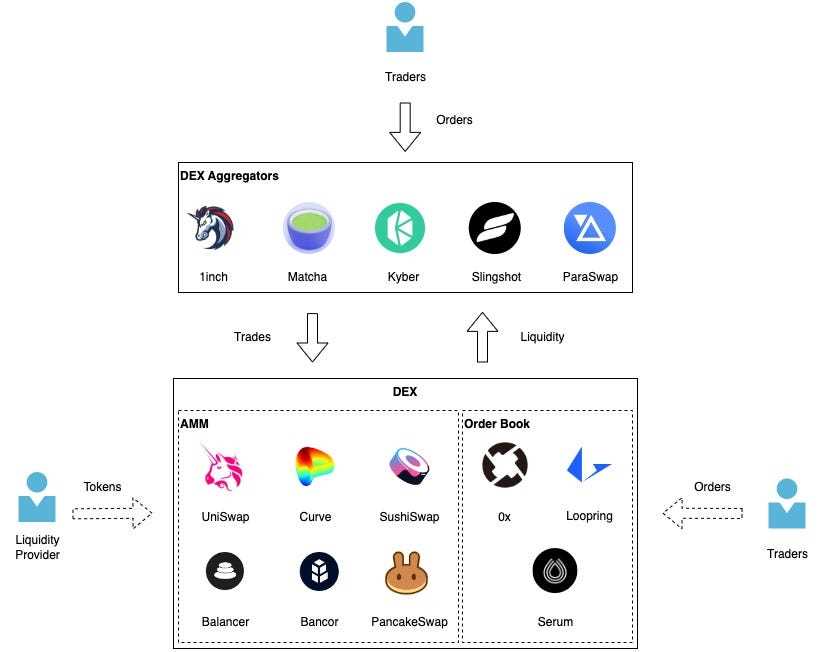

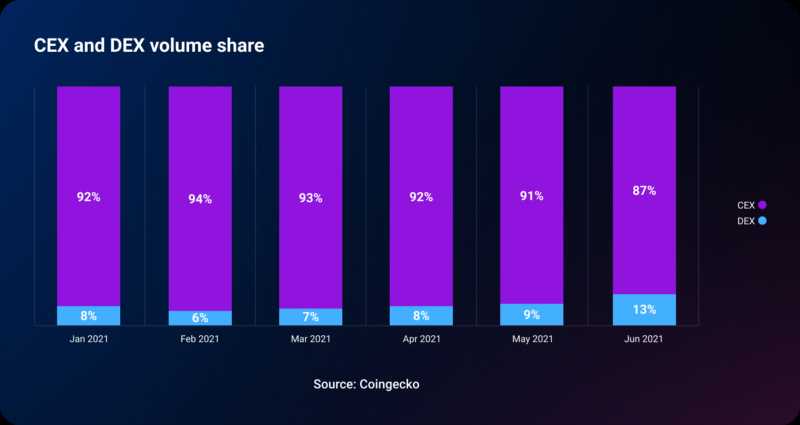

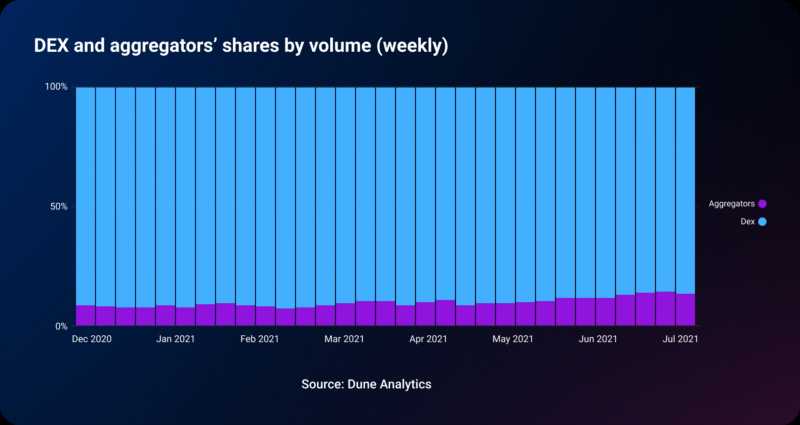

Decentralized finance (DeFi) has seen tremendous growth in recent years, revolutionizing the way we think about traditional financial systems. However, one of the challenges faced by DeFi platforms is liquidity fragmentation, where trading volume is spread across multiple decentralized exchanges (DEXs). This fragmentation can lead to inefficiencies and higher slippage for users.

