Discover the future of finance with 1inch, the trailblazer in decentralized finance (DeFi) solutions. Say goodbye to the old, rigid ways of traditional finance and embrace the limitless possibilities of the blockchain era.

At 1inch, we believe that financial freedom should be accessible to everyone. Our innovative platform empowers users to break free from the constraints of centralized systems, enabling them to trade, lend, borrow, and earn with ease. Join the millions of individuals who have already taken control of their financial destiny and unlocked the full potential of their assets.

With 1inch, you can navigate the ever-evolving DeFi landscape with confidence. Our advanced algorithms and smart routing technology ensure that you always get the best possible deal, whether it’s finding the lowest gas fees or securing the highest yields on your investments. Trust in our secure, transparent, and efficient protocols to maximize your returns and minimize your risks.

Embrace the future of finance and embark on a journey of financial sovereignty with 1inch. Gain access to a plethora of DeFi platforms, liquidity pools, and decentralized exchanges, all within a single, user-friendly interface. Seamlessly swap tokens, stake your assets, and participate in yield farming to grow your wealth exponentially.

Join the revolution today and experience the power of decentralized finance with 1inch. Together, let’s disrupt the traditional finance industry and create a more inclusive and prosperous future for all.

Traditional Finance

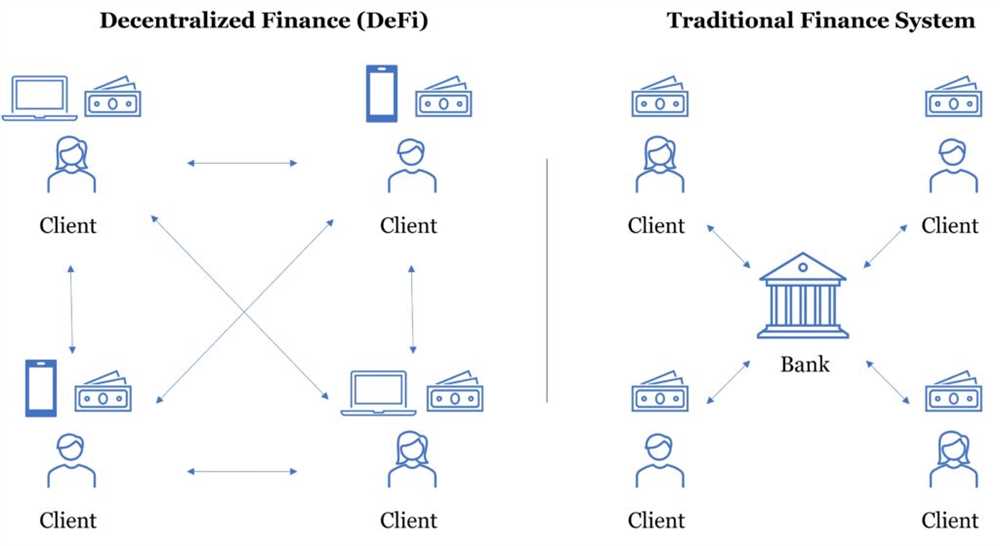

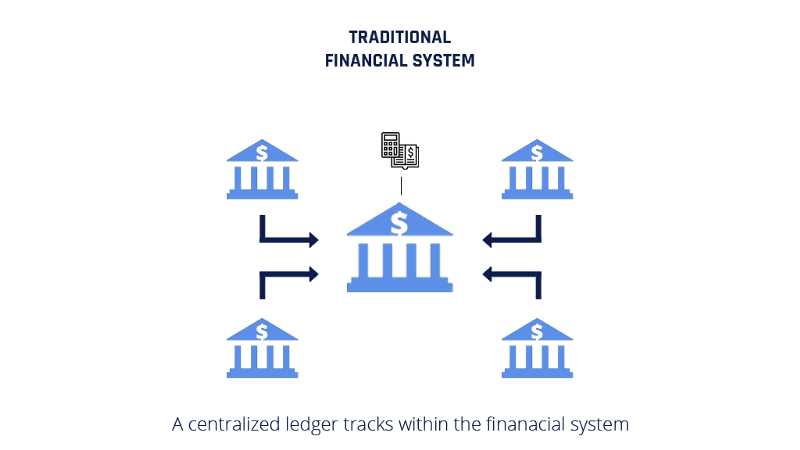

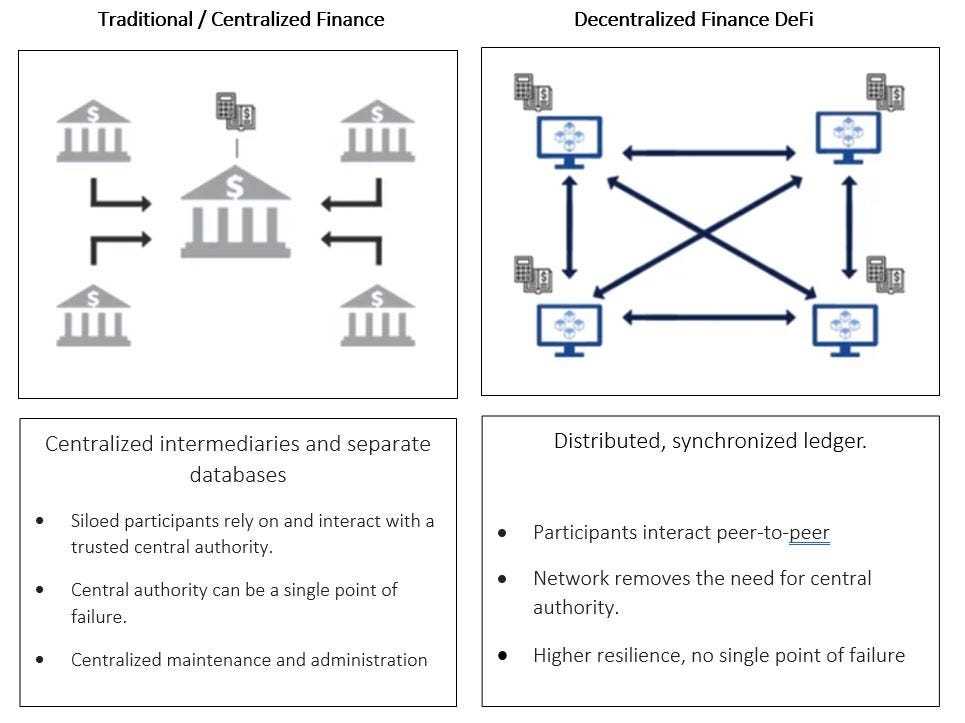

In the world of finance, traditional systems have long been the dominant force. These systems, which are primarily centralized and controlled by a select few, have served as the backbone of the financial industry for centuries. They have provided individuals and businesses with the means to save, invest, borrow, and transact in the global economy.

