Don’t miss out on the best deals!

Are you tired of missing out on profitable trading opportunities because of lack of liquidity? Look no further! 1inch’s liquidity sourcing algorithm for USDT trading is here to solve all your problems.

What is 1inch’s liquidity sourcing algorithm?

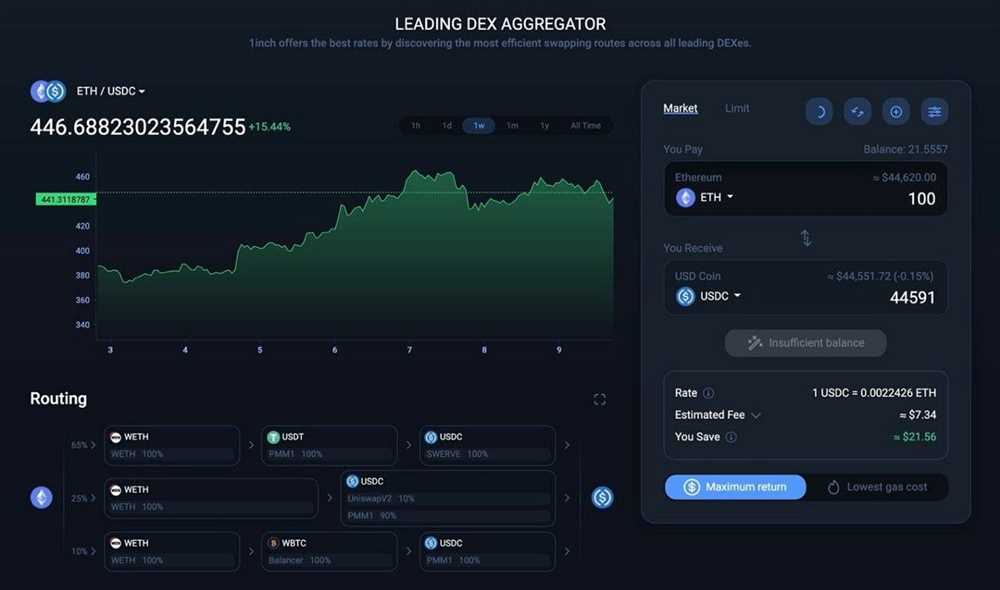

1inch’s liquidity sourcing algorithm is an innovative solution designed to optimize your trading experience. It scans multiple decentralized exchanges (DEXs) to find the best possible liquidity for USDT trading. With this algorithm, you can be confident that you are always getting the best prices for your trades.

Why choose 1inch’s liquidity sourcing algorithm?

1inch’s liquidity sourcing algorithm offers several advantages that set it apart from the competition:

- Maximum liquidity: Our algorithm connects to multiple DEXs to ensure that you have access to the highest possible liquidity. This means that you can execute your trades quickly and efficiently.

- Best prices: By scanning multiple DEXs, our algorithm finds the best possible prices for your trades. This ensures that you are always maximizing your profits.

- Real-time updates: Our algorithm constantly monitors the market, providing you with real-time updates on liquidity and prices. This allows you to make informed trading decisions.

How does 1inch’s liquidity sourcing algorithm work?

Our algorithm works by aggregating liquidity from various DEXs and splitting your trades across multiple pools to ensure the best execution. This means that even if a single DEX doesn’t have enough liquidity, our algorithm will combine liquidity from other sources to complete your trade at the best possible price.

Get started with 1inch’s liquidity sourcing algorithm today!

Don’t miss out on profitable trading opportunities due to lack of liquidity. Get started with 1inch’s liquidity sourcing algorithm for USDT trading today and take your trading to the next level.

The Advantages of 1inch’s Liquidity Sourcing Algorithm for USDT Trading

1inch’s liquidity sourcing algorithm is a cutting-edge technology that revolutionizes USDT trading. With its advanced features and powerful capabilities, this algorithm offers several significant advantages for traders.

Enhanced Liquidity

One of the key advantages of 1inch’s liquidity sourcing algorithm is its ability to enhance liquidity for USDT trading. By aggregating liquidity from various decentralized exchanges, 1inch ensures that traders have access to a large pool of liquidity, minimizing slippage and maximizing trading opportunities.

Improved Execution

1inch’s liquidity sourcing algorithm is designed to optimize execution for USDT trading. It constantly analyzes the market conditions and dynamically routes orders to the most favorable exchanges, ensuring that traders get the best possible execution prices. This improves trading efficiency and helps users achieve better results.

Additionally, the algorithm incorporates various strategies, including smart order routing and trading optimizations, to further improve execution and increase the chances of obtaining favorable prices.

Moreover, 1inch’s algorithm also takes into account gas costs, allowing traders to minimize transaction fees and optimize their trading strategies.

