Decentralized finance (DeFi) has gained significant attention and popularity in the cryptocurrency industry in recent years. DeFi platforms offer users the ability to engage in various financial activities such as lending, borrowing, and trading without the need for intermediaries. One key aspect of DeFi is the availability of decentralized exchanges (DEXs), which allow users to trade cryptocurrencies directly without relying on centralized platforms.

When it comes to DEX trading, one challenge users face is the fragmentation of liquidity across multiple exchanges. Dex aggregators like 1inch Finance aim to solve this problem by providing users with the best possible rates by splitting orders across different DEXs. In this article, we will compare 1inch Finance with other popular dex aggregators to see how they stack up against each other.

1inch Finance is a well-established dex aggregator that has gained a strong reputation in the market. It stands out for its cutting-edge technology and efficient routing algorithms, which allow users to access the most favorable rates across various DEXs. Additionally, 1inch Finance offers additional features such as limit orders and gas optimization tools, providing users with a comprehensive trading experience.

Other dex aggregators in the market, such as Uniswap, Sushiswap, and Kyber Network, also offer similar functionalities to 1inch Finance. However, each aggregator has its own unique features and advantages. By comparing these dex aggregators, users can make informed decisions on which platform best suits their needs.

What are Dex Aggregators?

A decentralized exchange (Dex) aggregator is a platform that brings together liquidity from various decentralized exchanges, allowing users to trade assets at the best possible prices. By aggregating liquidity, Dex aggregators aim to provide users with access to a wide range of tokens and better prices than they could achieve by trading on a single exchange.

Dex aggregators work by splitting a user’s trade across multiple decentralized exchanges, taking into account factors such as token availability, trading volume, and price slippage. They use sophisticated algorithms to ensure that users get the best possible price for their trades.

How do Dex aggregators work?

When a user wants to make a trade on a Dex aggregator platform, the aggregator automatically searches for the best prices across multiple decentralized exchanges. The aggregator splits the trade into smaller orders and executes them on the exchanges with the most favorable prices. This allows users to take advantage of the liquidity available on multiple platforms while minimizing price slippage.

Dex aggregators typically integrate with multiple blockchain networks, such as Ethereum, Binance Smart Chain, and Polygon, to provide users with a wide range of tokens and liquidity options. Users can connect their wallets to the aggregator platform and trade directly from their wallets, without the need for additional transfers between exchanges.

Advantages of using a Dex aggregator

| Advantage | Explanation |

|---|---|

| Better prices | Dex aggregators search multiple exchanges to find the best prices, allowing users to get better deals compared to trading on a single exchange. |

| Access to more tokens | By aggregating liquidity from multiple exchanges, Dex aggregators provide users with access to a wider range of tokens and trading pairs. |

| Reduced slippage | By splitting trades across multiple exchanges, Dex aggregators aim to minimize price slippage, ensuring that users get the best possible price for their trades. |

| Convenience | Users can trade directly from their wallets, without the need for multiple transfers between exchanges, making the trading process more convenient. |

Overall, Dex aggregators offer a convenient and efficient way for users to access liquidity from multiple decentralized exchanges and get the best possible prices for their trades. They provide a seamless trading experience and open up new opportunities for traders in the decentralized finance (DeFi) ecosystem.

Why use Dex Aggregators instead of DEXs?

Dex aggregators have emerged as powerful tools in the decentralized finance (DeFi) space, offering several advantages over traditional decentralized exchanges (DEXs). Here are some reasons why you should consider using Dex aggregators instead of DEXs:

1. Best Price Execution

Dex aggregators provide better price execution compared to individual DEXs. By aggregating liquidity from multiple DEXs, they can find the best prices available in the market. This ensures that you get the most favorable exchange rate and helps you maximize your trading profits.

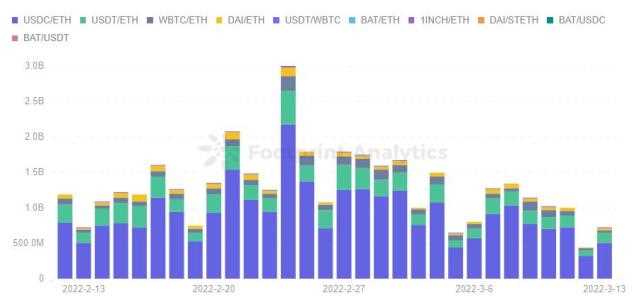

2. Improved Liquidity

DEXs typically suffer from liquidity fragmentation, as trading volumes are spread across different platforms. Dex aggregators solve this problem by pooling liquidity from multiple DEXs, resulting in improved liquidity depth. This means that larger trades can be executed more efficiently without significantly impacting the market price.

