1inch tokens have gained significant attention in the cryptocurrency market due to their potential for high returns. As more investors are becoming interested in this promising digital asset, it is important to choose the right platform for buying and trading 1inch tokens.

One of the top platforms for buying 1inch tokens is Binance. Binance offers a user-friendly interface and a wide range of trading pairs, allowing investors to easily trade 1inch tokens with other cryptocurrencies. Additionally, Binance has a high liquidity, ensuring that investors can buy and sell 1inch tokens at competitive prices.

Another popular platform for buying 1inch tokens is Coinbase. Coinbase is known for its strong security measures, ensuring that investors’ funds are protected. The platform also offers a simple and intuitive interface, making it easy for beginners to buy and trade 1inch tokens. Coinbase also provides a mobile app, allowing investors to buy and monitor their 1inch tokens on the go.

While Binance and Coinbase are both reliable platforms for buying 1inch tokens, they do have their own pros and cons. Binance offers a wider range of trading pairs and has lower fees compared to Coinbase. On the other hand, Coinbase provides a more user-friendly interface and stronger security measures.

Ultimately, the choice of platform for buying 1inch tokens depends on the investor’s preferences and priorities. It is important to consider factors such as fees, security, and user experience before making a decision. By carefully evaluating the pros and cons of each platform, investors can make an informed choice and maximize their investment in 1inch tokens.

Pros of Buying 1inch Tokens

1. Access to Decentralized Exchange Aggregation: Owning 1inch tokens allows you to access the platform’s decentralized exchange (DEX) aggregation services. This gives you access to the best prices and liquidity across various Ethereum-based DEXs, ensuring efficient and cost-effective trading.

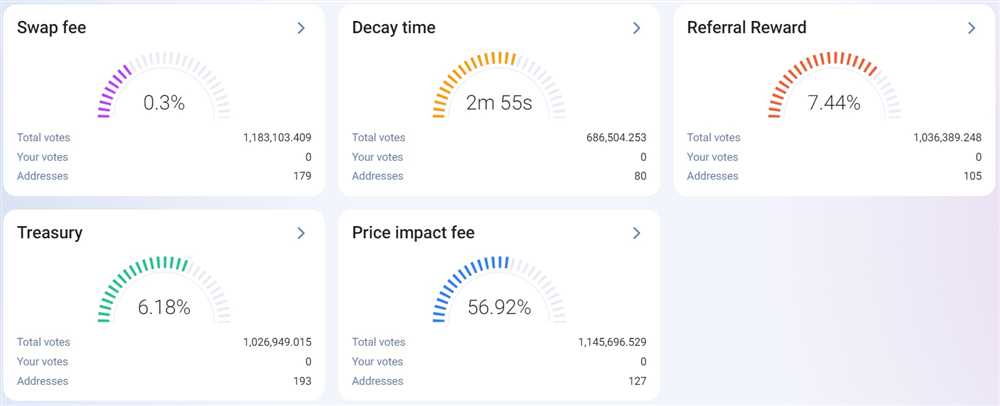

2. Governance Rights: By owning 1inch tokens, you become a part of the 1inch community and gain governance rights. This means you have the power to vote on important decisions related to the platform’s development and future upgrades. Your opinion counts and can shape the direction of the project.

