Tokenomics, the study of how cryptocurrencies and tokens function in a particular ecosystem, plays a crucial role in the success and adoption of decentralized platforms. One such platform is 1inch, a decentralized exchange aggregator that allows users to find the best prices across various exchanges.

At the heart of 1inch’s tokenomics is the native token called 1INCH. This ERC-20 token serves multiple purposes within the 1inch ecosystem, including governance, utility, and as a reward mechanism. Holding 1INCH tokens gives users voting rights to propose and decide on platform upgrades, ensuring a decentralized and community-driven decision-making process.

Besides governance, 1INCH is also utilized for transaction fee discounts when using the 1inch platform. By staking and holding 1INCH tokens, users can reduce their transaction costs, making it more economically viable to use the platform for their trades. This incentivizes users to acquire and hold 1INCH tokens, increasing the token’s value and demand.

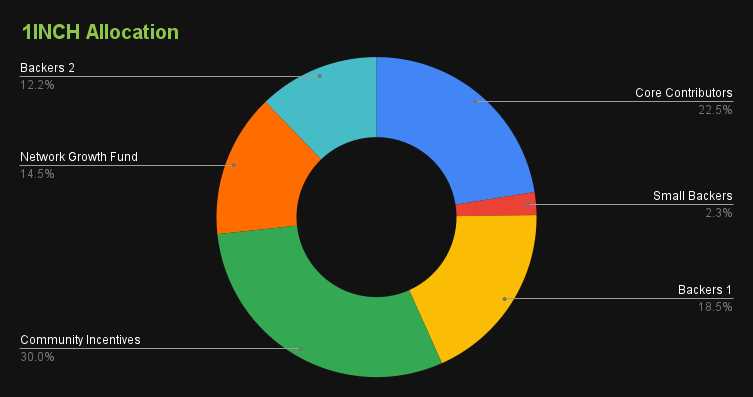

The token’s supply and distribution model further contribute to its tokenomics. The total supply of 1INCH is capped at 1.5 billion tokens, with a portion allocated for the platform’s founders, team, and community incentives. The distribution of tokens is designed to reward early adopters and participants in the 1inch ecosystem, aligning incentives for long-term engagement and growth.

Analyzing the tokenomics of 1inch provides insights into the factors that influence app users’ behavior and participation. The combination of governance rights, transaction fee discounts, and token distribution serves as powerful incentives for users to actively engage with the 1inch platform, contributing to its overall success and sustainability.

Analyzing the Tokenomics of 1inch

The tokenomics of 1inch play a crucial role in influencing users of the app. 1inch is a decentralized exchange (DEX) aggregator that enables users to find the best prices across various DEXs and make trades with minimal slippage. The 1inch token, known as 1INCH, is an integral part of the ecosystem and has several key functions.

Firstly, 1INCH holders have governance rights within the 1inch network. They can participate in the decision-making process by voting on proposals, such as protocol upgrades and changes. This gives token holders a say in the future development of the platform and ensures that the community’s interests are heard.

Secondly, 1INCH tokens are used for protocol fees. When users make trades on the 1inch platform, a small fee is charged, and a portion of this fee is used to buy and burn 1INCH tokens from the market. This mechanism helps to create a deflationary ecosystem, as it reduces the supply of 1INCH tokens over time. Additionally, the burning of tokens can contribute to an increase in the value of the remaining tokens, as the available supply becomes scarcer.

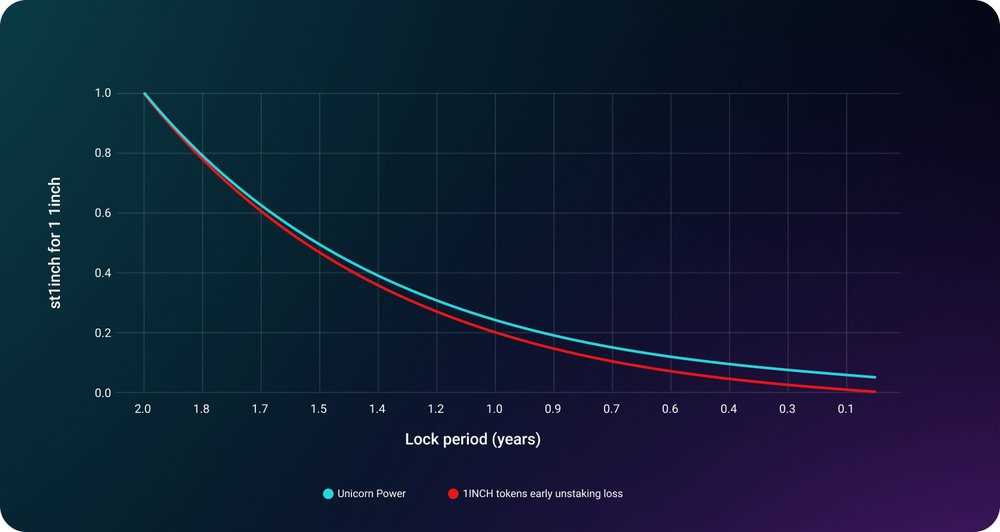

Furthermore, 1inch has implemented a staking mechanism to incentivize token holders. Users can stake their 1INCH tokens and earn staking rewards, which are distributed from the protocol fees collected. By staking their tokens, users contribute to the security and stability of the platform, while also earning passive income in the form of additional 1INCH tokens.

