Exploring 1inchswap’s Aggregation Protocol: A Deeper Dive into the Growing Popularity of Automated Market Makers

In the world of decentralized finance (DeFi), the rise of automated market makers (AMMs) has emerged as a game-changer. These protocols allow users to trade cryptocurrencies without the need for traditional intermediaries, such as centralized exchanges. One of the leading AMMs in the market is 1inchswap, whose aggregation protocol has gained widespread popularity.

1inchswap’s aggregation protocol stands out for its ability to provide users with the best possible trading rates across multiple liquidity sources. By leveraging smart contract technology, the protocol can split users’ trades across various decentralized exchanges to ensure optimal execution and minimize slippage.

What sets 1inchswap apart from other AMMs is its focus on decentralized liquidity sourcing. Instead of relying on a single liquidity provider, the protocol aggregates liquidity from multiple sources, including decentralized exchanges, liquidity pools, and even other AMMs. This not only ensures competitive rates but also reduces the likelihood of front-running and other manipulation tactics.

The benefits of 1inchswap’s aggregation protocol extend beyond just trading rates. With its sophisticated algorithm, the protocol also takes into account gas costs and transaction fees, ensuring that users get the most cost-effective trading experience possible. This is particularly important in today’s highly volatile and competitive DeFi landscape, where every basis point counts.

As decentralized finance continues to gain traction, the role of automated market makers like 1inchswap becomes increasingly crucial. With their ability to provide users with optimal trading rates and secure liquidity, these protocols are driving the next wave of innovation in the cryptocurrency space. Whether you’re a seasoned trader or a newcomer to DeFi, keeping a close eye on 1inchswap’s aggregation protocol is essential to stay ahead of the curve.

The Rise of Automated Market Makers

In recent years, the decentralized finance (DeFi) space has experienced a significant surge in popularity. One of the key innovations that has contributed to this growth is the emergence of automated market makers (AMMs).

AMMs are smart contracts that enable the creation and management of decentralized exchanges without the need for traditional order books. Instead, they rely on mathematical formulas and algorithms to determine the price of assets and facilitate trades.

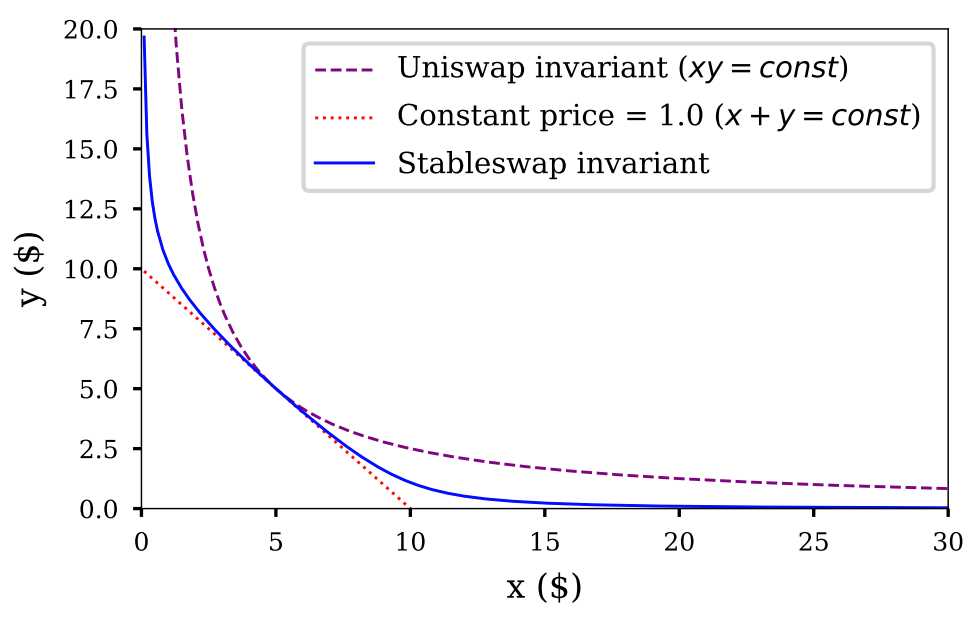

One of the most well-known and widely used AMMs is the Uniswap protocol. Uniswap introduced a new model for liquidity provision, allowing anyone to become a liquidity provider and earn fees by contributing to a liquidity pool.

