchain and external data sources, ensuring that the data used for transactions is accurate and tamper-proof.

The importance of decentralized oracles in 1inch.exchange cannot be overstated. They serve as the bridge that connects the on-chain world with the off-chain world, enabling users to trade a wide range of assets with confidence. Without decentralized oracles, the reliability and trustworthiness of the platform would be compromised, potentially leading to significant losses for users and undermining the overall credibility of DeFi as a whole.

The Significance of Decentralized Oracles in 1inch.exchange

Decentralized finance (DeFi) has gained significant popularity in recent years, with various platforms emerging to provide users with new financial opportunities. One such platform is 1inch.exchange, a decentralized exchange that allows users to trade cryptocurrencies in a fast and secure manner.

One of the key components that makes 1inch.exchange a reliable and efficient platform is its use of decentralized oracles. Decentralized oracles play a vital role in DeFi platforms by providing accurate and real-time price data from different sources.

What are Decentralized Oracles?

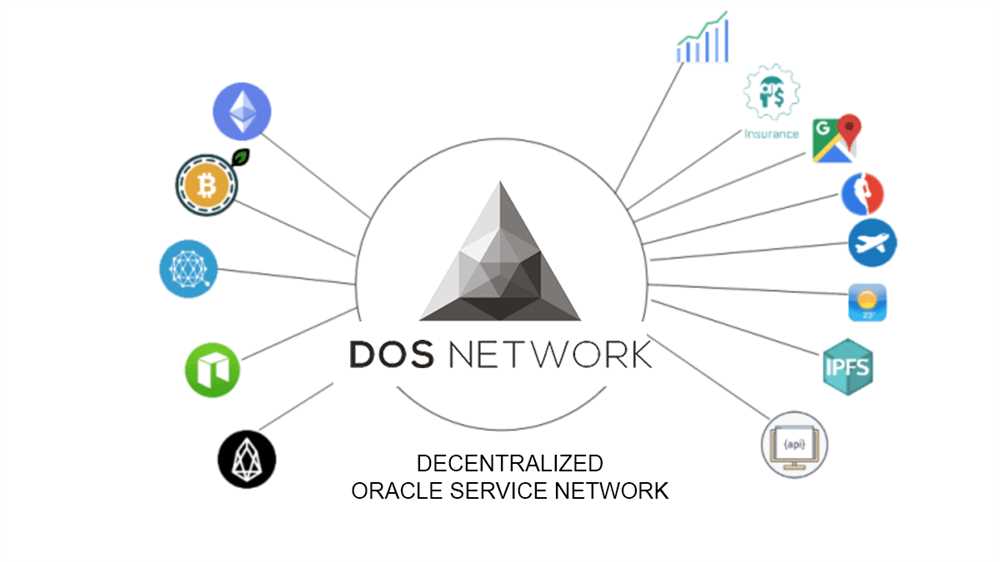

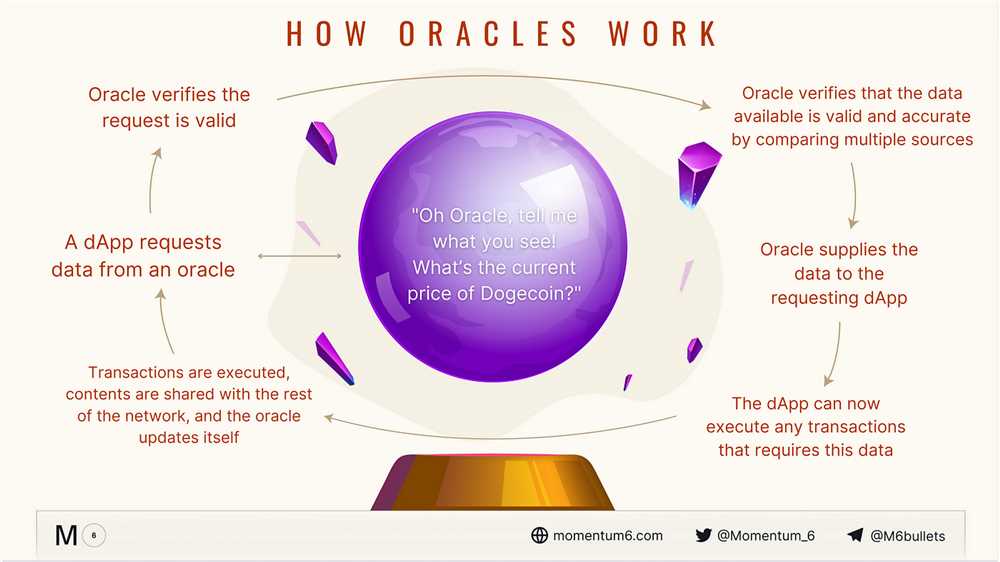

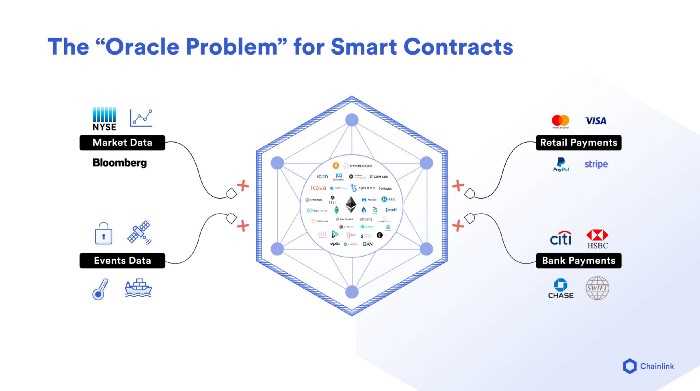

