In the world of decentralized finance (DeFi), 1inch has emerged as one of the most popular and innovative platforms. With its decentralized exchange (DEX) aggregator, 1inch allows users to find the best prices and execute trades across multiple DEXs with just one click. While 1inch offers exciting opportunities for investors, it’s crucial to analyze the risk factors associated with this platform.

First and foremost, one of the main risk factors to consider when investing in 1inch DeFi is the volatility of the cryptocurrency market. As with any investment in cryptocurrencies, the value of the assets can fluctuate greatly, leading to potential losses. It’s essential for investors to have a thorough understanding of market trends and to monitor their investments closely.

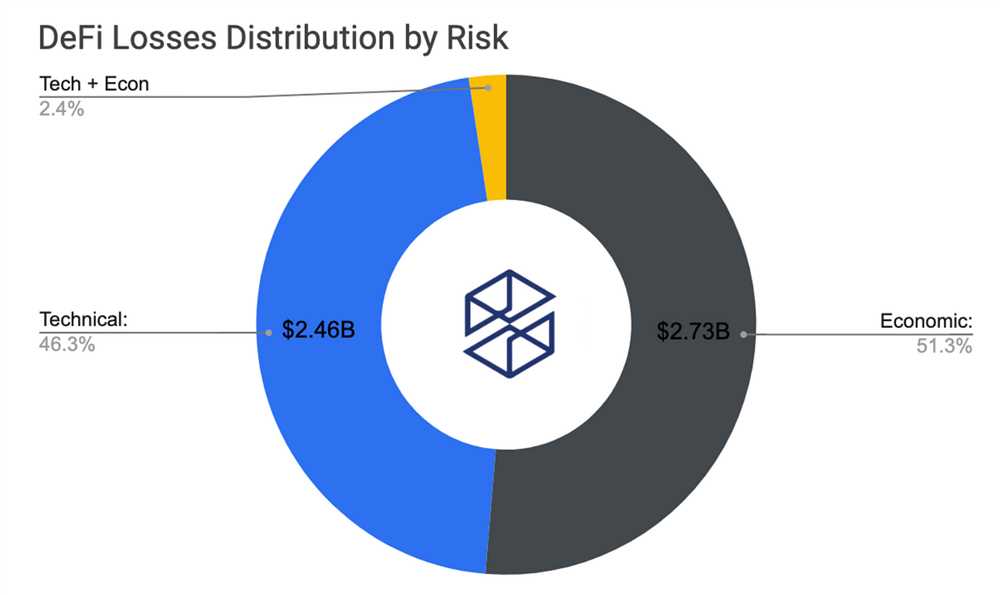

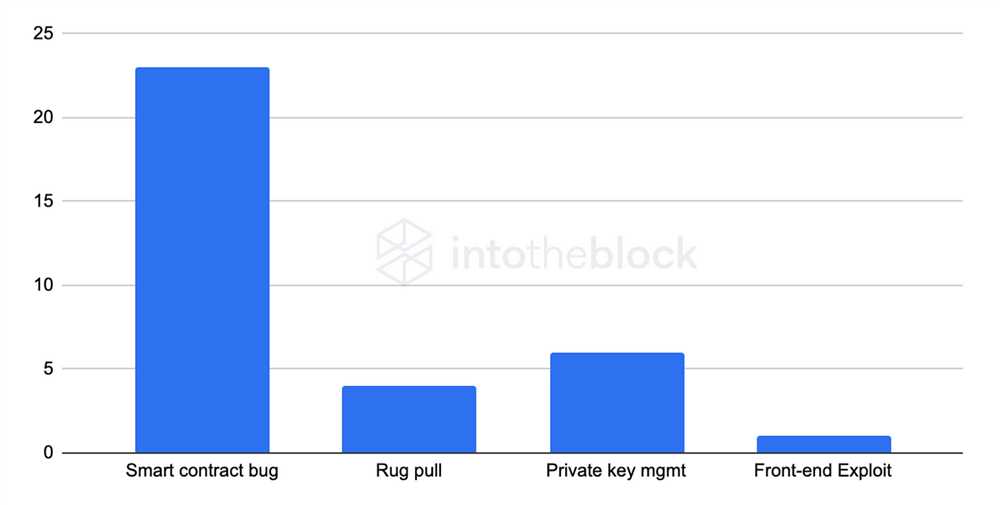

Another risk factor to be aware of is the smart contract risk. Smart contracts are self-executing contracts with the terms of the agreement written into code. While smart contracts provide transparency and eliminate the need for intermediaries, they can be vulnerable to hacking or coding errors. Investors should conduct due diligence to ensure the security and reliability of the smart contracts used by 1inch.