However, while Uniswap has been successful in many ways, it does have some limitations. For example, it suffers from high slippage and inefficient use of capital due to its reliance on a single liquidity pool. Additionally, it does not offer the best possible prices for trades, as it can only route trades within a single liquidity pool.

This is where automated market makers with aggregation protocols, such as 1inchswap, come into play. These protocols aim to solve the limitations of existing AMMs by aggregating liquidity from multiple sources and routing trades through the most optimal path.

1inchswap, in particular, has gained popularity for its ability to provide users with the best possible prices for their trades. It achieves this by splitting trades across different liquidity pools and decentralized exchanges, optimizing for both price and liquidity.

As a result of these advancements, the rise of automated market makers and aggregation protocols has revolutionized the DeFi space. They have made it easier for users to access liquidity and trade assets while reducing costs and improving efficiency.

Looking ahead, it is clear that automated market makers will continue to play a crucial role in the growth and development of the decentralized finance ecosystem. With ongoing innovations and improvements, they have the potential to further enhance liquidity provision and enable even more complex trading strategies.

In conclusion, the rise of automated market makers and aggregation protocols has ushered in a new era of decentralized finance. These technologies have revolutionized the way we trade and access liquidity, making DeFi more efficient, accessible, and cost-effective than ever before.

Exploring 1inchswap’s Aggregation Protocol

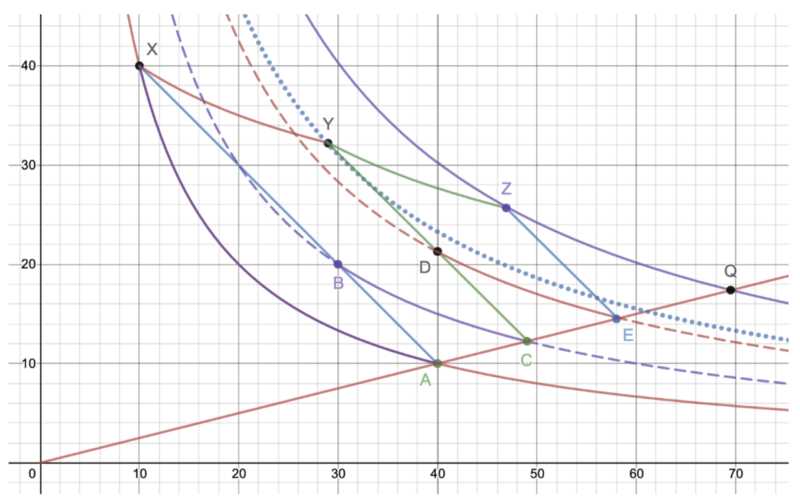

1inchswap’s aggregation protocol is a cutting-edge technology that aims to provide users with the best possible prices across multiple decentralized exchanges (DEXs). By leveraging its advanced algorithm and liquidity pools, 1inchswap is able to aggregate and split users’ orders across different DEXs, ensuring optimal execution and minimizing slippage.

One of the key features of 1inchswap’s aggregation protocol is its intelligent routing algorithm. The algorithm takes into account various parameters such as liquidity, trading fees, and price impact to determine the most favorable DEXs for executing a trade. By considering these factors, 1inchswap is able to ensure that users get the best prices and lowest fees for their trades.

Liquidity pools

1inchswap’s aggregation protocol taps into a network of liquidity pools to provide users with the best possible prices and maximize liquidity. These liquidity pools are integrated with various DEXs, allowing 1inchswap to access a wide range of trading pairs and ensure high liquidity for its users.

Splitting orders

In order to minimize slippage and optimize execution, 1inchswap’s aggregation protocol splits users’ orders across different DEXs. This allows the protocol to take advantage of the best prices and liquidity available on each DEX, ensuring that users get the most favorable execution for their trades.