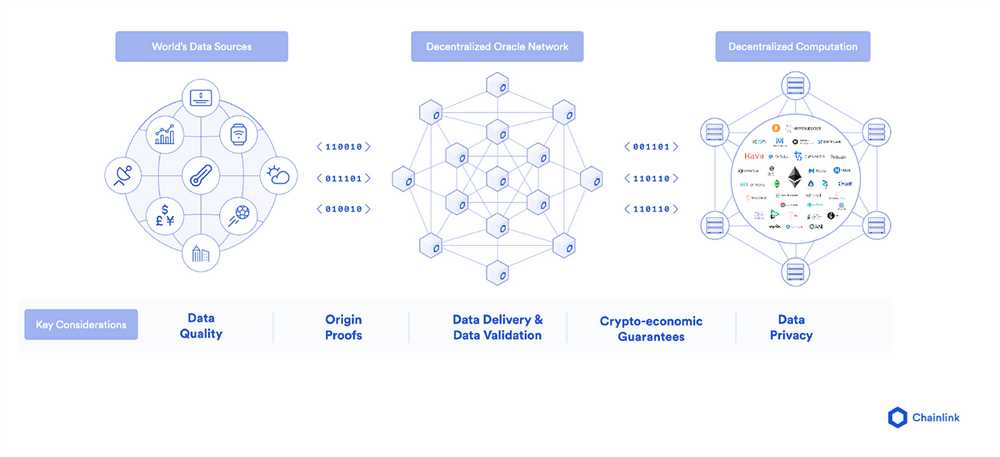

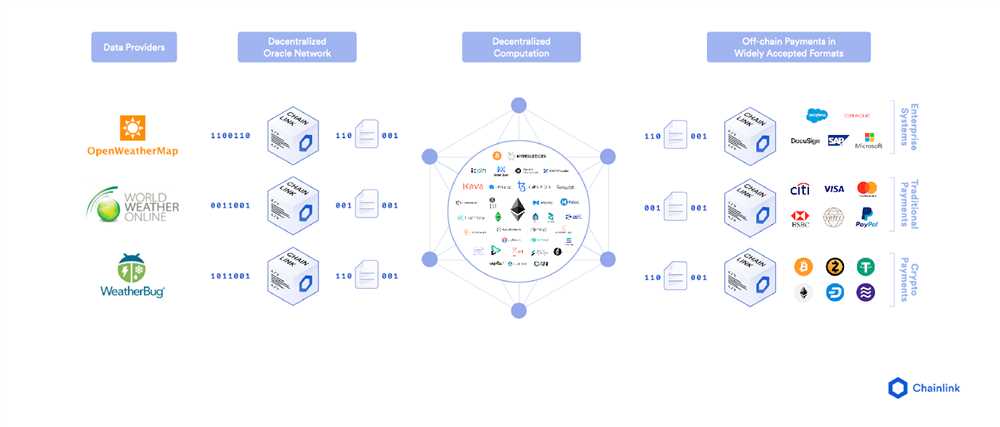

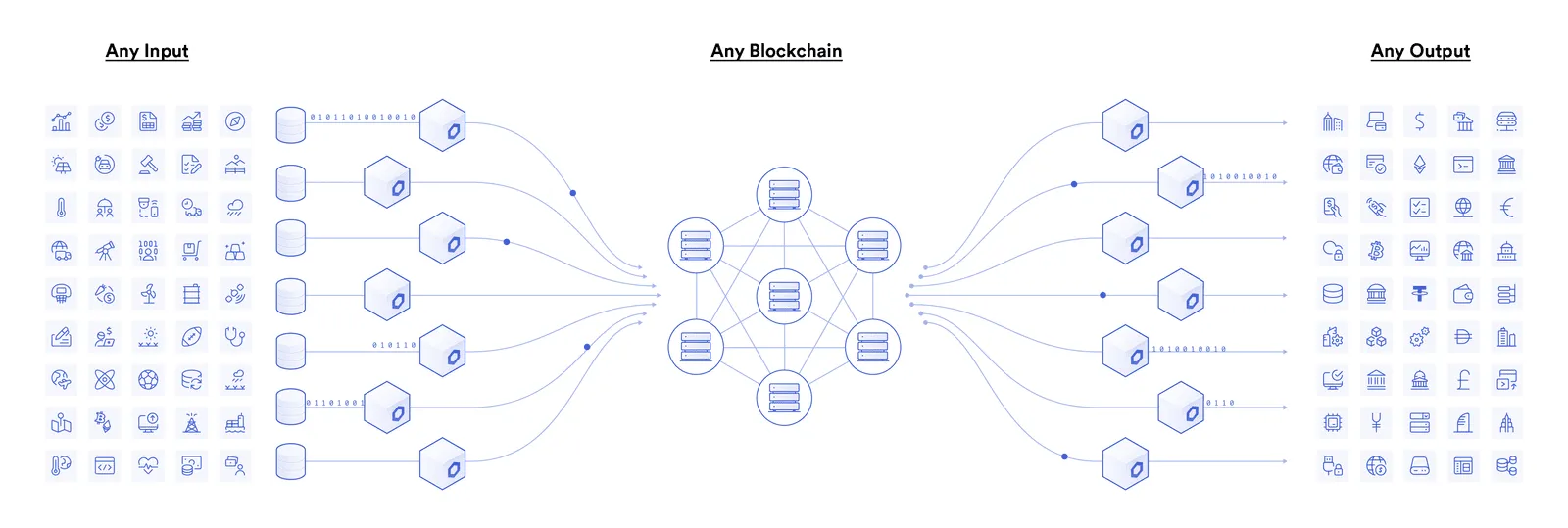

Decentralized oracles act as intermediaries between smart contracts and external data sources. They help smart contracts fetch critical data, such as asset prices, interest rates, and other market information, which is essential for executing various DeFi transactions.

In the case of 1inch.exchange, decentralized oracles play a crucial role in providing accurate price information for different cryptocurrencies. These oracles fetch data from various sources, including centralized exchanges, decentralized exchanges, and other liquidity providers.

The Benefits of Decentralized Oracles for 1inch.exchange

The use of decentralized oracles in 1inch.exchange offers several significant benefits:

| Benefit | Description |

|---|---|

| Real-time price data | Decentralized oracles provide real-time price data, ensuring that users can make trades at the most accurate and up-to-date prices. |

| Reliability | By using multiple data sources, decentralized oracles improve the reliability of price data, reducing the risk of manipulation or incorrect information. |

| Security | Decentralized oracles enhance the security of 1inch.exchange by ensuring that data is fetched from multiple sources and verified before being used in smart contracts. |

| Efficiency | By using decentralized oracles, 1inch.exchange can access price data quickly and efficiently, improving the overall trading experience for users. |

In conclusion, the significance of decentralized oracles in 1inch.exchange cannot be overstated. These oracles provide accurate, real-time price data from multiple sources, ensuring the reliability, security, and efficiency of the platform. As DeFi continues to grow, decentralized oracles will play a pivotal role in providing trustworthy and transparent data for various financial transactions.

Enhancing Trust and Security

In the decentralized finance (DeFi) space, trust and security are of utmost importance. With the rise of hacks and security breaches, it is crucial to ensure that users can trust the oracles used in platforms like 1inch.exchange.

Decentralized oracles play a vital role in enhancing trust and security. By sourcing data from various trusted sources, decentralization prevents a single point of failure and reduces the risk of manipulation or tampering.

1inch.exchange utilizes decentralized oracles to obtain accurate and reliable data for executing trades. These oracles aggregate information from multiple sources and utilize advanced algorithms to determine the most accurate and up-to-date data.

