If you’re interested in cryptocurrency, you’ve likely heard of staking. It’s a way to earn passive income by holding and validating tokens on a blockchain network. One project that has gained significant attention in the staking world is 1inch. But what exactly are the risks and rewards of staking 1inch?

First, let’s talk about the rewards. Staking 1inch can be a lucrative endeavor. By staking your tokens, you can earn additional tokens as a reward. These rewards are typically a percentage of the total amount of tokens being staked on the network. The more you stake, the more rewards you can earn. This is especially appealing if you believe in the long-term potential of 1inch and want to hold onto your tokens.

However, it’s important to consider the risks involved in staking 1inch. One major risk is the volatility of the cryptocurrency market. If the price of 1inch were to plummet, the value of your staked tokens would also decrease. This could result in significant losses if you were counting on those rewards for income. It’s crucial to carefully assess your risk tolerance and be prepared for potential market fluctuations.

Another risk to consider is the security of the staking platform. While 1inch is a reputable project, there is always the possibility of hacks or vulnerabilities in the platform. It’s essential to do thorough research and choose a reliable staking platform to mitigate this risk. Additionally, make sure to use necessary security measures such as two-factor authentication to protect your staked tokens.

In conclusion, staking 1inch can be a rewarding endeavor if approached with caution and careful consideration of the risks involved. By understanding the potential rewards and being prepared for market volatility, you can make informed decisions about staking your 1inch tokens. Just remember to do your due diligence and stay updated on the latest news and developments in the 1inch ecosystem.

The Risks and Rewards of Staking 1inch

Staking 1inch can be a profitable investment strategy, but it is not without its risks. Before deciding to stake your 1inch tokens, it is important to understand both the potential rewards and the potential pitfalls.

