Decentralized exchanges (DEXs) have been gaining popularity in the crypto world, offering users more control over their funds and removing the need for intermediaries. One such DEX that has caught the attention of many traders is 1inch.exchange. While there are several DEXs available, 1inch.exchange stands out from the crowd due to its unique features and innovative approach.

What sets 1inch.exchange apart is its use of advanced algorithms and smart contracts to optimize and streamline the trading process. The platform aggregates liquidity from various decentralized exchanges, allowing users to find the best prices and swap tokens efficiently. This means that users can access deeper liquidity pools and potentially get better rates compared to other DEXs.

In addition to its liquidity aggregation, 1inch.exchange also offers other features that enhance the trading experience. One notable feature is its Gas Token (CHI) mechanism, which allows users to save on transaction fees by utilizing gas tokens. This can be a significant advantage, especially during times of high network congestion when gas fees are sky-high.

Furthermore, 1inch.exchange prioritizes user experience by providing a user-friendly interface and seamless integration with popular wallets like MetaMask. This makes it easy for both experienced traders and newcomers to navigate the platform and execute trades with ease. The platform also provides comprehensive data and analytics, allowing users to make informed trading decisions.

Overall, 1inch.exchange offers a unique and compelling proposition for traders in the decentralized finance (DeFi) space. With its advanced algorithms, liquidity aggregation, gas-saving mechanisms, and user-friendly interface, 1inch.exchange sets itself apart from other decentralized exchanges and positions itself as a leading player in the DEX market.

Overview of Decentralized Exchanges

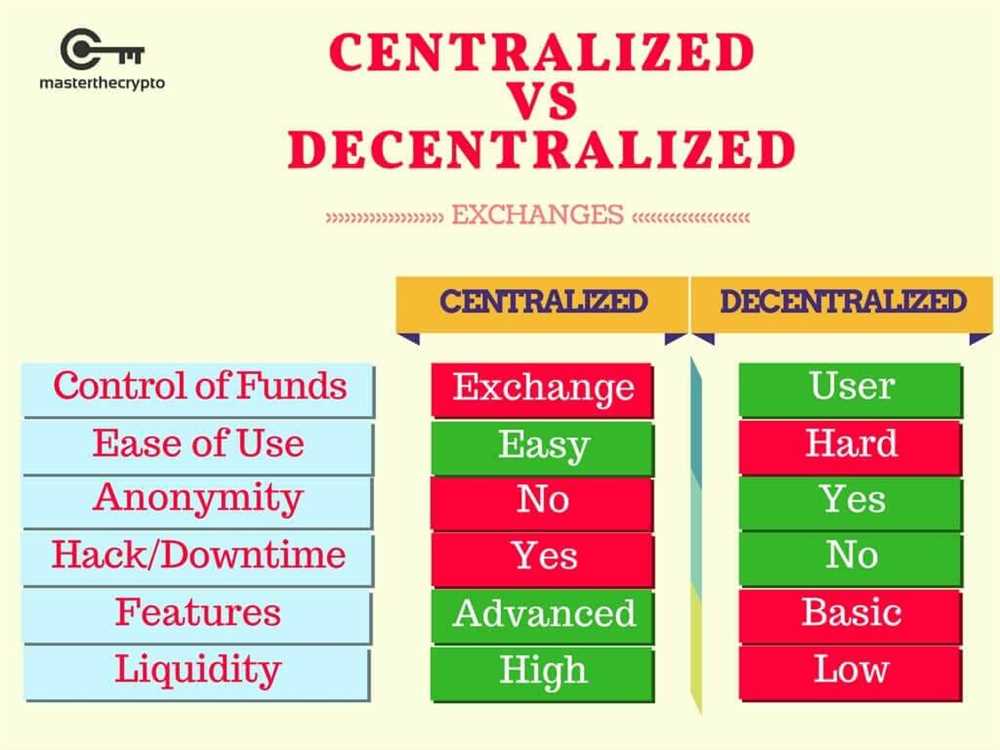

A decentralized exchange (DEX) is a type of cryptocurrency exchange that operates on a blockchain network, allowing users to trade cryptocurrencies directly with each other without the need for an intermediary.

Unlike centralized exchanges, which rely on a trusted third party to hold users’ funds and facilitate transactions, decentralized exchanges are built on smart contracts and operate in a peer-to-peer manner.

One of the main advantages of decentralized exchanges is that they offer increased security and privacy. Since users retain control of their own funds, there is no risk of a centralized exchange being hacked or going bankrupt. Additionally, transactions on a DEX are typically conducted anonymously or pseudonymously, providing users with greater privacy.

Another benefit of decentralized exchanges is that they enable the trading of a wide range of cryptocurrencies. Unlike centralized exchanges, which often only support a limited selection of tokens, DEXs allow users to trade any token that has been created on the blockchain network they are built on.

However, there are also some drawbacks to using decentralized exchanges. DEXs can be slower and less user-friendly compared to centralized exchanges, as they rely on the speed and scalability limitations of the underlying blockchain network. Additionally, the lack of a centralized entity overseeing transactions can lead to liquidity issues and lower trading volumes on DEXs.

Despite these challenges, decentralized exchanges have gained popularity in recent years due to their ability to provide users with greater control over their funds and increased privacy. They are seen as an important component of the decentralized finance (DeFi) ecosystem and are likely to continue to evolve and improve in the future.