3. Lower Slippage

Slippage, or the difference between the expected and executed price of a trade, can be a significant issue in DEXs with low liquidity. Dex aggregators mitigate this risk by splitting large orders into multiple smaller trades across different DEXs. By doing so, they reduce the impact of individual trades on the market price and minimize slippage.

4. Access to Multiple DEXs

Instead of being limited to a single DEX, dex aggregators allow you to access liquidity across multiple DEXs through a single interface. This saves you time and effort by eliminating the need to navigate through multiple platforms. You can easily compare prices and choose the best options for your trades, all in one place.

5. Enhanced Security

Dex aggregators prioritize security by partnering with reputable DEXs and performing rigorous audits. They ensure that the smart contracts used for trading are secure and free from vulnerabilities. By using dex aggregators, you can have confidence in the safety of your funds and trade with peace of mind.

In conclusion, Dex aggregators offer a range of benefits compared to individual DEXs. They provide best price execution, improved liquidity, lower slippage, access to multiple DEXs, and enhanced security. These advantages make dex aggregators a compelling choice for traders and investors in the DeFi space.

inch Finance: Features and Benefits

1. Diverse Liquidity Sources: 1inch Finance stands out among other decentralized exchange (DEX) aggregators for its ability to source liquidity from various platforms. By leveraging its unique Pathfinder algorithm, 1inch Finance finds the most efficient and lucrative trade routes across multiple DEXs, ensuring users get the best rates.

2. Low Slippage: Thanks to its advanced aggregation technology, 1inch Finance minimizes slippage, allowing users to execute trades at optimal prices. This is particularly beneficial for larger trades that are more susceptible to price impact.

