The emergence of decentralized finance (DeFi) has brought about a wave of innovation and disruption in the traditional financial landscape. 1inch, a decentralized exchange aggregator, has been at the forefront of this movement, providing users with the ability to find the most efficient trading routes across multiple exchanges. As the popularity of 1inch grows, it is important to consider the potential challenges and opportunities that the platform may face in the US regulatory landscape.

One of the main challenges that 1inch may encounter is the regulatory uncertainty surrounding cryptocurrencies and DeFi platforms in the United States. As the regulatory framework for these technologies is still being developed, there is a lack of clear guidance on how these platforms should be regulated. This uncertainty can create challenges for 1inch as it seeks to expand its user base and establish itself as a leading DeFi platform in the US.

Despite these challenges, there are also numerous opportunities for 1inch in the US regulatory landscape. By working closely with regulators and policymakers, 1inch has the potential to influence the development of regulations and shape the future of DeFi in the United States. This collaboration can help build trust and credibility for the platform, attracting more users and investors.

Additionally, as the demand for DeFi platforms continues to grow, there is a growing recognition among regulators of the benefits that these technologies can bring to the financial system. By highlighting the advantages of decentralized finance and demonstrating the responsible and compliant operation of its platform, 1inch can position itself as a valuable partner to regulators, opening the door to further growth and adoption.

In conclusion, while there are challenges and uncertainties in the US regulatory landscape for 1inch and other DeFi platforms, there are also significant opportunities for growth and collaboration. By navigating these challenges and working closely with regulators, 1inch has the potential to establish itself as a leading player in the US market, bringing the benefits of decentralized finance to a wider audience.

The Challenges and Opportunities of 1inch in US Regulation

1inch is a decentralized exchange aggregator that allows users to access multiple liquidity sources from various decentralized exchanges (DEXs) in a single platform. While 1inch offers unique opportunities for users to find the best prices and reduced slippage, it also faces several challenges in the US regulatory landscape.

One of the primary challenges for 1inch is navigating the complex regulatory framework in the United States. The regulatory environment surrounding cryptocurrency and decentralized finance (DeFi) is still evolving, and there is uncertainty around how existing regulations apply to platforms like 1inch. The lack of clear guidelines can lead to potential legal risks and compliance issues that 1inch would need to address effectively.

Another challenge is the need for 1inch to ensure compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations. These regulations are designed to prevent illicit activities such as money laundering and terrorist financing and often require platforms to collect and verify user information. Implementing robust AML and KYC procedures can be resource-intensive and may deter some users who value privacy and anonymity.

Despite these challenges, there are also opportunities for 1inch in the US regulatory landscape. The recent surge in interest and adoption of cryptocurrencies has pushed regulators to consider more favorable regulations. There is growing recognition of the potential benefits of decentralized finance and the importance of fostering innovation in the blockchain industry.

Additionally, 1inch can proactively engage with regulators and policymakers to contribute to the development of clear regulatory guidelines. By collaborating with industry stakeholders and educating regulators about the unique features and benefits of decentralized exchanges, 1inch can help shape a more favorable regulatory environment that promotes innovation while ensuring consumer protection.

Furthermore, 1inch can explore partnerships with US-based companies and institutions to strengthen its position in the market. Collaborating with traditional financial institutions or establishing strategic alliances with established players in the cryptocurrency industry can help legitimize the platform and build trust among US users.

In conclusion, while there are challenges for 1inch in the US regulatory landscape, there are also opportunities for the platform to thrive. By navigating the regulatory landscape effectively, implementing robust compliance measures, and actively participating in regulatory discussions, 1inch can position itself as a leader in the decentralized finance space in the United States.

The Evolving US Regulatory Environment

The regulatory landscape for cryptocurrency in the United States is continually evolving. As the popularity and adoption of cryptocurrencies increase, so does the scrutiny placed on these digital assets by regulators.

