Introducing Limit Orders

Are you tired of constantly monitoring the volatile cryptocurrency markets?

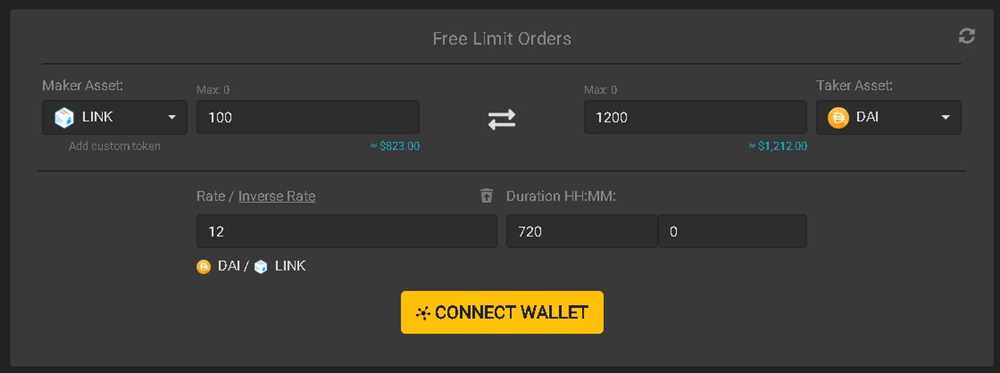

1inch, the leading decentralized exchange aggregator, has the perfect solution for you. With our innovative Limit Orders feature, you can now set your desired buy or sell price in advance and let our smart contract do the rest.

How Limit Orders Work

Take control of your trading and achieve precision in every transaction.

When you place a Limit Order on 1inch, you specify the price at which you want to buy or sell a particular cryptocurrency. Once the market reaches your specified price, the smart contract automatically executes the trade on your behalf. This eliminates the need for constant monitoring and ensures that you never miss the perfect opportunity.

The Benefits of Limit Orders

Maximize your trading potential and minimize risks.

By using Limit Orders on 1inch, you can strategically enter or exit positions at your preferred price levels. This allows you to optimize your trades, avoid emotional decision-making, and effectively manage risk. With our advanced trading technology, you can stay ahead of the market and make better-informed decisions.

Start Using Limit Orders Today

Experience the power of automated trading with 1inch.

Whether you are a beginner or an experienced trader, Limit Orders are a valuable tool that can enhance your trading experience. Don’t let market fluctuations dictate your trading strategy. Take control of your investments and enjoy the benefits of precision and convenience with 1inch’s Limit Orders feature.

The Advantages of Limit Orders in 1inch Trading

Limit orders are a powerful tool in 1inch trading that offer several advantages over other types of orders. By utilizing limit orders, traders can gain more control over their trades, maximize their profits, and minimize their risks.

1. Price Control

One of the main advantages of using limit orders in 1inch trading is the ability to have control over the price at which the trade is executed. With a limit order, a trader sets a specific price at which they are willing to buy or sell a certain asset. This means that the trade will only be executed at the specified price or better, ensuring that the trader does not pay more than they are willing to or sell for less than they desire. This level of price control allows traders to optimize their trades and achieve better results.

2. Maximizing Profits

Limit orders can also help traders maximize their profits. By setting a specific buy price below the current market price or a sell price above the market price, traders can take advantage of potential price movements. For example, if a trader believes that the price of a certain asset will decrease in the near future, they can set a limit order to buy at a lower price. If the price indeed drops, the trader can buy the asset at a discounted price and potentially make a larger profit when the price eventually rebounds.

Similarly, if a trader expects the price of an asset to rise, they can set a limit order to sell at a higher price. This allows the trader to capture potential gains and exit the position at a profit. By strategically using limit orders, traders can increase their chances of making profitable trades and optimizing their investment returns.

3. Risk Management

Limit orders also play a crucial role in minimizing risks in 1inch trading. By defining the price at which a trade should be executed, traders can protect themselves from unexpected price fluctuations and market volatility. For example, if a trader sets a limit order to sell a certain asset at a specific price, they are protected from potential price drops below that level. This helps to mitigate the impact of adverse market movements and allows traders to have a predefined exit strategy.

Furthermore, limit orders can also be used to set stop-loss levels, which automatically trigger the execution of a trade if a certain price threshold is reached. This ensures that losses are limited and prevents emotions from dictating trading decisions. By incorporating risk management strategies through limit orders, traders can protect their capital and trade with a more disciplined approach.

In conclusion, limit orders offer numerous advantages in 1inch trading. By providing price control, maximizing profits, and managing risks, they empower traders to make more informed and strategic trading decisions. Whether you are a professional trader or a beginner, utilizing limit orders can greatly enhance your trading experience on the 1inch platform.