Understanding the Risk Factors of 1inch DeFi

As with any investment in the decentralized finance (DeFi) space, investing in 1inch carries certain risks that investors should be aware of. While 1inch has gained popularity for its innovative approach to decentralized exchanges and liquidity aggregation, it’s important to understand the potential risks involved.

One of the main risk factors of investing in 1inch is the volatility of the cryptocurrency market. Cryptocurrencies, including the tokens used on the 1inch platform, can experience significant price fluctuations. This means that the value of your investment in 1inch may decrease rapidly, potentially leading to a loss of funds.

Another risk factor to consider is the potential for technical issues or vulnerabilities in the 1inch smart contracts or platform. While the team behind 1inch works hard to ensure the security and reliability of their technology, there is always a risk of bugs or vulnerabilities being exploited by malicious actors. This could result in the loss or theft of your funds.

Additionally, investing in 1inch exposes you to smart contract risk. Smart contracts are code-based agreements that execute automatically and can be vulnerable to programming errors or hacks. If there is a flaw in the 1inch smart contracts, it could lead to financial losses for investors.

Regulatory risk is another important factor to consider when investing in 1inch. As the DeFi space continues to evolve, governments around the world are starting to take notice and may introduce regulations that could impact the operation of platforms like 1inch. These regulations could restrict access to certain features or increase compliance costs, potentially affecting the value and usability of 1inch.

Lastly, it’s important to consider the risk of impermanent loss when providing liquidity on the 1inch platform. Impermanent loss occurs when the value of the tokens you provide as liquidity fluctuates significantly compared to holding them in your own wallet. This can result in a lower return on investment or even losses.

Overall, investing in 1inch DeFi offers potential rewards, but it’s crucial to be aware of the risks involved. By understanding and considering these risk factors, investors can make informed decisions and take appropriate measures to mitigate potential losses.

What Investors Need to Consider

When considering investing in 1inch DeFi, there are several important risk factors that investors should take into account:

| 1. Market Volatility: | Like other cryptocurrencies, 1inch DeFi is subject to market fluctuations and volatility. Investors should be prepared for the potential for significant price swings and should only invest what they can afford to lose. |

| 2. Smart Contract Vulnerabilities: | As with any decentralized finance project, there is always a risk of smart contract vulnerabilities. Investors should do their due diligence and assess the security measures in place to mitigate these risks. |

| 3. Regulatory Uncertainty: | The regulatory landscape surrounding DeFi is still evolving and uncertain. Investors should keep abreast of any regulatory developments that could impact the 1inch DeFi platform and their investments. |

| 4. Liquidity Risks: | The liquidity of the 1inch DeFi protocol is dependent on user participation and market conditions. If there is a lack of liquidity, it may impact the ability to buy or sell tokens at desired prices. |

| 5. Governance Risks: | 1inch DeFi operates on a decentralized governance model, which means that decisions regarding protocol upgrades and changes are made through a voting process. Investors should consider the potential risks associated with the governance structure and the influence of major stakeholders. |

| 6. Team and Community: | The strength and experience of the team behind the 1inch DeFi project, as well as the size and engagement of the community, can play a significant role in the success and stability of the platform. Investors should assess these factors before making investment decisions. |

Overall, investing in 1inch DeFi or any other decentralized finance project carries inherent risks. It is important for investors to conduct thorough research, seek expert advice, and only invest what they are willing to lose.

Evaluating the Security Risks:

When considering investing in 1inch DeFi, it is important to carefully evaluate the potential security risks involved. While the platform offers various benefits such as decentralized trading and high returns, it is vital to be aware of the following risks:

1. Smart Contract Vulnerabilities: Like any other DeFi project, 1inch DeFi operates on smart contracts. These contracts, while designed to be secure, are not immune to vulnerabilities. It is crucial to thoroughly assess the code and security measures implemented by 1inch DeFi to ensure the safety of your investments.

2. Cybersecurity Threats: As decentralized platforms gain popularity, they also attract the attention of hackers and cybercriminals. It is essential to evaluate the cybersecurity measures in place to protect users’ funds and personal information. Look for audits conducted by reputable firms and ensure that the platform implements best practices such as multi-factor authentication and cold storage for user assets.

3. Liquidity Risks: While decentralized exchanges provide greater liquidity compared to traditional exchanges in many cases, there is always a risk of insufficient liquidity. This can result in slippage and impact the efficiency of your trades. Always consider the liquidity of the market and evaluate the potential impact on your investment strategy.