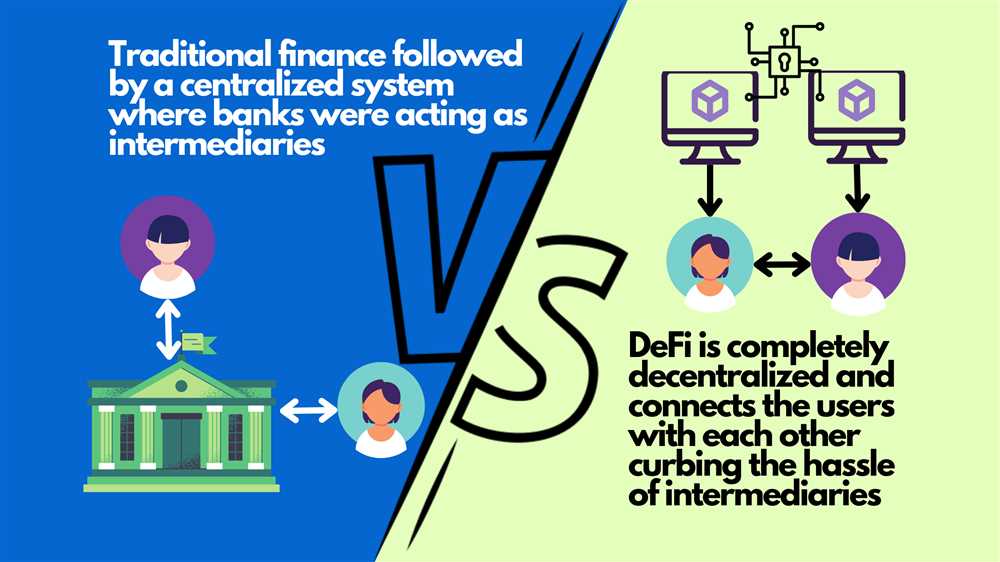

Traditionally, financial institutions such as banks, credit unions, and brokerages have acted as intermediaries in various financial transactions and services. They have facilitated the movement of money, the issuance of loans, and the management of investments. These institutions have relied on a centralized infrastructure that is governed by strict regulations and overseen by government entities.

The Limitations of Traditional Finance

While traditional finance has been successful in many ways, it is not without its limitations. One of the main drawbacks of traditional finance is its lack of accessibility. Many individuals, especially those in developing countries or underserved communities, have limited access to traditional financial services. This lack of access can hinder their ability to save, invest, and participate in the global economy.

Another limitation of traditional finance is its reliance on intermediaries. The involvement of intermediaries can introduce additional fees, delays, and complexities into financial transactions. It also limits the individual’s control over their own financial assets and decisions.