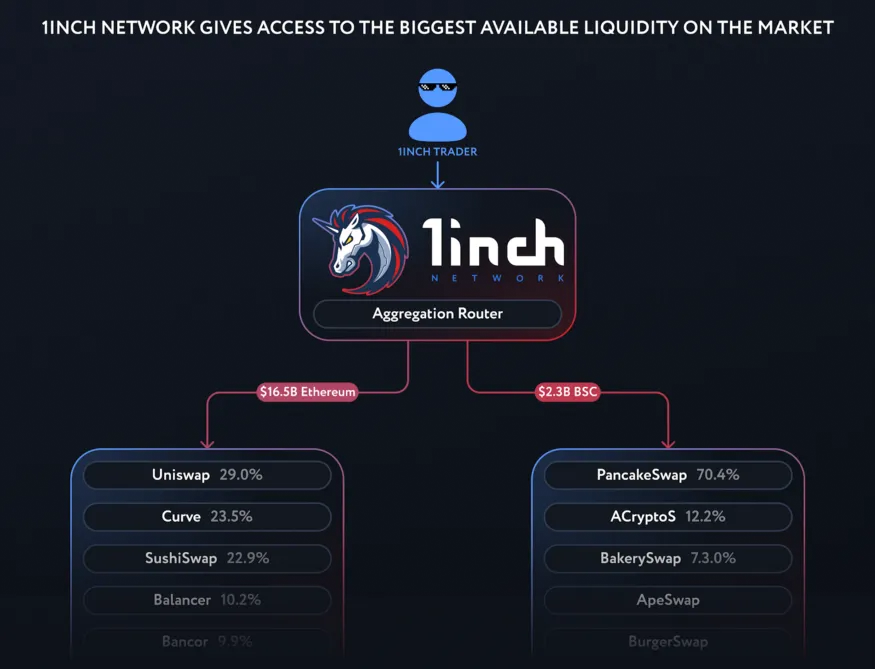

1inch is a DEX aggregator that aims to solve the problem of liquidity fragmentation in the DeFi ecosystem. It combines liquidity from various DEXs into one platform, allowing users to access the best possible price for their trades. By routing trades through different DEXs, 1inch minimizes slippage and maximizes the chances of getting the most favorable rates for users.

The 1inch DEX aggregator achieves this by utilizing a smart contract that splits a user’s trade across different liquidity sources. The smart contract scans multiple DEXs, comparing prices and executing the trade on the platform that provides the best rates. This process is automated and transparent, ensuring that users always get the most optimal results.

Moreover, 1inch is designed to be decentralized and non-custodial, meaning that users retain control of their funds throughout the trading process. The platform does not require users to create an account or provide personal information, enhancing privacy and security. 1inch also incentivizes liquidity providers by offering rewards in the form of native tokens.

In conclusion, 1inch is a DEX aggregator that tackles the issue of liquidity fragmentation in the DeFi ecosystem. By combining liquidity from multiple DEXs, 1inch improves the trading experience for users by minimizing slippage and providing the best possible rates. With its decentralized and non-custodial approach, 1inch offers a secure and efficient solution for accessing liquidity in the ever-growing world of DeFi.

What is 1inch DEX Aggregator?

The 1inch DEX Aggregator is a decentralized exchange aggregator that enables users to find and execute trades at the best prices across multiple decentralized exchanges (DEXs). It was launched in 2019 by Sergej Kunz and Anton Bukov and has quickly become one of the most popular tools in the decentralized finance (DeFi) ecosystem.

