In the ever-evolving world of finance, market makers play a crucial role in ensuring liquidity and facilitating the smooth functioning of financial markets. These intermediaries, typically large institutional players, buy and sell securities or assets to provide continuous quotes and narrow bid-ask spreads. However, the emergence of decentralized finance (DeFi) platforms has disrupted this traditional market-making model, offering a more efficient and accessible alternative.

Among the prominent players in the DeFi space, 1inch.exchange has emerged as a game-changer. Powered by smart contract technology and automated algorithms, 1inch.exchange allows users to execute trades across multiple decentralized exchanges in a single transaction. This innovative approach has not only reduced the complexity and cost of trading but also unlocked new opportunities for retail investors and liquidity providers.

1inch.exchange’s impact on traditional market makers cannot be understated. The platform’s ability to aggregate liquidity from multiple sources has significantly increased competition and lowered trading fees. Market makers, who once enjoyed a dominant position, are now facing fierce competition from decentralized protocols. The transparency and efficiency offered by 1inch.exchange have compelled traditional market makers to innovate and adapt their strategies to stay relevant in this rapidly changing landscape.

The Transformation of Traditional Market Makers

Traditional market makers have long played a crucial role in facilitating the trading of assets and providing liquidity to financial markets. These market makers typically operate as intermediaries, buying assets from sellers and selling them to buyers at slightly higher prices, thereby making a profit from the bid-ask spread.

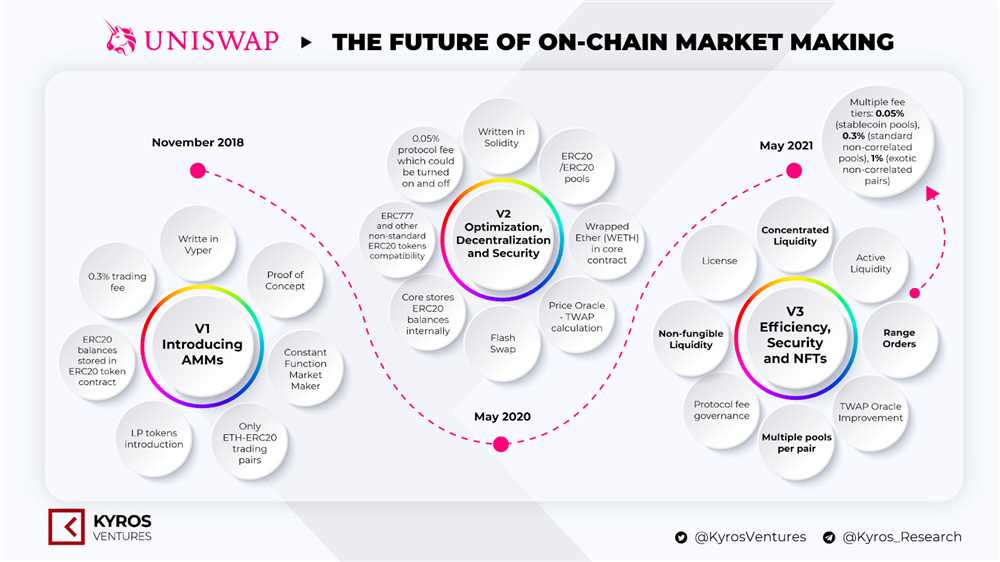

However, the emergence of decentralized finance (DeFi) platforms like 1inch.exchange has brought about a paradigm shift in the way market makers operate. With their automated market-making algorithms, these platforms have significantly disrupted the traditional market maker business model.

Efficiency and Transparency

One of the key advantages of DeFi platforms like 1inch.exchange is the efficiency and transparency they offer. Unlike traditional market makers, who often operate in centralized exchanges with limited access to order book data, 1inch.exchange leverages decentralized liquidity pools to automatically execute trades at the best available prices.

Furthermore, these platforms provide real-time visibility into the liquidity available in the pools, allowing traders to make more informed decisions. This transparency eliminates the need for traditional market makers to manually negotiate prices and execute trades, streamlining the trading process.

Cost Reduction

Another significant impact of the transformation brought about by platforms like 1inch.exchange is the reduction in costs for traders. Traditional market makers often charge fees for their services, which can eat into traders’ profits. In contrast, DeFi platforms typically charge minimal transaction fees, making trading more affordable for users.

Furthermore, the automation provided by these platforms eliminates the need for human intermediaries, reducing overhead costs for market-making operations. This cost reduction further benefits traders by providing them with access to more competitive pricing.