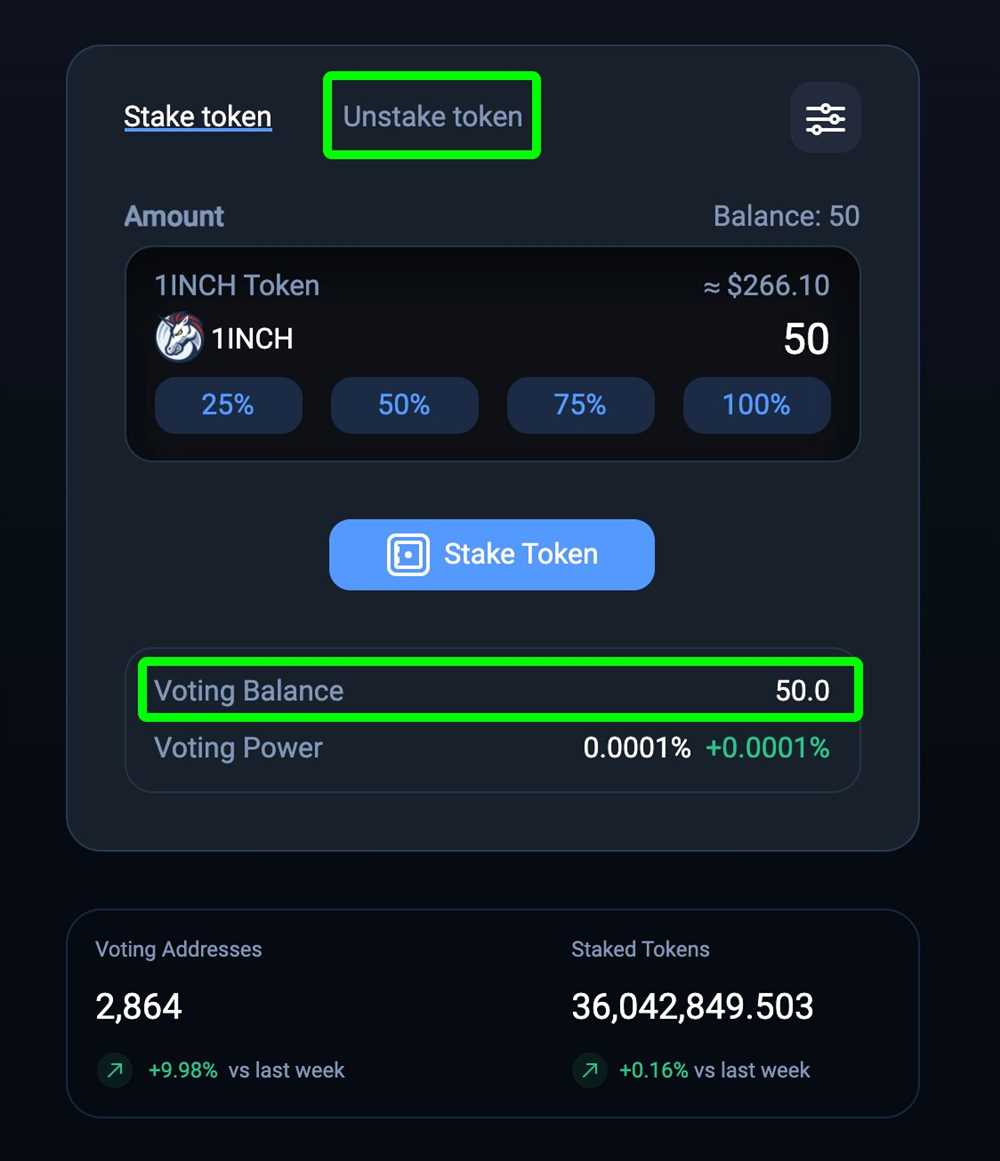

One of the main rewards of staking 1inch is the opportunity to earn passive income. When you stake your tokens, you are essentially lending them to the platform, and in return, you receive a portion of the platform’s fees and rewards. This can be a great way to earn extra income from your 1inch holdings.

However, there are also risks associated with staking 1inch. One of the main risks is the possibility of losing your staked tokens. While many staking platforms have measures in place to protect against hacks and other security breaches, there is always a small chance that your tokens could be stolen or lost. It is important to do your research and choose a reputable staking platform that has a strong track record of security.

Another risk to consider is the potential for volatility in the cryptocurrency market. The value of 1inch and other cryptocurrencies can be highly volatile, meaning that their price can fluctuate wildly in a short period of time. If the value of your staked tokens were to decrease significantly, you could potentially lose a portion of your investment.

It is also worth noting that staking 1inch typically involves locking up your tokens for a certain period of time, known as a lock-up period. During this time, you will not be able to access or sell your staked tokens. This lack of liquidity could be a disadvantage if you need to access your funds quickly.

In conclusion, staking 1inch can be a rewarding investment strategy, allowing you to earn passive income from your tokens. However, it is important to carefully consider the risks involved, such as the potential loss of your staked tokens and the volatility of the cryptocurrency market. By understanding these risks and choosing a reputable staking platform, you can make an informed decision about whether staking 1inch is right for you.

Understanding the Potential Risks

When considering staking 1inch, it is important to be aware of the potential risks involved. While staking can be a lucrative way to earn passive income, it also comes with its fair share of risks that investors should be prepared for.

1. Market Volatility

One of the main risks associated with staking 1inch is market volatility. The value of cryptocurrencies can be highly volatile, and this can have a significant impact on the value of the rewards earned through staking. If the price of 1inch drops significantly, the rewards earned may not be enough to offset the potential loss in the value of the staked tokens.

2. Smart Contract Risks

Another risk to consider is smart contract vulnerabilities. While the 1inch platform has been audited and is generally considered to be secure, there is always a risk of smart contract bugs or exploits. These vulnerabilities could potentially lead to the loss of staked tokens, so it is important to choose platforms that have undergone thorough security audits.

Additionally, there is also the risk of the platform being hacked or experiencing a security breach. While reputable platforms take measures to prevent these incidents, no system is completely immune to attacks.

It is also worth noting that engaging in staking activities requires users to interact with their digital wallets and potentially share private keys. This introduces an additional risk of user error or security breaches that could lead to the loss of staked assets.

Overall, while staking 1inch can be a profitable endeavor, it is important for investors to understand and accept the potential risks involved. Conducting thorough research, choosing reputable platforms, and practicing proper security measures can help mitigate these risks and make the most of the staking opportunity.

Evaluating the Potential Rewards

When considering staking 1inch, it is important to evaluate the potential rewards that can be gained from this investment. Staking can provide investors with various rewards, such as additional 1inch tokens or other incentives. However, it is crucial to assess these potential rewards before committing to staking your tokens.

Potential Rewards

One potential reward for staking 1inch is earning additional 1inch tokens. By staking your tokens, you become a validator in the protocol, which allows you to participate in the network’s consensus mechanism and earn rewards in the form of new tokens. The amount of additional tokens earned will depend on factors such as the duration of the staking period and the total number of tokens staked.

Aside from earning additional tokens, staking 1inch may also provide you with other incentives. This can include benefits like reduced transaction fees or priority access to certain features within the 1inch platform. These additional rewards can enhance your overall experience as a 1inch token holder and further incentivize you to participate in the staking process.

