Understanding the Potential Gains and Dangers of Incorporating 1inch into DeFi Trading

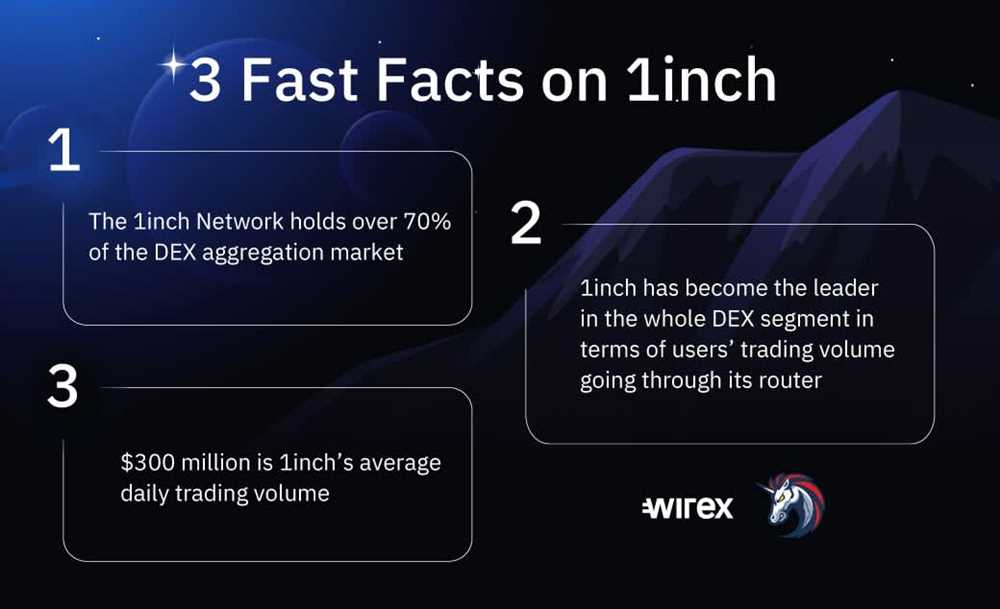

Decentralized Finance (DeFi) has emerged as a transformative force in the world of finance, and 1inch has quickly become one of the leading platforms for trading cryptocurrencies in the DeFi ecosystem. With its unique aggregation and liquidity protocols, 1inch offers traders the ability to access the best possible prices across multiple decentralized exchanges (DEXs), maximizing their trading opportunities.

However, like any investment or trading platform, using 1inch comes with its own set of risks and rewards. One of the key risks is the inherent volatility of the cryptocurrency market. While the potential for high returns exists, so does the potential for significant losses. Traders must carefully assess their risk tolerance and only invest funds they can afford to lose.

Another risk to consider when using 1inch is the potential for smart contract vulnerabilities. While 1inch has implemented extensive security measures, including audits and bug bounties, there is always a risk that an unforeseen vulnerability could be exploited. Traders should stay informed about potential risks and take appropriate precautions to protect their assets.

Despite these risks, there are also significant rewards associated with using 1inch for DeFi trading. One of the major benefits is the ability to access a wide range of cryptocurrencies and trading pairs. This allows traders to diversify their portfolios and take advantage of various market opportunities.

Additionally, 1inch’s unique aggregation protocol ensures that trades are executed at the best possible price, potentially saving traders money compared to using a single exchange. By tapping into the liquidity of multiple DEXs, 1inch provides traders with increased trading efficiency and the potential for improved profit margins.

In conclusion, using 1inch for DeFi trading offers both risks and rewards. Traders must carefully evaluate these factors and make informed decisions to maximize their potential returns while managing their risk exposure. With its innovative protocols and wide range of trading opportunities, 1inch has positioned itself as a valuable platform in the rapidly evolving world of DeFi.

The Benefits of 1inch for DeFi Trading

1inch is a decentralized exchange aggregator that offers several benefits for DeFi trading, making it a popular choice among traders. Here are some of the key benefits:

- Improved Liquidity: 1inch combines liquidity from various decentralized exchanges (DEXs) to provide users with access to a larger pool of liquidity. This ensures better prices and improved execution for trades.

- Cost Efficiency: By routing trades through different DEXs, 1inch helps to minimize slippage and reduce trading costs. Traders can take advantage of the best available prices across multiple exchanges, resulting in more cost-effective transactions.

- Time-Saving: 1inch automatically finds the most efficient trading routes across different DEXs, saving traders time and effort. Instead of manually searching for the best prices and executing trades on multiple platforms, users can simply make trades on 1inch and let the aggregator handle the rest.