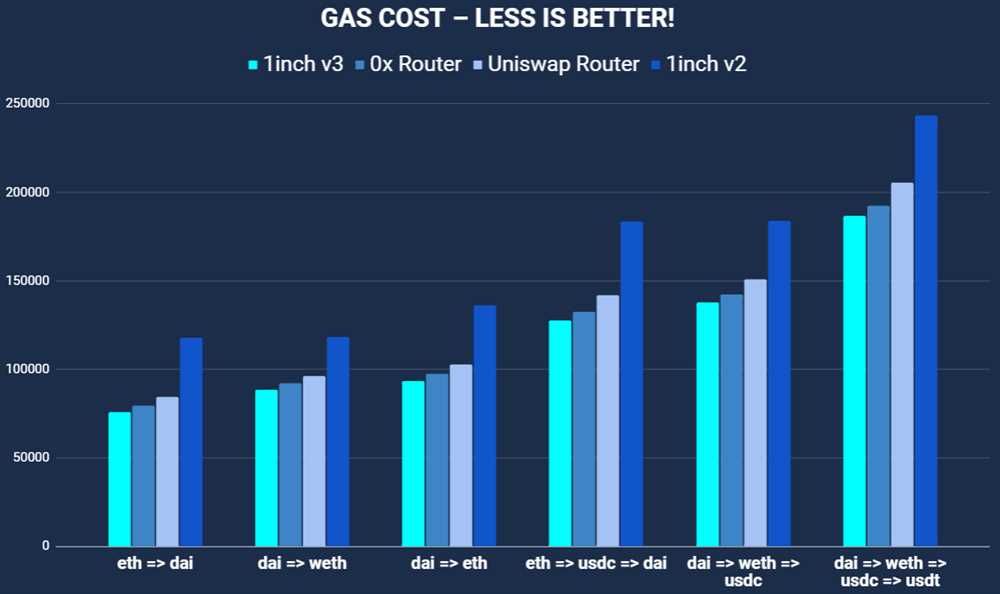

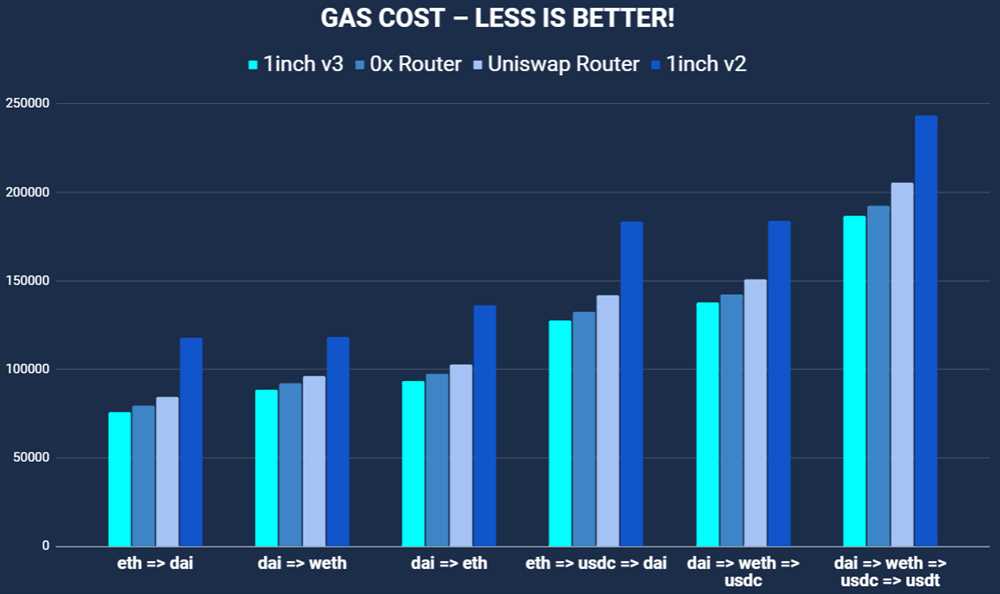

3. Gas Optimization: Gas fees on the Ethereum network can be significant, but 1inch Finance helps users reduce these costs. By splitting a large trade into smaller parts and routing them through different liquidity sources, users can optimize gas fees and save money.

4. Customizable Fee Structure: 1inch Finance allows users to customize their fee structure, providing flexibility and transparency. Users can choose between different fee models, such as the 1inch Liquidity Protocol (Mooniswap) fee or the 1inch Aggregation fee, depending on their preferences and trading needs.

5. Gas Token Refunds: To further reduce transaction costs, 1inch Finance offers gas token refunds. Users can pay the gas fees with tokens like CHI or GST2, which can be purchased at a discount. After the transaction is completed, any leftover gas tokens are converted back into ETH, providing additional savings.

6. Instant and Secure Transactions: With 1inch Finance, users can enjoy instant and secure transactions. By aggregating liquidity, the platform facilitates quick trade executions, while integrating with popular wallets like MetaMask ensures the highest level of security.

7. User-Friendly Interface: 1inch Finance provides a user-friendly interface that is easy to navigate and understand. Its intuitive design and simple layout make it accessible to both experienced traders and beginners, allowing users to make informed decisions and trade with confidence.

8. Competitive Rates: The competitive rates offered by 1inch Finance make it an attractive choice for traders looking for the best deals. By leveraging smart contract technology and accessing multiple liquidity sources, 1inch Finance ensures users get the most competitive rates for their trades.

Overall, 1inch Finance offers a comprehensive range of features and benefits that set it apart from other DEX aggregators. Its ability to source liquidity from various platforms, minimize slippage, optimize gas fees, and provide a customizable fee structure make it a powerful tool for traders seeking the best possible outcomes for their transactions.

Overview of 1inch Finance

1inch Finance is a decentralized exchange (DEX) aggregator and liquidity protocol that aims to provide users with the best prices and lowest slippage for their cryptocurrency trades. It was founded in 2020 and has quickly gained popularity due to its innovative approach to routing trades across multiple DEXs.

How Does 1inch Finance Work?

1inch Finance operates by splitting users’ orders across multiple liquidity sources, such as decentralized exchanges, in order to find the best possible prices. This is done through the use of complex algorithms and smart contract technology.

When a user wants to make a trade, 1inch Finance’s smart contract searches for the most advantageous routes across various DEXs to complete the order. By splitting the order and utilizing multiple liquidity sources, 1inch Finance aims to reduce slippage and maximize trading efficiency.

Key Features of 1inch Finance

1inch Finance offers several key features that set it apart from other DEX aggregators:

- Smart Routing: 1inch Finance’s smart contract technology enables it to find the most optimal routes for trades, ensuring users get the best possible prices and lowest slippage.