To determine the optimal split for an order, the aggregation protocol takes into account factors such as liquidity and price impact on each DEX. By analyzing these factors, 1inchswap is able to split the order in a way that maximizes execution efficiency and minimizes slippage.

| Advantages | Disadvantages |

|---|---|

| – Best prices across multiple DEXs | – Potential for higher gas fees |

| – High liquidity through network of liquidity pools | – Possibility of inconsistent pricing across DEXs |

| – Intelligent routing algorithm for optimal execution | – Limited choice of DEXs supported |

Understanding Automated Market Makers

Automated Market Makers (AMMs) have emerged as a popular and innovative solution for decentralized trading. Unlike traditional centralized exchanges that rely on order books, AMMs use smart contracts to facilitate trading directly between liquidity pools.

AMMs are designed to provide liquidity and allow users to swap between different tokens without the need for intermediaries. This is accomplished by leveraging the concept of liquidity pools, which consist of pools of tokens locked in a smart contract. These pools are used to automatically execute trades based on predefined algorithms.

How do AMMs work?

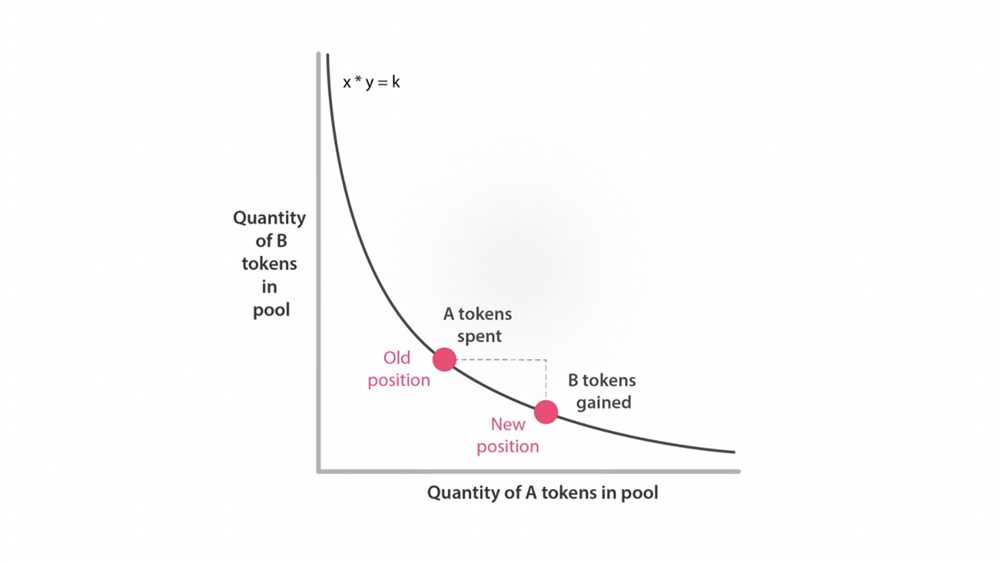

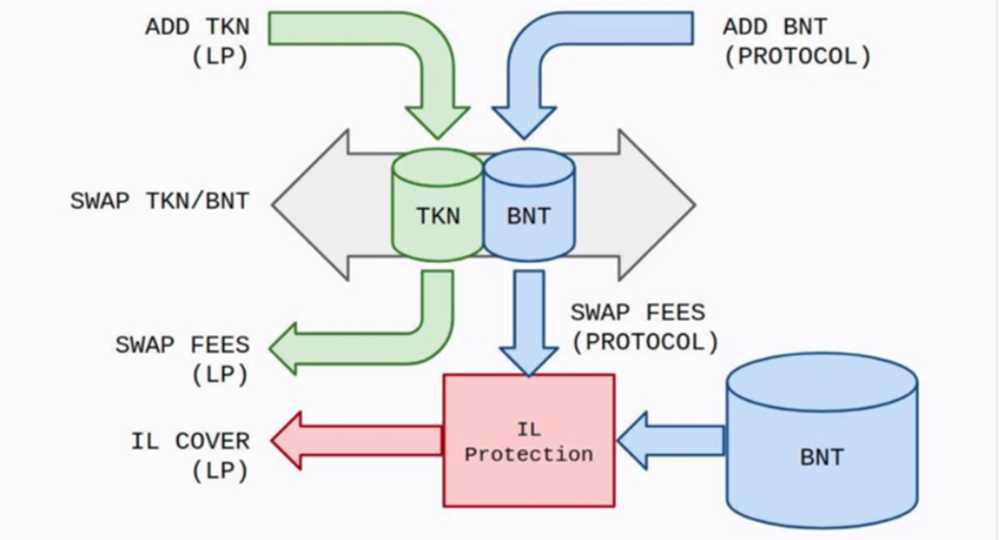

In an AMM, liquidity providers add funds to a liquidity pool by depositing tokens proportional to their desired share of the pool. These liquidity pools are then used to facilitate trades and determine the exchange rates between tokens.

When a trader wants to make a swap, the AMM algorithm calculates the optimal price based on the ratio of tokens in the liquidity pool. The algorithm ensures that the trade is executed at a fair market price by maintaining a constant product of the two token balances.

The key feature of AMMs is that they eliminate the need for traditional order books and centralized intermediaries. Instead, the liquidity pools and algorithms determine the price and execute trades. This decentralized nature allows for increased accessibility, transparency, and efficiency in trading.

Benefits of AMMs

AMMs offer several advantages over traditional exchanges:

- 24/7 trading: AMMs operate on the blockchain, which means they are not subject to traditional trading hours or holidays.

- Accessibility: Anyone with internet access can participate in AMMs, making them more inclusive and enabling users from around the world to trade.

- No KYC requirements: AMMs typically do not require users to provide personal information or undergo Know Your Customer (KYC) procedures.

- Liquidity provision: AMMs incentivize liquidity providers by offering them a portion of the transaction fees generated by the protocol.

- Aggregation: Some AMMs, like 1inchswap, aggregate liquidity from multiple sources to provide the best possible trading rates.

