1inch, the decentralized exchange aggregator, has quickly become a popular choice for traders looking to swap their USDT tokens for other cryptocurrencies. With its innovative algorithm, 1inch promises to provide users with the best possible trading outcomes by finding the most efficient paths across multiple liquidity sources.

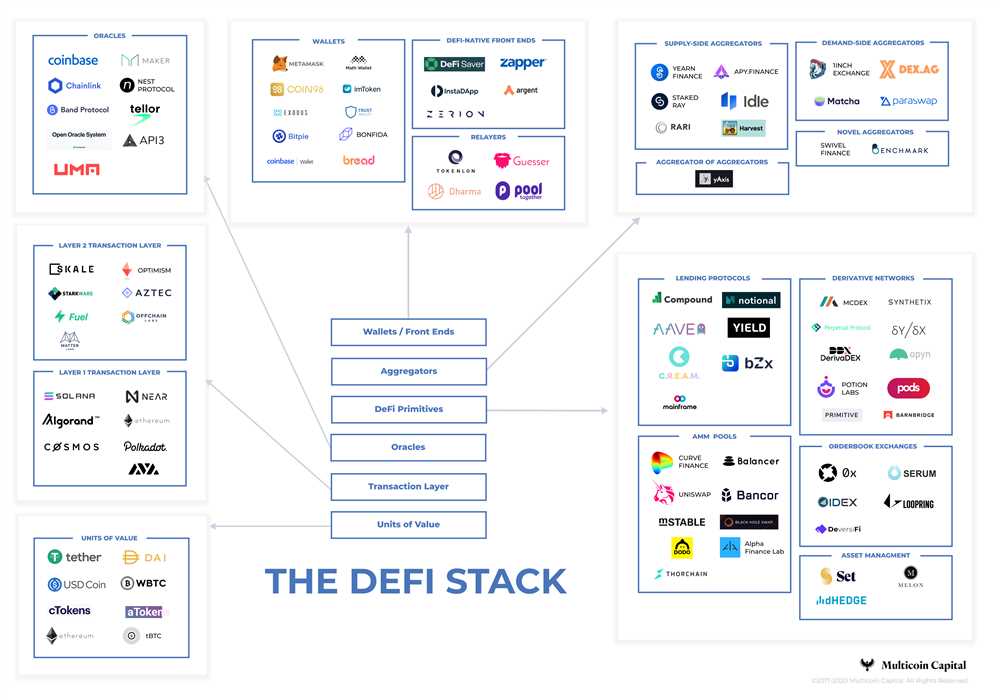

But how exactly does 1inch achieve optimal trading outcomes? The answer lies in its mechanics. When a user submits a trade, 1inch splits it across several decentralized exchanges, taking advantage of their liquidity pools. This not only helps to achieve better prices but also reduces slippage, maximizing the user’s trading gains. By diving into the mechanics of 1inch’s trading algorithms, we can gain a better understanding of how it ensures optimal outcomes.

One of the key components of 1inch’s mechanics is its Pathfinder algorithm. This algorithm scans various decentralized exchanges and liquidity pools to find the best possible trading routes. It takes into account factors such as liquidity, price impact, and gas fees to determine the most efficient path for the trade. By analyzing these factors, 1inch is able to minimize trading costs and maximize the user’s gains.

Another important aspect of 1inch’s mechanics is its Smart Order Routing (SOR) technology. This technology enables 1inch to split the user’s trade across multiple decentralized exchanges, ensuring that the trade is executed at the best available prices. By splitting the trade, 1inch minimizes the impact on the price and avoids front-running, resulting in better outcomes for the user.

In conclusion, 1inch’s mechanics play a vital role in ensuring optimal trading outcomes for USDT holders. By utilizing its Pathfinder algorithm and SOR technology, 1inch is able to find the most efficient routes and execute trades at the best possible prices. Whether you’re a novice trader or an experienced investor, understanding 1inch’s mechanics can help you make informed decisions and maximize your trading gains.