Evaluating Risks and Rewards

Before deciding to stake your 1inch tokens, it is crucial to evaluate the risks and rewards associated with the process. While the potential rewards can be enticing, it is important to consider factors such as the volatility of the cryptocurrency market and potential risks specific to the 1inch protocol.

Additionally, it is advisable to research and compare the potential rewards offered by different staking platforms or protocols. Each platform may have its own set of rewards and associated risks, so conducting thorough due diligence is essential to make an informed decision.

| Risks | Rewards |

|---|---|

| Market volatility | Additional 1inch tokens |

| Protocol-specific risks | Reduced transaction fees |

| Priority access to platform features |

By carefully evaluating the potential rewards and risks associated with staking 1inch tokens, you can make an informed decision and maximize your investment opportunities.

Mitigating the Risks through Proper Staking Strategies

Staking 1inch can be a lucrative investment opportunity, but like any investment, it comes with its own set of risks. However, by implementing proper staking strategies, investors can mitigate these risks and maximize their rewards.

Diversify Your Staked Assets

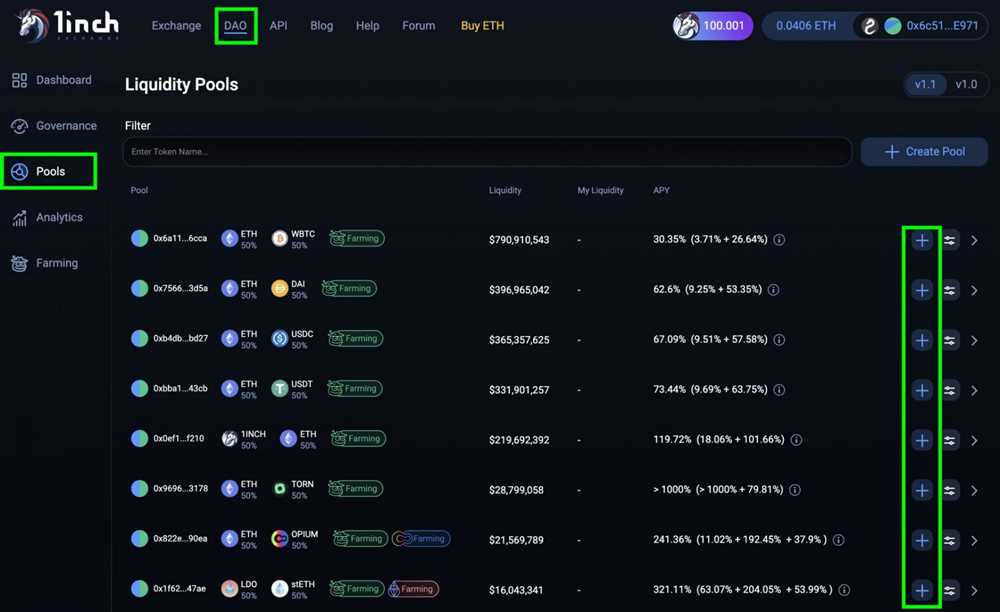

One of the key strategies to minimize risks in staking is diversifying your staked assets. Instead of staking all your 1inch tokens in a single pool, consider spreading them across multiple pools. By doing so, you can reduce the impact of potential issues or vulnerabilities in a single pool. Diversification also allows you to take advantage of different staking rewards offered by various pools.

Stay Informed and Monitor the Market

Keeping yourself updated with the latest news and developments in the cryptocurrency market is crucial for successful staking. Stay informed about any updates or changes in the staking protocol, security vulnerabilities, or potential risks. Regularly monitor the market trends to identify any opportunities or risks that may arise. This will help you make informed decisions and adapt your staking strategy accordingly.

Choose Reliable Staking Providers

When staking your 1inch tokens, it is important to choose reliable staking providers or platforms. Look for providers that have a proven track record, positive user reviews, and a secure infrastructure. Conduct thorough research and due diligence before selecting a provider to ensure that your staked assets are in safe hands.

| Risks | Strategies |

|---|---|

| Volatility | Consider staking a portion of your tokens instead of all |

| Hacking or Security breaches | Use hardware wallets to secure your tokens |

| Smart contract vulnerabilities | Review the smart contract code before staking |

| Liquidity risks | Opt for staking options with lower lock-up periods |

By following these strategies, you can minimize the risks associated with staking 1inch and increase your chances of achieving profitable returns. Remember to always do your own research and consult with financial professionals before making any investment decisions.

