Are you looking for a way to take your trading to the next level? The 1inch Aggregator is here to help. With its advanced customization options, you can tailor your trading strategies and parameters to suit your individual needs and preferences. Whether you’re an experienced trader or just getting started, this powerful tool can help you optimize your trading and maximize your profits.

One of the key features of the 1inch Aggregator is its ability to customize trading strategies. With this tool, you can define your own rules and conditions for executing trades. Want to buy a specific cryptocurrency when its price reaches a certain threshold? Or maybe you want to sell a particular token when its value dips below a certain level? With the 1inch Aggregator, you can set up these rules and more, ensuring that your trades are executed exactly as you want them to be.

Another great thing about the 1inch Aggregator is its customizable parameters. This tool allows you to adjust various settings to match your risk tolerance and trading style. For example, you can set the maximum slippage you’re willing to accept, or define the minimum amount of liquidity you require before executing a trade. By customizing these parameters, you can ensure that your trades are executed in a way that aligns with your trading goals and preferences.

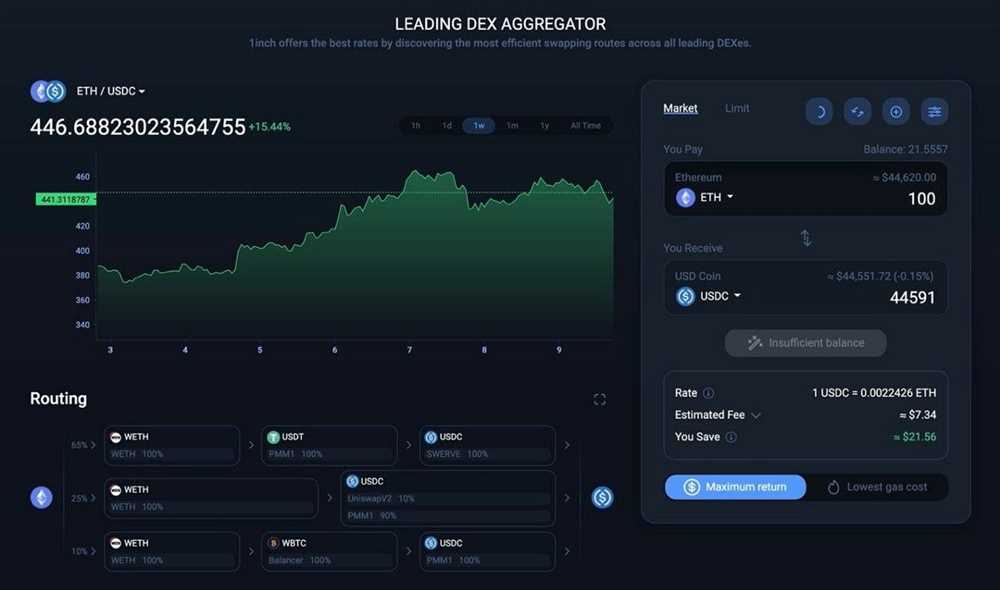

The 1inch Aggregator also offers advanced analytics and reporting features, allowing you to track the performance of your customized trading strategies. With detailed statistics and charts, you can easily evaluate the effectiveness of your rules and parameters, and make adjustments as needed. This data-driven approach can help you make better-informed trading decisions and improve your overall trading performance.

In conclusion, the 1inch Aggregator is a powerful tool that allows you to customize your trading strategies and parameters to suit your individual needs and preferences. Whether you’re an experienced trader or just getting started, this tool can help you take your trading to the next level. So why wait? Start customizing your trading strategies and parameters with the 1inch Aggregator today and unlock the full potential of your trading activities.

What is the 1inch Aggregator?

The 1inch Aggregator is a decentralized exchange (DEX) aggregator that sources liquidity from various DEXes to provide users with the best possible trading prices and low slippage. It is a platform that aggregates liquidity from different decentralized exchanges, including but not limited to Uniswap, Sushiswap, Balancer, and many more.

