The 1inch DEX (Decentralized Exchange) has rapidly gained popularity in the decentralized finance (DeFi) space for its innovative features and unique approach to liquidity aggregation. The 1inch team recently released their detailed whitepaper, which provides a comprehensive overview of the platform’s architecture, protocols, and governance mechanism. In this in-depth review, we will dive into the key features outlined in the whitepaper, exploring how 1inch differentiates itself from other decentralized exchanges.

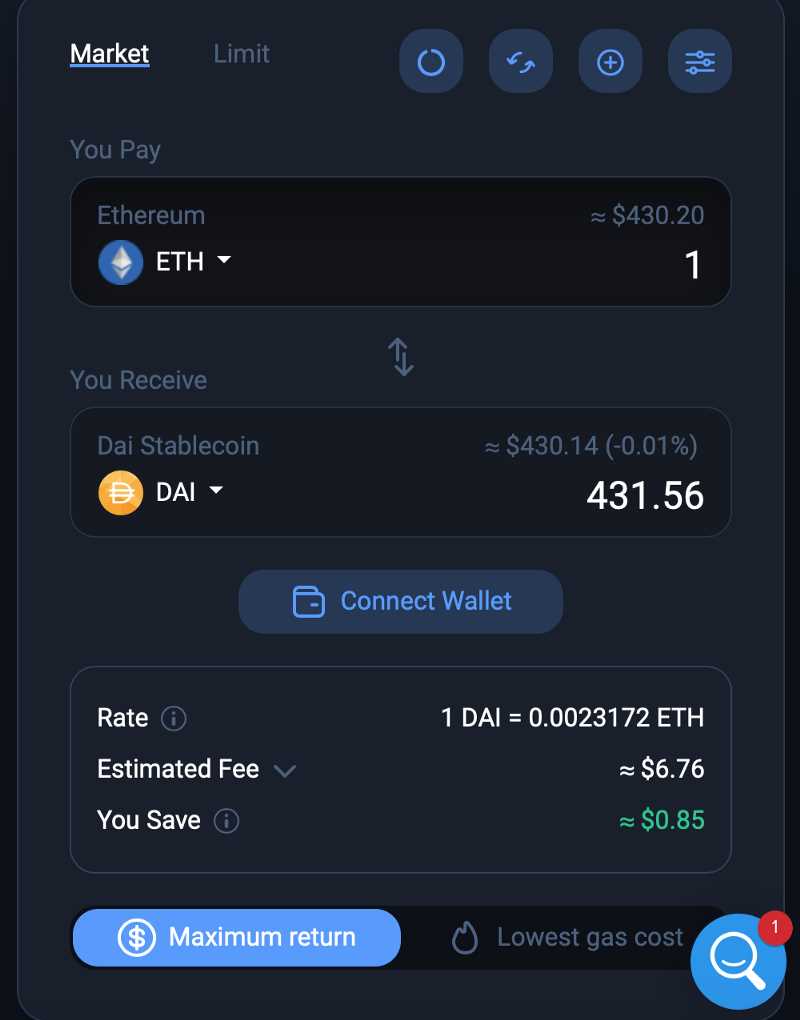

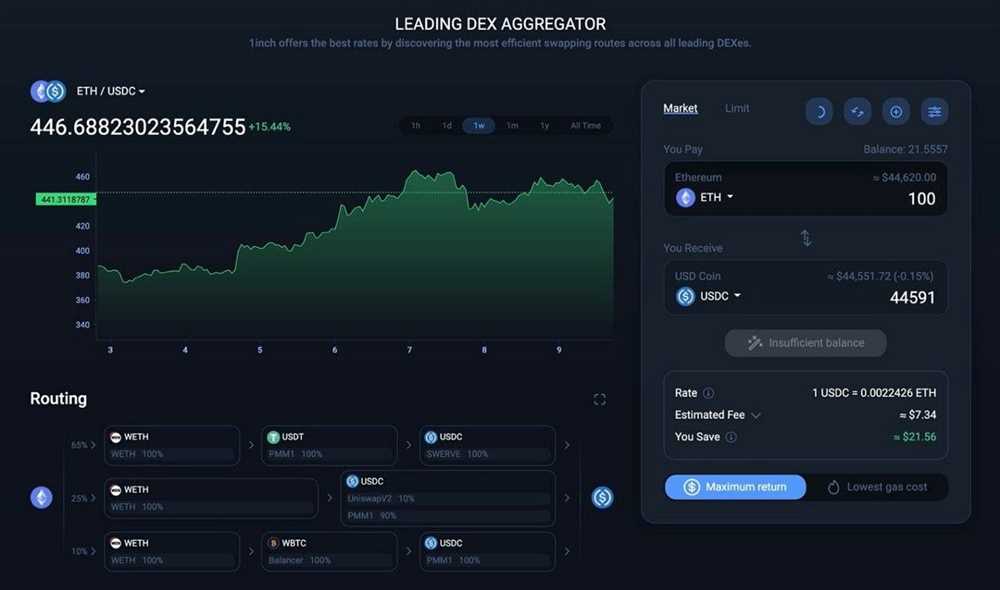

One of the standout features of 1inch DEX is its Pathfinder algorithm, which optimizes the path for token swaps across multiple liquidity sources. Unlike traditional decentralized exchanges that rely on a single liquidity source, 1inch uses intelligent routing to split and aggregate liquidity from various decentralized exchanges, liquidity pools, and lending protocols. This algorithm ensures users get the best possible rates for their token swaps, even in highly fragmented markets. The whitepaper provides a detailed explanation of how the Pathfinder algorithm works, allowing users to gain a deeper understanding of the technology behind 1inch DEX.

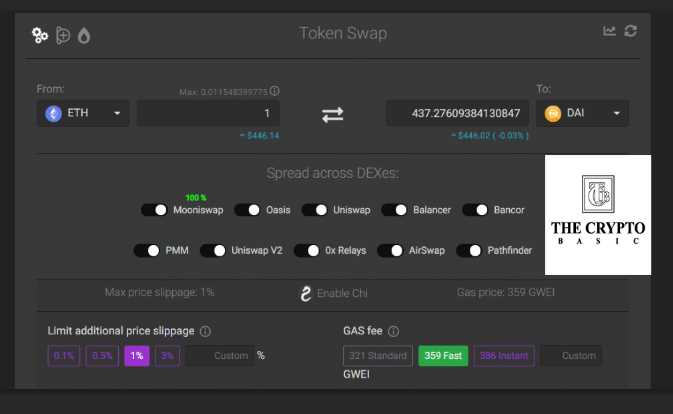

In addition to liquidity aggregation, 1inch DEX also offers a unique feature called “Chi Gastoken.” This feature allows users to save on transaction fees when interacting with the Ethereum network. By converting gas fees into CHI tokens, users can lock in gas at a lower price and use it for future transactions within a specific timeframe. The whitepaper provides a comprehensive analysis of Chi Gastoken, discussing its benefits and potential use cases within the DeFi ecosystem.

Furthermore, the 1inch whitepaper introduces the concept of “Instant Governance,” a decentralized governance mechanism that gives 1inch tokenholders the power to make important decisions regarding the platform’s development and future upgrades. The whitepaper outlines the governance model and the role of the 1inch token (1INCH) in the decision-making process. This innovative governance structure enhances decentralization and community involvement, setting 1inch apart from other DeFi platforms in terms of self-sustainability and long-term development.

