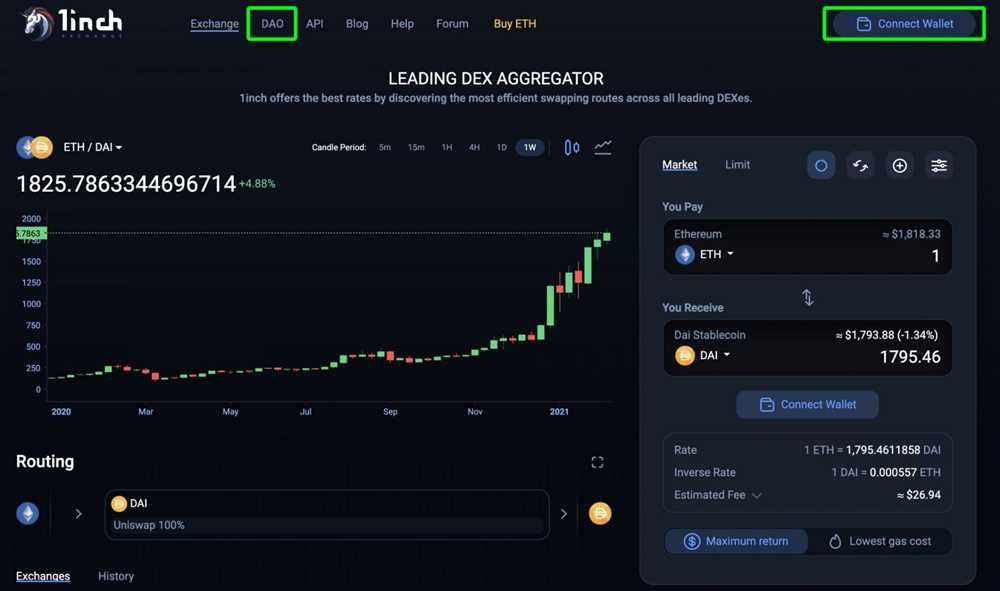

1inch is a decentralized exchange aggregator that allows users to find the best possible prices for their trades across multiple decentralized exchanges (DEXs). In addition to providing competitive trading rates, 1inch also offers staking rewards to its users. Staking is the process of locking up your tokens in a smart contract in order to support the network and earn rewards.

There are several options available for staking your 1inch tokens, each with its own set of rewards and requirements. In this article, we will compare and analyze the different staking options offered by 1inch, helping you to determine the best option for your needs.