By using decentralized oracles, 1inch.exchange minimizes the risk of price manipulation and ensures that traders have access to the most reliable information. This enhances trust and confidence among users, making 1inch.exchange a trusted platform in the DeFi ecosystem.

Furthermore, decentralized oracles provide a higher level of security. Traditional centralized oracles are susceptible to hacks and attacks, as they store data in a single location. In contrast, decentralized oracles distribute data across a network of nodes, making it extremely difficult for hackers to compromise the integrity of the data.

With the increasing popularity of DeFi platforms, the role of decentralized oracles in enhancing trust and security cannot be overstated. They play a fundamental role in ensuring that users can confidently trade assets and engage in financial activities without the fear of manipulation or fraudulent activities.

In conclusion, decentralized oracles are integral to the trust and security of platforms like 1inch.exchange. By sourcing data from multiple sources and utilizing advanced algorithms, these oracles provide accurate and reliable information to users. This not only enhances trust but also increases the overall security of the platform, making it a reliable and trustworthy option in the DeFi space.

Improving Efficiency and Liquidity

Decentralized oracles play a crucial role in improving the efficiency and liquidity of 1inch.exchange. By providing accurate and reliable price data, decentralized oracles ensure that users can make informed decisions when trading on the platform.

Efficiency is enhanced as decentralized oracles allow for real-time updates of price data. This eliminates the need for manual updates, which can be time-consuming and prone to errors. With decentralized oracles, traders can access the most up-to-date and accurate information, allowing them to execute trades quickly and efficiently.

Additionally, decentralized oracles improve liquidity on 1inch.exchange. By providing accurate price data from multiple sources, decentralized oracles ensure that trades can be executed at fair and competitive prices.

Accurate and Reliable Price Data

Decentralized oracles obtain price data from various sources and aggregate this information to provide accurate and reliable price feeds. This ensures that users have access to the most up-to-date and accurate price data when trading on 1inch.exchange.

Moreover, decentralized oracles use data verification mechanisms to ensure the accuracy and reliability of the price data. This includes relying on multiple data sources, utilizing consensus algorithms, and implementing data validation techniques. By doing so, decentralized oracles minimize the risk of manipulation or inaccuracies in price data.

Enhancing Liquidity

Decentralized oracles enhance liquidity by providing accurate and competitive price data from multiple sources. This ensures that traders can access a wide pool of liquidity and execute trades at fair prices.

Furthermore, decentralized oracles can also provide information on the depth of liquidity in different markets. This allows traders to assess the market conditions and make informed decisions on their trading strategies. By increasing transparency and accessibility to liquidity, decentralized oracles contribute to a more efficient and liquid trading environment on 1inch.exchange.

In summary, decentralized oracles are vital for improving efficiency and liquidity on 1inch.exchange. By providing accurate and reliable price data, decentralized oracles enable traders to make informed decisions and execute trades quickly and efficiently. Moreover, by aggregating price data from multiple sources, decentralized oracles enhance liquidity and contribute to a fair and competitive trading environment.

Enabling Seamless Cross-Chain Swaps

One of the key advantages of decentralized exchanges like 1inch.exchange is their ability to facilitate cross-chain swaps. Cross-chain swaps allow users to exchange cryptocurrencies that exist on different blockchain networks, making it easier for traders to access a wider range of tokens.

Traditionally, exchanging tokens across different blockchains has been a complex and time-consuming process. Users would have to rely on centralized exchanges or custodial services to facilitate the swap, which often involves multiple transactions and additional fees.

