The decentralized finance (DeFi) ecosystem is constantly evolving, with new projects and platforms emerging to meet the growing demand for decentralized trading and financial services. One such platform that has gained significant attention is 1inch Exchange.

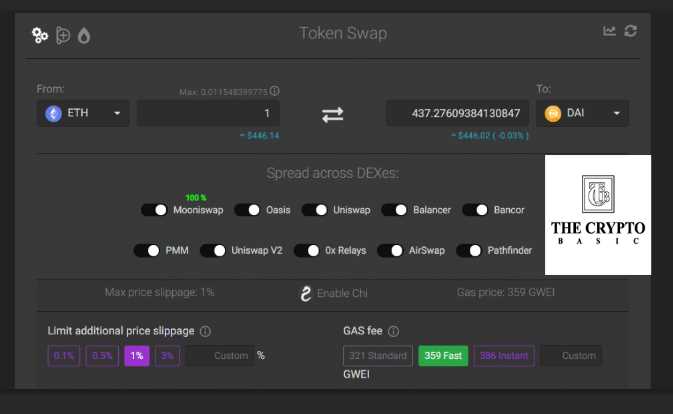

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading prices. Since its launch in 2020, 1inch Exchange has quickly gained popularity due to its innovative technology and user-friendly interface.

However, as the regulatory landscape surrounding DeFi continues to evolve, platforms like 1inch Exchange have to adapt to ensure compliance with local laws and regulations. This is crucial for the long-term sustainability and growth of decentralized finance.

To navigate these regulatory challenges, 1inch Exchange has established partnerships with other regulated entities and implemented robust compliance measures. The platform has also been proactive in engaging with regulators and industry leaders to advocate for clear and fair regulations that support innovation in the DeFi space.

Despite these challenges, 1inch Exchange remains committed to its core principles of decentralization, transparency, and user empowerment. The platform continues to provide users with access to a wide range of decentralized trading options, while ensuring that their funds and personal information are secure.

As the regulatory environment continues to evolve, platforms like 1inch Exchange will play a crucial role in shaping the future of decentralized finance. By adapting to changing regulations and advocating for fair and clear guidelines, 1inch Exchange is poised to continue driving innovation and accessibility in the DeFi space.

1inch Exchange: Embracing Evolving Regulatory Landscapes

In the rapidly evolving world of decentralized finance (DeFi), regulatory landscapes are constantly changing. As one of the leading decentralized exchanges, 1inch Exchange is committed to adapting and embracing these evolving regulatory environments.

Understanding Regulatory Compliance

Regulatory compliance is a crucial aspect of operating within the financial industry. It ensures that businesses and individuals adhere to the laws and regulations set forth by governing bodies. In the context of cryptocurrency and DeFi, regulatory compliance plays a significant role in maintaining trust, protecting consumers, and preventing illegal activities such as money laundering and fraud.

1inch has recognized the importance of regulatory compliance from its inception and has taken proactive measures to comply with applicable laws. The platform has implemented Know Your Customer (KYC) procedures and is committed to preventing any form of illicit activity on its platform.

Adapting to Changing Regulations

As the regulatory landscape in the crypto industry continues to evolve, 1inch Exchange remains at the forefront of compliance. The team closely monitors regulatory developments around the world and adjusts its operations accordingly to ensure full compliance.

By working closely with regulatory authorities and legal experts, 1inch Exchange aims to stay ahead of the curve and proactively address any regulatory changes. This commitment to compliance allows users of the platform to trade with confidence and peace of mind.

Building Regulatory Partnerships

1inch Exchange understands the importance of building strong partnerships with regulatory bodies. By engaging in open dialogue and fostering positive relationships with regulatory authorities, 1inch aims to contribute to the development of regulatory frameworks that are conducive to the growth of the DeFi industry.

These partnerships help bridge the gap between innovation and regulation, ensuring that 1inch Exchange can continue to provide its users with a secure and compliant trading experience.

As the DeFi industry continues to mature, regulatory environments will inevitably evolve. 1inch Exchange is committed to embracing these changes, adapting its practices, and working collaboratively with regulatory authorities to create a sustainable and compliant ecosystem.

Understanding the Regulatory Environment

The regulatory environment surrounding cryptocurrency exchanges is complex and ever-changing. As the global market for digital assets continues to grow, governments and regulatory bodies are increasingly focused on implementing rules and guidelines to ensure the stability and integrity of the financial system.

