In the world of decentralized finance (DeFi), the 1inch DEX aggregator has quickly become a popular tool for traders and investors. This powerful platform allows users to access multiple decentralized exchanges (DEXs) and liquidity sources in one place, providing them with the best possible prices and lowest slippage.

Unlike traditional centralized exchanges, where users trade directly with the exchange, 1inch connects to various DEXs and sources liquidity from multiple pools. It uses complex algorithms and smart contract technology to split the user’s trade across multiple exchanges, ensuring the most favorable rates.

One of the key features of 1inch is its ability to find and route trades across different liquidity sources in real-time. By aggregating liquidity from various DEXs, including Uniswap, SushiSwap, and Balancer, among others, 1inch ensures that users can access the best trading opportunities available in the market.

The mechanics behind 1inch’s DEX aggregator are powered by a combination of machine learning and its innovative Pathfinder algorithm. The Pathfinder algorithm analyzes various factors, such as price, liquidity, gas fees, and slippage, to determine the optimal route for a trade. It then splits the trade across multiple DEXs to achieve the best price execution.

With its user-friendly interface and transparent pricing information, 1inch has become a go-to platform for both novice and experienced traders. The ability to save on fees and secure the best available rates has made 1inch a game-changer in the world of DeFi, providing users with a seamless trading experience and maximizing their investment potential.

What is a DEX Aggregator?

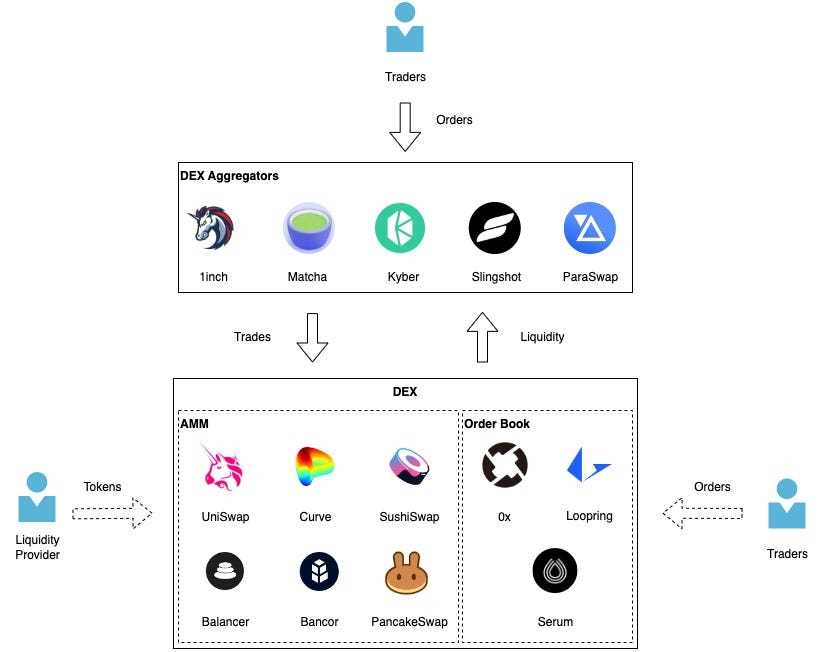

A DEX aggregator is a platform that allows users to access multiple decentralized exchanges (DEXs) through a single interface. DEXs are cryptocurrency exchanges that operate on a decentralized network, without the need for a central authority or intermediary. They enable peer-to-peer trading, providing users with control over their assets and reducing the risk of hacks or thefts.

However, with the growing number of DEXs available in the market, it becomes challenging for users to find the best prices and liquidity for their trades. This is where DEX aggregators come in. They scan multiple DEXs to find the best available prices and execute trades on behalf of the users. By aggregating liquidity from different DEXs, users can access a larger pool of assets and get better rates.

DEX aggregators benefit users by offering competitive prices, reducing slippage, and minimizing trading fees. They also provide access to a wider range of tokens and cryptocurrencies, as they can connect with various DEXs that support different assets. Additionally, DEX aggregators often provide advanced trading features, such as limit orders, stop-loss orders, and routing options.

Overall, DEX aggregators simplify the process of trading on decentralized exchanges, making it more efficient and user-friendly. They provide users with a comprehensive view of the available liquidity across multiple DEXs, allowing them to make informed decisions and execute trades at the best possible prices.

The Technology behind 1inch

The 1inch DEX aggregator is built on a sophisticated technology stack that enables it to provide users with the best possible prices and lowest slippage when trading on decentralized exchanges (DEXs). The key technologies behind 1inch include:

Smart Contract Technology

1inch utilizes smart contract technology to execute trades across multiple DEXs simultaneously. By using smart contracts, 1inch allows users to trade tokens directly from their wallets without the need for intermediaries or custodial services. This ensures that users maintain full control and ownership of their assets at all times.

Decentralized Price Oracle

1inch leverages decentralized price oracles to access real-time pricing data from various DEXs. These oracles continuously monitor the market and provide 1inch with accurate and up-to-date information about token prices and liquidity. By aggregating this data, 1inch is able to find the best trading routes that offer the lowest slippage and optimal prices for users.