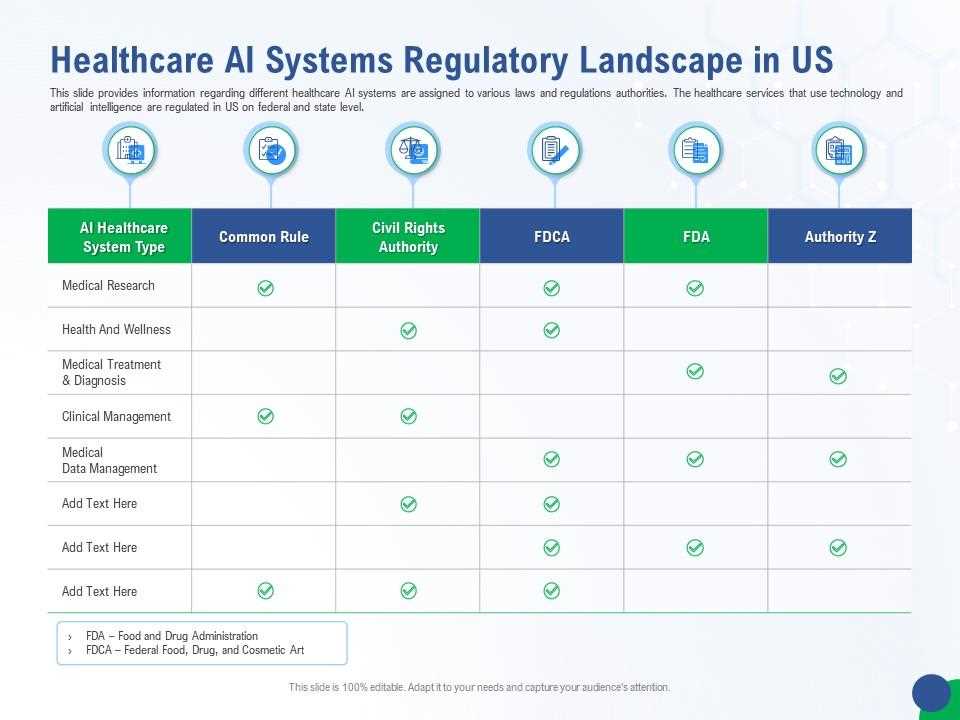

In recent years, there has been an increased focus on regulating cryptocurrency exchanges, such as 1inch, in order to protect consumers and ensure the integrity of the financial system. The Securities and Exchange Commission (SEC) has been particularly active in this space, asserting its authority over digital assets and pursuing enforcement actions against those who violate securities laws.

Beyond the SEC, there are other regulatory bodies that have a stake in the cryptocurrency industry. For example, the Commodity Futures Trading Commission (CFTC) has jurisdiction over derivatives and futures markets, which can include certain types of cryptocurrency products. The Financial Crimes Enforcement Network (FinCEN) also plays a role in enforcing anti-money laundering regulations for cryptocurrency transactions.

One of the challenges within the US regulatory environment is the lack of clear and consistent guidelines. The classification of cryptocurrencies as securities, commodities, or something else entirely can vary depending on the specific circumstances and the regulatory body involved. This uncertainty can create difficulties for companies like 1inch that operate in the cryptocurrency space and seek to comply with applicable regulations.

However, it is important to note that the US regulatory landscape is not entirely prohibitive. There have been indications of a more favorable approach to cryptocurrency in recent years, particularly with the appointment of officials who have a deeper understanding of digital assets and blockchain technology.

Additionally, there are opportunities for companies like 1inch to collaborate and engage with regulators in order to shape the regulatory framework in a way that balances consumer protection with innovation. By actively participating in the regulatory process, companies can help create a more favorable environment for their operations and the broader cryptocurrency industry.

Overall, the regulatory environment for cryptocurrency in the United States is dynamic and complex. While there are challenges to navigate, there are also opportunities for companies like 1inch to thrive and contribute to the development of a more inclusive and supportive regulatory framework.

Challenges Faced by 1inch in the US

While 1inch, a decentralized exchange aggregator, has experienced significant growth and success in the cryptocurrency market, it also faces several challenges in the US regulatory landscape. These challenges include:

- Compliance with Regulatory Requirements: The US has a complex regulatory environment for cryptocurrency-related activities. 1inch must ensure compliance with various regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Meeting these regulations can be time-consuming and costly.

- Uncertainty Surrounding Securities Laws: The definition of securities in the US is broad, and the Securities and Exchange Commission (SEC) has taken a strict approach towards cryptocurrency projects. 1inch must navigate this uncertainty and ensure that its token does not fall under the classification of a security.

- State-specific Regulations: In addition to federal regulations, each state in the US has its own set of rules for cryptocurrency businesses. This fragmented regulatory landscape adds complexity for 1inch and requires additional resources to understand and comply with state-specific requirements.

- Legal and Regulatory Enforcement: Violations of US regulations can result in significant financial penalties and legal consequences. 1inch must constantly monitor and adapt to regulatory changes to ensure compliance and avoid legal and financial ramifications.

- Competitive Landscape: 1inch operates in a highly competitive market, with numerous decentralized exchanges and aggregators vying for market share. To remain competitive, 1inch must continuously innovate and offer value-added services while navigating the regulatory challenges.

Despite these challenges, 1inch also has opportunities for growth in the US market. By effectively addressing the regulatory landscape, building trust with regulators and users, and providing innovative solutions, 1inch can position itself for success in the US decentralized finance ecosystem.