How to Start Staking 1inch and What You Need to Know

If you’re interested in staking 1inch, here’s what you need to do:

Step 1: Set Up a Wallet

The first thing you’ll need is a cryptocurrency wallet that supports the 1inch token. Some popular options include MetaMask, Trust Wallet, and Ledger Wallet. Make sure to choose a wallet that you trust and follow the necessary steps to set it up.

Step 2: Obtain 1inch Tokens

In order to stake 1inch, you’ll need to obtain some tokens. You can do this by purchasing them from a cryptocurrency exchange that supports 1inch. Once you have the tokens, transfer them to your wallet.

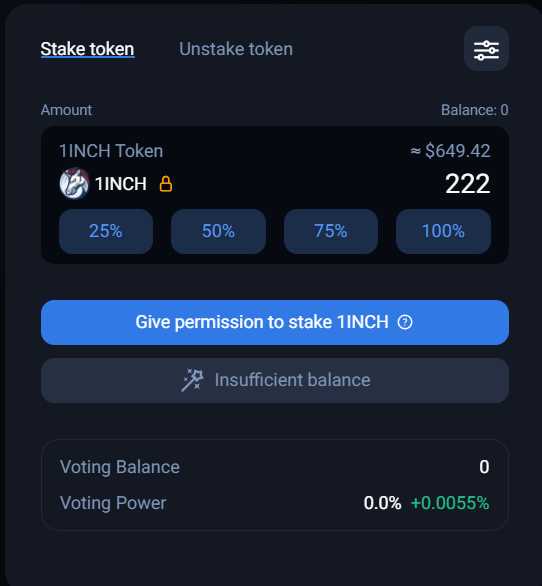

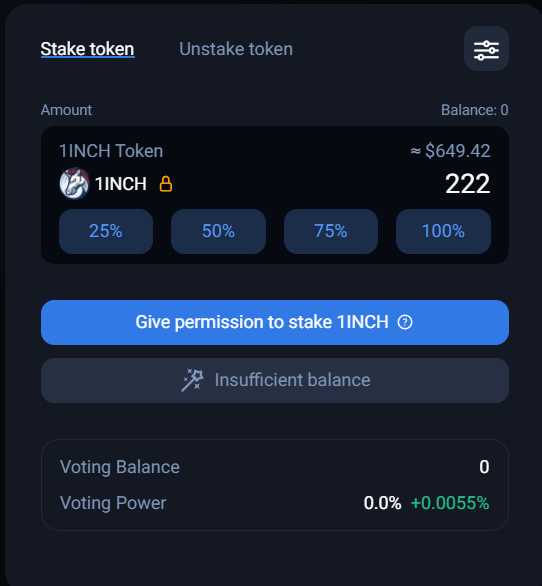

Step 3: Choose a Staking Platform

Next, you’ll need to choose a staking platform that supports 1inch. Some popular options include 1inch’s own staking platform and other decentralized finance (DeFi) platforms. Research each platform to understand their staking requirements, fees, and rewards before making a decision.

Step 4: Delegate or Self-Stake

Once you’ve chosen a staking platform, you’ll need to decide whether to delegate your tokens or self-stake. When you delegate, you allow another user to stake your tokens on your behalf, while self-staking means you stake the tokens yourself. Consider factors such as the platform’s reputation, security, and staking rewards when making this decision.