One of the main challenges for cryptocurrency exchanges, including 1inch Exchange, is navigating this evolving regulatory landscape. Compliance with regulations is crucial to establishing trust with users and ensuring the long-term viability of the platform.

Regulatory Bodies

Many countries have regulatory bodies that oversee and enforce regulations related to cryptocurrency exchanges. These bodies, such as the Securities and Exchange Commission (SEC) in the United States or the Financial Conduct Authority (FCA) in the United Kingdom, play a vital role in setting guidelines and monitoring compliance within the industry.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations

To prevent illicit activities such as money laundering and terrorist financing, cryptocurrency exchanges are often required to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. KYC procedures involve verifying the identity of users, while AML procedures involve monitoring transactions for suspicious activity.

- KYC verification typically involves collecting personal information such as name, address, and identification documents.

- AML procedures require exchanges to implement transaction monitoring systems and report suspicious transactions to the relevant authorities.

Regulatory Compliance Challenges

Adapting to changing regulatory environments can be challenging for cryptocurrency exchanges, as requirements and guidelines may vary across jurisdictions. Compliance efforts can involve significant resources, including legal and compliance teams, to ensure that the platform meets all relevant regulatory requirements.

Additionally, regulatory changes can have a significant impact on the operations and user experience of cryptocurrency exchanges. Changes in regulations may require exchanges to modify their systems, implement new procedures, or even restrict certain services in order to remain compliant.

Conclusion

The regulatory environment surrounding cryptocurrency exchanges is a crucial aspect that must be understood and navigated effectively. As the industry continues to evolve, exchanges like 1inch Exchange must stay informed about regulatory developments and adapt their practices to maintain compliance and provide a secure and transparent trading platform for their users.

Compliance Measures Implemented by 1inch Exchange

As a decentralized exchange, 1inch Exchange is committed to ensuring compliance with the evolving regulatory landscape in the cryptocurrency industry. To achieve this, 1inch Exchange has implemented a range of compliance measures to promote transparency and protect the interests of its users.

One of the key compliance measures employed by 1inch Exchange is Know Your Customer (KYC) procedures. KYC requires users to provide identification documents such as passports or driver’s licenses to verify their identity. This helps prevent fraudulent activities such as money laundering and ensures that the exchange is not being used for illegal purposes.

In addition to KYC procedures, 1inch Exchange also conducts Anti-Money Laundering (AML) checks. This involves the monitoring of transactions and the identification of suspicious patterns or activities. By implementing AML measures, 1inch Exchange aims to detect and prevent money laundering attempts and terrorist financing.

Another compliance measure implemented by 1inch Exchange is the adherence to local regulations and compliance frameworks. The exchange works closely with legal and regulatory authorities in different jurisdictions to ensure compliance with relevant laws and regulations. This includes obtaining necessary licenses and permits to operate in certain regions.

To further enhance compliance, 1inch Exchange has also introduced transaction limits and monitoring mechanisms. These measures help prevent illegal activities and ensure that transactions conducted on the platform adhere to legal requirements. By monitoring transactions, 1inch Exchange can swiftly address any suspicious activities and take appropriate action.

Furthermore, 1inch Exchange regularly updates its compliance policies and procedures to keep up with the changing regulatory environment. This allows the exchange to adapt to new rules and regulations in a timely manner, providing a safe and compliant trading environment for its users.

|

Compliance Measures Implemented by 1inch Exchange: |

| KYC procedures |

| AML checks |

| Adherence to local regulations |

| Transaction limits |

| Monitoring mechanisms |

| Regular updates to compliance policies |

Question-answer:

What is 1inch Exchange?

1inch Exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates. It was founded in 2019 by Sergej Kunz and Anton Bukov and has grown to become one of the most popular decentralized exchanges in the DeFi space.

How does 1inch Exchange adapt to changing regulatory environments?

1inch Exchange adopts a proactive approach in adapting to changing regulatory environments. They keep a close eye on regulatory developments and work closely with legal experts to ensure compliance with relevant laws and regulations. They also prioritize transparency and user education, providing clear information on the legal implications of using their platform and offering resources to help users stay informed about regulatory updates in their jurisdictions.