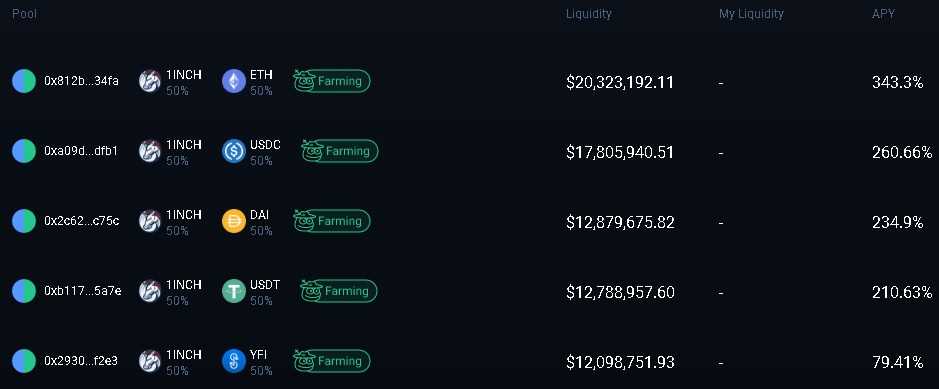

3. Liquidity Provider Incentives: 1inch offers liquidity provider incentives, which means that by owning 1inch tokens and providing liquidity to the platform, you can earn rewards. These rewards can come in the form of additional tokens or a share of the platform’s trading fees. This provides an opportunity to earn passive income while contributing to the liquidity of the platform.

4. Potential for Token Appreciation: As with any investment, there is the potential for the value of 1inch tokens to appreciate over time. If the platform continues to gain traction and attract users, the demand for 1inch tokens may increase, leading to a rise in their value. This could result in capital gains for token holders.

5. Exposure to the DeFi Ecosystem: Buying 1inch tokens gives you exposure to the decentralized finance (DeFi) ecosystem. As one of the leading DEX aggregators, 1inch is closely tied to the DeFi space and its developments. By owning 1inch tokens, you can stay updated and be part of the growth and innovation happening in the DeFi industry.

6. Diversification of Crypto Portfolio: Adding 1inch tokens to your crypto portfolio offers diversification. Owning tokens from various projects and platforms can help spread the risk and potentially increase the overall performance of your portfolio. Including 1inch tokens can provide exposure to the DEX aggregation space, which is an increasingly important part of the crypto ecosystem.

7. Early Adopter Benefits: As an early adopter of 1inch tokens, you may enjoy additional benefits. Early supporters of a project often have opportunities to access exclusive features, participate in airdrops, or receive special rewards. By getting involved early, you can potentially take advantage of these incentives and rewards.

Overall, buying 1inch tokens offers access to decentralized exchange aggregation, governance rights, liquidity provider incentives, the potential for token appreciation, exposure to the DeFi ecosystem, portfolio diversification, and potential early adopter benefits. It is important to carefully consider the risks and rewards before investing in any cryptocurrency.

Profit Potential

Investing in 1inch tokens can offer significant profit potential as the platform continues to grow and expand its user base. As 1inch is one of the leading decentralized exchanges, the demand for its tokens is likely to increase over time.

One of the main factors driving the profit potential of 1inch tokens is the increasing adoption of decentralized finance (DeFi). As more users join the DeFi space, the demand for liquidity and trading platforms like 1inch will continue to grow. This increased demand can drive up the value of 1inch tokens, providing investors with a potential return on their investment.

In addition, as the 1inch platform expands its offerings and introduces new features, it may attract more users and increase its market share. This can contribute to the growth of the 1inch token value and potentially generate profits for investors.

However, it’s important to note that investing in cryptocurrencies comes with risks, and the value of 1inch tokens can be volatile. The cryptocurrency market is known for its price fluctuations, and investors should carefully consider their risk tolerance before investing in 1inch tokens.

Overall, investing in 1inch tokens can offer profit potential, especially with the increasing demand for decentralized exchanges and the growth of the DeFi space. However, individuals should conduct thorough research and seek professional advice before making any investment decisions.

Access to Advanced DeFi Features

By buying 1inch tokens, users gain access to advanced decentralized finance (DeFi) features provided by various platforms. These features include:

1. Liquidity Aggregation: 1inch integrates with multiple decentralized exchanges (DEXs) to provide users with the best possible rates for their trades. Users can access high liquidity pools across different platforms, optimizing their trading experience.

2. Automated Market Making: 1inch offers automated market making capabilities, allowing users to create liquidity pools and earn fees by providing liquidity to these pools. This feature is particularly attractive to those looking to generate passive income in the DeFi space.