An Exploration of 1inch’s Mechanics: Maximizing USDT Trading Results

1inch has gained significant popularity in the decentralized finance (DeFi) space due to its innovative approach to optimizing trades. One of the many assets that can be traded on the 1inch platform is USDT (Tether), a stablecoin pegged to the US dollar.

When it comes to trading USDT on 1inch, there are several mechanics involved in ensuring the best possible trading outcome. These mechanics encompass various features and strategies implemented by 1inch to maximize trading efficiency.

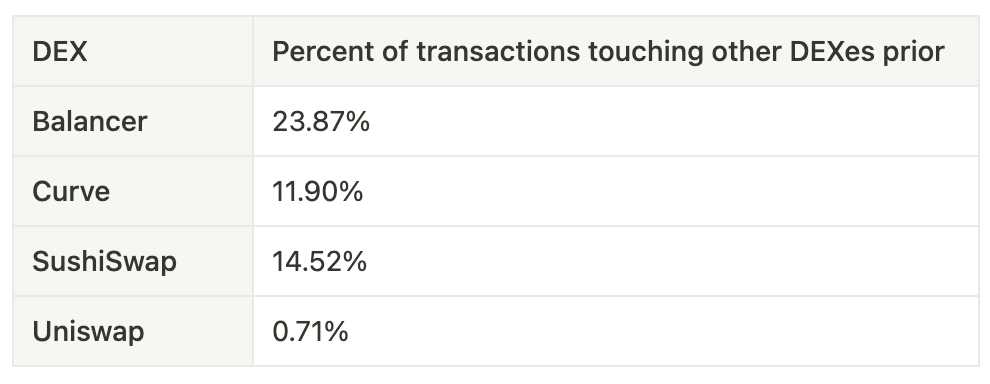

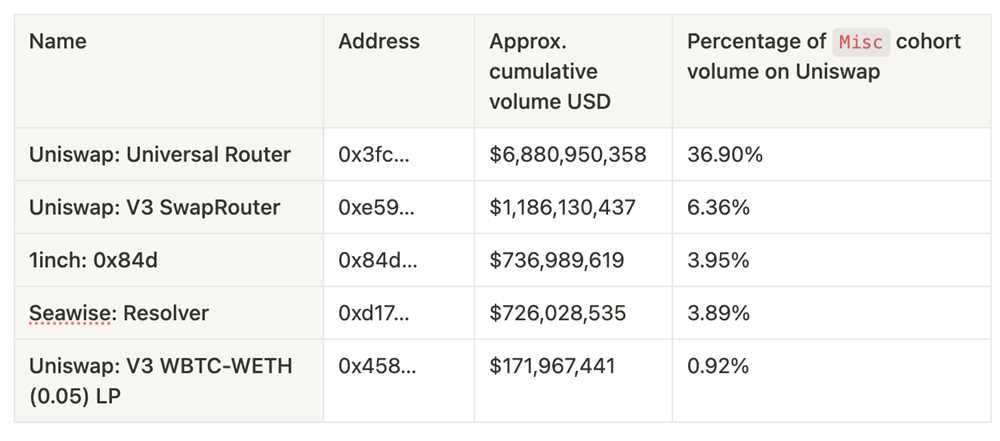

One key mechanic utilized by 1inch to maximize USDT trading results is its smart contract technology. The 1inch smart contract scans multiple decentralized exchanges (DEXs) simultaneously, such as Uniswap, SushiSwap, and Balancer, to find the most optimal trading path for USDT. By analyzing the liquidity and prices across these DEXs, 1inch can effectively minimize slippage and find the best possible rates for USDT trades.

To further enhance trading results, 1inch employs its Pathfinder algorithm. This algorithm calculates the most efficient route to execute trades by considering factors such as gas costs, liquidity, and exchange rates. By carefully analyzing these parameters, 1inch ensures that traders receive the highest possible return when trading USDT.

