1inch Exchange has quickly become one of the leading decentralized exchanges in the fast-growing world of cryptocurrency trading. With its innovative trading algorithm, 1inch Exchange has revolutionized the way users can trade their digital assets. In this comprehensive analysis, we will delve into the inner workings of 1inch Exchange’s trading algorithm, exploring its key features and benefits for traders.

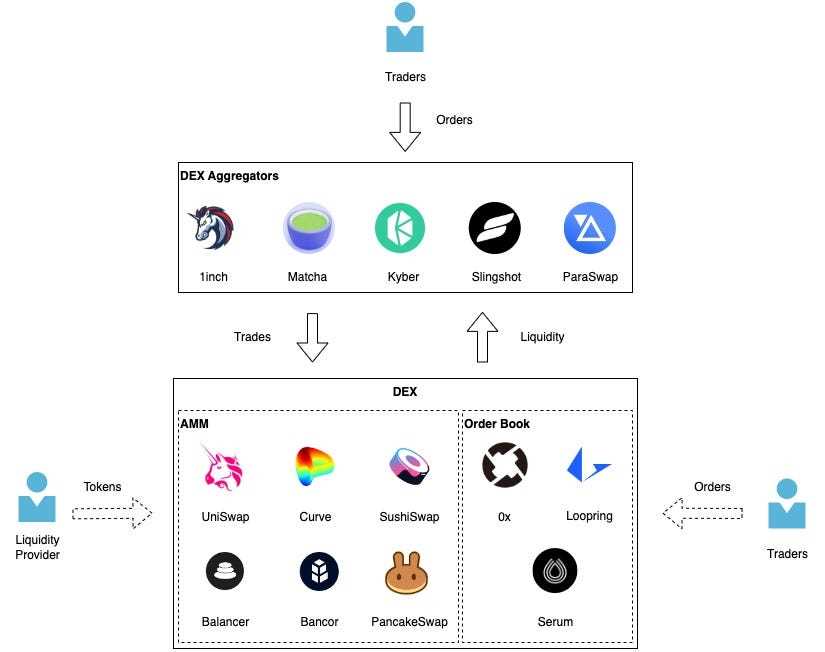

The core of 1inch Exchange’s trading algorithm lies in its ability to find the most optimal routes for trading a specific pair of tokens. Traditional exchanges typically offer limited options for users, often resulting in higher fees and slippage. However, 1inch Exchange uses an aggregation protocol that combines multiple liquidity sources and splits orders across different decentralized exchanges to achieve the best possible prices for traders.

One of the key strengths of 1inch Exchange’s trading algorithm is its ability to minimize slippage. Slippage refers to the difference between the expected price of a trade and the actual executed price. With its intelligent routing system, 1inch Exchange ensures that trading orders are executed at the best available prices across various decentralized exchanges, thereby reducing slippage and maximizing potential gains for traders.

Furthermore, 1inch Exchange’s trading algorithm takes into account other factors, such as transaction fees and gas prices, when determining the optimal trading route. By considering these factors, 1inch Exchange is able to provide users with a cost-effective trading experience while minimizing the associated fees and expenses. This feature makes 1inch Exchange an attractive option for traders who value efficiency and cost savings.

In conclusion, 1inch Exchange’s trading algorithm offers a comprehensive solution for users looking to trade their digital assets in a decentralized and efficient manner. With its ability to find the most optimal routes, minimize slippage, and consider transaction fees, the algorithm sets 1inch Exchange apart from traditional exchanges. As the cryptocurrency market continues to grow, 1inch Exchange and its trading algorithm are poised to play a significant role in shaping the future of decentralized trading.

The Trading Algorithm Analysis of 1inch Exchange

The trading algorithm used by 1inch Exchange is an integral part of its highly efficient and innovative decentralized exchange platform. This algorithm not only ensures the best possible execution of trades, but also allows users to access the most favorable prices across multiple liquidity sources.

