If you’re looking to invest in the fast-growing world of decentralized finance (DeFi), you may want to consider 1inch. With its unique approach to optimizing decentralized exchanges, 1inch has quickly become a prominent player in the DeFi space.

So, what exactly is 1inch? In a nutshell, it’s a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading outcomes. By splitting orders across different platforms, 1inch minimizes slippage and maximizes returns for traders.

The growth potential of 1inch is undeniable. As more individuals and institutions flock to DeFi, the need for efficient and user-friendly trading solutions becomes increasingly apparent. 1inch addresses this need by offering a seamless and intuitive platform that allows users to access liquidity from multiple sources with just a few clicks.

In addition to its user-friendly interface, 1inch also boasts a robust ecosystem of liquidity providers and stakers. By participating in the 1inch network, users can earn 1INCH tokens and take advantage of various rewards programs. This incentivizes users to contribute to the platform’s liquidity, further enhancing its growth potential.

Furthermore, 1inch is constantly evolving and exploring new partnerships and integrations. This commitment to innovation ensures that the platform remains at the forefront of the DeFi industry, providing users with cutting-edge solutions and opportunities.

While investing in any cryptocurrency carries certain risks, 1inch’s track record and promising future make it an intriguing investment option for those interested in the DeFi space. With its unique approach to decentralized exchanges and commitment to growth, 1inch may just be the next big thing in the world of decentralized finance.

Overview of 1inch DeFi

1inch DeFi is a decentralized finance platform that aims to provide users with optimal trading routes across various decentralized exchanges (DEXs). It was launched in August 2020 by Sergej Kunz and Anton Bukov. The platform is built on the Ethereum blockchain and utilizes smart contracts to automate and optimize trades.

The main feature of 1inch DeFi is its aggregation protocol, which combines liquidity from multiple DEXs to ensure users get the best possible prices for their trades. By splitting a trade across different exchanges, 1inch DeFi reduces slippage and maximizes the yield for traders.

In addition to its aggregation protocol, 1inch DeFi offers other services such as liquidity mining, gas optimization, and staking. The liquidity mining program allows users to earn native tokens by providing liquidity to the platform. Gas optimization helps users save on transaction fees by finding the most cost-effective route for their trades. Staking allows users to earn additional rewards by locking up their tokens for a certain period of time.

| Key Features | Description |

|---|---|

| Aggregation Protocol | Combines liquidity from multiple DEXs to provide the best trading prices and reduce slippage. |

| Liquidity Mining | Allows users to earn native tokens by providing liquidity to the platform. |

| Gas Optimization | Helps users save on transaction fees by finding the most cost-effective route for their trades. |

| Staking | Allows users to earn additional rewards by locking up their tokens for a certain period of time. |

1inch DeFi has gained popularity among traders and investors due to its innovative approach to decentralized trading. It has attracted a significant amount of liquidity and has established partnerships with various industry leaders. With its focus on improving the trading experience and maximizing returns for users, 1inch DeFi is considered one of the top players in the DeFi space.

In conclusion, 1inch DeFi offers a comprehensive suite of tools and services that enable users to navigate the decentralized trading landscape with ease. Its aggregation protocol, liquidity mining, gas optimization, and staking features set it apart from other platforms and make it an attractive option for traders and investors looking to maximize their returns in the DeFi market.