Overview of the 1inch Whitepaper

The 1inch whitepaper provides a comprehensive analysis of the 1inch DEX protocol and its distinguishing features. The document outlines the key aspects of the platform, including its core functionalities, architecture, and governance model.

Core Functionalities

The whitepaper begins by explaining the core functionalities of 1inch DEX. It highlights that the protocol enables users to access the best available prices for trades across multiple decentralized exchanges (DEXs). By using various liquidity sources and smart contract algorithms, it aims to minimize slippage and provide users with optimal trade execution.

Additionally, the whitepaper describes the functionality of 1inch Aggregation Protocol, which allows users to execute large trades across different liquidity sources. It provides an overview of the algorithm used and explains how it balances trade-offs between gas costs and price impact.

Architecture

The whitepaper also delves into the architecture of the 1inch DEX protocol. It outlines the various components such as smart contracts, oracles, and the off-chain API. It explains how these components work together to ensure efficient and reliable trade execution.

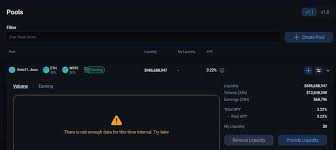

Furthermore, the whitepaper explains the role of the 1inch Liquidity Protocol, which enables liquidity providers to earn fees by contributing liquidity to the platform. It discusses the algorithm used to distribute fees among liquidity providers and how it incentivizes them to provide competitive liquidity.

Governance Model

The whitepaper concludes by detailing the governance model of 1inch DEX. It describes the role of the 1inch DAO (Decentralized Autonomous Organization) and its decision-making process. It also explains the 1inch token and how it can be used for voting and participating in the governance of the protocol.