The Rise of DeFi

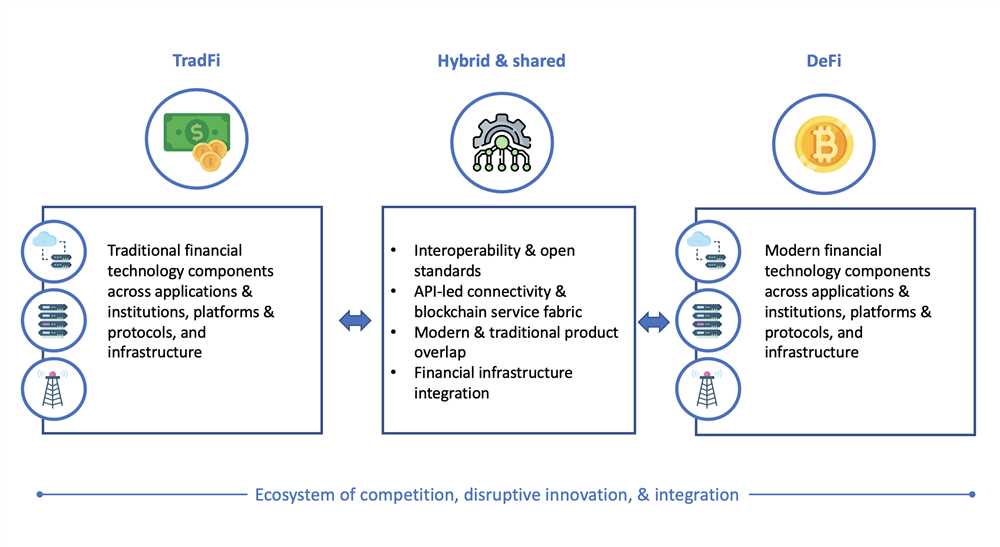

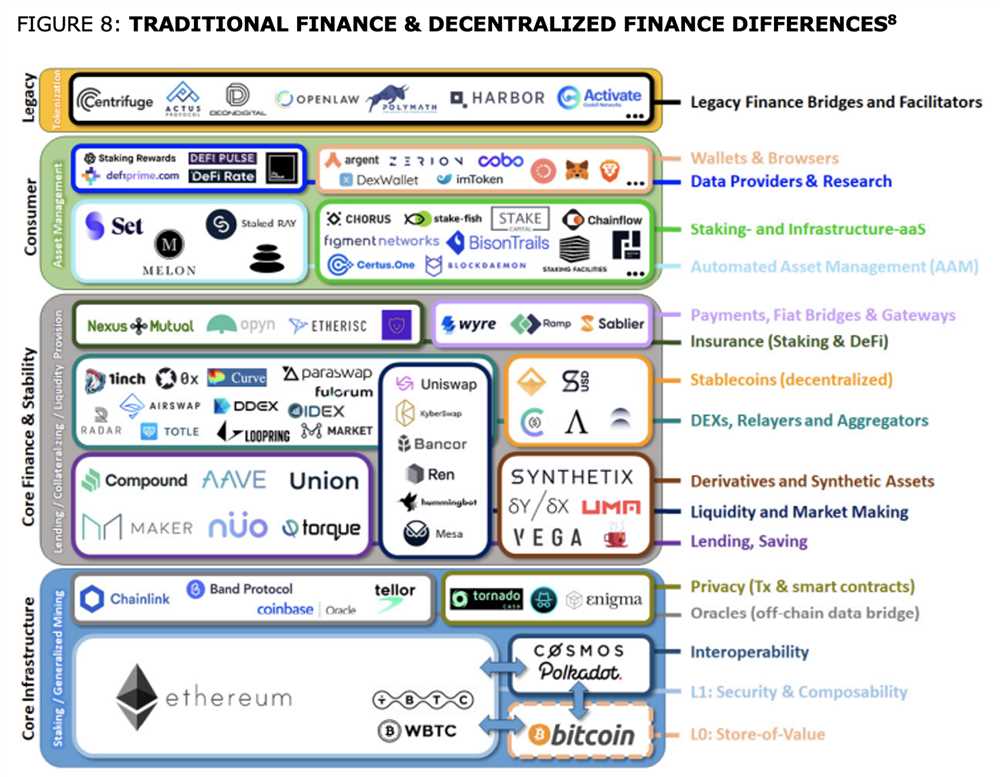

Decentralized Finance, or DeFi, has emerged as a disruptive force that aims to address the limitations of traditional finance. DeFi leverages blockchain technology to create a decentralized and open financial system. By eliminating intermediaries and reducing reliance on centralized institutions, DeFi provides individuals with direct control over their financial assets and decisions.

DeFi platforms, such as the innovative 1inch exchange, offer a range of services including lending, borrowing, trading, and yield farming. These platforms are built on blockchain networks, which enable transparent, secure, and efficient financial transactions. The use of smart contracts ensures that transactions are executed automatically and without the need for intermediaries.

With DeFi, individuals can access financial services without traditional barriers and restrictions. They can participate in the global economy, earn passive income from their assets, and contribute to the growth and development of decentralized finance.

As the world continues to embrace DeFi, the traditional finance industry faces the challenge of adapting to this new paradigm. In order to remain relevant and competitive, traditional financial institutions will need to explore and embrace the opportunities offered by decentralized finance.

The Current Financial System

The traditional financial system, also known as centralized finance or CeFi, is characterized by a hierarchical structure where financial intermediaries, such as banks and lending institutions, play a central role in facilitating transactions and managing funds.

While this system has been the backbone of global economic activity for centuries, it has several inherent limitations.

Limitations of the Current Financial System

|

|