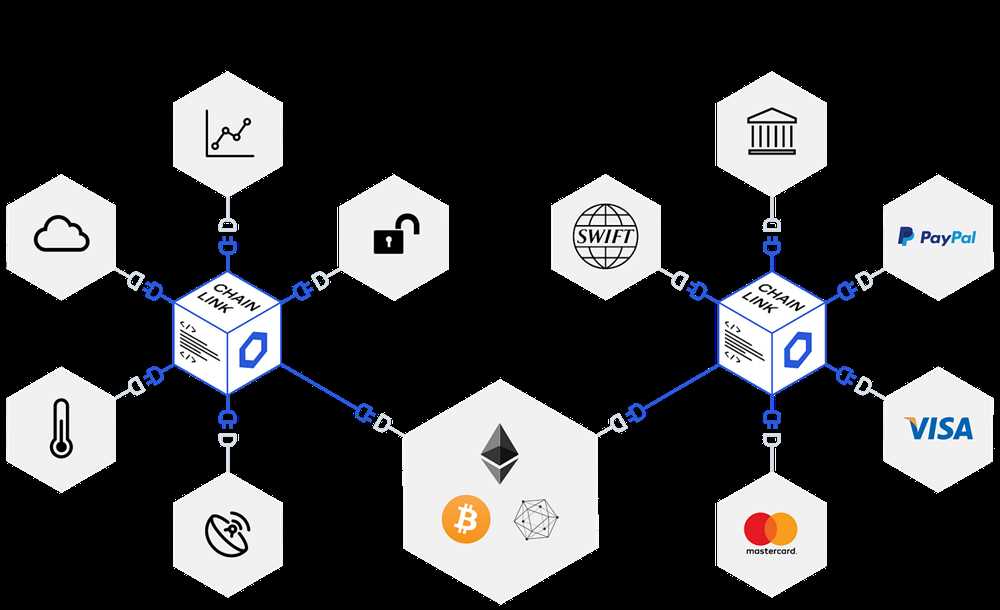

However, with the introduction of decentralized oracles like the one used by 1inch.exchange, cross-chain swaps have become much simpler and more efficient. The oracle acts as a bridge between different blockchains, providing the necessary information and liquidity to enable seamless swaps.

When a user initiates a cross-chain swap on 1inch.exchange, the oracle retrieves real-time data about the desired tokens from various sources. It then calculates the optimal trading path across different liquidity sources, taking into account factors such as transaction costs and slippage.

The oracle then executes the necessary transactions to facilitate the swap and ensure the user receives the desired tokens. This process is automated and transparent, eliminating the need for users to interact with multiple exchanges or worry about the underlying complexities of cross-chain swaps.

By enabling seamless cross-chain swaps, 1inch.exchange and decentralized oracles are democratizing access to a wider range of tokens and fostering liquidity across different blockchains. This not only benefits individual traders but also contributes to the overall growth and development of the decentralized finance ecosystem.

Supporting DeFi Innovation and Integration

Decentralized finance (DeFi) has emerged as one of the most disruptive and promising sectors in the blockchain industry. By leveraging smart contracts and decentralized infrastructure, DeFi platforms aim to provide financial services that are accessible to anyone with an internet connection, bypassing traditional intermediaries and centralized authorities.

1inch.exchange, with its decentralized exchange aggregator, plays a crucial role in supporting DeFi innovation and integration. By connecting multiple decentralized exchanges and liquidity sources, 1inch.exchange provides users with the best possible rates and lower slippage while executing their trades.

Advantages of Decentralized Oracles

A key component of 1inch.exchange’s infrastructure is its use of decentralized oracles. Decentralized oracles are essential for sourcing accurate and reliable data from various external sources, such as price feeds, liquidity pools, and other relevant information.

By using decentralized oracles, 1inch.exchange ensures that the information it provides to its users is accurate and tamper-proof. This empowers traders and liquidity providers to make informed decisions based on reliable and up-to-date data.

Enabling Seamless Integration

1inch.exchange’s decentralized oracles also play a crucial role in enabling seamless integration with other DeFi protocols and applications. By providing reliable data to other platforms, 1inch.exchange contributes to the overall interoperability and liquidity in the DeFi ecosystem.

With the integration of decentralized oracles, DeFi projects can leverage 1inch.exchange’s accurate data to enhance their functionalities and provide users with better services. This fosters innovation and allows the DeFi ecosystem to grow and evolve, benefiting all participants.

Conclusion

The importance of decentralized oracles in 1inch.exchange cannot be understated. By supporting DeFi innovation and integration, 1inch.exchange plays a vital role in creating a more interconnected and efficient financial ecosystem. With reliable data from decentralized oracles, users can trust the information they receive and make informed decisions, while projects can leverage this data to enhance their offerings.

The use of decentralized oracles in 1inch.exchange is a testament to the power of blockchain technology in revolutionizing the financial industry. With continued advancements and collaborations, the decentralized finance sector can continue to grow and drive economic empowerment for individuals around the world.

Question-answer:

What is a decentralized oracle?

In the context of blockchain technology, a decentralized oracle is a system that enables smart contracts to interact with data and services outside of the blockchain. It serves as a bridge between the blockchain and the external world, providing reliable and tamper-proof data to smart contracts.

Why are decentralized oracles important for 1inch.exchange?

Decentralized oracles are crucial for 1inch.exchange because they provide accurate and up-to-date information about token prices, liquidity, and other relevant data. This information is essential for executing transactions on the platform and ensuring that users get the best possible trading rates.