Opportunities for 1inch in the US Market

As 1inch expands its operations into the US market, it is poised to tap into a wide range of opportunities. The US market presents numerous advantages for 1inch, including:

1. Large and Active Crypto Community

The United States has one of the largest and most active crypto communities in the world. This presents a significant opportunity for 1inch to attract a large user base and increase its trading volume. With its advanced features and competitive rates, 1inch can offer a compelling alternative to existing decentralized exchanges in the US.

2. Mainstream Adoption of Cryptocurrencies

Cryptocurrencies have gained significant traction in the US, with many individuals and businesses embracing digital assets as a form of payment and investment. This growing adoption provides 1inch with a prime opportunity to position itself as a leading platform for trading and swapping cryptocurrencies in the US market.

Moreover, the increasing acceptance of cryptocurrencies by traditional financial institutions and banks in the US further solidifies the potential for 1inch to establish strong partnerships and integrations within the traditional financial sector.

With its user-friendly interface, liquidity aggregation, and competitive rates, 1inch can cater to both experienced traders and newcomers entering the crypto market.

3. Regulatory Clarity

As the US regulatory landscape evolves and provides more clarity on the rules governing the crypto industry, there is an opportunity for 1inch to navigate the regulatory framework effectively. By adhering to the necessary compliance measures and obtaining licenses, 1inch can establish itself as a trusted and compliant platform, ensuring users’ peace of mind when conducting transactions on the platform. This regulatory clarity provides 1inch with a competitive advantage in the market.

4. Potential for Partnerships

The US market offers a wide range of potential partnership opportunities for 1inch. By collaborating with established US-based businesses, such as fintech companies, exchanges, and liquidity providers, 1inch can expand its reach, enhance its liquidity, and increase its user base. Strategic partnerships can also help 1inch navigate the complex regulatory environment and establish a strong foothold in the US market.

Overall, the US market presents numerous opportunities for 1inch to grow and establish itself as a leading decentralized exchange platform. By leveraging the large and active crypto community, embracing the mainstream adoption of cryptocurrencies, navigating the regulatory landscape, and forging strategic partnerships, 1inch can capture a significant market share and solidify its position in the US market.

The Future of 1inch in the US Regulatory Landscape

1inch, a decentralized exchange aggregator, has gained significant traction in the crypto industry due to its ability to provide users with the best trading rates across multiple platforms. However, as the platform expands into the United States, it will face various challenges and opportunities in the US regulatory landscape.

Challenges

One of the major challenges that 1inch will face is regulatory compliance. The US regulatory environment for cryptocurrencies and decentralized finance (DeFi) is complex and rapidly evolving. 1inch will need to ensure that it complies with all relevant regulations, including know-your-customer (KYC) procedures and anti-money laundering (AML) requirements.

Additionally, 1inch will need to navigate the patchwork of state and federal regulations in the US. Different states have different approaches to regulating crypto, and this can create significant compliance challenges for platforms like 1inch.

Opportunities

Despite the challenges, the US market presents significant opportunities for 1inch. The US has a large and growing crypto user base, and there is a strong demand for decentralized finance services. By expanding into the US market, 1inch can tap into this demand and capture a significant market share.

Furthermore, the US regulatory landscape is gradually becoming more favorable towards cryptocurrencies and DeFi. Regulatory bodies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have shown increased interest in understanding and regulating the crypto industry. This indicates a potential for clearer and more favorable regulations for platforms like 1inch in the future.

| Challenges | Opportunities |

|---|---|

| Complex and evolving US regulatory environment | Large and growing crypto user base in the US |

| Compliance with state and federal regulations | Strong demand for decentralized finance services |

| Need for KYC and AML procedures | Potential for clearer and more favorable regulations in the future |

In conclusion, while 1inch will face challenges in navigating the US regulatory landscape, the platform also has significant opportunities to grow and succeed in the US market. By staying compliant with regulations and tapping into the growing demand for DeFi services, 1inch can establish itself as a leading decentralized exchange aggregator in the US.

Question-answer:

What are the potential challenges that 1inch may face in the US regulatory landscape?

1inch may face potential challenges such as heightened regulatory scrutiny, compliance with state and federal regulations, and navigating the complex framework of securities laws in the US.

What opportunities are there for 1inch in the US regulatory landscape?

By complying with regulatory requirements and building strong relationships with regulators, 1inch can establish trust and credibility in the US market. Additionally, the growing demand for decentralized finance (DeFi) platforms presents an opportunity for 1inch to expand its user base and gain a competitive edge.

How can 1inch address the challenges posed by US regulations?

1inch can address the challenges posed by US regulations by actively engaging with regulatory agencies, working towards clear compliance frameworks, and establishing partnerships with compliant entities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures can also help mitigate regulatory risks.