Improved Trade Execution

In addition to providing users with access to multiple decentralized liquidity sources, 1inch Trading also offers improved trade execution for its users. Through its advanced algorithms and smart contract technology, 1inch Trading ensures that users get the best possible price and execution for their trades.

One of the key features that contribute to improved trade execution on 1inch Trading is the use of limit orders. Limit orders allow users to set a specific price at which they are willing to buy or sell a particular token. When the market reaches the specified price, the limit order is executed automatically.

This feature is particularly valuable in volatile market conditions, where prices can change rapidly. By setting a limit order, users can ensure that they buy or sell tokens at their desired price, even if the market price fluctuates in the meantime. This helps users avoid slippage and get the best possible price for their trades.

In addition to limit orders, 1inch Trading also offers other features to improve trade execution. These include advanced order routing algorithms, which automatically scan multiple liquidity sources to find the best prices and execute trades efficiently. This ensures that users get the most favorable execution for their trades.

Price Impact Minimization

1inch Trading also focuses on minimizing price impact for large trades. When executing large trades, the market price of the token can sometimes move significantly due to the size of the trade. This is known as slippage and can result in unfavorable execution for the user.

To minimize price impact, 1inch Trading uses sophisticated algorithms that break large trades into smaller orders and execute them gradually. This helps to distribute the market impact of the trade over a longer period, reducing the chances of experiencing slippage and getting a less favorable price.

Transaction Cost Optimization

Another aspect of improved trade execution on 1inch Trading is transaction cost optimization. When placing a trade, users need to pay transaction fees on the Ethereum network. These fees can vary depending on network congestion and demand.

1inch Trading automatically evaluates transaction fees and optimizes trades to minimize these costs for users. By intelligently selecting the most cost-effective route and timing the transaction to take advantage of lower fees, 1inch Trading helps users save on transaction costs and maximize their trading profits.

Overall, 1inch Trading’s focus on improved trade execution through limit orders, price impact minimization, and transaction cost optimization ensures that users can trade efficiently and get the best possible outcomes for their trades.

Reduced Trading Costs

One of the key benefits of using limit orders in 1inch trading is the ability to reduce trading costs. When you place a limit order, you set a specific price at which you are willing to buy or sell a particular asset. This means that you are not subject to the current market price, which can fluctuate rapidly.

By setting a limit order, you can avoid paying higher prices or receiving lower prices than you are comfortable with. This can help you save money and ensure that you are getting a fair deal.

In addition, limit orders can also help you avoid unnecessary fees. Some platforms charge higher fees for market orders, which are executed immediately at the current market price. By using limit orders, you have more control over the execution of your trades and can potentially reduce the fees that you have to pay.

Another way that limit orders can reduce trading costs is through the use of advanced trading techniques. For example, you can use a time-weighted average price (TWAP) strategy to execute your trades over a specified time period. This can help you avoid large price swings and reduce the impact of your trades on the market.

Benefits of Reduced Trading Costs:

1. Lower costs: By using limit orders, you can potentially avoid paying higher prices and reduce the fees that you have to pay.

2. Control over execution: With limit orders, you have more control over when and at what price your trades are executed.

3. Advanced trading strategies: Limit orders enable the use of advanced trading techniques, such as TWAP, to reduce market impact and optimize trade execution.

Overall, the role of limit orders in 1inch trading is crucial for reducing trading costs and ensuring that you can make the most out of your trades.

Minimized Price Slippage

When trading on 1inch, minimizing price slippage is crucial to ensure efficient and profitable transactions. Price slippage occurs due to the discrepancy between the expected price of an asset and the actual executed price.

1inch’s advanced limit order functionality plays a significant role in minimizing price slippage by allowing users to set specific price targets for their trades. By setting a limit order, users can specify the maximum or minimum price at which they are willing to buy or sell an asset.

By using limit orders, traders can avoid the risks associated with market orders, where the execution price is determined by the current market conditions. Market orders often result in higher price slippage, especially when trading large volumes or in volatile markets.

Benefits of Using Limit Orders:

- Control over Pricing: Limit orders give traders precise control over the price at which their trades are executed, helping to minimize price slippage and achieve more favorable prices.

- Reduced Market Impact: By using limit orders, traders can minimize their impact on the market, especially when dealing with large volumes. This reduces the chances of causing significant price fluctuations and allows for more efficient trading.

In conclusion, by utilizing the limit order functionality provided by 1inch, traders can achieve minimized price slippage, ensuring more efficient and profitable trades. Take advantage of this powerful tool to optimize your trading strategy and maximize your returns.

Question-answer:

What are limit orders?

Limit orders are instructions to buy or sell a security at a specific price or better. They are used to set a maximum price at which you are willing to buy or a minimum price at which you are willing to sell.

How do limit orders work in 1inch trading?

In 1inch trading, limit orders allow users to set the desired price at which they want to buy or sell a specific asset. When the market reaches the specified price, the order is executed. Limit orders are an effective way to take advantage of price fluctuations in the market.