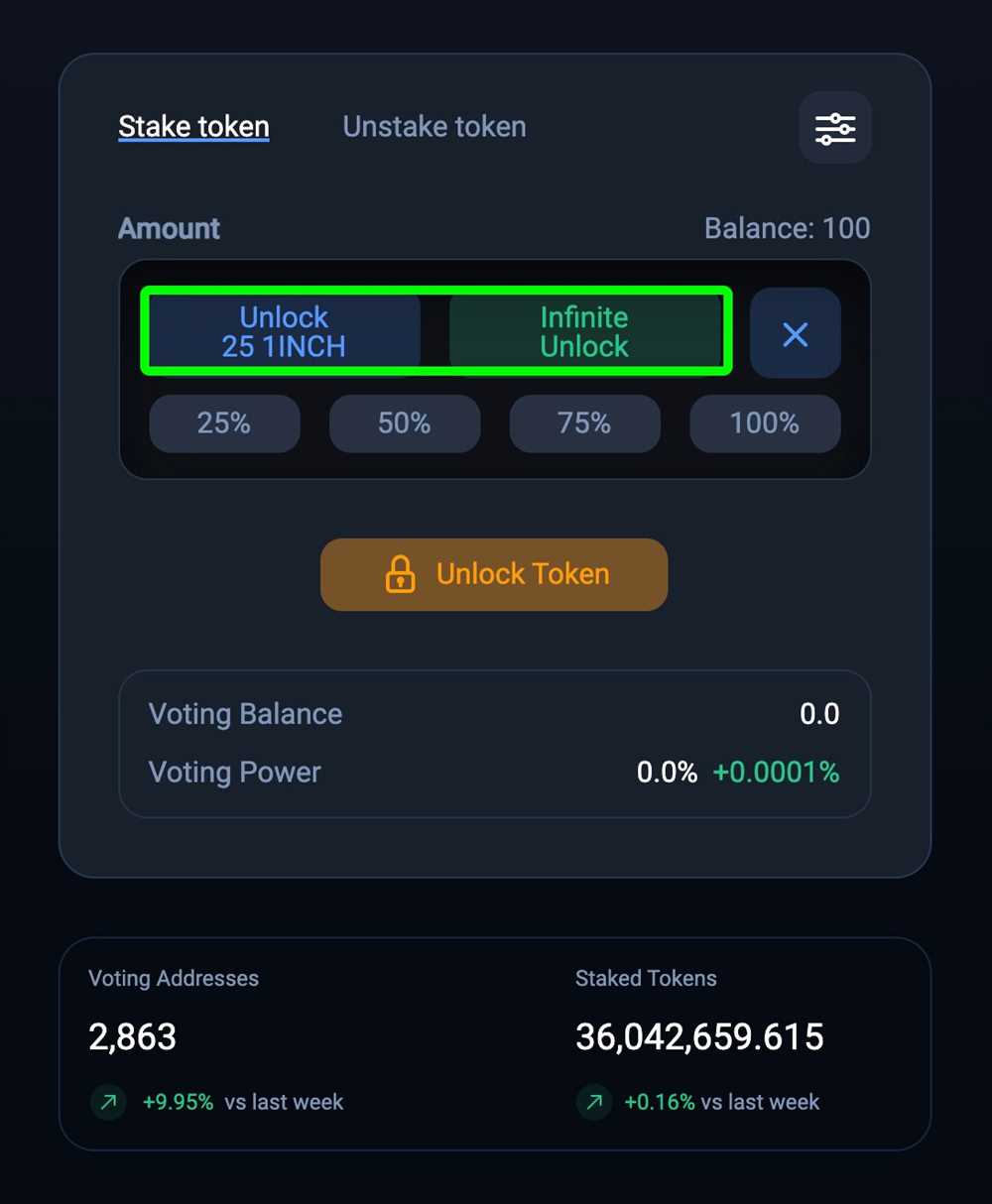

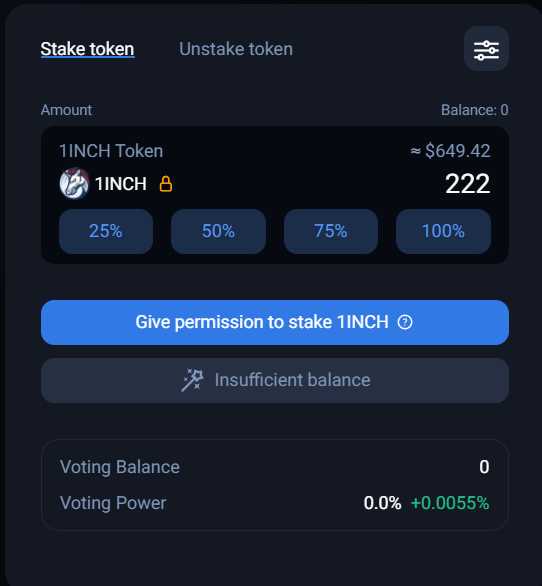

Step 5: Stake Your 1inch Tokens

Finally, you can stake your 1inch tokens on the chosen platform. Follow the instructions provided by the platform to complete the staking process. Depending on the platform, you may need to lock your tokens for a certain period of time, so make sure you understand the terms and conditions before proceeding.

Remember, staking involves risks, including the potential loss of your staked tokens. It’s important to do thorough research and understand the platform’s terms and conditions, as well as the potential rewards and risks, before staking your 1inch tokens.

Question-answer:

What is staking in the context of cryptocurrency?

In the context of cryptocurrency, staking refers to the act of holding digital assets in a cryptocurrency wallet to support the operations of a blockchain network. By staking, users can earn rewards for participating in the network and validating transactions.

How does staking work on the 1inch platform?

Staking on the 1inch platform involves locking your 1inch tokens in a smart contract for a specific period of time. By doing so, you contribute to the liquidity of the platform and support its decentralized exchange operations. In return, you earn rewards in the form of additional 1inch tokens.