Seamless User Experience

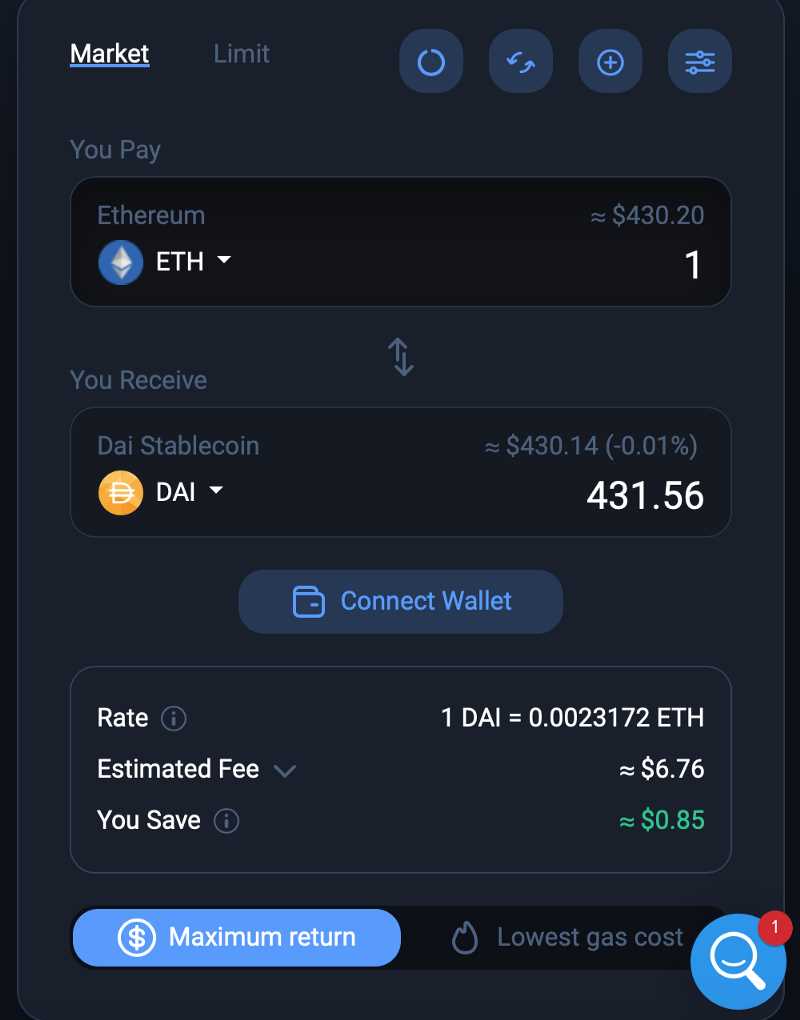

1inch’s liquidity sourcing algorithm provides a seamless user experience for traders. With its intuitive interface and user-friendly design, traders can easily access and navigate the platform, making it simple and straightforward to trade USDT. Whether you are a beginner or an experienced trader, 1inch’s liquidity sourcing algorithm offers a hassle-free trading experience.

Conclusion

1inch’s liquidity sourcing algorithm for USDT trading offers numerous advantages. From enhanced liquidity and improved execution to a seamless user experience, this algorithm empowers traders to make the most of their USDT trading activities. Whether you are looking to maximize profitability or streamline your trading strategies, 1inch’s liquidity sourcing algorithm is the ideal solution.

Improved Market Liquidity

1inch’s liquidity sourcing algorithm for USDT trading not only provides efficient execution and low slippage, but also contributes to improving overall market liquidity. By aggregating liquidity from various decentralized exchanges (DEXs) and centralized exchanges (CEXs), 1inch ensures that traders have access to a deep and diverse pool of liquidity.

Through its advanced routing algorithms, 1inch automatically splits and routes trades across multiple liquidity sources, optimizing for the best available prices and minimizing the impact on the market. This approach ensures that traders can execute large orders without significantly moving the market price, resulting in improved market liquidity.

Furthermore, 1inch’s liquidity protocol constantly monitors the state of the market and dynamically adjusts its routing strategies to adapt to changing market conditions. This ensures that traders always benefit from the most optimal liquidity routes, even in highly volatile markets.

In addition to aggregating liquidity, 1inch’s protocol also incentivizes liquidity providers to contribute to the market by offering them competitive rewards. This helps attract additional liquidity to the market, further enhancing market depth and overall liquidity.

Overall, 1inch’s liquidity sourcing algorithm for USDT trading contributes to improved market liquidity, allowing traders to enjoy efficient execution, low slippage, and access to a deep and diverse pool of liquidity. Whether you are a casual trader or a professional market participant, 1inch’s liquidity sourcing algorithm ensures that you can trade with confidence and take advantage of the best available prices in the market.