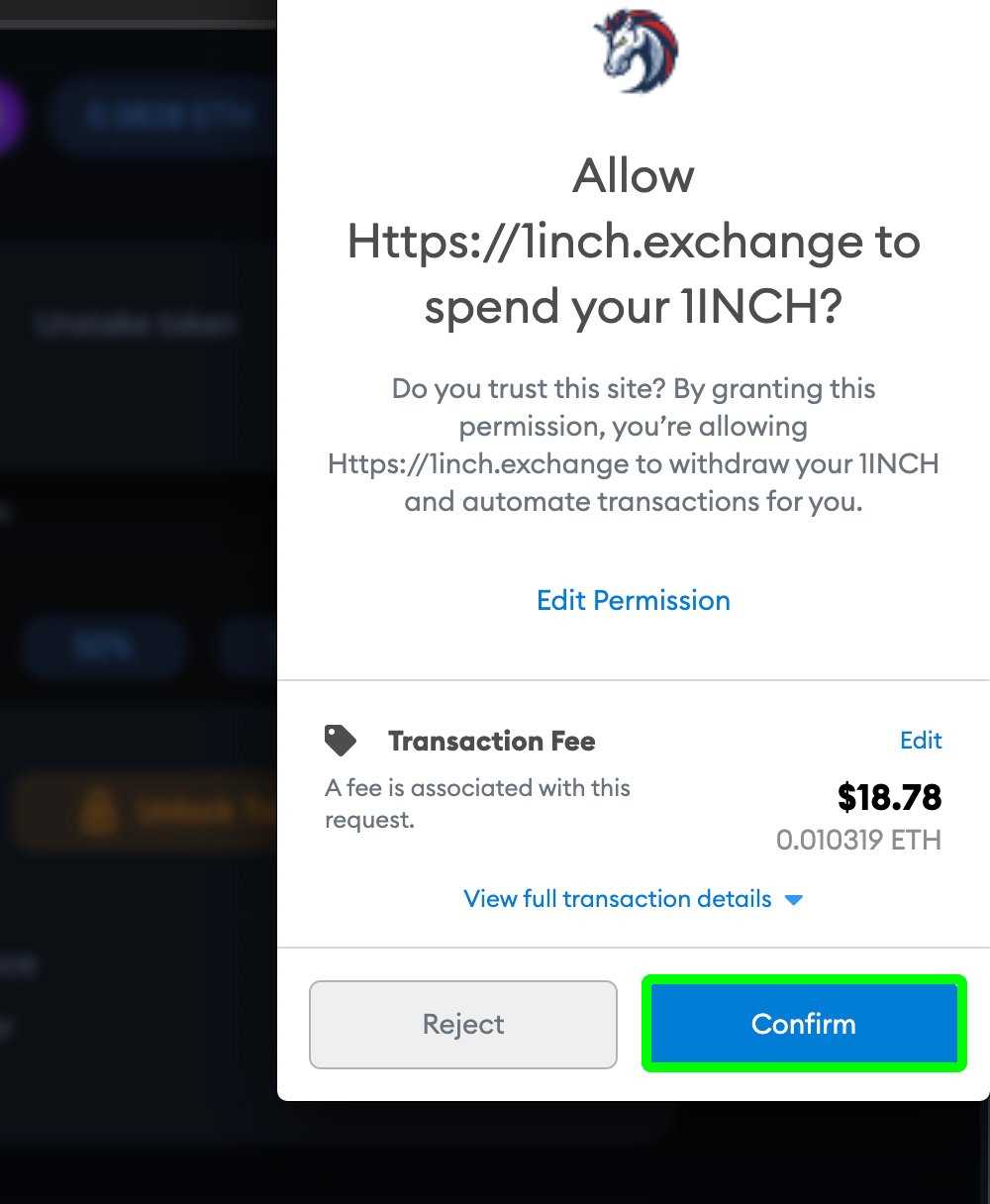

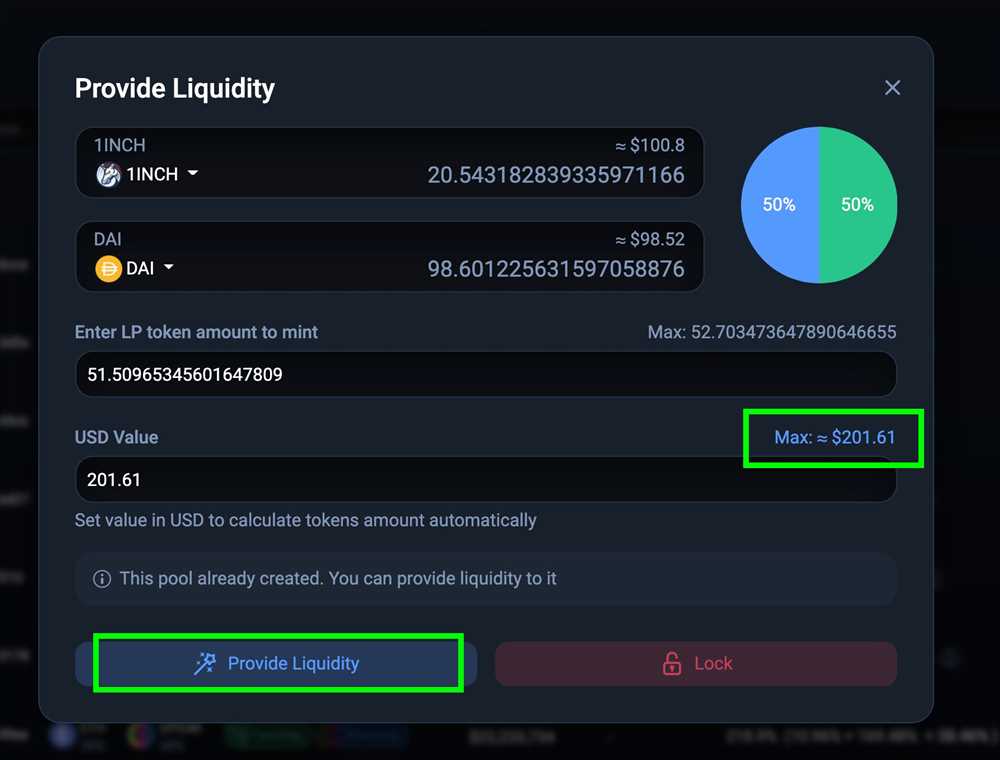

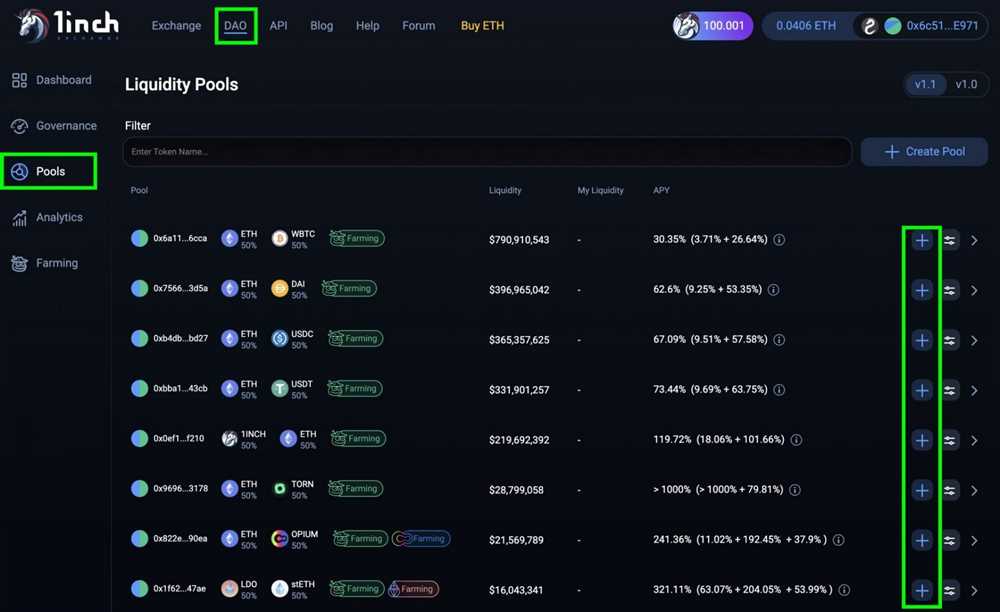

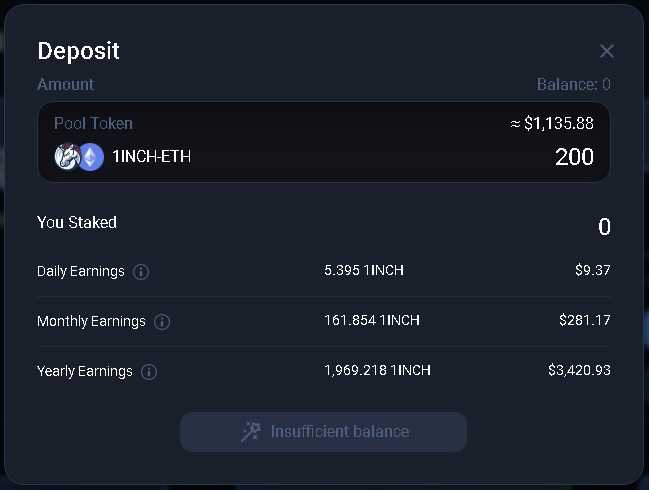

One of the main staking options provided by 1inch is the 1INCH Liquidity Mining program. This program allows users to earn rewards by providing liquidity to the 1inch DEX. By adding your tokens to the liquidity pool, you not only help to increase the efficiency of the exchange, but you also earn a share of the trading fees generated by the platform. The rewards are distributed proportionally to the amount of liquidity you provide, incentivizing users to contribute more to the pool.