4. Regulatory Risks: The regulatory landscape surrounding cryptocurrencies and DeFi projects is still evolving. Changes in regulations or the introduction of new laws could impact the operations of 1inch DeFi and other similar platforms. Stay informed about the regulatory environment and be prepared to adapt your investment strategy accordingly.

5. Market Volatility: Just like any other investment, the value of assets on 1inch DeFi can fluctuate significantly. Market volatility can result in rapid and unexpected price changes, potentially leading to losses. It is crucial to carefully consider your risk tolerance and diversify your investments to mitigate the impact of market volatility.

Before investing in 1inch DeFi or any other DeFi project, make sure to conduct thorough research, consider the risks involved, and consult with a financial advisor if necessary. Understanding and evaluating these security risks can help you make informed investment decisions and protect your assets in the decentralized finance space.

Assessing the Volatility:

Volatility is a critical factor to consider when analyzing the risk associated with investing in 1inch DeFi. The price of cryptocurrencies, including the 1inch token, can experience significant fluctuations in a short period.

It is essential to assess the historical price movements of 1inch and understand the factors that can influence its volatility. Factors such as market sentiment, regulatory changes, technological advancements, and competition can all contribute to price swings.

Investors should also consider the overall market volatility of the cryptocurrency industry. Cryptocurrencies, as a whole, are known for their high volatility, which can increase the risk of investing in 1inch or any other digital asset.

Furthermore, it is crucial to evaluate the liquidity of the 1inch token. Low liquidity can exacerbate price volatility, making it challenging to buy or sell tokens at desired prices. In contrast, higher liquidity can help stabilize prices and reduce the risk of sudden price drops or spikes.

Additionally, investors should analyze the trading volume of 1inch. Higher trading volume generally indicates a more liquid market, reducing the risk of significant price fluctuations due to individual trades.

It is also essential to consider factors specific to the decentralized finance (DeFi) sector. DeFi projects, including 1inch, can be influenced by the overall sentiment towards DeFi, security breaches, smart contract vulnerabilities, and regulatory changes targeted at the industry.

Investors should conduct thorough research and stay updated on the latest news and developments in the DeFi space to assess the potential impact on 1inch’s volatility and associated risks.

In conclusion, assessing the volatility of 1inch DeFi is crucial for investors to understand and mitigate the potential risks. By considering historical price movements, market factors, overall industry volatility, liquidity, trading volume, and DeFi-specific risks, investors can make informed decisions and manage their investment portfolios effectively.

Examining the Market Liquidity:

Market liquidity is an important factor to consider when analyzing the risk factors of 1inch DeFi. Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. In the case of 1inch, market liquidity determines how easily users can trade their assets on the platform.

There are several aspects to consider when examining the market liquidity of 1inch DeFi:

- Trading Volume: One of the key indicators of market liquidity is the trading volume on the platform. Higher trading volume indicates more active trading and higher liquidity. Investors should examine the historical trading volume of 1inch and compare it to other decentralized exchanges to determine its liquidity.

- Order Book Depth: The order book depth measures the number of buy and sell orders at different price levels. A deeper order book indicates higher market liquidity as it means there are more market participants willing to buy or sell at different price levels. Investors should look at the depth of the order book on 1inch to assess its liquidity.

- Slippage: Slippage refers to the difference between the expected price of a trade and the actual executed price. In a liquid market, slippage is minimal as there are enough buyers and sellers to match orders at the desired price. Investors should consider the slippage on 1inch to evaluate its market liquidity.

- Market Maker Programs: Market maker programs are initiatives that incentivize liquidity providers to add liquidity to the market by providing buy and sell orders. These programs can significantly impact market liquidity on 1inch. Investors should assess the presence and effectiveness of market maker programs on the platform.

By examining these aspects of market liquidity, investors can gain insights into the risk factors associated with trading on 1inch DeFi. It is important to understand the level of liquidity on the platform as it can impact the ease of trading, price stability, and overall user experience.

Question-answer:

What is 1inch DeFi?

1inch DeFi is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trade execution.

How does 1inch DeFi work?

1inch DeFi scans multiple decentralized exchanges to find the most economical swap across all liquidity sources and split trades across multiple platforms to minimize slippage and maximize returns for users.

What are the risk factors associated with investing in 1inch DeFi?

Investing in 1inch DeFi carries a number of risk factors such as smart contract vulnerabilities, price volatility, regulatory uncertainty, and market manipulation.

How can investors mitigate the risks associated with 1inch DeFi?

Investors can mitigate the risks associated with 1inch DeFi by conducting thorough due diligence, diversifying their investments, using reputable platforms, and staying informed about the latest developments and security practices in the DeFi space.