In addition, 1inch leverages its aggregation feature to provide users with the best prices for USDT trades. The aggregation feature combines liquidity from multiple DEXs, allowing traders to access deeper order books and obtain more favorable rates. This ensures that traders can maximize their USDT trading results by obtaining the best possible prices.

Furthermore, 1inch incorporates the concept of slippage control into its mechanics. Slippage refers to the difference between the expected price of a trade and the executed price. By setting slippage control parameters, traders on 1inch can specify the maximum acceptable slippage for their trades. This ensures that traders have greater control over their USDT trading outcomes and minimizes the chances of undesirable price deviations.

Overall, 1inch’s mechanics for maximizing USDT trading results involve a combination of smart contract technology, Pathfinder algorithm, liquidity aggregation, and slippage control. Through these mechanics, 1inch aims to provide traders with the most efficient and profitable trading experience when trading USDT on its platform.

Understanding the Mechanisms behind 1inch’s Trading Algorithm

1inch’s trading algorithm is designed to ensure optimal trading outcomes for users when trading USDT. This algorithm combines various mechanisms and protocols to achieve the best results.

Decentralized Exchanges Aggregation and Routing

1inch’s trading algorithm aggregates liquidity from various decentralized exchanges (DEXs) such as Uniswap, SushiSwap, and many others, to provide users with the best possible trading rates. The algorithm analyzes the available liquidity across these DEXs and determines the optimal route to execute the trade, taking into account factors such as slippage and gas fees.

Smart Contract Execution

1inch’s algorithm relies on smart contracts to execute trades. These smart contracts are audited to ensure the security and reliability of the trading process. The algorithm interacts with these contracts to execute trades on behalf of users, ensuring that the desired trading outcome is achieved.

The algorithm also implements various advanced trading strategies, such as swapping through multiple DEXs in a single transaction, to minimize slippage and maximize trading efficiency. This allows users to get the best possible trading rates while saving on gas fees.

Fair and Transparent Pricing

1inch’s trading algorithm ensures fair and transparent pricing by taking into account the real-time market conditions and trading volume across different DEXs. This allows users to trade at competitive rates, without being disadvantaged by price manipulation or illiquid markets.

Gas Optimization

1inch’s algorithm also focuses on gas optimization to reduce transaction costs for users. By carefully selecting the optimal route for executing trades and minimizing unnecessary steps, the algorithm aims to reduce gas fees associated with trading USDT, providing users with cost-efficient trading options.

In conclusion, 1inch’s trading algorithm combines decentralized exchange aggregation, smart contract execution, fair pricing, and gas optimization to ensure optimal trading outcomes for users when trading USDT. By leveraging these mechanisms, 1inch aims to provide users with a seamless and efficient trading experience.

Optimizing USDT Trading on 1inch: Tips and Best Practices

When it comes to trading USDT on 1inch, there are some tips and best practices that can help ensure optimal outcomes. By following these recommendations, traders can maximize their trading efficiency and minimize potential risks. Here are some tips to get the most out of your USDT trades on 1inch:

1. Choose the Right Liquidity Pools

When trading USDT on 1inch, it’s crucial to select the liquidity pools that offer the best rates and lowest slippage. By analyzing different pools and their respective prices, you can make more informed decisions and improve your trading outcomes.

2. Analyze Gas Fees

Gas fees can significantly impact your trading costs. Therefore, it’s essential to understand the current gas prices on the Ethereum network and select the appropriate time to execute your trades. By monitoring and optimizing gas fees, you can reduce transaction costs and make your USDT trades more profitable.

3. Utilize the Advanced Settings

1inch provides advanced settings that can help optimize your USDT trading experience. Adjusting slippage tolerance, transaction deadline, and other parameters can improve your chances of executing trades at desired rates and minimize the risks of failed transactions.

Additionally, utilizing features such as limit orders and partial fill can enable more precise trading strategies and enhance overall trading outcomes.

4. Stay Updated with Market Conditions

Keeping an eye on the market conditions is crucial when trading USDT on 1inch. By staying informed about the latest news and events that may impact USDT’s value or the overall market sentiment, you can make more informed decisions and optimize your trading strategies.