One of the key features of the 1inch trading algorithm is its ability to split a single trade across multiple decentralized exchanges, thereby maximizing liquidity and reducing slippage. The algorithm scans various liquidity sources, including decentralized exchanges like Uniswap, SushiSwap, and Balancer, as well as centralized exchanges such as Binance and Coinbase, in order to identify the best possible prices for a given trade.

The algorithm’s decision-making process is based on real-time data analysis, taking into account factors such as liquidity depth, trading volume, and transaction fees. By considering these factors, the algorithm ensures that users are able to execute trades at the most optimal prices, while also minimizing the overall cost of the transaction.

In addition to optimizing trade execution, the 1inch trading algorithm also incorporates a smart routing mechanism. This mechanism enables the algorithm to determine the most efficient and cost-effective route for executing a trade. By analyzing available liquidity on various exchanges, the algorithm can split a trade into smaller parts and execute them across multiple exchanges, thus reducing slippage and maximizing price efficiency.

Furthermore, the 1inch trading algorithm prioritizes decentralization and security. It uses smart contracts to facilitate the execution of trades, ensuring that the algorithm operates in a trustless and transparent manner. Additionally, the algorithm incorporates various security measures, such as transaction validation and integrity checks, to protect user funds and prevent any potential vulnerabilities.

| Key Features: | Benefits: |

|---|---|

| Splitting trades across multiple exchanges | – Maximizes liquidity |

| Real-time analysis of liquidity depth, trading volume, and transaction fees | – Ensures optimal trade execution |

| Smart routing mechanism | – Reduces slippage |

| Decentralized execution through smart contracts | – Trustless and transparent |

| Enhanced security measures | – Protects user funds |

Overall, the trading algorithm used by 1inch Exchange is a highly sophisticated and efficient system that empowers users to access the best possible prices and execute trades in a secure and decentralized manner. Through its innovative features and advanced analysis techniques, the algorithm sets a new standard for decentralized trading platforms.

The Background and Importance of Trading Algorithms

In the world of finance, trading algorithms have become an essential tool for both individual investors and institutional traders. These algorithms are computer programs that use mathematical models and strategies to execute trades on behalf of their users. They analyze vast amounts of financial data in real-time, identifying patterns and trends that human traders may miss.

The history of trading algorithms can be traced back to the early 1980s, when the first computerized trading systems were developed. These systems were initially used by large financial institutions to automate their trading activities and improve efficiency. Over time, trading algorithms have evolved and become more sophisticated, incorporating advanced mathematical models and artificial intelligence techniques.

Today, trading algorithms play a crucial role in global financial markets. They provide liquidity to markets, ensuring that there are always buyers and sellers for every trade. They also help reduce transaction costs by executing trades at the optimal price and minimizing slippage. Additionally, trading algorithms enable traders to execute trades at high speeds and in large volumes, which is essential in today’s fast-paced and highly competitive trading environment.

The importance of trading algorithms extends beyond the realm of traditional financial markets. With the rise of cryptocurrencies and decentralized finance (DeFi), trading algorithms have become essential for navigating these new and complex markets. They help investors and traders take advantage of arbitrage opportunities, manage risk, and optimize their trading strategies.

As trading algorithms become more prevalent, it is important to ensure that they are fair, transparent, and free from manipulation. Regulators and market participants are increasingly focused on developing regulatory frameworks and best practices for algorithmic trading to promote market integrity and protect investors.

In conclusion, trading algorithms have revolutionized the way financial markets operate. They have become a vital tool for traders and investors, providing them with insights and opportunities that were previously unavailable. As technology continues to advance, we can expect trading algorithms to become even more sophisticated and powerful, shaping the future of finance.

Overview of 1inch Exchange

1inch Exchange is a decentralized exchange (DEX) aggregator that enables users to access multiple DEXs in a single platform. It was founded in 2019 by Sergej Kunz and Anton Bukov, two cryptocurrency enthusiasts who wanted to solve the problem of liquidity fragmentation in the decentralized finance (DeFi) space.