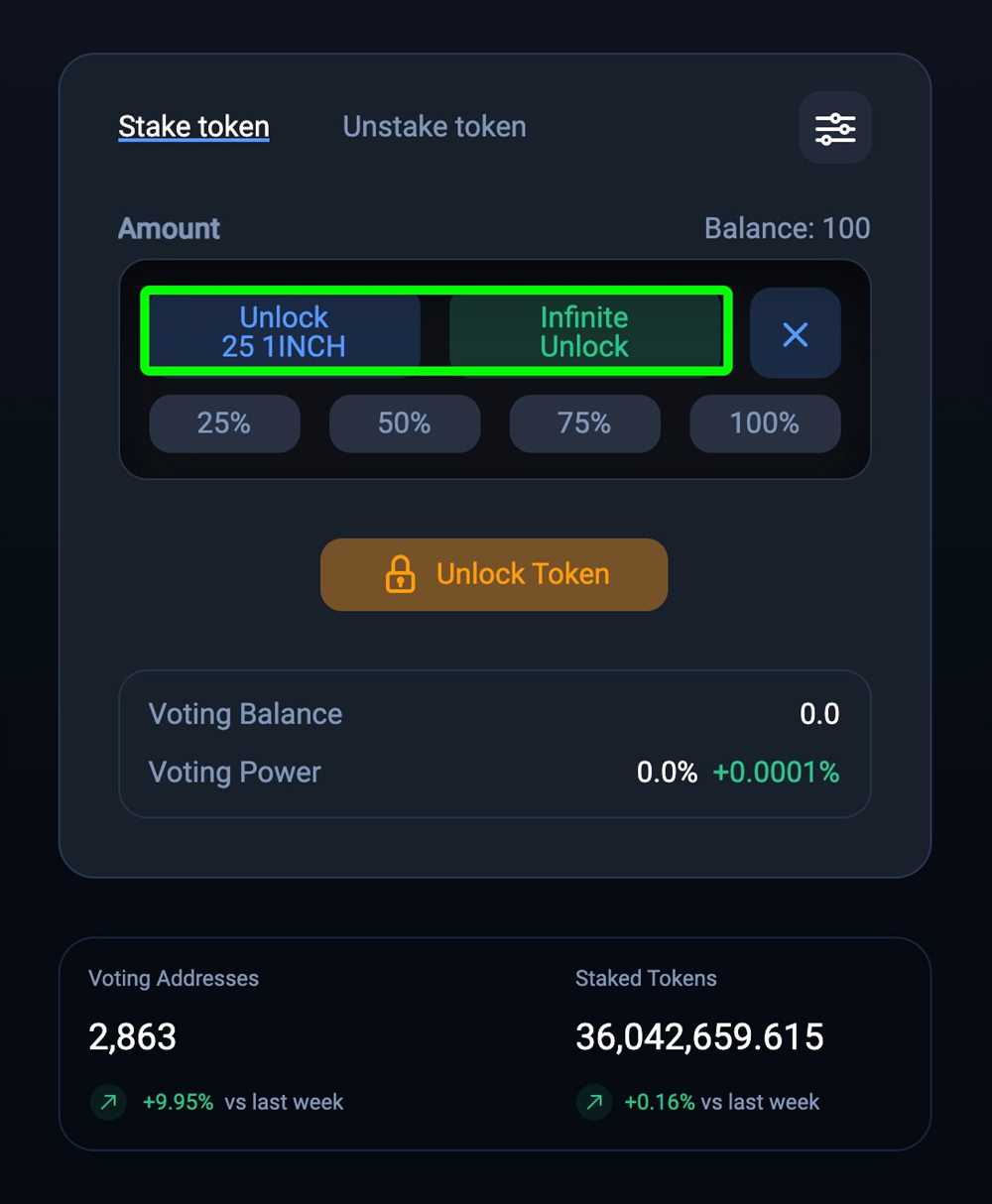

Another staking option offered by 1inch is the 1INCH Governance Staking. This program allows users to stake their 1INCH tokens and participate in the governance of the 1inch network. By staking your tokens, you gain voting power and the ability to participate in important decision-making processes. In return for your participation, you earn governance rewards, which can include additional tokens or other benefits.

Choosing the right staking option for your 1inch tokens depends on your individual goals and risk tolerance. If you are looking to earn passive income by providing liquidity to the 1inch DEX, the Liquidity Mining program may be the best choice for you. On the other hand, if you are interested in actively participating in the governance of the 1inch network and shaping its future, the Governance Staking option may be more suitable.

In conclusion, 1inch offers several staking options that allow users to earn rewards while supporting the network. Whether you are looking for passive income or active participation, there is a staking option that can meet your needs. By carefully considering the rewards and requirements of each option, you can make an informed decision and maximize the benefits of your 1inch tokens.

A Comparison of 1inch Staking Rewards:

When it comes to staking rewards, 1inch offers several options for users to choose from. In this article, we will compare the different staking options available and help you make an informed decision based on your preferences and goals.

1. Liquidity Provider (LP) Tokens

- By staking your LP tokens, you can earn a portion of the trading fees generated on 1inch.

- LP tokens are earned by providing liquidity to the platform.

- Staking LP tokens can offer attractive rewards, but also come with risks as they are subject to impermanent loss.

2. Governance (GOV) Tokens

- Staking GOV tokens allows you to participate in the governance of the 1inch platform.

- As a staker, you can vote on proposals and decisions that impact the future of 1inch.

- Governance staking can be an excellent option if you are interested in having a say in the platform’s development.