In conclusion, the emergence of decentralized finance platforms like 1inch.exchange has led to a transformation in the traditional market maker ecosystem. These platforms offer efficiency, transparency, and cost reduction, challenging the established business models of traditional market makers. As the DeFi landscape continues to evolve, it remains to be seen how traditional market makers will adapt and innovate in response to this paradigm shift.

Increased Efficiency and Liquidity

One of the key advantages of 1inch.exchange is the increased efficiency and liquidity it brings to the traditional market makers in the cryptocurrency space. Traditionally, market makers have acted as intermediaries between buyers and sellers, providing liquidity by buying and selling assets on different markets.

Efficiency

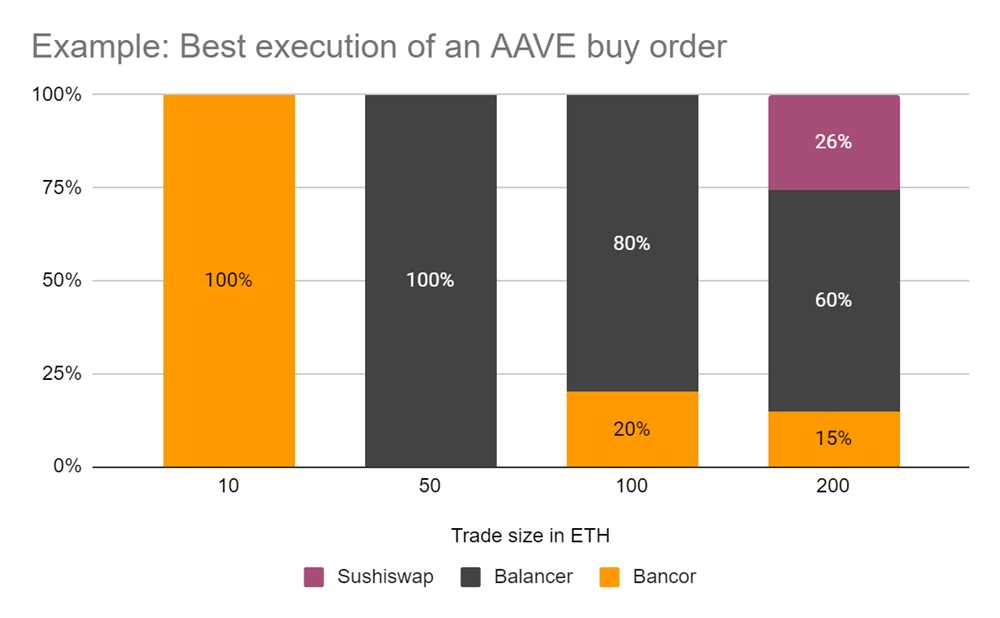

With 1inch.exchange, the process of market making becomes more efficient. The platform allows market makers to access multiple decentralized exchanges simultaneously, pooling liquidity from various sources. This reduces the need for market makers to manually search for the best prices on different exchanges and execute trades, as 1inch.exchange automatically finds and executes the most lucrative trades. As a result, market makers can save time and resources, and focus on more strategic activities.