The main purpose of the 1inch DEX Aggregator is to enhance the liquidity in the DeFi space by sourcing liquidity from various DEXs and optimizing trades to ensure users get the best possible pricing. This is achieved through the use of smart contract technology and a unique algorithm that splits users’ orders across multiple DEXs to minimize slippage and maximize returns.

The 1inch DEX Aggregator supports a wide range of tokens and liquidity sources, including decentralized exchanges like Uniswap, SushiSwap, and Balancer, as well as liquidity protocols like Curve and 0x. By aggregating liquidity from multiple sources, the 1inch DEX Aggregator offers users a more comprehensive and efficient trading experience.

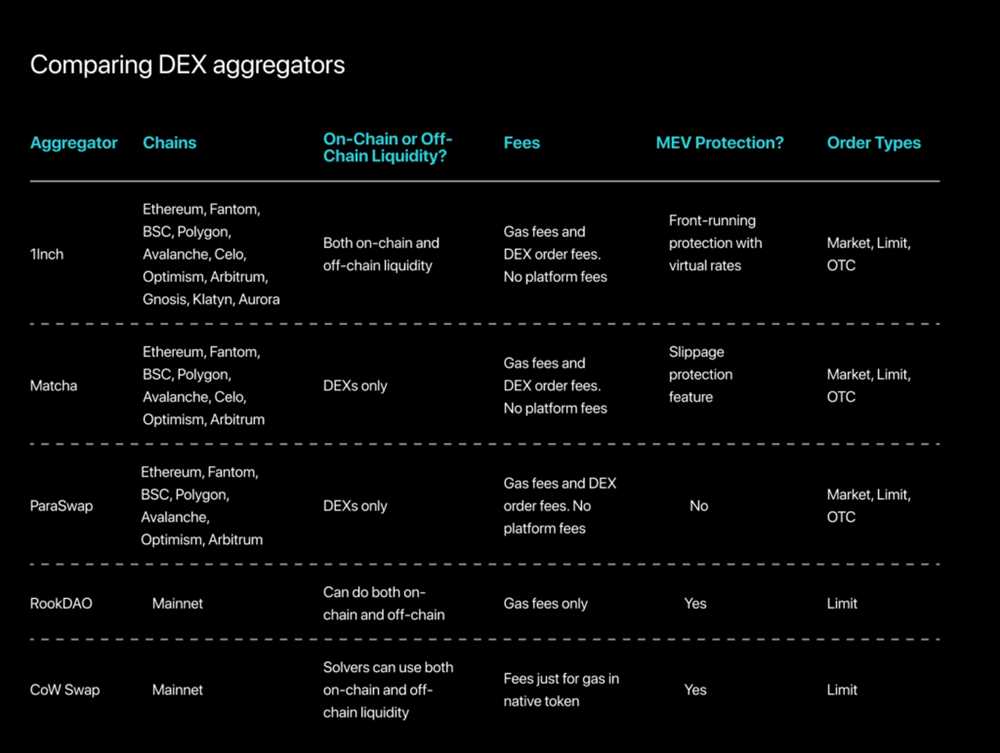

One of the key features of the 1inch DEX Aggregator is its ability to provide users with the most competitive prices for their trades. The aggregator scans multiple DEXs in real-time and routes trades through the most cost-effective path, considering not only the token price but also the gas fees and other transaction costs associated with each exchange.

Additionally, the 1inch DEX Aggregator offers users the option to perform token swaps with a single transaction, saving time and reducing costs compared to manually executing multiple transactions on individual DEXs.

Overall, the 1inch DEX Aggregator plays a crucial role in the DeFi ecosystem by increasing liquidity, improving price efficiency, and simplifying the trading process for users. It has gained significant traction within the DeFi community and continues to evolve and innovate to meet the growing demands of its users.