The platform’s name, “1inch,” is derived from the concept of reducing slippage by splitting trades across multiple DEXs, resulting in better execution prices for users. The aim of 1inch Exchange is to provide users with the best possible trading experience by sourcing liquidity from various DEXs and routing trades to obtain optimal prices.

1inch Exchange operates by aggregating liquidity from various DEXs, such as Uniswap, SushiSwap, Curve, and Balancer. It uses a smart contract algorithm to split a user’s trade across multiple DEXs in order to find the best possible price. The algorithm takes into account factors such as trading fees, liquidity depth, and slippage to optimize the execution of trades.

One of the key features of 1inch Exchange is its gas optimization algorithm. Gas fees are a significant concern in the Ethereum network, and 1inch Exchange aims to reduce transaction costs as much as possible. The platform analyzes gas prices across different DEXs and routes trades to the most cost-effective option, thus saving users money on fees.

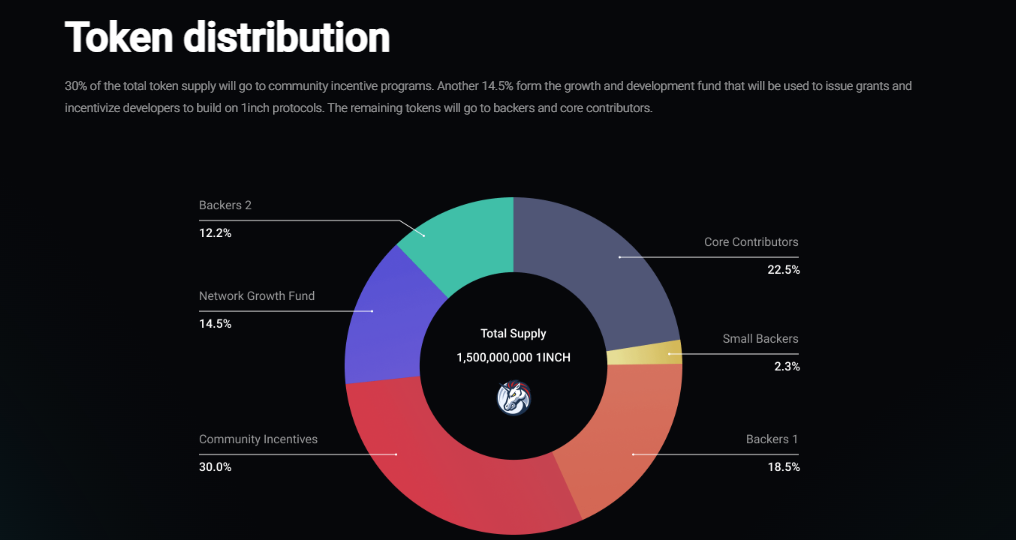

Moreover, 1inch Exchange offers users a user-friendly interface and supports a wide range of assets for trading. The platform also provides a mobile app for users to access the exchange on the go. Additionally, 1inch Exchange has its native token, 1INCH, which can be used for governance and as a discount token for trading fees.

In summary, 1inch Exchange is a decentralized exchange aggregator that aims to provide users with the best trading experience by sourcing liquidity from various DEXs and optimizing trades for the most cost-effective execution. With its gas optimization algorithm and user-friendly interface, 1inch Exchange has become a popular choice among DeFi traders.

Understanding the Algorithm Used by 1inch Exchange

1inch Exchange is a decentralized exchange aggregator that aims to provide users with the best possible trading routes across multiple liquidity sources. The platform achieves this through the use of a sophisticated algorithm that evaluates various parameters to determine the optimal trades.

How the Algorithm Works

The algorithm used by 1inch Exchange functions by splitting a user’s trade across multiple decentralized exchanges to maximize liquidity and achieve the best possible rates. The algorithm takes into account several factors, including:

- Current liquidity on different exchanges

- Trading fees on each exchange

- Slippage on different trading pairs

- Gas fees for executing each trade

- Distance to different trading routes

By analyzing these parameters, the algorithm identifies the most efficient and cost-effective trading routes, allowing users to benefit from better rates and reduced slippage.