- Aggregated Information: 1inch provides users with detailed information on prices, liquidity, and trading volumes across multiple DEXs. This allows traders to make informed decisions and take advantage of market trends, enhancing their trading strategies.

- Low Slippage: The aggregation of liquidity on 1inch helps to minimize slippage, which occurs when the execution price of a trade differs from the expected price. This is especially beneficial for large trades, where even a small slippage can have a significant impact on the overall cost.

- Security and Reliability: 1inch ensures the security of user funds by using well-audited smart contracts and providing integrations with reputable blockchain platforms. The platform has gained a reputation for reliability, with a strong track record of successfully executing trades.

In conclusion, 1inch offers a range of benefits for DeFi trading, including improved liquidity, cost efficiency, time-saving features, aggregated information, low slippage, and security. These advantages make 1inch an attractive option for traders looking to maximize their gains and minimize risks in the decentralized finance space.

The Potential Risks of Using 1inch for DeFi Trading

While 1inch has gained popularity as a decentralized finance (DeFi) trading platform, it is important to be aware of the potential risks associated with using it for trading. These risks include:

| Risk | Description |

|---|---|

| Lack of Regulation | As a decentralized platform, 1inch operates outside of traditional financial regulations. This means that users may not benefit from the same level of protections and oversight provided by regulated exchanges. |

| Smart Contract Risks | 1inch operates using smart contracts on the Ethereum blockchain. While smart contracts are designed to be secure, they are not immune to bugs or vulnerabilities. These vulnerabilities could be exploited by hackers, potentially resulting in the loss of funds. |

| High Volatility | The cryptocurrency market is known for its high volatility, and this volatility extends to DeFi trading as well. Prices can fluctuate rapidly, leading to potential losses if trades are not carefully timed. |

| Impermanent Loss | When providing liquidity to decentralized exchanges like 1inch, there is a risk of impermanent loss. This occurs when the value of the assets provided as liquidity changes compared to holding the assets individually. This can result in a loss of value compared to simply holding the assets. |

| Counterparty Risks | While 1inch aims to provide decentralized trading, there is still some level of counterparty risk. Users are interacting with other individuals in the ecosystem, and there is always a possibility of scams or fraudulent activity. |

It is important to thoroughly research and understand the risks associated with using 1inch or any other DeFi platform before engaging in trading. Users should also consider implementing proper security measures such as using hardware wallets and staying up to date with the latest security practices.

How 1inch Combats the Risks in DeFi Trading

DeFi trading can be highly risky due to the decentralized nature of the ecosystem and the presence of smart contract vulnerabilities. However, 1inch has implemented several measures to mitigate these risks and ensure a safe trading experience for its users.

First and foremost, 1inch utilizes audited and secure smart contracts. The team behind 1inch takes security seriously and works with reputable auditors to thoroughly analyze and assess the code for any potential vulnerabilities. This helps to prevent any exploits or hacks that could lead to the loss of funds.

In addition, 1inch has implemented a robust and sophisticated algorithm that scans multiple decentralized exchanges (DEXs) to find the best trading routes and execute trades with minimal slippage and maximum returns. This algorithm takes into account various factors such as liquidity, gas fees, and trading volume, ensuring that users always get the most favorable trading conditions.

Furthermore, 1inch incorporates security features such as access controls and permission systems to prevent unauthorized access to users’ funds. Users have full control over their wallets and can securely connect them to the 1inch platform without worrying about their funds being compromised.

1inch also provides users with detailed information and statistics about the liquidity and trading volume of various tokens and DEXs. This helps users make informed decisions and reduces the risks associated with trading on less liquid or unreliable platforms.

Moreover, 1inch has a dedicated support team that is available to assist users in case of any issues or concerns. This ensures that users can get timely help and guidance, further enhancing the safety and reliability of the platform.

Overall, 1inch is committed to providing a secure and reliable trading experience in the decentralized finance space. By implementing rigorous security measures, utilizing audited smart contracts, and offering comprehensive support, 1inch addresses the risks associated with DeFi trading and ensures a safer environment for users.

Question-answer:

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized platforms to provide users with the best prices for trading cryptocurrencies.

What are the risks of using 1inch for DeFi trading?

One of the main risks of using 1inch for DeFi trading is the possibility of encountering smart contract vulnerabilities or exploits, which can result in the loss of funds. Additionally, there is always a risk associated with the volatility and unpredictability of the cryptocurrency market, as well as the potential for slippage and high gas fees.