It is these limitations that have fueled the rise of decentralized finance, or DeFi, as a viable alternative to the traditional financial system. DeFi leverages blockchain technology and smart contracts to create a transparent, inclusive, and efficient ecosystem for financial activities.

By eliminating intermediaries and implementing decentralized protocols, DeFi platforms provide users with direct control over their assets, lower fees, faster transactions, and greater accessibility.

As the DeFi industry continues to evolve and disrupt the traditional finance sector, platforms like 1inch are at the forefront of driving innovation and reshaping the financial landscape.

Defining DeFi

The term “DeFi” stands for decentralized finance, which refers to a new and innovative approach to financial systems that is built on blockchain technology. Unlike traditional finance systems, which are centralized, DeFi aims to create open and permissionless financial protocols that allow for anyone to participate, without the need for intermediaries or third parties.

DeFi is characterized by its use of smart contracts, which are self-executing contracts with predefined rules and conditions. These smart contracts are programmed on a blockchain, such as Ethereum, and are publicly auditable and transparent. This means that all transactions and interactions within the DeFi ecosystem can be verified and traced by anyone.

One of the key benefits of DeFi is its ability to provide financial services to underserved populations. With traditional finance, many people are excluded due to high fees, strict requirements, and lack of access. DeFi, on the other hand, aims to remove these barriers and provide financial services to anyone with an internet connection.

DeFi encompasses a wide range of financial products and services, including lending and borrowing platforms, decentralized exchanges, stablecoins, and yield farming. These platforms and protocols enable users to lend and borrow assets, trade on decentralized exchanges, earn interest on deposits, and more.