1inch uses a combination of on-chain and off-chain algorithms to process and analyze this pricing data. The off-chain part of the system collects and aggregates data, while the on-chain part executes the trades on behalf of users.

Pathfinder Algorithm

The Pathfinder algorithm is at the core of the 1inch DEX aggregator. This algorithm determines the most efficient trading route by considering factors such as token prices, liquidity, and gas costs. The Pathfinder algorithm analyzes the available trading paths in real-time and selects the one that offers the best outcome for the user.

The Pathfinder algorithm takes into account various parameters, including slippage tolerance and the gas cost associated with each trading route. By considering these factors, 1inch ensures that users get the best possible trade execution while minimizing costs.

Overall, the technology behind 1inch enables users to access the best prices and liquidity across multiple DEXs, all without compromising the security and control of their assets. With its smart contract technology, decentralized price oracles, and advanced algorithms, 1inch is revolutionizing the decentralized trading experience.

Advantages of Using 1inch DEX Aggregator

1inch DEX Aggregator offers several advantages that make it an attractive option for traders and investors in the decentralized finance (DeFi) space. Here are some of the key benefits of using 1inch:

1. Wide Range of Supported Tokens and DEXs

1inch provides access to a vast number of tokens and decentralized exchanges (DEXs). This allows users to trade and swap between a wide range of assets easily. The aggregator integrates with various DEXs, such as Uniswap, SushiSwap, Balancer, and many others, ensuring users can find the best available prices and liquidity for their trades.

2. Best Price Execution

With its Pathfinder algorithm, 1inch DEX Aggregator scans multiple liquidity sources to find the most optimal trading path and execute trades at the best available prices. This ensures that users can get the most value out of their trades and minimize slippage.

3. Gas Cost Optimization

1inch takes gas cost optimization seriously. It combines various token swaps into a single transaction to minimize gas fees and reduce overall costs for users. This feature is especially beneficial for traders executing multiple trades or swapping large amounts of tokens.

4. Security and Trust

1inch is built with security in mind. It undergoes rigorous audits, and its smart contracts are regularly reviewed by external security firms to ensure the safety of user funds. Additionally, the platform utilizes advanced security measures, including non-custodial wallets, to provide users with full control and ownership of their assets.

5. User-Friendly Interface

1inch offers a user-friendly interface that is designed to be intuitive and easy to navigate. The platform provides detailed information about token prices, liquidity, and fees, allowing users to make informed decisions when executing trades. Additionally, 1inch provides advanced trading features, such as limit orders and partial fills, to cater to the needs of professional traders.

| Advantages of Using 1inch DEX Aggregator |

|---|

| Wide range of supported tokens and DEXs |

| Best price execution |

| Gas cost optimization |

| Security and trust |

| User-friendly interface |

How to Use 1inch DEX Aggregator

The 1inch DEX Aggregator is a powerful tool that allows users to trade assets across multiple decentralized exchanges (DEXes) in a single transaction. By leveraging the liquidity of various DEXes, users can get the best possible exchange rate and lower slippage compared to trading on a single exchange.

Step 1: Connect Your Wallet

To start using the 1inch DEX Aggregator, you need to connect your Ethereum-compatible wallet to the 1inch platform. Supported wallets include MetaMask, Ledger, Trezor, and WalletConnect. Make sure your wallet is properly set up and connected to the Ethereum network.

Step 2: Select Your Tokens

Once your wallet is connected, you can choose the tokens you want to trade. The 1inch DEX Aggregator supports a wide range of tokens, including both popular and less-known ones. You can search for tokens by name or paste the contract address directly in the search bar.

Step 3: Set Your Trading Parameters

After selecting the tokens, you can specify the amount you want to trade and set other trading parameters. These parameters include the slippage tolerance, which determines the maximum acceptable price impact for your trade, and the swap mode, which allows you to prioritize either the best available price or the fastest transaction speed.

Step 4: Review and Confirm

Before executing the trade, it’s important to carefully review the details of your transaction. Check the estimated gas fees, the exchange rate, and the total amount of tokens you will receive. Once you are satisfied with the details, click on the “Swap” button to initiate the trade.

Step 5: Approve and Execute

Depending on the tokens involved in the trade, you may need to approve the spending of your tokens before the trade can be executed. This is a standard security measure for many decentralized exchanges. Follow the on-screen instructions to approve the transaction, and then wait for the trade to be executed. The execution time may vary depending on network congestion.

That’s it! You have successfully used the 1inch DEX Aggregator to trade assets across multiple DEXes. Remember to always double-check the transaction details and be mindful of the gas fees before proceeding with any trade.

Question-answer:

How does the 1inch DEX aggregator work?

The 1inch DEX aggregator works by splitting a user’s trade across multiple decentralized exchanges (DEXs) in order to find the best possible trading routes and prices. It uses various algorithms to compare prices and liquidity across different DEXs and routes the trade accordingly.

What is the benefit of using the 1inch DEX aggregator?

The benefit of using the 1inch DEX aggregator is that it allows users to get the best prices and liquidity for their trades by automatically splitting the trade between multiple DEXs. This can result in lower slippage and better overall trade execution.