Moreover, 1inch has introduced a referral program to encourage user adoption and retention. Users who refer others to the platform can earn a percentage of the fees generated by their referrals. This creates a network effect, as more users are incentivized to use and promote 1inch, leading to increased liquidity and trading volume on the platform.

In conclusion, the tokenomics of 1inch play a vital role in incentivizing and rewarding users. The 1INCH token provides governance rights, serves as a deflationary asset, offers staking rewards, and promotes user adoption through the referral program. These mechanisms encourage active participation, enhance the value proposition of the 1inch platform, and contribute to its overall success.

Understanding the Token Model

1inch operates on a unique token model that incentivizes active participation and rewards users for contributing to the platform. The primary token used within the 1inch ecosystem is the 1INCH token.

The 1INCH token has several key functionalities within the platform. Firstly, it serves as a governance token, allowing holders to participate in decision-making processes. Token holders can propose and vote on changes to the platform, such as fee structures or upgrades to the protocol.

In addition to governance, the 1INCH token also functions as a utility token within the platform. Holders of the token receive various benefits, such as reduced fees and access to premium features. The token can also be staked to earn additional rewards, encouraging long-term participation and commitment.

The token model is designed to create a sustainable and vibrant ecosystem. By providing holders with a say in the platform’s development and rewarding active participation, 1inch aims to foster a community-driven initiative that benefits all stakeholders.

A crucial aspect of the token model is the allocation of tokens. The 1INCH token has a limited supply, ensuring scarcity and value appreciation over time. The tokens are distributed through a variety of mechanisms, including liquidity mining, staking rewards, and ecosystem grants.

Furthermore, the 1INCH token’s value is directly linked to the success and adoption of the 1inch platform. As the platform gains users and transaction volume, the demand for the token increases, driving its value higher. This alignment of incentives creates a positive feedback loop, incentivizing users to actively engage with the platform and hold the token.

In conclusion, the token model of 1inch plays a crucial role in incentivizing active participation and rewarding users within the platform. By providing governance rights, utility benefits, and a limited supply, the 1INCH token creates a sustainable and thriving ecosystem that benefits all stakeholders.

| Key Features of the 1INCH Token | Description |

|---|---|

| Governance | Allows token holders to propose and vote on changes to the platform. |

| Utility | Provides holders with reduced fees, access to premium features, and the opportunity to stake the tokens for additional rewards. |

| Scarcity | The limited supply of 1INCH tokens ensures value appreciation over time. |

| Token Distribution | Tokens are distributed through liquidity mining, staking rewards, and ecosystem grants. |

| Value Proposition | The value of the 1INCH token is directly linked to the platform’s success and adoption, creating a positive feedback loop. |

Token Distribution and Governance

The token distribution of 1inch is designed to incentivize various participants in the ecosystem and promote decentralized governance.

Initial Token Distribution

The initial token distribution of 1inch was carried out through various means, including a liquidity mining program, airdrops, and strategic partnerships. This helped to ensure that the platform was widely accessible to users and developers from the early stages.

Governance Token

The 1inch token (1INCH) serves as the governance token of the platform. Holders of the 1INCH token have the power to participate in the decision-making process for various protocol upgrades, parameter adjustments, and other governance activities.

Governance Mechanisms

The governance mechanisms of 1inch are designed to promote decentralized decision-making and to enable the community to have a say in the future direction of the platform.

- Voting: 1INCH token holders can participate in on-chain voting to express their preferences and make collective decisions regarding protocol upgrades and other governance proposals.

- Delegation: Token holders can delegate their voting power to trusted addresses or entities, allowing them to participate in the governance process even if they are unable to vote directly.

- Snapshot: The platform also utilizes the Snapshot voting system, which allows token holders to create and vote on proposals off-chain. These votes are then submitted to the blockchain for execution.

Incentives

The tokenomics of 1inch include various incentives to encourage users to participate in the platform and contribute to its growth.

- Liquidity Mining: Users who provide liquidity to the 1inch platform can earn 1INCH tokens as rewards. This incentivizes the provision of liquidity, which enhances the overall trading experience on the platform.

- Protocol Fees: A portion of the fees generated from trades on the 1inch platform is used to buy back and burn 1INCH tokens. This reduces the token supply over time, which can potentially increase the value of the remaining tokens.

Overall, the token distribution and governance mechanisms of 1inch are designed to ensure a fair and decentralized platform that gives its users and stakeholders a voice in shaping its future. By incentivizing participation and promoting governance, 1inch aims to create a sustainable ecosystem that benefits all of its participants.

Incentivizing App Users with Tokens

One of the key elements of 1inch’s tokenomics is its approach to incentivizing app users with tokens. The platform has designed a system that rewards users for various actions and behaviors, encouraging them to actively participate in the ecosystem.