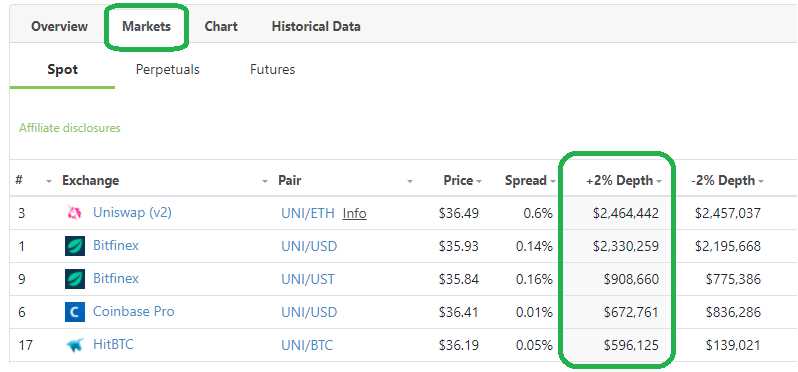

Liquidity

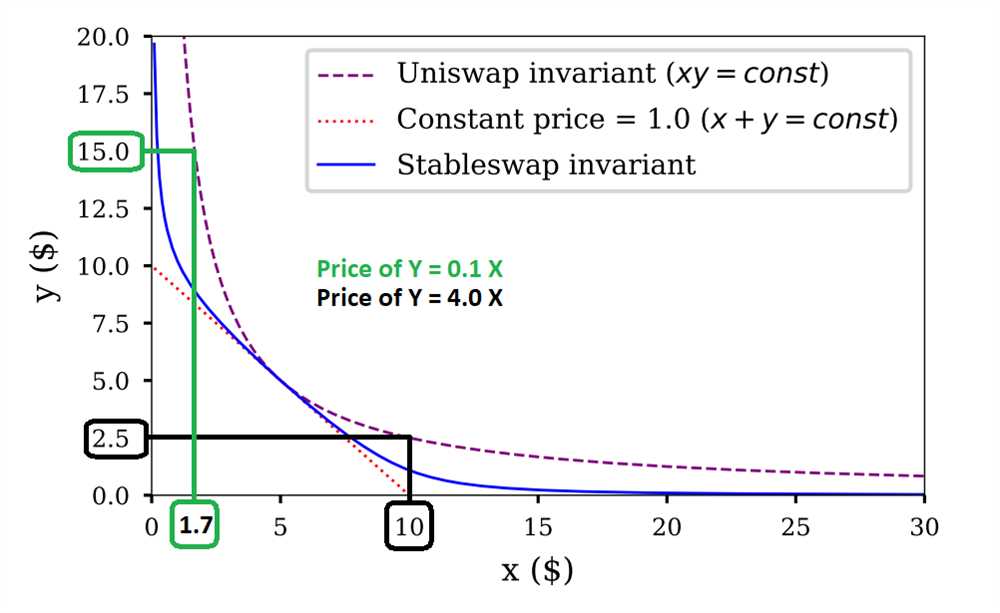

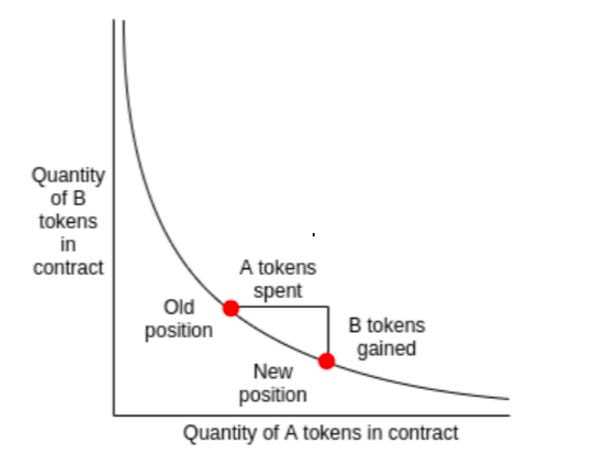

1inch.exchange also significantly increases liquidity in the cryptocurrency market. By aggregating liquidity from different sources, the platform provides a larger pool of assets for traders to buy and sell. This means that traders can find better prices and execute trades faster, without having to worry about liquidity constraints. Increased liquidity also reduces price slippage, which occurs when the price of an asset moves significantly between the time a trade is initiated and executed. This benefits both market makers and traders, as it leads to fairer and more efficient markets.

In addition, 1inch.exchange allows market makers to provide liquidity directly to the platform and earn fees in return. This creates a win-win situation, as market makers can profit from their liquidity provision activities, while traders can benefit from increased liquidity and improved market conditions.

Overall, the increased efficiency and liquidity provided by 1inch.exchange have the potential to revolutionize the traditional market maker role in the cryptocurrency space. Market makers can leverage the platform to optimize their trading strategies, improve their profitability, and contribute to the development of fair and efficient markets.

Shift towards Decentralization

1inch.exchange has heralded a paradigm shift in the world of market making by embracing decentralization. Unlike traditional market makers who rely on centralized platforms and intermediaries, 1inch.exchange operates on the principles of decentralization, empowering users with full control over their assets.

Decentralization is at the core of 1inch.exchange’s philosophy. By eliminating the need for intermediaries, it reduces the costs associated with traditional market making processes such as commissions and fees. This in turn enables more efficient and cost-effective trading for users.

Benefits of Decentralization in Market Making

Decentralization brings several benefits to market making activities:

Transparency: With decentralized platforms like 1inch.exchange, transactions and order books are publicly available on the blockchain, ensuring transparency and reducing the likelihood of fraud or manipulation.

Increased liquidity: Decentralized platforms like 1inch.exchange pool liquidity from various sources, creating a larger liquidity pool and enabling more efficient trading. This increased liquidity benefits both traders and market makers.

