Decentralized finance (DeFi) has revolutionized the way we interact with cryptocurrencies and has opened up a world of possibilities in terms of trading, lending, and borrowing. One of the key players in the DeFi space is 1inch Exchange, a decentralized exchange aggregator that allows users to trade their cryptocurrencies across multiple exchanges in a seamless and efficient manner. In this article, we will explore the role of aggregation and splitting on 1inch Exchange and how these features contribute to its success.

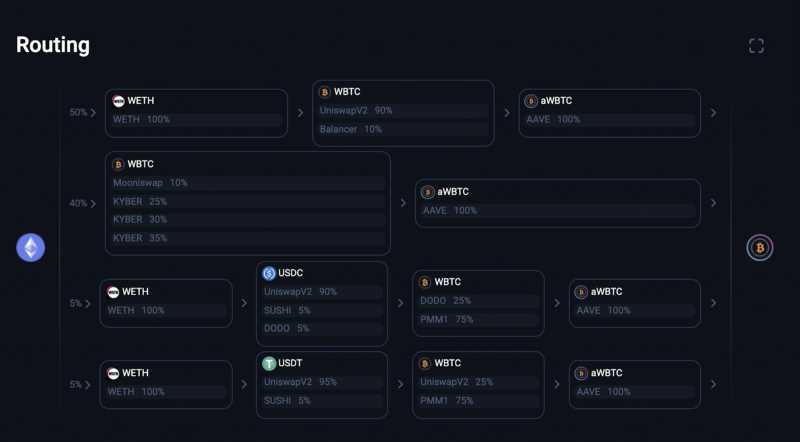

Aggregation is a crucial aspect of 1inch Exchange that sets it apart from traditional centralized exchanges. Instead of relying on a single exchange to execute trades, 1inch leverages smart contracts to split orders across multiple exchanges to find the best possible price. This process is known as aggregation, and it ensures that users get the most favorable rates for their trades. By tapping into a network of liquidity pools, 1inch is able to offer users a competitive advantage over other exchanges in terms of pricing.

Splitting is another important feature that augments the effectiveness of 1inch Exchange. When a trade occurs on 1inch, it is divided into multiple smaller orders that are executed across different exchanges simultaneously. This splitting mechanism allows users to take advantage of the liquidity available on various exchanges, maximizing the potential for a successful trade. By diversifying the execution of trades, 1inch minimizes the risks associated with low liquidity, slippage, and market manipulation that can often occur on individual exchanges.

By combining aggregation and splitting, 1inch Exchange provides users with a powerful trading platform that offers optimal liquidity, competitive pricing, and reduced risks. The platform’s algorithm ensures that trades are executed swiftly and efficiently, taking advantage of the best opportunities available in the market. Whether you are a casual trader or a seasoned investor, understanding the role of aggregation and splitting on 1inch Exchange is crucial to making informed decisions and optimizing your trading strategy in the ever-evolving landscape of decentralized finance.

The Importance of Aggregation and Splitting on 1inch Exchange

Aggregation and splitting are essential features on 1inch Exchange that play a crucial role in optimizing trades for users. These features allow for better liquidity and improved price execution, ultimately resulting in cost savings and increased profitability.

Aggregation involves the consolidation of liquidity from various decentralized exchanges (DEXs) into a single platform. This means that users can access a wider range of trading pairs and depth of liquidity, which leads to better pricing. By aggregating liquidity, 1inch Exchange ensures that users can easily find the best possible prices for their trades.

Splitting, on the other hand, refers to the division of a trade into multiple smaller trades across different DEXs. This technique is beneficial for users as it helps to minimize slippage and increase the likelihood of obtaining the best possible prices. By splitting trades, 1inch Exchange effectively “hedges” against any potential price fluctuations on a single DEX.

The combination of aggregation and splitting on the 1inch Exchange platform offers several advantages for users. Firstly, it increases the chances of finding the most favorable prices for trades, therefore maximizing profitability. Additionally, the reduced slippage resulting from splitting trades translates to significant cost savings for users.