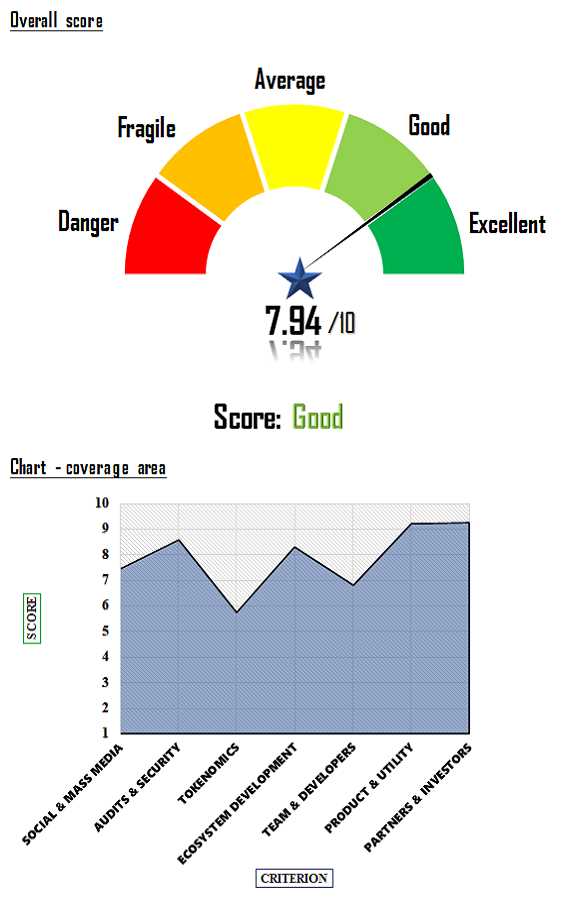

Analysis

When analyzing the growth potential of 1inch DeFi, it’s important to consider various factors that can impact its success as an investment.

One key factor to consider is the market demand for decentralized finance (DeFi) platforms. As the cryptocurrency industry continues to gain mainstream adoption, more users are seeking out decentralized alternatives to traditional financial systems. This increasing demand presents a significant opportunity for platforms like 1inch to thrive.

Another factor to consider is the technology and features offered by 1inch. The platform’s unique aggregation algorithm allows users to find the best prices and liquidity across multiple decentralized exchanges. This not only improves the user experience but also enables users to minimize slippage and maximize their profits. The platform’s focus on security and transparency also adds to its appeal.

Furthermore, the partnerships and collaborations of 1inch DeFi are worth noting. The platform has established strategic partnerships with various DeFi projects and protocols, which opens up new avenues for growth and expansion. These partnerships can help attract more users and liquidity to the platform, further enhancing its growth potential.

However, it’s important to acknowledge the risks involved in investing in 1inch DeFi. The cryptocurrency market is highly volatile, and DeFi platforms are not immune to this volatility. Investors should carefully assess their risk tolerance and conduct thorough research before making any investment decisions.

In conclusion, 1inch DeFi has significant growth potential due to the increasing demand for decentralized finance platforms and the unique features it offers. However, it’s crucial for investors to approach this investment with caution and conduct comprehensive analysis to mitigate risks.

Growth Potential of 1inch

1inch is a decentralized finance (DeFi) platform that aims to provide users with the best possible prices for their crypto asset swaps. With its innovative aggregation protocol, 1inch is able to search multiple decentralized exchanges (DEXs) simultaneously to find the most optimal trading paths for users.

The growth potential of 1inch is significant, as it addresses a critical need in the DeFi ecosystem. By aggregating liquidity and optimizing trading paths, 1inch can offer users better prices and lower slippage compared to traditional DEXs. This competitive advantage has contributed to the platform’s rapid growth and popularity.

The platform’s native token, 1INCH, also adds another layer of potential growth. Token holders can participate in the platform’s governance and decision-making processes. This gives them a stake in the platform’s success, which could incentivize them to actively contribute and support its growth.

Furthermore, 1inch has been expanding its partnerships and integrations with other DeFi protocols and platforms, further enhancing its growth potential. By collaborating with other projects in the DeFi space, 1inch can access new markets and user bases, potentially increasing its adoption and usage.

As the DeFi space continues to gain traction and evolve, 1inch is well-positioned to capitalize on the growing demand for efficient and cost-effective trading solutions. Its innovative protocol, competitive advantage, and strategic partnerships make it a promising investment opportunity in the DeFi sector.

In conclusion, the growth potential of 1inch is undeniable. With its innovative aggregation protocol, native token governance, and strategic partnerships, 1inch is well-positioned to capitalize on the expanding DeFi market. Whether you’re a trader looking for better prices or an investor looking for a promising DeFi project, 1inch is definitely worth considering.

Investment Opportunities

When considering investment opportunities, it is important to thoroughly analyze the potential growth of a project before making any decisions. For those interested in decentralized finance (DeFi), 1inch offers a promising investment option.

1inch is a decentralized exchange aggregator that operates on multiple blockchains, including Ethereum and Binance Smart Chain. It aims to provide users with the best possible rates for their trades by splitting orders across various decentralized exchanges.