3. DAI Savings Rate (DSR)

- By depositing DAI into the 1inch platform, you can earn a variable interest rate through the DSR.

- The DSR is an attractive option for stablecoin holders looking to earn a passive income on their investments.

- However, it is important to note that the DSR is subject to fluctuations and may not always offer the same high rewards as other staking options.

Overall, the choice of 1inch staking rewards depends on your risk tolerance, investment goals, and desired level of involvement in the platform’s governance. Consider your options carefully and weigh the potential rewards against the associated risks before making a decision.

Exploring the Best Options for You

When it comes to staking rewards on the 1inch platform, there are several options available that can suit your needs and preferences. These options differ in terms of rewards, lock-up periods, and minimum requirements.

One of the best options for you may be the Mooniswap LP tokens staking. By staking your LP tokens on 1inch, you can earn attractive rewards in the form of 1INCH tokens. The lock-up period for this option is relatively short, ranging from 6 to 12 months, depending on the token pair.

If you prefer a longer lock-up period, the 1inch Governance staking option might be more suitable for you. By staking your 1INCH tokens in this option, you can actively participate in the governance of the 1inch platform and earn rewards in the form of additional 1INCH tokens. The lock-up period for this option is 12 months.

Another option to consider is the 1inch Liquidity Protocol (1LP) staking. This option allows you to stake your 1INCH tokens to provide liquidity on the 1inch platform and earn rewards in the form of fees generated from trades. The lock-up period for this option is 12 months, providing you with long-term earning potential.

Finally, if you want a flexible staking option, the 1inch Spot staking might be the best choice for you. By staking your 1INCH tokens in this option, you can earn rewards in the form of additional 1INCH tokens, and there is no lock-up period. This option allows you to easily access your staked tokens whenever you need them.