Moreover, aggregation and splitting contribute to increased liquidity on the 1inch Exchange platform. This attracts more traders, enhancing market depth and overall trading volume. As a result, users benefit from improved price execution when trading on 1inch Exchange.

In conclusion, the importance of aggregation and splitting on 1inch Exchange cannot be understated. These features optimize trades by providing better pricing, minimizing slippage, and increasing profitability for users. The combination of aggregation and splitting ultimately enhances liquidity and price execution on the platform, making it a highly sought-after decentralized exchange.

Enhancing Liquidity and Reducing Slippage

Aggregation and splitting are crucial strategies for enhancing liquidity and reducing slippage on the 1inch Exchange platform. Liquidity refers to the availability of tokens for trading, while slippage represents the difference between the expected price of a trade and the actual executed price.

The Role of Aggregation

Aggregation plays a significant role in improving liquidity as it consolidates liquidity from multiple sources into a single, unified order book. By accessing liquidity from various decentralized exchanges and protocols, 1inch Exchange can offer users better trading opportunities.

When a user places a trade on 1inch Exchange, the aggregator scans multiple platforms and calculates the best possible trade based on price and available liquidity. This enables users to access the most favorable trading conditions while minimizing slippage.

The Role of Splitting

Splitting is another important technique used by 1inch Exchange to enhance liquidity and reduce slippage. When a large trade is placed, splitting divides it into smaller parts and executes them across multiple liquidity sources.

This approach helps prevent substantial price impacts and market distortions that can occur when executing large trades on a single platform. By splitting a trade, 1inch Exchange ensures that each part is executed at the best available price and doesn’t significantly impact the market.

Moreover, splitting also allows for better utilization of liquidity across different platforms. It enables users to access liquidity from various sources simultaneously, increasing the likelihood of finding the best prices and reducing slippage.

In summary, enhancing liquidity and reducing slippage are crucial goals for any trading platform, and 1inch Exchange achieves this through advanced aggregation and splitting techniques. By consolidating liquidity and splitting large trades, 1inch Exchange provides users with the most favorable trading conditions while minimizing market impact and price discrepancies.

Maximizing Price Optimization and Efficiency

When using 1inch Exchange, it is important to understand how to maximize price optimization and efficiency in your trades. By following a few key strategies, you can ensure that you are getting the most out of your trades and maximizing your profits.

1. Utilize Aggregation

One of the main benefits of using 1inch Exchange is its aggregation feature. This feature allows you to compare prices across multiple decentralized exchanges (DEXs) to find the best price for your trade. By taking advantage of aggregation, you can ensure that you are getting the best possible price and optimizing your trades.

2. Consider Splitting Trades

Another strategy to consider is splitting your trades. When you split a trade, you divide it into multiple smaller trades across different DEXs. This can help you achieve better price optimization by taking advantage of price differences between DEXs. However, it is important to carefully consider gas fees and slippage when splitting trades to ensure it is cost-effective.

Additionally, splitting trades can help improve overall efficiency as it reduces the impact of large trades on the market. By splitting your trades, you can avoid significant price slippage and improve the overall execution of your trades.

3. Take Advantage of Limit Orders

1inch Exchange also offers the option to place limit orders. By using limit orders, you can specify the price at which you want to buy or sell a particular asset. This can be useful for optimizing the price of your trades, especially if you are willing to wait for a specific price level.

Limit orders can also help improve efficiency by reducing the need for constant monitoring of the market. Instead of constantly checking the price and executing trades manually, you can set a limit order and let the platform automatically execute it when the specified price is reached.

Conclusion

Maximizing price optimization and efficiency on 1inch Exchange requires a combination of utilizing aggregation, considering splitting trades, and taking advantage of limit orders. By applying these strategies, you can ensure that you are getting the best possible price and optimizing your trades for maximum efficiency and profitability. However, it is important to carefully consider the specific market conditions and trading costs to make informed decisions and minimize risks.

Minimizing Transaction Costs and Fees

When using 1inch Exchange, it is important to understand how to minimize transaction costs and fees to maximize your profits. Here are some strategies to consider:

1. Aggregation:

Aggregation is the process of combining multiple liquidity sources to find the best possible price. By utilizing aggregation, you can access liquidity from multiple decentralized exchanges and ensure that you are getting the best rates. This helps to minimize slippage and reduce transaction costs.