Enhancing Liquidity in the DeFi Ecosystem

DeFi, short for Decentralized Finance, has revolutionized the way financial transactions are conducted. It has provided a transparent and open platform for users to access various financial services without the need for intermediaries. However, one of the challenges faced by the DeFi ecosystem is the lack of liquidity.

The Importance of Liquidity

Liquidity is essential for the smooth operation of any financial market. It refers to the ability of an asset to be quickly bought or sold at stable prices without causing a significant impact on its price. In the DeFi ecosystem, liquidity plays a crucial role in enabling users to trade tokens and access financial services efficiently.

Without sufficient liquidity, traders may face high slippage and significant price impact when executing trades. This reduces the attractiveness of DeFi platforms as users prefer to trade on platforms that offer better liquidity. Moreover, low liquidity also hinders the development of advanced financial products such as derivatives and lending platforms.

The Role of 1inch DEX Aggregator

1inch is a DEX aggregator that aims to enhance liquidity in the DeFi ecosystem. It achieves this by aggregating liquidity from various decentralized exchanges (DEXs) into one platform, providing users with better access to liquidity across multiple markets.

1inch uses an algorithm that searches for the best trading routes across different DEXs to optimize trades and minimize slippage. By splitting orders into smaller parts and executing them via multiple DEXs, 1inch effectively improves liquidity and ensures users get the best possible trading rates.

Additionally, 1inch offers a variety of features such as limit orders, gas optimization, and smart contract execution to further enhance the liquidity and trading experience for users. These features help users to execute trades more efficiently and at lower costs.

| Benefits of 1inch DEX Aggregator |

|---|

| Access to the best liquidity across multiple DEXs |

| Optimized trades with reduced slippage |

| Lower costs through gas optimization and limit orders |

| Improved trading experience for users |

In conclusion, the 1inch DEX aggregator plays a vital role in enhancing liquidity in the DeFi ecosystem. By aggregating liquidity from multiple DEXs and offering various features, 1inch ensures that users have access to the best possible liquidity and trading experience, ultimately making DeFi platforms more efficient and attractive for users.

Benefits of Using 1inch DEX Aggregator

The 1inch DEX Aggregator offers several key benefits that make it a powerful tool for enhancing liquidity in the DeFi ecosystem:

1. Improved Liquidity

The 1inch DEX Aggregator allows users to access liquidity across multiple decentralized exchanges (DEXs). By splitting orders across various DEXs, it increases the chances of finding the best available prices and depth for a specific trade. This results in improved liquidity and reduced slippage, ultimately benefiting traders.

2. Cost Savings

By finding and executing trades on the most cost-effective DEXs, the 1inch DEX Aggregator helps users save on transaction costs. It scans multiple DEXs simultaneously and routes orders to ensure the most efficient trading path, helping users maximize their profits by minimizing fees.

3. Time Efficiency

The 1inch DEX Aggregator saves users time by eliminating the need to manually search and compare prices across different DEXs. Instead of visiting multiple platforms and executing trades individually, users can access multiple DEXs through a single interface. This streamlines the trading process and allows users to quickly take advantage of favorable market conditions.

4. Access to More Tokens

The 1inch DEX Aggregator aggregates liquidity from a wide range of DEXs, resulting in access to a larger pool of tokens. This increases the variety of assets users can trade and provides more opportunities for diversification in their investment strategies.

Conclusion:

The 1inch DEX Aggregator offers significant benefits to users in terms of improved liquidity, cost savings, time efficiency, and access to more tokens. By leveraging its powerful features, traders can enhance their trading experience in the DeFi ecosystem and optimize their investment strategies.

Improved Liquidity Provision

With the 1inch DEX Aggregator, liquidity provision in the DeFi ecosystem is greatly enhanced. The protocol aggregates liquidity from various decentralized exchanges, allowing users to find the best trading routes and obtain optimal prices for their transactions.

This improved liquidity provision is made possible through the use of smart contract technology. Smart contracts automatically execute trades on behalf of users, ensuring secure and seamless transactions. The 1inch DEX Aggregator also leverages advanced algorithms to split trades across multiple exchanges, maximizing liquidity and minimizing slippage.