It’s important to carefully consider these options and choose the one that aligns with your goals and risk tolerance. Each option offers its own unique benefits, so take the time to explore them and make an informed decision. Remember, staking involves risks, and it’s crucial to do your own research and seek professional advice if needed.

| Staking Option | Rewards | Lock-up Period | Minimum Requirement |

|---|---|---|---|

| Mooniswap LP tokens staking | 1INCH tokens | 6 to 12 months | LP tokens |

| 1inch Governance staking | 1INCH tokens | 12 months | 1INCH tokens |

| 1inch Liquidity Protocol (1LP) staking | Trading fees | 12 months | 1INCH tokens |

| 1inch Spot staking | 1INCH tokens | No lock-up period | 1INCH tokens |

By exploring and understanding these options, you can make an informed decision and maximize your staking rewards on the 1inch platform.

Understanding the Benefits

When considering staking rewards on the 1inch platform, it is important to understand the benefits that come with participating in the network.

1. Passive Income

One of the key benefits of staking on 1inch is the ability to earn passive income. By locking your tokens in a staking pool, you can passively earn rewards in the form of additional tokens. This can be a great way to grow your cryptocurrency holdings without actively trading or investing.

2. Network Security

By participating in the staking network, you are contributing to the security and decentralization of the 1inch platform. Stakers help to validate transactions and secure the network against potential attacks. The more tokens that are staked, the more secure the network becomes.

3. Token Distribution

Staking also plays a role in token distribution. As more tokens are staked, the circulating supply decreases, which can potentially lead to an increase in token value. Staking rewards help incentivize token holders to lock up their tokens, leading to a more evenly distributed supply and potentially providing more stability to the token’s price.

4. Voting and Governance

Some staking programs on the 1inch platform also offer voting and governance rights to token holders. This means that stakers have a say in the decision-making process of the platform, such as voting on proposed upgrades or changes. This can give stakers a sense of ownership and control over the future direction of the platform.

Overall, participating in staking on the 1inch platform can provide a range of benefits, from earning passive income to contributing to network security and having a say in the platform’s governance. It is important to consider these benefits and weigh them against any potential risks before deciding to stake your tokens.

Maximizing Your Rewards

To maximize your rewards when staking with 1inch, it is important to consider several factors.

First, it is important to choose the right liquidity pool. Different pools offer different rewards, so you should research and compare the options available. Look for pools with high APY (Annual Percentage Yield) to maximize your earnings.

Another factor to consider is the duration of the staking period. Some pools offer shorter staking periods with higher rewards, while others have longer lock-up periods but offer higher APY. It’s important to find the right balance that suits your investment goals and risk tolerance.

Diversification is also key when it comes to maximizing your rewards. Rather than staking all your tokens in a single pool, consider spreading them across multiple pools. This can help mitigate risks and potentially increase your overall rewards.

Regularly monitoring your staking rewards is also essential. Some pools may offer additional rewards or incentives for certain periods, so it’s important to stay informed and take advantage of these opportunities.

Lastly, it is important to stay up-to-date with any changes or updates from 1inch. Staking rewards can be subject to changes, so it’s important to stay informed and adjust your strategy accordingly.

By considering these factors and staying actively engaged with your staking, you can maximize your rewards and make the most out of staking with 1inch.

Question-answer:

What are 1inch staking rewards?

1inch staking rewards are incentives given to users who participate in the staking program offered by the 1inch decentralized exchange platform. Users who stake their 1inch tokens can earn additional tokens as rewards, which are distributed based on their staked amount and the duration of their stake.

How do staking rewards on 1inch work?

Staking rewards on 1inch work by allowing users to lock up their 1inch tokens for a certain period of time. During this period, users earn rewards in the form of additional tokens, which are distributed proportionally based on the amount of tokens staked and the duration of the stake. The longer you stake and the more tokens you have staked, the higher your rewards will be.