Security: Decentralized platforms are more secure as they eliminate the single point of failure associated with centralized exchanges. Users retain full control of their assets and do not need to trust a centralized authority with their funds.

The Future of Market Making

The shift towards decentralization is expected to continue shaping the future of market making. As more users recognize the benefits of decentralized platforms like 1inch.exchange, traditional market makers will face increasing competition. This will likely lead to the adoption of decentralized solutions by both users and market making firms.

Additionally, the growing trend of decentralized finance (DeFi) and the expanding ecosystem of decentralized exchanges (DEXs) provide further opportunities for decentralized market making to thrive. As the DeFi space continues to evolve, market makers will need to adapt to these new decentralized structures to remain competitive.

In conclusion, the shift towards decentralization driven by platforms like 1inch.exchange is transforming the traditional market making landscape. The benefits of decentralization in terms of transparency, increased liquidity, and security are undeniable, and market makers are increasingly recognizing the value and potential of this new paradigm.

New Opportunities and Challenges

The introduction of 1inch.exchange has brought forth a wave of new opportunities and challenges for traditional market makers. This decentralized exchange protocol has disrupted the traditional market making landscape, offering a new model that is more efficient, transparent, and accessible.

Opportunities

One of the major opportunities that 1inch.exchange presents is the ability for market makers to interact with a wider range of liquidity sources. Traditionally, market makers relied on a limited number of centralized exchanges for liquidity. However, 1inch.exchange aggregates liquidity from various decentralized exchanges, giving market makers access to a larger pool of liquidity. This opens up new avenues for profit and allows market makers to explore different trading strategies.

Additionally, 1inch.exchange provides market makers with the opportunity to participate in governance and decision-making processes. As a decentralized protocol, 1inch.exchange is governed by its community of users. Market makers can actively participate in voting on proposals and shaping the future of the protocol. This gives market makers a stake in the protocol’s success and allows them to have a say in its development.

Challenges

While 1inch.exchange presents numerous opportunities, it also poses certain challenges for traditional market makers. One of the main challenges is the shift in trading infrastructure. Market makers need to adapt their existing systems to interact with decentralized exchanges and handle new types of assets. This may require significant investments in technology and infrastructure to ensure seamless integration with the protocol.

Another challenge is the increased complexity of managing risk. With the decentralized nature of 1inch.exchange, market makers have to navigate a more complex and fragmented market. They need to carefully evaluate the risks associated with different liquidity sources and adjust their risk management strategies accordingly. This requires a thorough understanding of the protocol’s mechanics and a proactive approach to risk management.

Furthermore, the evolving regulatory landscape poses another challenge for market makers on 1inch.exchange. As decentralized exchanges gain popularity, regulators around the world are taking a closer look at their operations. Market makers need to stay up-to-date with the evolving regulatory requirements and ensure compliance while operating on the protocol.

In conclusion, 1inch.exchange brings new opportunities and challenges for traditional market makers. While it offers access to a wider range of liquidity sources and the ability to participate in governance, it also requires adjustments to trading infrastructure, sophisticated risk management strategies, and compliance with regulatory requirements. Market makers who are able to adapt to this new paradigm shift have the potential to thrive in the ever-evolving decentralized market.

Question-answer:

What is 1inch.exchange?

1inch.exchange is a decentralized exchange aggregator that is built on the Ethereum blockchain. It combines liquidity from various decentralized exchanges to offer users the best possible trading rates.

How does 1inch.exchange impact traditional market makers?

1inch.exchange has a significant impact on traditional market makers by reducing their role in the market. It allows users to access decentralized liquidity directly, bypassing the need for market makers to facilitate trades.

What are some advantages of 1inch.exchange over traditional market makers?

1inch.exchange offers several advantages over traditional market makers. It provides users with better trading rates by sourcing liquidity from multiple decentralized exchanges. Additionally, it eliminates the need for intermediaries and reduces costs.

Are traditional market makers becoming obsolete?

While the role of traditional market makers is certainly being disrupted by platforms like 1inch.exchange, it is too soon to say if they will become obsolete. Traditional market makers still play a crucial role in providing liquidity and stability to financial markets.

Can traditional market makers adapt to the changing landscape?

Yes, traditional market makers can adapt to the changing landscape by integrating with decentralized exchanges and offering their services on these platforms. By embracing new technologies, market makers can continue to provide value to the market.