Welcome to the forefront of decentralized finance (DeFi) on the Ethereum blockchain! With 1inch, you can explore the vast possibilities of this thriving ecosystem and unlock unprecedented opportunities.

1inch is your compass in the decentralized finance landscape. By harnessing the power of Ethereum’s smart contracts, it connects you to a world of innovative protocols, liquidity pools, and yield farms, all in one place.

Discover the best exchange rates, zero-fee trades, and low slippage with 1inch. Whether you’re a trader looking for the best price or a liquidity provider seeking high returns, our intelligent routing algorithm ensures you get the most out of your transactions.

With 1inch, you can also participate in exciting opportunities like yield farming and staking, earning passive income on your assets. Seamlessly navigate through various DeFi platforms and leverage multiple strategies with ease.

Stay ahead of the curve and tap into the potential of decentralized finance with 1inch. Empower yourself with financial sovereignty, transparency, and security, all while enjoying a user-friendly experience.

Join us on 1inch and unlock the endless possibilities of decentralized finance on Ethereum today!

The rise of decentralized finance

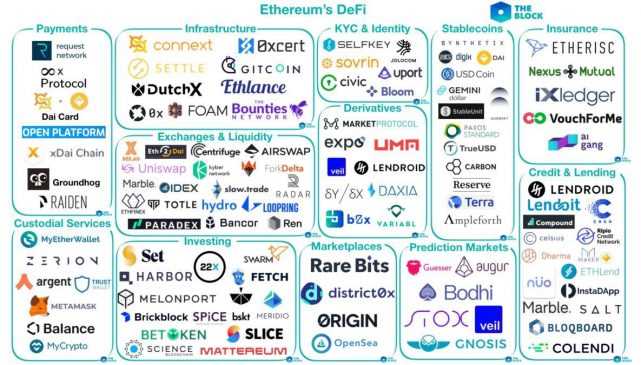

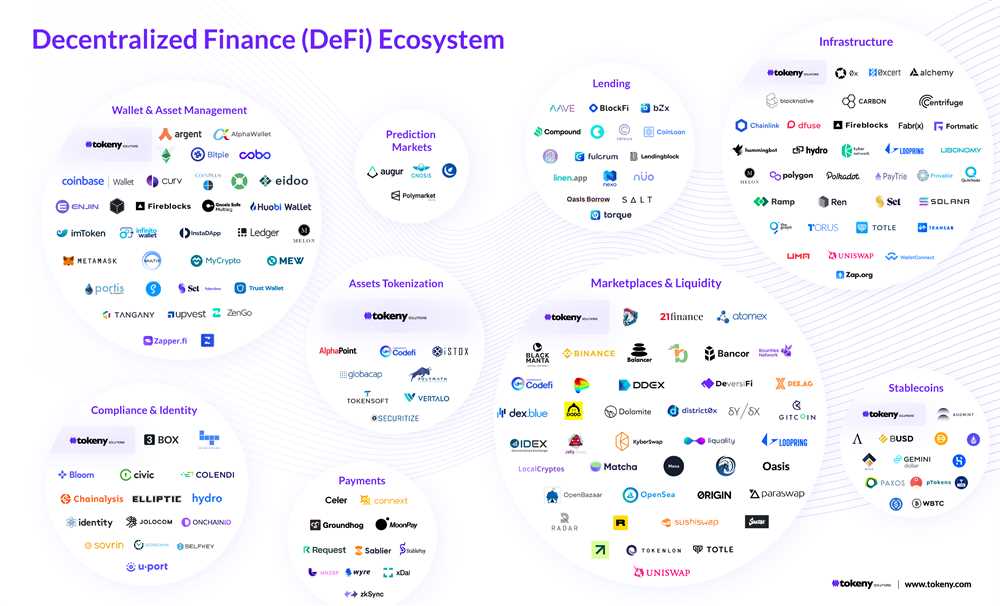

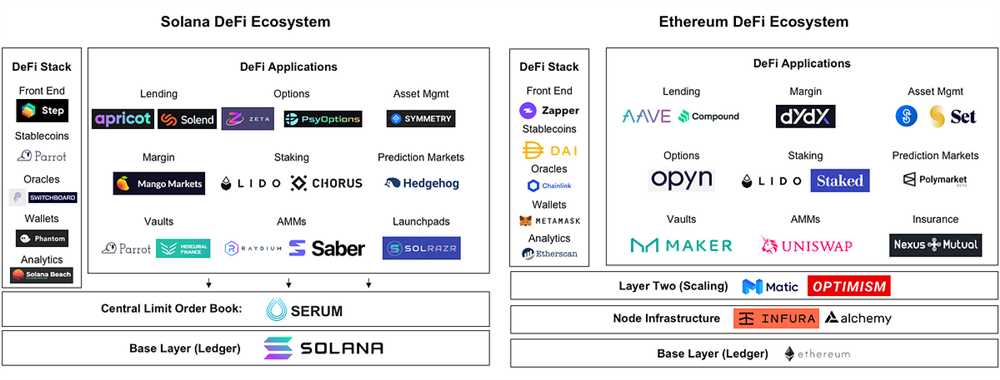

The rise of decentralized finance, also known as DeFi, has been one of the most significant trends in the world of finance in recent years. DeFi refers to the use of blockchain technology, specifically Ethereum, to recreate traditional financial instruments and services in a decentralized, transparent, and automated manner.