Overall, AMMs have revolutionized the decentralized trading landscape by offering a more accessible, efficient, and user-friendly way to trade tokens. As the crypto space continues to evolve, it’s likely that AMMs will play an increasingly important role in the future of finance.

How 1inchswap’s Protocol Revolutionizes Decentralized Exchanges

Decentralized exchanges (DEXs) have gained popularity in recent years due to their ability to facilitate peer-to-peer transactions without relying on intermediaries. However, these platforms often suffer from limited liquidity and high slippage, making it challenging for traders to execute large transactions efficiently.

1inchswap’s protocol aims to address these issues by providing an innovative aggregation solution that combines multiple DEXs into a single platform. This protocol revolutionizes decentralized exchanges in several ways:

1. Enhanced Liquidity

1inchswap’s protocol aggregates liquidity from various DEXs, creating a more robust trading environment for users. By tapping into multiple liquidity sources, the protocol ensures competitive prices and deeper order books, reducing slippage and improving trading efficiency.

2. Optimization Algorithms

One of the key features of 1inchswap’s protocol is its advanced optimization algorithms. These algorithms analyze the available liquidity across different DEXs and determine the most favorable route for executing trades. By intelligently splitting orders across multiple exchanges, the protocol minimizes slippage and maximizes price execution.

3. Cost Efficiency

The protocol’s aggregation mechanism also enables cost efficiency for users. By aggregating liquidity, 1inchswap reduces the need for multiple transactions on different exchanges, resulting in lower gas fees for users.

Additionally, the protocol’s optimization algorithms ensure that trades are executed at the best available prices, maximizing the value users receive from their transactions.

In conclusion, 1inchswap’s protocol revolutionizes decentralized exchanges by addressing liquidity issues, improving trading efficiency, and reducing costs for users. With its innovative aggregation and optimization algorithms, the protocol enhances the trading experience, making decentralized exchanges a more viable option for both retail and institutional traders.

The Advantages of 1inchswap’s Aggregation Protocol

1inchswap’s aggregation protocol offers several key advantages that set it apart from other automated market makers. These advantages include:

- Efficiency: 1inchswap’s aggregation protocol is designed to find the best possible trading routes across multiple decentralized exchanges, resulting in better execution prices and lower slippage for users. By aggregating liquidity from various sources, 1inchswap is able to minimize the impact of large trades on the market.