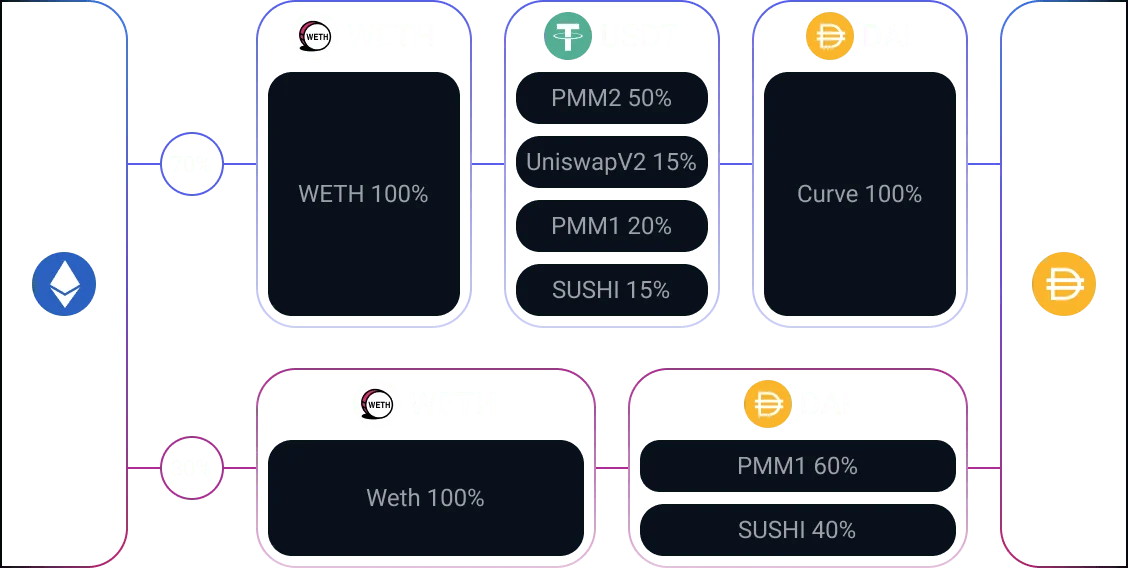

By accessing multiple DEXes simultaneously, the 1inch Aggregator increases the chances of finding the most optimal trading routes with the best prices and lowest fees. It splits the user’s trade across multiple DEXes to ensure the most favorable outcome for the user.

The 1inch Aggregator uses smart contracts to interact with the different DEXes and execute trades on behalf of the users. It scans various DEXes, analyzes the available liquidity, and provides users with the best trading execution path.

How does the 1inch Aggregator work?

When a user initiates a trade on the 1inch Aggregator, the platform determines the best route to execute the trade. It calculates the optimal trading path by considering factors such as liquidity, slippage, and transaction fees across different DEXes.

Once the most optimal route is determined, the 1inch Aggregator splits the user’s trade into multiple smaller trades across different DEXes to minimize slippage and reduce overall trading costs. This allows users to access the best available prices and liquidity across multiple DEXes in a single trade.

The 1inch Aggregator also takes into account the gas fees associated with each DEX and executes trades accordingly to ensure the best overall trading experience for users.

Overall, the 1inch Aggregator provides users with a seamless and efficient trading experience by aggregating liquidity from multiple DEXes and optimizing trade execution to achieve the best possible outcomes.

Key features of the 1inch Aggregator:

1. Best price sourcing: The 1inch Aggregator scans multiple DEXes to find the best possible trading prices and access to liquidity.

2. Low slippage: By splitting trades across multiple DEXes, the 1inch Aggregator minimizes slippage and optimizes trade execution.

3. Gas optimization: The platform considers gas fees associated with different DEXes and executes trades in a way that minimizes overall trading costs.

4. Wide range of supported DEXes: The 1inch Aggregator supports various decentralized exchanges, ensuring users have access to a diverse pool of liquidity.

5. Trustless and decentralized: The 1inch Aggregator operates using smart contracts and is completely trustless, ensuring transparency and security for users.

Overall, the 1inch Aggregator is a powerful tool that enables traders to customize their trading strategies and parameters to maximize their trading outcomes. By leveraging the platform’s liquidity aggregation and optimization capabilities, users can access the best available prices and liquidity across different DEXes in a seamless and efficient manner.

Why Customize Your Trading Strategies and Parameters?

When it comes to trading, one size does not fit all. Every trader has their own risk tolerance, investment goals, and trading style. This is why it is crucial to customize your trading strategies and parameters.

By customizing your trading strategies and parameters, you can align your trading approach with your individual needs and preferences. Here are a few reasons why customization is important:

1. Maximizing Profit Potential

Customization allows you to tailor your trading strategies to maximize your profit potential. You can fine-tune your parameters based on your analysis of the market conditions, historical data, and your risk tolerance. This way, you can identify the most profitable opportunities and execute trades accordingly.

2. Minimizing Risk

Customizing your trading strategies and parameters empowers you to minimize risk. You can set specific stop-loss levels, define risk/reward ratios, and implement risk management techniques that suit your risk appetite. This helps protect your capital and reduce the potential for significant losses.

Moreover, customization enables you to adapt your strategies to changing market conditions. You can modify your parameters as the market evolves, ensuring that your trading approach remains relevant and effective.

Remember: Trading is a dynamic activity, and the ability to customize your strategies and parameters allows you to adapt and stay ahead of the curve.

In conclusion, customizing your trading strategies and parameters is essential for aligning your trading approach with your unique needs and preferences. It helps you maximize profit potential, minimize risk, and adapt to changing market conditions. By taking the time to customize your strategies, you can enhance your trading performance and achieve your investment goals.

Step-by-Step Guide to Customizing Your Trading Strategies and Parameters

Customizing your trading strategies and parameters is a crucial step in maximizing your trading potential. With the 1inch Aggregator, you have the flexibility to tailor your strategies to suit your individual trading style and preferences. In this guide, we will walk you through the step-by-step process of customizing your trading strategies and parameters.

- Set your trading goals: Before customizing your strategies, it is essential to define your trading goals. Are you looking to maximize profits or minimize risks? Understanding your objectives will help you make informed decisions when customizing your trading strategies.