By aggregating liquidity from multiple sources, the 1inch DEX Aggregator also reduces the risk of impermanent loss for liquidity providers. Liquidity providers can benefit from improved capital efficiency and higher returns, as their funds are allocated across multiple exchanges and can take advantage of arbitrage opportunities.

In addition, the 1inch DEX Aggregator offers a user-friendly interface that allows users to easily access and use the platform. The intuitive design and comprehensive information provided enable users to make informed decisions and execute trades effectively.

In summary, the 1inch DEX Aggregator significantly improves liquidity provision in the DeFi ecosystem. It combines liquidity from multiple decentralized exchanges, enhances capital efficiency, reduces the risk of impermanent loss, and provides users with a seamless trading experience.

Reduced Slippage

One of the major challenges faced by traders in the DeFi ecosystem is the issue of slippage. Slippage refers to the difference between the expected price of a trade and the actual executed price. In highly volatile and illiquid markets, slippage can be significant and can erode the profitability of trades.

With the 1inch DEX aggregator, traders can benefit from reduced slippage due to its smart routing algorithm. The algorithm splits trades across multiple decentralized exchanges to ensure that the best prices are obtained for each trade. By analyzing the liquidity available on different exchanges, the algorithm determines the optimal route for each trade, minimizing slippage and maximizing trading profits.

The reduced slippage offered by the 1inch DEX aggregator is particularly advantageous in times of market volatility. During periods of high price fluctuations, slippage can be magnified, making it even more crucial to obtain the best possible prices. By leveraging the liquidity available on various exchanges, the 1inch DEX aggregator helps traders navigate through volatile markets with minimal slippage.

Furthermore, the 1inch DEX aggregator continuously monitors the order books of decentralized exchanges to ensure that trades are executed at the most favorable prices. By constantly updating and optimizing its routing algorithm, the aggregator ensures that traders always have access to the best possible prices and minimized slippage.

In conclusion, the 1inch DEX aggregator offers a solution to the problem of slippage in the DeFi ecosystem. By leveraging its smart routing algorithm and analyzing the liquidity available on different exchanges, the aggregator is able to reduce slippage and enhance trading profits for users. Whether in times of market volatility or during normal trading conditions, the 1inch DEX aggregator provides traders with the advantage of reduced slippage and improved liquidity.

Question-answer:

What is 1inch DEX Aggregator?

1inch DEX Aggregator is a decentralized exchange (DEX) aggregator that allows users to find the best prices and liquidity across multiple DEXes. It automatically splits a user’s order across different DEXes to provide the most optimal trading experience.

How does 1inch DEX Aggregator enhance liquidity in the DeFi ecosystem?

1inch DEX Aggregator enhances liquidity in the DeFi ecosystem by aggregating liquidity from various DEXes, such as Uniswap, Sushiswap, and more. By doing so, it increases the trading volume and overall liquidity available in the market, making it easier and more efficient for users to trade digital assets.

What are the advantages of using 1inch DEX Aggregator?

There are several advantages of using 1inch DEX Aggregator. Firstly, it allows users to get the best prices across multiple DEXes, ensuring they get the most value for their trades. Secondly, it provides better liquidity by aggregating liquidity from different sources. Lastly, it saves users time and effort by automatically finding the best routes and executing trades in a seamless manner.

How secure is 1inch DEX Aggregator?

1inch DEX Aggregator takes security seriously and implements various measures to protect user funds. It uses smart contract technology to ensure that trades are executed in a transparent and secure manner. Additionally, it undergoes regular security audits to identify and address any potential vulnerabilities. However, it’s important for users to exercise caution and do their own research before engaging with any DeFi platform.

Is 1inch DEX Aggregator available on mobile devices?

Yes, 1inch DEX Aggregator is available on mobile devices. It offers a mobile application that can be downloaded from the App Store or Google Play Store. Users can access and use the aggregator on their smartphones, making it convenient for them to trade and manage their DeFi assets on the go.