2. Splitting:

Splitting is the process of dividing a trade into smaller parts and executing them separately. This can help to reduce the impact of large orders on the market, as well as decrease slippage. By splitting your trades, you can take advantage of different liquidity pools and potentially achieve better overall prices.

3. Gas Optimization:

Gas fees can often be a large component of transaction costs when using decentralized exchanges. To minimize gas fees, you can select a lower gas price or optimize your transactions by batching them together. Additionally, you can choose to trade during times of lower network congestion to reduce gas fees.

4. Compare DEXs:

1inch Exchange allows you to compare prices and fees across different decentralized exchanges. By comparing the rates and fees offered by different platforms, you can choose the option with the lowest transaction costs. This can be especially useful when trading high-value assets.

5. Utilize Limit Orders:

Limit orders allow you to set a specific price at which you want to buy or sell an asset. By using limit orders, you can potentially achieve better prices than by executing market orders. This can help to minimize transaction costs, especially when trading assets with high volatility.

By implementing these strategies, you can minimize transaction costs and fees when using 1inch Exchange, ultimately optimizing your trading experience and maximizing your profits.

Ensuring Security and Trust in Decentralized Exchanges

In the world of decentralized exchanges (DEXs), security and trust are of paramount importance. Unlike traditional centralized exchanges, DEXs operate on a peer-to-peer network, where users can trade cryptocurrencies directly with each other, without the need for intermediaries. While this offers greater control and privacy for users, it also introduces new risks and challenges.

One of the main challenges in ensuring security in DEXs is the prevention of front-running attacks. Front-running occurs when a malicious actor exploits the time delay between transaction submission and execution to execute their own transactions at a more favorable price. To mitigate this risk, DEXs employ various mechanisms such as non-public order books, where the details of pending transactions are kept hidden until execution.

Another important aspect of security in DEXs is the protection of user funds. Unlike centralized exchanges, where users typically deposit their funds into a single custodial wallet controlled by the exchange, in DEXs, users retain control of their private keys and assets at all times. This means that users must be vigilant in protecting their private keys and using secure wallets to store their assets.

Trust is also a crucial factor in the success of DEXs. Users need to have confidence that the platform they are using is reliable, transparent, and free from manipulation. To build trust, DEXs often undergo audits by third-party security firms to ensure that their smart contracts and protocols are secure and free from vulnerabilities.

Additionally, many DEXs have implemented decentralized governance frameworks, where token holders can vote on important decisions and changes to the protocol. This helps to ensure that the platform is governed in a decentralized and transparent manner, reducing the risk of malicious actors gaining control and compromising the security of the exchange.

In conclusion, ensuring security and trust in decentralized exchanges is essential for the success and adoption of these platforms. By implementing robust security measures, protecting user funds, and building trust through transparency and decentralized governance, DEXs can provide users with a safe and reliable way to trade cryptocurrencies.

Question-answer:

How does aggregation work on 1inch Exchange?

Aggregation on 1inch Exchange works by splitting a single trade into multiple smaller trades across different decentralized exchanges to achieve the best possible price for the user.

What is the purpose of splitting a trade on 1inch Exchange?

The purpose of splitting a trade on 1inch Exchange is to maximize liquidity and obtain the best prices by executing portions of the trade on different decentralized exchanges.

What factors are considered when splitting a trade on 1inch Exchange?

When splitting a trade on 1inch Exchange, several factors are considered, including the available liquidity on different exchanges, the gas costs, the slippage, and the user’s specified preferences.

How does aggregation benefit users on 1inch Exchange?

Aggregation on 1inch Exchange benefits users by allowing them to get the best possible prices on their trades, as it takes advantage of the liquidity and prices available on multiple decentralized exchanges.

Can users manually select the exchanges for trading on 1inch Exchange?

Yes, users can manually select the exchanges they want to trade on 1inch Exchange. They have the option to choose specific exchanges or let the platform automatically split the trade based on the best available options.