Conclusion

Optimizing USDT trading on 1inch requires careful consideration of liquidity pool selection, gas fees, advanced settings, and staying updated with market conditions. By following these tips and best practices, traders can enhance their trading outcomes and maximize their USDT trading efficiency.

Achieving Optimal USDT Trading Outcomes on 1inch: Case Studies

When trading USDT on 1inch, achieving optimal outcomes is essential for maximizing profits and minimizing risks. In this section, we will dive into some case studies to demonstrate how users can achieve optimal USDT trading outcomes using 1inch.

Case Study 1: Arbitrage Trade

A trader, Alice, identifies a price discrepancy for USDT between two decentralized exchanges (DEXs). She notices that the sell price for USDT on DEX A is higher than the buy price for USDT on DEX B. Alice wants to take advantage of this opportunity to make a profit.

By using 1inch’s smart contract, Alice can split her trading volume between DEX A and DEX B to ensure the best possible outcome. The smart contract will automatically find the optimal trading routes and execute the trades, taking into account factors such as slippage and fees. This way, Alice can maximize her profits while minimizing her risks.

Case Study 2: Liquidity Provision

Bob has a large amount of USDT and wants to provide liquidity to a specific trading pair on 1inch. By providing liquidity, Bob can earn fees for every trade made on that trading pair. However, Bob wants to ensure that his capital is utilized efficiently and that he is getting the best possible returns.

Using 1inch’s liquidity protocol, Bob can analyze different liquidity pools and find the one with the highest yield. He can compare factors such as liquidity depth, trading volume, and fees to identify the most optimal pool for his USDT. By choosing the right pool, Bob can achieve the optimal outcome for his liquidity provision strategy.

Case Study 3: Stablecoin Swaps

Charlie wants to swap his USDT for another stablecoin, such as USDC or DAI, as he believes it will provide a more stable investment. However, Charlie wants to ensure that he is getting the best swap rate and minimum slippage for his USDT.

By using 1inch’s aggregation protocol, Charlie can input his desired swap details, such as the amount of USDT he wants to swap and the target stablecoin. The protocol will then search for the best swap rates across multiple exchanges and execute the trade at the most optimal rate. Charlie can achieve his goal of getting the best possible outcome for his USDT swap.

In conclusion, 1inch’s mechanics provide users with the tools to achieve optimal USDT trading outcomes. Whether it’s arbitrage trades, liquidity provision, or stablecoin swaps, users can maximize their profits and minimize their risks by utilizing 1inch’s smart contract and protocols.

Note: Case studies are for illustrative purposes only and do not constitute financial advice. Users should conduct their own research and exercise caution when trading or providing liquidity.

Question-answer:

What is 1inch’s mechanics?

The mechanics of 1inch refer to the underlying technology and algorithms used by the platform to provide optimal trading outcomes for users.

How does 1inch ensure optimal USDT trading outcomes?

1inch ensures optimal USDT trading outcomes by utilizing various strategies, such as splitting orders across multiple decentralized exchanges, leveraging flash loans, and utilizing the best available token swap rates.

Can you explain how 1inch splits orders across multiple decentralized exchanges?

When a user places a trade on 1inch, the platform automatically splits the order across multiple decentralized exchanges to find the best available rates and minimize slippage. This allows users to get the most value out of their trades.

What are flash loans and how does 1inch leverage them?

Flash loans are a type of loan that allows users to borrow funds without any collateral, as long as the loan is paid back within the same transaction. 1inch leverages flash loans to provide liquidity for trades, ensuring that there are enough funds available on decentralized exchanges to fulfill users’ orders.

How does 1inch ensure that users get the best available token swap rates?

1inch utilizes its algorithm to track the token swap rates on various decentralized exchanges in real time. By comparing the rates offered by different exchanges, 1inch is able to route trades through the exchange that offers the best rate, thus ensuring that users get the most favorable swap rates.