3. Yield Farming: 1inch tokens enable users to participate in yield farming strategies, where they can earn additional tokens or rewards by staking their assets in specific protocols. This feature allows users to maximize their returns on investment and optimize their yield farming strategies.

4. Flash Loans: 1inch supports flash loans, a unique feature in DeFi that allows users to borrow a large amount of funds without collateral, execute trades or strategies, and repay the loan within one transaction. Flash loans enable users to take advantage of arbitrage opportunities and generate profits quickly.

5. Governance Participation: By holding 1inch tokens, users have the opportunity to participate in the governance of the 1inch platform. They can propose and vote on protocol upgrades, changes, and additions, giving them a voice in shaping the future of the platform.

Overall, buying 1inch tokens grants users access to a wide range of advanced DeFi features, empowering them to trade, provide liquidity, earn rewards, and engage in the decision-making processes of the platform.

Diversification of Crypto Portfolio

Diversification is a key strategy when it comes to investing, and the same applies to the crypto market. Building a well-diversified crypto portfolio can help mitigate risks and maximize potential returns.

When it comes to investing in cryptocurrencies like 1inch tokens, diversification can be achieved in several ways:

1. Investing in Multiple Cryptocurrencies

Instead of focusing solely on 1inch tokens, investors can consider allocating their funds to a variety of different cryptocurrencies. This approach helps spread out the risk and reduces the impact of volatility in a particular cryptocurrency.

By investing in a range of cryptocurrencies, investors gain exposure to different sectors within the crypto market and increase the likelihood of benefiting from multiple growth opportunities.

2. Investing in Different Types of Cryptocurrencies

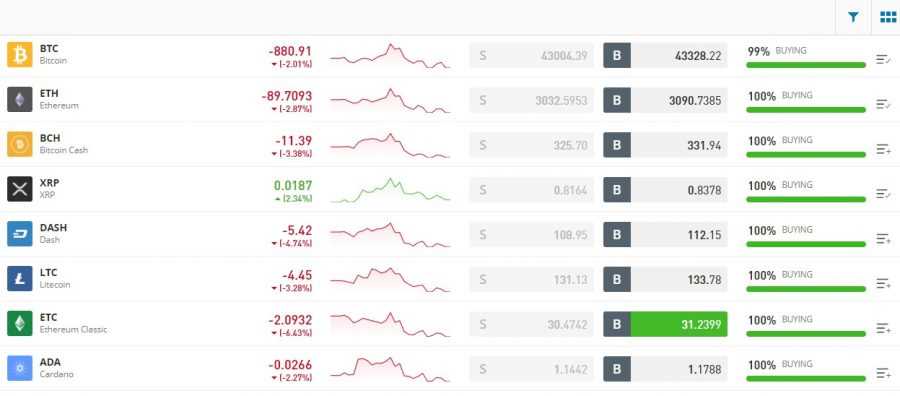

Another diversification strategy is to invest in different types of cryptocurrencies. This includes investing in blue-chip cryptocurrencies like Bitcoin and Ethereum, as well as smaller-cap altcoins.

Blue-chip cryptocurrencies are generally considered less risky and more stable, while smaller-cap altcoins can offer higher growth potential. By investing in both, investors balance stability with growth prospects.

3. Allocating Funds to Different Investment Models

Investors can also diversify their crypto portfolio by allocating funds to different investment models. This includes long-term HODLing, day trading, and participating in decentralized finance (DeFi) projects.

Each investment model carries its own risks and rewards. By spreading funds across different investment models, investors can hedge their bets and potentially benefit from different market conditions.

It’s important to note that diversification does not guarantee profits or protect against losses, but it is a risk management strategy that aims to improve overall portfolio performance.

Before diversifying a crypto portfolio, it’s crucial to conduct thorough research, consider one’s risk tolerance, and consult with a financial advisor if necessary. Additionally, staying updated with the latest market trends and news can help inform investment decisions.