Overall, DeFi represents a major shift in the financial landscape, as it challenges the traditional financial system and empowers individuals to take control of their own finances. As the industry continues to grow and evolve, it is expected to bring about significant changes and opportunities in the world of finance.

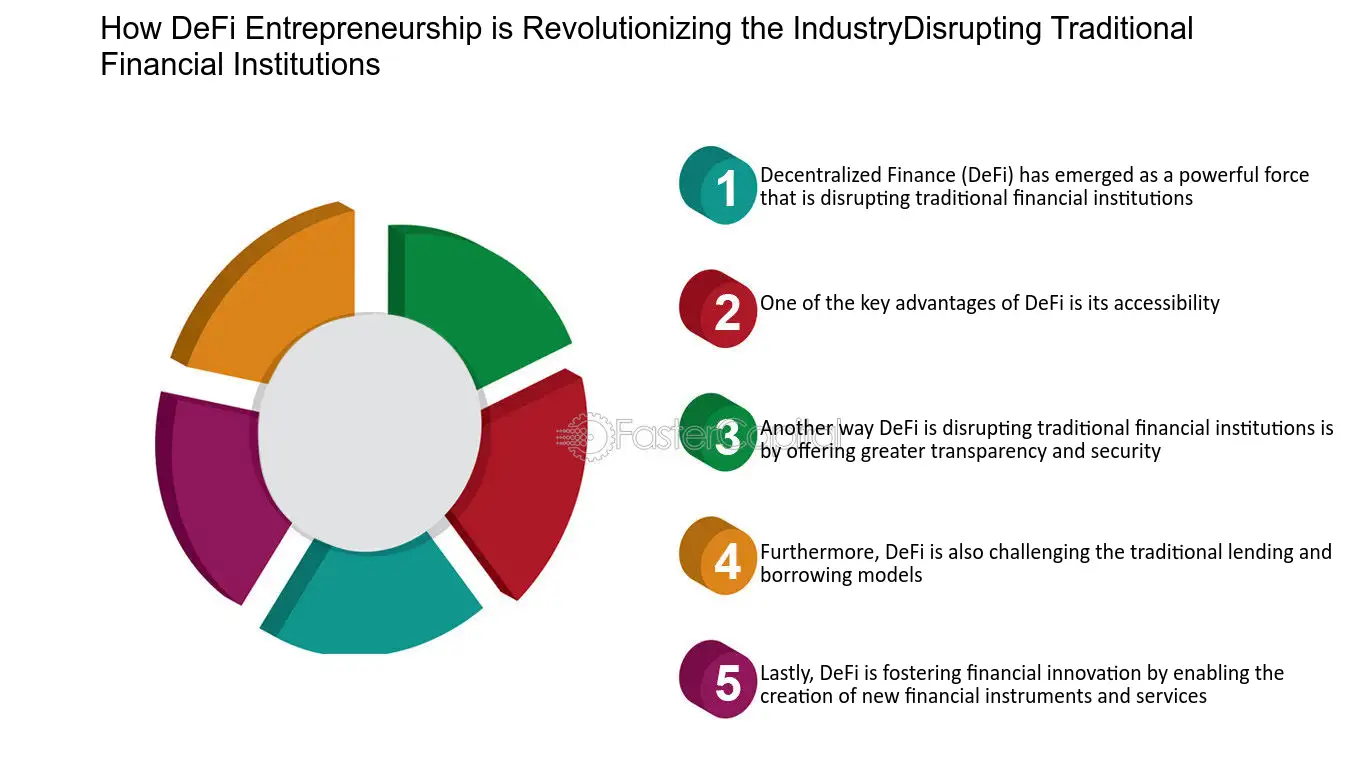

Disrupting the Industry

1inch’s groundbreaking technology is revolutionizing the traditional finance industry by introducing decentralized finance (DeFi) solutions. With its innovative platform, users can now enjoy faster, cheaper, and more efficient financial services.