User Rewards

1inch offers a range of rewards to its app users, including:

- Liquidity Provider (LP) Rewards: Users who provide liquidity to the 1inch liquidity pools are eligible to receive rewards in 1inch tokens. This incentivizes users to contribute to the liquidity of the platform, increasing the overall efficiency and effectiveness of the decentralized exchange.

- Staking Rewards: Users can also stake their 1inch tokens to earn additional rewards. By locking up their tokens for a specific period of time, users are able to participate in governance and decision-making processes while earning a passive income.

- Trading Rewards: 1inch rewards users who complete trades on the platform with additional tokens. This encourages active trading and helps to drive liquidity on the exchange.

Governance Participation

Another way 1inch incentivizes its app users is by allowing them to participate in governance. Holders of 1inch tokens have the ability to vote on important protocol decisions and proposals. This gives users a sense of ownership and a voice in the future direction of the platform.

Table: Example of User Rewards

| Action | Reward |

|---|---|

| Providing liquidity to 1inch pools | 1inch tokens |

| Staking 1inch tokens | Additional 1inch tokens |

| Completing trades on 1inch | Bonus 1inch tokens |

By offering these incentives, 1inch is able to attract and retain active app users. The tokenomics of the platform create a positive feedback loop, where increased user participation leads to a stronger and more vibrant ecosystem.

The Impact of Tokenomics on 1inch’s User Base

Tokenomics is a crucial aspect of any decentralized finance (DeFi) project, and it plays a significant role in shaping the user base of platforms like 1inch. 1inch, a decentralized exchange (DEX) aggregator, has a unique tokenomics model that incentivizes users to participate actively on the platform.

How Tokenomics Works on 1inch

1inch has two tokens: 1inch (1INCH) and Chi Gastoken (CHI). 1INCH is the governance token of the platform, while CHI is a gas-saving token that reduces transaction costs. Both tokens have distinct roles within the 1inch ecosystem.

Users who hold 1INCH tokens have the power to participate in protocol governance, including voting on important decisions and proposing changes to the platform. This allows users to have a say in the development and future of 1inch.

On the other hand, CHI tokens are used to reduce transaction costs for trades on 1inch. By converting gas fees into CHI, users can effectively save on transaction costs, especially during times of high network congestion. This incentivizes users to hold CHI tokens and actively engage in trading on the platform.

The Influence on User Base

The tokenomics of 1inch has a direct impact on its user base. The ability to participate in governance through holding 1INCH tokens creates a sense of ownership and community engagement among users. This encourages users to become long-term supporters of the platform and actively contribute to its growth.

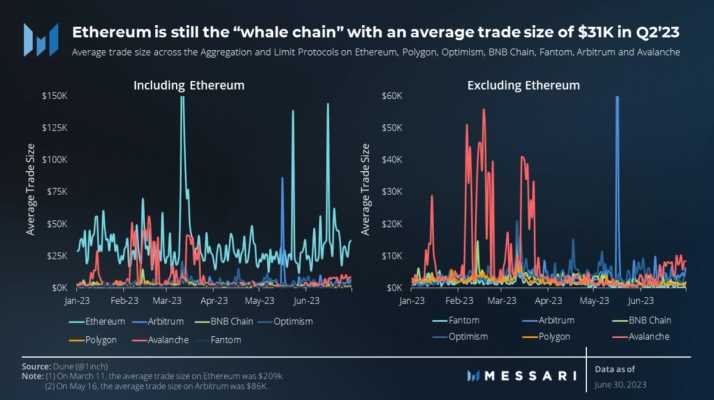

The presence of CHI tokens also attracts users looking to save on transaction costs. By providing a mechanism for reducing gas fees, 1inch becomes an attractive option for traders, particularly during periods of high Ethereum network congestion. This leads to increased user adoption and trading volume on the platform.

The combination of governance and gas-saving tokens creates a synergy that strengthens the user base of 1inch. Users are not only incentivized to actively trade on the platform but also to contribute to its development and decision-making processes. This aligns the incentives of both the platform and its users, resulting in a more engaged and dedicated user base.

Overall, the tokenomics of 1inch undoubtedly influence its user base. By providing governance and gas-saving tokens, 1inch creates an ecosystem where users are empowered to actively participate and contribute. This ultimately contributes to the growth and success of the platform in the highly competitive DeFi landscape.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to find the best prices for users.

How does the tokenomics of 1inch work?

The tokenomics of 1inch are designed to incentivize users and liquidity providers. The platform has a native token called 1INCH, which can be used for various purposes such as governance, fee discounts, and staking.

What are the benefits of using 1inch?

Using 1inch allows users to enjoy better prices and lower fees compared to trading directly on a single decentralized exchange. Additionally, users can participate in the 1inch governance and earn rewards through staking their 1INCH tokens.

How does tokenomics influence app users?

The tokenomics of 1inch incentivize users to use the platform by providing them with benefits such as fee discounts and the ability to participate in governance. This can attract more users to the app and increase its overall usage.