Decentralized finance aims to eliminate the need for intermediaries, such as banks, by relying on smart contracts and decentralized applications (dApps). This allows users to have direct control over their funds and access financial services without the restrictions imposed by traditional financial systems.

One of the key advantages of decentralized finance is its ability to provide financial services to the unbanked and underbanked populations around the world. With DeFi, anyone with an internet connection can participate in lending, borrowing, trading, and other financial activities, regardless of their location or socioeconomic status.

Additionally, decentralized finance offers increased security and privacy. Transactions on the blockchain are recorded in a transparent and immutable manner, reducing the risk of fraud and manipulation. By eliminating the need for intermediaries, users can also maintain control over their personal data and financial information.

1inch, a decentralized exchange aggregator built on Ethereum, is at the forefront of the decentralized finance movement. By combining multiple decentralized exchanges, 1inch provides users with the best possible trading rates and low slippage. With 1inch, navigating the decentralized finance landscape becomes seamless and efficient.

In conclusion, the rise of decentralized finance has the potential to revolutionize the financial industry. By offering greater accessibility, security, and privacy, DeFi opens up new opportunities for individuals around the world. With platforms like 1inch, users can confidently embrace the decentralized finance revolution on Ethereum.

Importance of efficient protocols

Efficient protocols are crucial in the decentralized finance landscape to ensure smooth and cost-effective transactions. With the rise of blockchain technology and the increasing adoption of decentralized applications (DApps), efficient protocols are becoming more important than ever.

One of the key benefits of efficient protocols is their ability to streamline and automate processes, reducing the need for intermediaries and increasing transaction speed. By eliminating unnecessary steps and middlemen, efficient protocols enable users to interact directly with the decentralized finance ecosystem, resulting in faster and more efficient transactions.

Moreover, efficient protocols can significantly reduce transaction fees, making decentralized finance more accessible and affordable for a wider range of users. High transaction fees have been a major concern in the crypto space, often hindering the adoption of decentralized finance by everyday users. By optimizing the protocols, transaction fees can be minimized, making it more feasible for users to participate in the decentralized finance ecosystem.

Enhanced security and trust

Efficient protocols also play a crucial role in enhancing security and trust within the decentralized finance landscape. With robust and efficient protocols in place, users can have confidence that their transactions are secure and their funds are protected.

Decentralized finance protocols rely on advanced cryptographic techniques to ensure the integrity and immutability of transactions. Efficient protocols can further strengthen these security measures, making it harder for malicious actors to manipulate or tamper with the decentralized finance ecosystem.

Scalability and interoperability

Another important aspect of efficient protocols is their ability to enhance scalability and interoperability within the decentralized finance landscape. With the growing popularity of decentralized finance, it is essential for protocols to be able to handle a high volume of transactions without compromising performance.

Efficient protocols can also facilitate interoperability between different decentralized finance platforms and blockchains. This interoperability allows users to seamlessly transfer assets and liquidity across different decentralized applications, opening up a world of possibilities for decentralized finance.

In conclusion, efficient protocols are essential to navigating the decentralized finance landscape effectively. They enable faster transactions, reduce transaction fees, enhance security and trust, and promote scalability and interoperability. As decentralized finance continues to evolve and mature, the importance of efficient protocols will only grow, shaping the future of finance.

Navigating the DeFi landscape

Decentralized Finance, or DeFi, has emerged as one of the most exciting and innovative sectors in the blockchain industry. With its potential to transform traditional financial systems and provide greater access to financial services, navigating the DeFi landscape is crucial for anyone looking to leverage its benefits.

Understanding DeFi

DeFi refers to a set of financial applications and protocols that operate on decentralized networks, primarily on the Ethereum blockchain. These platforms aim to recreate and improve upon traditional financial instruments, such as lending, borrowing, trading, and investing, but with the added benefits of transparency and disintermediation.

The core idea behind DeFi is to eliminate the need for intermediaries, such as banks or brokers, and enable peer-to-peer transactions through smart contracts. This not only reduces costs but also enhances security and efficiency by removing single points of failure and censorship.

The Role of 1inch

1inch is a decentralized exchange aggregator that plays a vital role in navigating the DeFi landscape. It allows users to find the best prices and execute trades across multiple decentralized exchanges seamlessly.

By using advanced algorithms and smart contract technology, 1inch ensures that users get the best possible rates for their trades. It scans multiple liquidity pools, taking into account gas fees and slippage, to optimize trade execution and minimize costs.

Additionally, 1inch offers a unique feature called “Chi Gastoken,” which enables users to save on gas fees by reducing the overall cost of their transactions. This can significantly enhance the overall user experience and make DeFi more accessible to a wider audience.