Benefits of 1inch’s Industry Disruption

By disrupting the industry, 1inch brings numerous benefits to users, including:

| Lower Fees | 1inch leverages the power of decentralized exchanges to significantly reduce fees compared to traditional finance. Users can save on transaction costs and enjoy more value for their money. |

| Improved Accessibility | DeFi opens up financial services to a wider audience by removing barriers to entry. With 1inch, anyone with an internet connection can access a range of financial tools and services. |

| Increased Efficiency | Traditional finance often involves multiple intermediaries and lengthy processes. With 1inch’s technology, transactions are executed directly on the blockchain, eliminating middlemen and reducing processing time. |

| Global Reach | 1inch’s platform is accessible globally, allowing users from all over the world to participate in DeFi. This global reach fosters financial inclusion and empowers individuals regardless of their geographic location. |

Unlocking Opportunities

With its disruptive technology, 1inch unlocks new opportunities for users, such as:

- Access to a wide range of decentralized financial products and services

- Seamless and secure cross-chain transactions

- Exposure to new investment opportunities

- Participation in decentralized governance and staking

1inch’s industry disruption marks a significant shift in the way we think about and interact with financial services. With its user-centric approach and innovative solutions, 1inch is shaping the future of finance.

The Rise of 1inch

1inch is a revolutionary DeFi protocol that has quickly gained popularity in the cryptocurrency market. The platform aims to revolutionize the way people trade and interact with decentralized finance.

Birth of a Vision

The idea behind 1inch was conceived by Sergej Kunz and Anton Bukov in 2019. They recognized the potential of decentralized finance and saw how traditional financial systems were limiting the opportunities for investors. With a vision to create a more open and inclusive financial system, they set out to build a platform that would allow users to access the best available prices across multiple decentralized exchanges.

1inch started as a simple aggregator, finding the most optimal prices across various liquidity pools. However, it quickly expanded its services to include other innovative features such as liquidity mining and yield farming.

Building the Community

From its inception, 1inch has been focused on building a strong and engaged community. The team believes that the success of the platform depends on the active participation and support of its users. They have implemented governance mechanisms that allow users to have a say in the future development of the protocol.

Through various partnerships and collaborations with other projects in the DeFi space, 1inch has been able to grow its community and strengthen its position in the market. The team regularly engages with its community through social media channels, providing updates, answering questions, and gathering feedback.

The Future of 1inch

As the DeFi ecosystem continues to evolve, 1inch remains committed to providing innovative solutions and improving user experience. The team is constantly working on developing new features and expanding its services to meet the growing demands of the market.

With its user-centric approach and dedication to decentralization, 1inch has the potential to disrupt the traditional finance industry and empower individuals to take control of their financial future.

Question-answer:

What is the book “From Traditional Finance to DeFi: 1inch’s Industry Disruption” about?

The book “From Traditional Finance to DeFi: 1inch’s Industry Disruption” is about the transformation of the finance industry from traditional methods to decentralized finance (DeFi) through the perspective of the cryptocurrency exchange platform 1inch.

Why should I be interested in “From Traditional Finance to DeFi: 1inch’s Industry Disruption”?

If you are interested in learning about the revolution happening in the finance industry and how decentralized finance (DeFi) is disrupting traditional systems, then “From Traditional Finance to DeFi: 1inch’s Industry Disruption” is a book that you should definitely read. It provides insights into the rise of 1inch as a leading DeFi platform and how it is transforming the industry.

What can I learn from “From Traditional Finance to DeFi: 1inch’s Industry Disruption”?

“From Traditional Finance to DeFi: 1inch’s Industry Disruption” offers valuable insights into the evolution of the finance industry and the emergence of decentralized finance (DeFi). It covers topics such as the advantages of DeFi over traditional finance, the challenges faced by the industry, and the role of 1inch in driving the DeFi revolution. By reading this book, you can gain a deeper understanding of the future of finance and the potential of DeFi.

Is “From Traditional Finance to DeFi: 1inch’s Industry Disruption” suitable for beginners?

Yes, “From Traditional Finance to DeFi: 1inch’s Industry Disruption” is suitable for beginners as it provides a comprehensive overview of the finance industry and the rise of decentralized finance (DeFi). The book explains concepts in a clear and accessible manner, making it easy for readers who are new to the topic to understand and grasp the ideas presented.