Overall, the 1inch whitepaper offers a comprehensive overview of the platform, detailing its core functionalities, architecture, and governance model. It provides valuable insights into the unique features of 1inch DEX, making it a must-read for anyone interested in decentralized finance and liquidity aggregation.

Differentiating Features of 1inch DEX

The 1inch DEX is a decentralized exchange (DEX) that offers several unique features that set it apart from other DEXs in the market. These differentiating features include:

1. Aggregation Algorithm

One of the key features of 1inch DEX is its aggregation algorithm, which automatically splits the user’s trade across multiple DEXs to find the best possible trading route. This algorithm takes into account factors such as liquidity, price, and slippage, ensuring that users always get the best trading rate.

2. Gas Optimization

Gas fees are a common concern for users of decentralized exchanges. 1inch DEX addresses this issue by implementing a gas optimization feature, which minimizes the amount of gas required for each transaction. This not only reduces transaction costs but also improves the overall efficiency of the platform.

3. Smart Contract Security

Security is of paramount importance in the world of decentralized finance. 1inch DEX utilizes various measures to ensure the security of its smart contracts. These measures include audits by reputable security firms and the implementation of a bug bounty program, which incentivizes users to identify and report any vulnerabilities.

4. Liquidity Aggregation

1inch DEX offers liquidity aggregation, which allows users to access liquidity from multiple DEXs through a single interface. This significantly improves the liquidity available for trading and reduces slippage. Users can enjoy the benefits of lower fees and better trade execution on the platform.

Overall, the differentiating features of 1inch DEX make it an attractive choice for traders and investors in the decentralized finance space. Its aggregation algorithm, gas optimization, smart contract security, and liquidity aggregation contribute to an enhanced trading experience and improved outcomes for users.

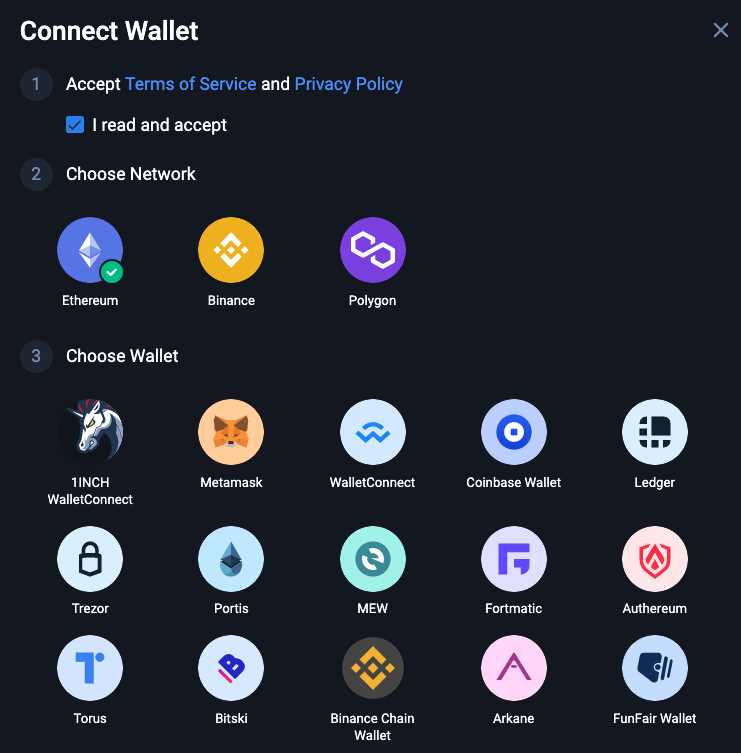

Decentralization and Trustless Trading

One of the key features of the 1inch DEX is its commitment to decentralization and trustless trading. Unlike traditional centralized exchanges, 1inch operates entirely on the Ethereum blockchain, meaning that all transactions and trades are executed directly between users, without the need for an intermediary.

This decentralized nature eliminates the risk of a single point of failure or censorship, as there is no central authority controlling the platform. Instead, the 1inch DEX relies on smart contracts to facilitate trades, ensuring that transactions are executed exactly as intended and without any possibility of manipulation or fraud.

Furthermore, 1inch utilizes an efficient aggregation algorithm that scans multiple decentralized exchanges to find the best possible prices for users. This algorithm takes into account factors such as liquidity, slippage, and gas costs, optimizing trades to provide users with the most favorable outcomes.

Users of the 1inch DEX can also benefit from increased liquidity, as the platform aggregates liquidity from various sources. This means that traders are not limited to the liquidity of a single exchange but can access a larger pool of funds, resulting in better trade execution and reduced price volatility.