- Liquidity: By accessing liquidity from multiple decentralized exchanges, 1inchswap’s aggregation protocol ensures that users have access to a larger pool of liquidity, ultimately reducing the risk of failed transactions due to lack of liquidity. This increased liquidity also enables users to execute larger trades with minimal price impact.

- Transparency: 1inchswap’s aggregation protocol provides users with transparent and verifiable transaction data, allowing users to track and verify the execution of their trades. This transparency builds trust among users and ensures that there are no hidden fees or unfavorable trading practices.

- Choice: 1inchswap’s aggregation protocol allows users to choose from a wide range of decentralized exchanges, giving them the flexibility to select the exchange with the most favorable trading conditions. This choice empowers users and enables them to optimize their trading strategies based on their specific needs.

- Security: 1inchswap’s aggregation protocol is built on robust security measures, ensuring that users’ funds and sensitive information are protected at all times. By leveraging smart contracts and encryption techniques, 1inchswap provides a secure and trustless trading environment for its users.

In conclusion, 1inchswap’s aggregation protocol offers significant advantages in terms of efficiency, liquidity, transparency, choice, and security. These advantages make it a powerful and reliable tool for automated trading on decentralized exchanges.

Enhanced Liquidity, Lower Slippage, and Reduced Fees

In the world of decentralized finance (DeFi), liquidity plays a crucial role in the efficiency and effectiveness of trading. However, liquidity fragmentation across various decentralized exchanges (DEXs) often leads to lower liquidity and increased slippage for users.

1inchswap’s aggregation protocol addresses this issue by aggregating liquidity from multiple DEXs into a single interface. This enhanced liquidity allows users to access a larger pool of funds, resulting in improved trading experiences with reduced slippage.

With the aggregation protocol, users are no longer limited to a single DEX but can access liquidity from multiple sources. This increased liquidity pool not only improves the overall trading experience but also enables users to execute larger trades without significant price impact.

In addition to enhanced liquidity, the 1inchswap aggregation protocol also aims to reduce fees for users. By comparing the prices and fees across multiple DEXs, the protocol selects the most cost-effective trading route, minimizing fees for users.

The protocol achieves this by leveraging smart contract technology to automate the trading process, eliminating the need for manual price comparison and trade execution. This automation not only saves users time but also reduces the likelihood of human error.

Furthermore, the aggregation protocol incorporates various algorithms and strategies to optimize trading outcomes. For example, it may split a large trade into smaller orders across multiple DEXs to minimize slippage. This sophisticated approach ensures that users can efficiently trade assets while minimizing costs.

In summary, 1inchswap’s aggregation protocol offers enhanced liquidity, lower slippage, and reduced fees for users. By aggregating liquidity from multiple DEXs, users can access a larger pool of funds and execute trades with reduced price impact. Additionally, the protocol leverages automation and smart contract technology to minimize fees and optimize trading outcomes. With these features, 1inchswap provides a more efficient and cost-effective solution for trading in the decentralized finance space.

Question-answer:

What is an automated market maker?

An automated market maker (AMM) is a decentralized protocol that facilitates the trading of cryptocurrencies without the need for traditional order books. Instead of relying on buyers and sellers to match their trades, AMMs use smart contracts and liquidity pools to provide liquidity and determine prices.

How does 1inchswap’s aggregation protocol work?

1inchswap’s aggregation protocol combines multiple liquidity sources to provide users with the best possible prices for their trades. It scans different decentralized exchanges and liquidity pools, aggregates the available liquidity, and calculates the most optimal route to execute a trade.

What are the benefits of using 1inchswap’s aggregation protocol?

Using 1inchswap’s aggregation protocol can result in better prices and lower slippage for traders. By accessing multiple liquidity sources, the protocol can find the most favorable rates and execute trades in a more cost-efficient manner. Additionally, the protocol offers a high level of transparency and security by operating on decentralized networks.

Is 1inchswap’s aggregation protocol suitable for all types of trades?

Yes, 1inchswap’s aggregation protocol is designed to be flexible and suitable for both small and large trades. Whether you’re conducting a small transaction or a large volume trade, the protocol will find the best available prices and execute the trade on your behalf.