In conclusion, diversification is a prudent approach when it comes to investing in cryptocurrencies like 1inch tokens. By investing in multiple cryptocurrencies, different types of cryptocurrencies, and allocating funds to different investment models, investors can reduce risk and increase the potential for returns in their crypto portfolio.

Cons of Buying 1inch Tokens

While there are certainly positive aspects to buying 1inch tokens, it is important to consider the potential downsides as well. Here are some cons to be aware of:

1. Volatility

The cryptocurrency market is known for its high volatility and price fluctuations, and the 1inch token is no exception. The value of 1inch tokens can experience significant ups and downs in a short period of time. This volatility can make it difficult to predict and manage investments effectively.

2. Regulatory Uncertainty

The regulatory environment for cryptocurrencies is still evolving, and there is ongoing uncertainty about how governments around the world will regulate and classify these assets. This regulatory uncertainty can cause instability in the market and impact the value of 1inch tokens.

3. Limited Use Cases

While the 1inch platform offers decentralized exchange services, the use cases for the 1inch token itself are currently limited. It primarily serves as a governance token for voting on protocol upgrades and decisions. This limited utility may affect the overall demand and value of the token.

4. Competition

The decentralized finance (DeFi) space is highly competitive, with many platforms providing similar services to 1inch. This competition can impact the growth and adoption of the 1inch platform, which may in turn affect the value of the 1inch token.

5. Technical Risks

As with any cryptocurrency or blockchain project, there are inherent technical risks involved. These risks can include vulnerabilities in the smart contract code, potential security breaches, or other technical issues that may arise. Investors should be aware of these risks and take them into consideration.

It is important to conduct thorough research and consider all factors before buying 1inch tokens or any other cryptocurrency. Understanding the potential cons can help investors make informed decisions and manage their investments wisely.

Question-answer:

What are the pros of buying 1inch tokens?

There are several pros of buying 1inch tokens. First, it allows you to participate in the governance of the 1inch platform, giving you a say in its future development. Second, holding 1inch tokens entitles you to a share of the platform’s revenue, which can be a lucrative opportunity. Additionally, buying 1inch tokens can offer potential price appreciation if the platform becomes more popular and successful in the decentralized finance (DeFi) space.

What are the cons of buying 1inch tokens?

Although buying 1inch tokens has its benefits, there are also some cons to consider. One con is the volatility of the cryptocurrency market, which means that the price of 1inch tokens can fluctuate significantly. This volatility can lead to potential losses if the price of the token drops significantly after purchase. Additionally, there is always a certain level of risk involved in investing in cryptocurrencies, and the 1inch token is no exception. It’s important to do thorough research and understand the risks before purchasing any cryptocurrency.

How can buying 1inch tokens give me a say in the platform’s development?

Buying 1inch tokens allows you to participate in the governance of the 1inch platform through a mechanism called decentralized autonomous organization (DAO). Holding 1inch tokens gives you voting rights, which means you can vote on proposals and decisions regarding the future development of the platform. This gives token holders a voice in shaping the direction of the 1inch platform and allows them to contribute to its overall growth and success.

What kind of revenue can I expect from holding 1inch tokens?

Holding 1inch tokens entitles you to a share of the platform’s revenue. The amount of revenue you can expect to receive will depend on several factors, including the overall success and usage of the 1inch platform. The platform generates revenue through fees collected from transactions made on its decentralized exchange. As the platform becomes more popular and sees increased usage, the revenue generated will likely increase as well. It’s important to note that the revenue distribution may vary over time and will be subject to the governance decisions made by token holders.

Are there any risks associated with buying 1inch tokens?

Yes, there are risks associated with buying 1inch tokens. The cryptocurrency market is known for its volatility, and the price of 1inch tokens can fluctuate significantly. This means that there is a possibility of incurring losses if the price of the token drops after purchase. Additionally, investing in cryptocurrencies always carries a level of risk, as the market is still relatively new and unpredictable. It’s important to carefully consider these risks and do thorough research before making any investment decisions.