The growth potential of 1inch lies in its innovative approach to solving the liquidity fragmentation problem in decentralized exchanges. By aggregating liquidity from different platforms, 1inch provides users with significantly more opportunities for trading and better prices.

The decentralized finance market has experienced tremendous growth in recent years, with more users and traders entering the space. This growth has created a demand for efficient and reliable decentralized exchange solutions, making 1inch a potentially lucrative investment.

| Benefits of Investing in 1inch DeFi | |

|---|---|

| 1. Diversification | Investing in 1inch DeFi provides an opportunity to diversify your portfolio within the decentralized finance space. By adding 1inch to your investment strategy, you can spread your risk across different DeFi projects and potentially increase your chances of substantial returns. |

| 2. Potential for Growth | With the rapid growth of the DeFi market, 1inch has the potential to experience significant growth in the coming years. As more users adopt decentralized finance and realize the benefits of decentralized exchanges, the demand for platforms like 1inch is likely to increase. |

| 3. Problem-solving Approach | 1inch is tackling a critical issue in the decentralized finance space – liquidity fragmentation. By providing users with the best possible rates through decentralized exchange aggregation, 1inch offers a unique solution that can attract a large user base. |

| 4. Experienced Team and Partnership | 1inch has a team of experienced developers and blockchain enthusiasts working towards the project’s success. Additionally, 1inch has formed partnerships with other notable projects in the DeFi space, which can contribute to its growth. |

It is important to note that investing in cryptocurrencies and DeFi projects carries inherent risks, including volatile market conditions and regulatory uncertainties. Therefore, thorough research and careful consideration are necessary before making any investment decisions.

In conclusion, 1inch DeFi presents an attractive investment opportunity due to its innovative approach to liquidity aggregation, its potential for growth in the expanding DeFi market, and its experienced team and partnerships. However, it is crucial to conduct further analysis and evaluate the risks involved before making any investment decisions.

Is 1inch a Good Investment?

When considering whether or not to invest in 1inch DeFi, it is important to analyze its growth potential and evaluate its merits as an investment opportunity.

1inch is a decentralized exchange aggregator that allows users to find the best prices across various liquidity sources. It offers several advantages over traditional centralized exchanges, such as lower fees, improved liquidity, and increased transparency.

One of the key factors that make 1inch a good investment is its potential for growth in the DeFi market. As the adoption of decentralized finance continues to increase, the demand for decentralized exchanges like 1inch is expected to rise. This can potentially lead to an increase in the value of 1inch tokens, providing investors with a profitable investment opportunity.

Additionally, 1inch has a strong team of developers and advisors, who are experienced in the crypto and blockchain industry. This gives investors confidence in the project’s long-term prospects and the ability to navigate the ever-evolving DeFi landscape.

Furthermore, 1inch has established partnerships with other leading DeFi projects and platforms, which can contribute to its growth and success. These partnerships can help to improve liquidity, attract more users, and expand the reach of the 1inch ecosystem.

It is important to note that investing in 1inch, like any other investment, carries risks. The cryptocurrency market is highly volatile and subject to regulatory and security risks. Therefore, it is important for investors to do their own research, assess their risk tolerance, and consult with a financial advisor before making any investment decisions.

| Pros | Cons |

|---|---|

| High growth potential in the DeFi market | Volatility and regulatory risks |

| Lower fees compared to centralized exchanges | Potential competition from other DeFi projects |

| Improved liquidity | Security concerns in the cryptocurrency market |

| Experienced team and strong partnerships |

In conclusion, 1inch has the potential to be a good investment due to its growth potential in the DeFi market, lower fees, improved liquidity, and strong team and partnerships. However, investors should be aware of the risks involved and conduct thorough research before making any investment decisions.

Question-answer:

What is 1inch DeFi?

1inch DeFi is a decentralized finance platform that allows users to swap and trade different cryptocurrencies on various decentralized exchanges. It aggregates liquidity from multiple sources to provide users with the best possible rates.

How does 1inch DeFi work?

1inch DeFi works by connecting to various decentralized exchanges and routing users’ trades to the exchange with the best price. It uses smart contracts to split trades across multiple exchanges to ensure users get the best possible rates.