- Choose the optimal trading strategy: The 1inch Aggregator offers a wide range of trading strategies to choose from. Whether you prefer market making, arbitrage, or simply trading on the best available price, select the strategy that aligns with your goals and risk appetite.

- Define your parameters: Once you have chosen a trading strategy, it’s time to define your parameters. These parameters will determine how your strategy executes trades. For example, you can set parameters such as slippage tolerance, minimum trade size, or maximum trade duration.

- Test your strategy: Before deploying your customized strategy, it’s essential to test it thoroughly. Use historical data or simulated trading environments to evaluate the performance of your strategy. This step will help you identify any weaknesses or areas for improvement.

- Monitor and adjust: Once your customized strategy is live, constantly monitor its performance. Keep an eye on key metrics such as profitability, trade execution speed, and risk management. If necessary, make adjustments to your parameters or switch to a different strategy.

- Stay informed: The cryptocurrency market is highly dynamic, so it’s crucial to stay informed about the latest market trends and developments. Stay updated with news, monitor market indicators, and be ready to adapt your strategies accordingly.

By following this step-by-step guide, you can effectively customize your trading strategies and parameters with the 1inch Aggregator. Remember, the key is to align your strategies with your trading goals and continuously adapt them to the evolving market conditions. Good luck!

Step 1: Assessing Your Trading Goals and Risk Tolerance

Before customizing your trading strategies and parameters with the 1inch Aggregator, it is important to assess your trading goals and risk tolerance. This step will help you align your trading decisions with your personal objectives and ensure that you are comfortable with the level of risk involved.

When assessing your trading goals, consider what you aim to achieve through your trading activities. Are you looking to generate short-term profits or are you more focused on long-term investment growth? Understanding your goals will help you determine the appropriate trading strategies to employ and the parameters to set.

Another important factor to consider is your risk tolerance. This refers to the amount of risk you are willing to accept when making investment decisions. Some traders may be more comfortable with higher levels of risk in pursuit of greater returns, while others may prefer a more conservative approach. Assessing your risk tolerance will help you determine the appropriate risk management strategies and adjust the parameters of your trading strategies accordingly.

It is also worth noting that your trading goals and risk tolerance may evolve over time. As you gain more experience and knowledge in trading, you may become more comfortable with higher levels of risk or change your goals to align with new opportunities. Regularly reassessing your goals and risk tolerance is essential to ensure that your trading strategies and parameters remain aligned with your current objectives.

In conclusion, before customizing your trading strategies and parameters with the 1inch Aggregator, take the time to assess your trading goals and risk tolerance. This will help you make informed decisions and tailor your strategies to suit your individual needs and preferences.

Step 2: Understanding the Available Options on the 1inch Aggregator

Once you have familiarized yourself with the basics of the 1inch Aggregator, it’s time to explore the available options and functionalities that can be customized to suit your trading strategies and parameters. The 1inch Aggregator offers a wide range of features to enhance your trading experience.

Here are some key options to understand:

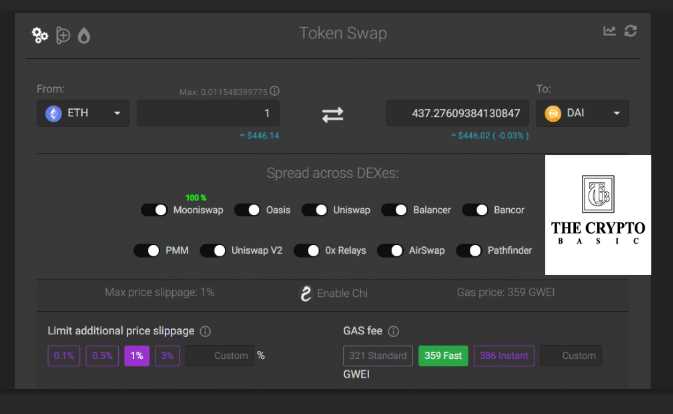

- Source Tokens: This option allows you to select the tokens you want to swap.

- Destination Tokens: You can choose the tokens you want to receive after the swap.

- Slippage Tolerance: This parameter determines the maximum allowed difference between the expected and actual price of the trade.

- Gas Price: You can adjust the gas price to optimize transaction speed and cost.

- Protocol: Choose the protocol to execute the swap, such as Uniswap, SushiSwap, or Balancer.

- Impact: This metric shows the estimated price impact of the trade.

- Minimum Return: Set a minimum acceptable return for your trade.

- Allowance: Adjust the allowance limit for the token you are swapping.

By understanding and adjusting these options according to your preferences, you can fine-tune your trading strategies and parameters to achieve optimal results on the 1inch Aggregator.

Question-answer:

What is the 1inch Aggregator?

The 1inch Aggregator is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates.

How can I customize my trading strategies with the 1inch Aggregator?

You can customize your trading strategies with the 1inch Aggregator by setting different parameters such as slippage tolerance, gas price, maximum trading amount, and preferred tokens. These parameters allow you to tailor your trading strategies to your specific needs and preferences.