In conclusion, navigating the DeFi landscape requires an understanding of its underlying principles and the tools available to interact with this emerging ecosystem. With its advanced algorithms and gas-saving features, 1inch is an invaluable tool for anyone looking to navigate the decentralized finance landscape on Ethereum.

Understanding the role of decentralized exchanges

In the world of decentralized finance (DeFi), decentralized exchanges (DEXs) play a crucial role in enabling users to trade digital assets in a trustless and secure manner. Unlike traditional centralized exchanges, which rely on intermediaries to facilitate transactions, decentralized exchanges operate on blockchain technology, allowing users to trade directly with each other without the need for a middleman.

What are decentralized exchanges?

Decentralized exchanges are platforms that allow users to trade cryptocurrencies and other digital assets directly with each other. These exchanges are built on blockchain networks and are designed to eliminate the need for a central authority to manage and execute trades.

Through the use of smart contracts, decentralized exchanges ensure that transactions are executed automatically and without the need for intermediaries. This not only makes the trading process more efficient but also reduces the risk of hacks, fraud, and censorship.

The advantages of decentralized exchanges

There are several advantages to using decentralized exchanges:

1. Security: By eliminating the need for a central authority, decentralized exchanges significantly reduce the risk of hacks and theft. Since funds are held in user-controlled wallets, there is no central point of failure that hackers can target.

2. Privacy: Decentralized exchanges prioritize privacy by allowing users to trade without the need for KYC (Know Your Customer) verification. This ensures that users can maintain their anonymity while engaging in transactions.

3. Trustlessness: Decentralized exchanges operate on blockchain technology, which means that transactions are executed automatically and without the need for trust in a central authority. The use of smart contracts ensures that trades are executed as agreed upon, eliminating the need to trust the counterparty.

4. Liquidity: Many decentralized exchanges operate on liquidity pools, which allow users to trade directly with the pool rather than relying on individual buyers and sellers. This ensures that there is always liquidity available for trading, making it easier and faster to execute trades.

Overall, decentralized exchanges are revolutionizing the way we trade digital assets by providing a secure, efficient, and trustless environment for users to engage in transactions. With the rise of decentralized finance, the role of decentralized exchanges in the cryptocurrency ecosystem is only set to grow.

Exploring the benefits of 1inch on Ethereum

1inch is a decentralized exchange aggregator and a liquidity protocol that operates on the Ethereum blockchain. In the dynamic world of decentralized finance (DeFi), 1inch provides users with various benefits that enhance their trading experience.

Efficiency and Cost-Effectiveness

One of the key benefits of using 1inch on Ethereum is its efficiency in finding the best possible trade routes across multiple decentralized exchanges. By leveraging its smart contract technology and algorithm, 1inch ensures users get the most optimal prices and lowest slippage for their trades. This results in reduced costs and maximized profits for traders.

Superior Liquidity Options

1inch aggregates liquidity from various decentralized exchanges, enabling users to access a vast pool of assets and liquidity sources. This opens up a world of possibilities and enhances the liquidity options available to traders, ensuring they can execute trades even for illiquid assets without suffering from high slippage or lack of liquidity.

Moreover, 1inch integrates with leading decentralized liquidity protocols like Uniswap, SushiSwap, and Balancer, allowing users to tap into their respective liquidity pools. This integration further enhances the liquidity options and depth available on the 1inch platform.

Smart Contract Security

As a protocol built on Ethereum, 1inch benefits from the robust security provided by the Ethereum blockchain. 1inch’s smart contracts undergo thorough security audits by top firms, ensuring the system is safe and reliable for users. This focus on security and trustworthiness gives users peace of mind when interacting with the 1inch protocol.

| Benefits | Description |

|---|---|

| Optimal Trading Routes | 1inch finds the best possible trade routes, resulting in reduced costs and higher profits. |

| Diverse Liquidity Options | 1inch aggregates liquidity from multiple sources, giving users access to a wide range of assets and liquidity. |

| Integration with Leading Protocols | 1inch integrates with popular liquidity protocols, enhancing the liquidity options available to users. |

| Smart Contract Security | 1inch’s smart contracts undergo rigorous security audits, ensuring the safety and reliability of the platform. |

Question-answer:

What is decentralized finance?

Decentralized finance, also known as DeFi, refers to financial applications and platforms that are built on blockchain technology and operate without intermediaries. It aims to provide users with greater control over their finances, eliminate the need for traditional financial institutions, and enable permissionless access to financial services.

What is 1inch?

1inch is a decentralized exchange aggregator that searches multiple liquidity sources to find the most efficient trading routes for users. It splits user trades across different decentralized exchanges to optimize for price and minimize slippage. It also provides liquidity and trading opportunities across various platforms in the decentralized finance landscape.

How does 1inch work on Ethereum?

1inch on Ethereum interacts with different decentralized exchanges like Uniswap, Kyber Network, and Balancer to find the best possible trading routes for users. When a user wants to make a trade, 1inch compares prices across multiple exchanges and splits the trade into smaller parts to find the most favorable rates. By doing so, it helps users save money on fees and achieve better trading outcomes.