Smart Contract Integration

1inch Exchange’s algorithm is integrated into smart contracts deployed on the Ethereum blockchain. These smart contracts interact with various decentralized exchanges and execute trades on behalf of users. The algorithm ensures that trades are executed at the most favorable rates and provides users with real-time information on trade execution.

Dynamic and Real-time Optimization

The algorithm is constantly updated and optimized in real-time to adapt to changing market conditions. It takes into account factors such as changes in liquidity, network congestion, and gas fees to provide users with the most accurate and favorable trading routes.

| Advantages | Limitations |

|---|---|

|

|

In conclusion, the algorithm used by 1inch Exchange provides users with a comprehensive and efficient trading experience. By analyzing various parameters and leveraging multiple decentralized exchanges, the platform ensures users can make the most of their trades and optimize their trading strategies.

Advantages and Disadvantages of the 1inch Exchange Algorithm

The 1inch Exchange algorithm offers several advantages and disadvantages that traders should consider when using the platform. These factors can greatly impact the overall trading experience and potential profitability.

Advantages

1. Improved liquidity: The 1inch Exchange algorithm utilizes various decentralized exchanges to provide traders with access to a larger pool of liquidity. This increased liquidity can lead to better trade execution and reduced slippage.

2. Reduced costs: By aggregating liquidity across multiple exchanges, the 1inch algorithm can often find the most cost-effective routes for executing trades. This can result in lower fees and better prices for traders.

3. Smart contract security: 1inch Exchange utilizes audited and trusted smart contracts, providing an added layer of security to traders. This helps minimize the risk of hacking or unauthorized access to funds.

Disadvantages

1. Complexity: The 1inch Exchange algorithm can be complex to understand and navigate for novice traders. The multiple steps and calculations involved may require a deeper understanding of how the system works.

2. Potential for slippage: Despite seeking the best available prices, there is still a possibility of slippage when using the 1inch Exchange algorithm. This can occur when the market moves rapidly or when there is limited liquidity.

3. Limited access to certain tokens: While the 1inch Exchange algorithm provides access to a wide range of tokens, there may be certain tokens or markets that are not available on the platform. Traders looking for specific assets may need to seek alternative platforms.

In conclusion, the 1inch Exchange algorithm offers improved liquidity, reduced costs, and enhanced security for traders. However, its complexity, potential for slippage, and limited access to certain tokens are key factors to consider when using the platform.

Question-answer:

What is 1inch Exchange’s trading algorithm?

1inch Exchange’s trading algorithm is a complex system that uses different strategies to execute trades on various decentralized exchanges. The algorithm splits the orders into smaller parts and routes them through different liquidity sources to achieve the best possible price for the user.

How does 1inch Exchange’s trading algorithm work?

1inch Exchange’s trading algorithm works by aggregating liquidity from different decentralized exchanges and splitting the user’s order into smaller parts. It then routes these parts through different liquidity sources, taking into account various factors such as prices, fees, and slippage. The algorithm dynamically adjusts the trading strategy to achieve the best possible outcome for the user.

What advantages does 1inch Exchange’s trading algorithm have?

1inch Exchange’s trading algorithm has several advantages. Firstly, it offers users access to liquidity from multiple decentralized exchanges, maximizing their chances of finding the best price. Secondly, the algorithm splits orders into smaller parts and routes them strategically, reducing slippage and minimizing the impact on the market. Lastly, the algorithm is constantly evolving and adapting to market conditions, ensuring that users always get the best possible trading experience.

Can I trust 1inch Exchange’s trading algorithm?

Yes, you can trust 1inch Exchange’s trading algorithm. It is built on a transparent and audited codebase, and the team behind 1inch Exchange has a strong track record in the decentralized finance space. The algorithm has undergone rigorous testing and has been proven to deliver competitive prices and low slippage. However, as with any trading platform, it is always recommended to do your own research and understand the risks involved before using the algorithm.