- Aggregation of Liquidity: By aggregating liquidity from various DEXs, 1inch Finance provides users with access to a larger pool of liquidity, increasing the chances of finding better prices.

- Gas Optimization: 1inch Finance aims to minimize gas fees for users by intelligently routing trades and taking advantage of lower-cost options.

- Limit Orders: Users can place limit orders on 1inch Finance, allowing them to set specific price targets and execute trades automatically when the target is reached.

- Pathfinder: 1inch Finance’s Pathfinder algorithm helps users find optimized routes for their trades, taking into account factors such as liquidity, slippage, and gas costs.

Overall, 1inch Finance is a powerful and innovative DEX aggregator that aims to provide users with the best trading experience possible. Its advanced technology and comprehensive features make it a popular choice among crypto traders looking to optimize their trades.

Key Features of 1inch Finance

1. Aggregation of multiple DEXs: 1inch Finance is a decentralized exchange (DEX) aggregator that pools liquidity from various DEXs such as Uniswap, SushiSwap, Balancer, Kyber Network, and many more. This allows users to access a wide range of trading options and get the best possible price for their trades.

2. Optimized gas fees: 1inch Finance utilizes an intelligent routing algorithm that automatically selects the most cost-effective path for each transaction. It takes into account gas fees on different DEXs and compares them to provide users with the lowest fees.

3. Smart contract security: 1inch Finance places a strong emphasis on security. The platform only integrates audited and trusted smart contracts, reducing the risk of vulnerabilities and hacks. Additionally, 1inch Finance has a bug bounty program that rewards users who discover and report security issues.

4. Instant swaps: With 1inch Finance, users can perform instant swaps, allowing for quick and efficient trading. The platform splits larger orders into multiple smaller ones across different DEXs to optimize execution. This ensures that trades are completed as quickly as possible while minimizing slippage.

5. Limit orders: 1inch Finance offers a limit order feature, enabling users to set specific price targets for their trades. When the target price is reached, the transaction is automatically executed, allowing users to take advantage of favorable market conditions.

6. Liquidity protocols: In addition to aggregating liquidity from various DEXs, 1inch Finance also supports liquidity protocols such as Mooniswap. This allows users to benefit from the unique features and incentives offered by these protocols.

7. Governance and profit-sharing: 1inch Finance has its own governance token called 1INCH. Holders of the token can participate in decision-making processes and earn rewards through profit-sharing. This gives users a stake in the platform and aligns their interests with the overall success of 1inch Finance.

8. Integrations with wallets: 1inch Finance seamlessly integrates with popular cryptocurrency wallets such as MetaMask and WalletConnect. This makes it easy for users to connect their wallets and execute trades directly from their preferred wallet interface.

9. Transparency and open-source: 1inch Finance is committed to transparency and has made its codebase open-source. This allows developers to review and verify the platform’s functionality, ensuring that it operates as intended and giving users confidence in its reliability.

10. User-friendly interface: Despite its advanced features, 1inch Finance offers a user-friendly interface that is easy to navigate and understand. The platform provides users with a clear overview of available trading options and ensures a smooth and intuitive user experience.

Question-answer:

What is 1inch Finance?

1inch Finance is a decentralized exchange (DEX) aggregator that allows users to find and execute the best trades across multiple DEXs. It sources liquidity from various DEXs and uses an algorithm to determine the most cost-effective route for a trade.

How does 1inch Finance compare to other DEX aggregators?

1inch Finance distinguishes itself from other DEX aggregators by offering a higher level of optimization in its trading algorithms. It leverages the advantages of various DEXs to provide users with the best possible outcomes. Additionally, 1inch Finance offers a user-friendly interface that simplifies the trading process.

What are the advantages of using 1inch Finance?

Using 1inch Finance offers several advantages, including lower slippage and better pricing. Its advanced algorithms find the most efficient trading routes, resulting in improved execution and lower transaction costs. Furthermore, 1inch Finance provides access to a wider range of liquidity by aggregating various DEXs.

Are there any downsides to using 1inch Finance?

While 1inch Finance offers many benefits, there are a few potential downsides. One downside is that the platform may have higher gas fees compared to directly trading on a single DEX. Additionally, using 1inch Finance requires users to have a certain level of understanding of decentralized finance (DeFi) and how to navigate between different platforms.