Overall, the decentralized and trustless nature of the 1inch DEX provides users with increased security, transparency, and control over their funds. By eliminating the need for intermediaries and relying on smart contracts, 1inch enables truly peer-to-peer trading that is resistant to censorship and manipulation.

Analysis of the 1inch Whitepaper

The 1inch whitepaper provides a comprehensive overview of the various features and functionalities of the 1inch DEX, highlighting its unique differentiating factors. The whitepaper begins by explaining the problem of fragmented liquidity in decentralized exchanges (DEXs) and the inefficiencies associated with it.

The whitepaper then introduces the concept of an Automated Market Maker (AMM) and its role in providing liquidity to DEXs. It explains how the 1inch DEX leverages multiple AMMs to aggregate liquidity from various sources and execute trades at the best available prices. This innovative approach is a key differentiator for 1inch, as it allows users to access the deepest liquidity pools and get the most favorable rates.

Another notable feature highlighted in the whitepaper is the 1inch DEX’s gas optimization mechanism. Gas fees are a major concern in the Ethereum ecosystem, and the whitepaper outlines the various strategies employed by 1inch to reduce gas costs for users. These include batched execution, optimal gas price selection, and on-chain governance decisions. By minimizing gas fees, 1inch aims to make decentralized trading more accessible to a wider audience.

The whitepaper also discusses the importance of security and transparency in decentralized finance (DeFi) protocols. It highlights the 1inch DEX’s commitment to security practices, such as third-party audits and bug bounties, to ensure that user funds are protected. The transparency aspect is addressed through the use of on-chain data and open-source code, which allows users to independently verify the platform’s operations.

Furthermore, the whitepaper dives into the governance model of 1inch and its token, the 1INCH token. It explains how the token is used for decentralized governance and decision-making, rewarding liquidity providers, and participating in the platform’s future upgrades. The whitepaper emphasizes the decentralized nature of 1inch’s governance, where no single entity holds the power to make unilateral decisions, ensuring a fair and inclusive ecosystem.

In conclusion, the 1inch whitepaper provides a detailed analysis of the differentiating features of the 1inch DEX. From its innovative approach to liquidity aggregation and gas optimization to its commitment to security and transparency, the whitepaper showcases the strengths and unique offerings of the 1inch DEX. The governance model and the use of the 1INCH token further enhance the decentralized nature of the platform. Overall, the whitepaper serves as a valuable resource for gaining a comprehensive understanding of the 1inch DEX and its potential impact on the decentralized finance space.

Efficiency and Cost-Effectiveness

One of the key differentiating features of the 1inch DEX is its efficiency and cost-effectiveness. The team behind 1inch has designed and implemented a unique algorithm that aggregates liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trading rates.

The 1inch algorithm takes into account factors such as liquidity pools, trading fees, and gas prices to ensure that users can execute trades at the most favorable rates. By aggregating liquidity from multiple DEXs, 1inch minimizes slippage and maximizes the efficiency of trades.

In addition to its efficient trading algorithm, 1inch also offers cost-effective trading fees. The platform charges a competitive fee of 0.3% per trade, which is lower than many other DEXs in the market. This cost-effectiveness allows users to save on trading fees and maximize their returns.

Gas Optimization

Gas optimization is another key aspect of the efficiency of the 1inch DEX. Gas refers to the computational cost of executing transactions on the Ethereum network. High gas prices can significantly impact the cost-effectiveness of trades.

The 1inch team has implemented several strategies to optimize gas usage. Firstly, they use a process called “gas tokenization” to offset gas costs. This allows users to pay for gas in advance and lock in lower gas prices. Additionally, the 1inch algorithm considers gas prices when selecting the optimal trading route, further reducing gas costs for users.

By prioritizing efficiency and cost-effectiveness, 1inch aims to provide users with a seamless trading experience and maximize their returns on investment.

Question-answer:

What is the main purpose of the 1inch DEX?

The main purpose of the 1inch DEX is to provide users with the best possible prices and high liquidity by aggregating multiple decentralized exchanges.

How does 1inch achieve the best prices for users?

1inch achieves the best prices for users by splitting their orders across different decentralized exchanges, finding the most optimal trading routes and accessing the deepest liquidity pools.

What are the differentiating features of 1inch DEX?

The differentiating features of 1inch DEX include the Pathfinder algorithm, which automatically finds the best paths for trades, the Chi GasToken, which reduces transaction fees, and the Liquidity Protocol, which allows users to earn fees on their idle assets.