Increased Trading Efficiency

With 1inch’s liquidity sourcing algorithm for USDT trading, traders can experience a significant increase in trading efficiency. The algorithm is designed to analyze multiple liquidity sources and provide the best possible trading rates for USDT.

1inch’s algorithm takes into account various factors, such as liquidity depth, slippage, and transaction fees, to ensure that traders get the most favorable rates for their USDT trades. By sourcing liquidity from multiple decentralized exchanges, the algorithm minimizes slippage and maximizes trading efficiency.

The algorithm continuously scans the market for the best available rates and executes trades instantly, ensuring that traders can capitalize on favorable market conditions. This eliminates the need for manual market research and enables traders to make quick and informed trading decisions.

Furthermore, 1inch’s liquidity sourcing algorithm is powered by advanced smart contract technology, which guarantees secure and transparent trading operations. Traders can have full confidence in the algorithm, knowing that their trades are executed in a reliable and trustworthy manner.

By leveraging 1inch’s liquidity sourcing algorithm for USDT trading, traders can optimize their trading strategies and maximize their profits. The increased trading efficiency provided by the algorithm gives traders a competitive edge in the market, allowing them to stay ahead of the curve and capitalize on lucrative trading opportunities.

In conclusion, 1inch’s liquidity sourcing algorithm for USDT trading offers increased trading efficiency, providing traders with the best possible rates and maximizing their profits. With its advanced technology and secure operations, the algorithm is a valuable tool for traders looking to optimize their trading strategies.

Enhanced Risk Management

1inch’s liquidity sourcing algorithm for USDT trading not only ensures efficient execution and optimal pricing, but also prioritizes risk management to protect users’ funds.

Advanced Security Measures

1inch employs advanced security measures to safeguard user information and assets. The platform utilizes multi-signature wallets and implements strict security protocols, including cold storage for offline asset storage and encryption algorithms for data protection.

Risk Assessment and Mitigation

1inch’s liquidity sourcing algorithm incorporates risk assessment and mitigation strategies to minimize the exposure to potential market risks. The algorithm continuously monitors liquidity providers and market conditions to identify and mitigate risks associated with impermanent loss, price slippage, and volatility.

The risk assessment mechanism is powered by sophisticated algorithms that analyze historical data and market trends, allowing users to make informed decisions based on accurate risk assessment reports.

Additionally, 1inch provides users with intuitive risk management tools and features, such as limit orders and stop-loss orders, to further protect their positions and investments. These tools enable users to set predetermined price levels at which their orders should be executed or limit potential losses by automatically selling assets if prices reach certain thresholds.

By combining advanced security measures, thorough risk assessment, and intuitive risk management tools, 1inch provides users with enhanced risk management capabilities, ensuring a secure and reliable trading experience.

Access to Competitive Rates

At 1inch, we understand the importance of accessing competitive rates when trading USDT. Our liquidity sourcing algorithm ensures that you get the best possible rates for your trades, allowing you to maximize your profits.

Efficient Liquidity Pool Aggregation

1inch’s liquidity sourcing algorithm aggregates liquidity from a wide range of decentralized exchanges and liquidity providers. By accessing multiple liquidity sources, our algorithm ensures that you always get the most competitive rates available in the market.

Real-Time Rate Optimization

Our algorithm continuously monitors and analyzes the rates offered by different liquidity sources. It then optimizes the route and splits the trading volume across multiple exchanges to ensure that you get the best rates in real-time. This dynamic rate optimization feature sets 1inch apart from other platforms, allowing you to take advantage of even the smallest price differences.

With 1inch’s liquidity sourcing algorithm, you can be confident that you have access to the most competitive rates in the USDT trading market. Start using 1inch today and experience the difference for yourself.

Question-answer:

What is 1inch’s liquidity sourcing algorithm for USDT trading?

1inch’s liquidity sourcing algorithm for USDT trading is a smart contract that automatically routes trades through various decentralized liquidity sources to ensure the best possible rates for USDT trading. It scans multiple liquidity sources, such as decentralized exchanges, and uses intelligent algorithms to split the trade across different pools to achieve the most favorable pricing.

How does 1inch’s liquidity sourcing algorithm work?

1inch’s liquidity sourcing algorithm works by aggregating liquidity from various decentralized exchanges and other liquidity sources. It analyzes the available liquidity and market prices across multiple platforms and routes the trade through the most competitive options to achieve the best possible rate for USDT trading. The algorithm is designed to split the trade across different pools to minimize slippage and maximize the trading efficiency.

Why should I use 1inch’s liquidity sourcing algorithm for USDT trading?

You should use 1inch’s liquidity sourcing algorithm for USDT trading because it allows you to get the best possible rates for your trades. The algorithm scans multiple decentralized exchanges and liquidity sources, ensuring that you have access to the most competitive prices and liquidity. By using this algorithm, you can minimize slippage, reduce trading fees, and achieve better overall trading efficiency.