Understanding Decentralized Exchanges

Decentralized exchanges (DEXs) are a type of cryptocurrency exchange that operate on a blockchain network, allowing users to trade digital assets directly with each other without the need for an intermediary. Unlike traditional centralized exchanges, where users often have to deposit their funds into the exchange’s custody, DEXs enable users to retain control of their assets throughout the entire trading process.

DEXs utilize smart contracts to facilitate trades, where the terms of the trade are written into code and automatically executed once certain conditions are met. This eliminates the need for a trusted third party to oversee the transaction, providing users with a high level of transparency and security.

One of the key advantages of DEXs is their ability to avoid censorship and government regulation. Since transactions take place directly between peers on a decentralized network, there is no central authority that can impose restrictions or oversight on the exchange. This makes DEXs particularly appealing to users who value privacy and autonomy.

Another benefit of DEXs is their potential for lower fees compared to centralized exchanges. Because DEXs eliminate the need for intermediaries, such as brokers or custodians, users can avoid paying the additional fees associated with these services. Instead, users typically only pay a small fee to cover the cost of executing the smart contract.

However, it’s important to note that DEXs also have some limitations. One of the main challenges is the relatively lower liquidity compared to centralized exchanges. Since DEXs rely on peer-to-peer trading, liquidity can be limited to the number of users actively trading on the platform. This can result in higher slippage and less favorable prices for certain assets.

| Advantages | Limitations |

|---|---|

| Greater privacy and autonomy | Lower liquidity |

| Lower fees | Potentially less favorable prices |

| No censorship or government regulation |

In summary, decentralized exchanges offer a unique approach to trading digital assets, providing users with greater control, privacy, and potentially lower costs. While they may have limitations such as lower liquidity, the benefits they offer make them an attractive option for those seeking a more decentralized and transparent trading experience.

What is 1inch.exchange?

1inch.exchange is a decentralized exchange (DEX) that operates on the Ethereum blockchain. It was launched in 2020 and has quickly gained popularity due to its unique features and capabilities.

Unlike traditional centralized exchanges, 1inch.exchange is non-custodial, meaning that users remain in control of their funds throughout the entire trading process. This is achieved through the use of smart contracts, which eliminates the need for intermediaries and provides users with more security and privacy.

One of the key features of 1inch.exchange is its smart routing system. This system automatically splits orders across multiple liquidity sources to ensure users get the best possible price for their trades. By aggregating liquidity from various sources, including decentralized exchanges, 1inch.exchange minimizes slippage and reduces the overall cost of trading.

In addition to its smart routing system, 1inch.exchange offers a range of other advanced features. These include limit orders, which allow users to set specific price targets for their trades, and liquidity mining, which provides users with the opportunity to earn rewards by providing liquidity to the platform.

Key Features of 1inch.exchange:

- Decentralized: 1inch.exchange operates on the Ethereum blockchain and uses smart contracts to ensure trustless and secure trading.

- Smart Routing: The platform automatically splits orders across multiple liquidity sources to achieve the best possible price.

- Limit Orders: Users can set specific price targets for their trades to execute at the desired price.

- Liquidity Mining: Users can earn rewards by providing liquidity to the platform.

- Multi-Chain Support: 1inch.exchange has expanded to support other blockchains, including Binance Smart Chain and Polygon, to provide users with more options and liquidity.

Overall, 1inch.exchange offers a user-friendly and secure trading experience for individuals looking to trade cryptocurrencies on a decentralized exchange. Its smart routing system and advanced features make it stand out among other decentralized exchanges in the market.

Key Features of 1inch.exchange

1inch.exchange offers a unique set of features that set it apart from other decentralized exchanges. These features include:

1. Aggregation Protocol

1inch.exchange is known for its powerful aggregation protocol, which combines liquidity from various decentralized exchanges to provide users with the best possible trading rates. By fragmenting orders and splitting them across different trading venues, the protocol minimizes slippage and maximizes the chances of getting the most favorable prices.

2. High-Speed Trading

1inch.exchange is built on an advanced technology stack that enables fast and efficient trading. The exchange leverages smart contract execution and off-chain order routing to ensure quick settlement and reduce transaction costs. This allows users to execute trades within seconds, providing a seamless trading experience.

3. Gas Fee Optimization

Gas fees on the Ethereum network can be significantly high during times of congestion. However, 1inch.exchange employs gas fee optimization strategies to minimize transaction costs for users. The platform intelligently selects the most cost-effective trading routes, taking into account gas prices and liquidity pools, to ensure users get the best value for their trades.

4. Liquidity Provider Programs

1inch.exchange offers various liquidity provider programs to incentivize users to provide liquidity to the platform. These programs reward users with a share of the trading fees generated on the exchange, providing an additional income stream for liquidity providers. By participating in these programs, users not only earn passive income but also contribute to the overall liquidity of the platform.

5. Intuitive User Interface

1inch.exchange is designed with user convenience in mind. The platform features an intuitive and user-friendly interface that makes it easy for both novice and experienced traders to navigate and execute trades. The interface provides clear and concise information about available trading pairs, prices, and liquidity, enabling users to make informed decisions.

6. Transparency and Security

1inch.exchange prioritizes transparency and security. The platform provides users with detailed information about the aggregation process, including the sources of liquidity and the execution paths taken. This ensures that users have a clear understanding of how their trades are executed. Additionally, 1inch.exchange implements robust security measures, such as audits and bug bounties, to protect user funds and maintain the integrity of the platform.

| Key Features | Description |

|---|---|

| 1. Aggregation Protocol | Combines liquidity from various decentralized exchanges to provide users with the best trading rates. |

| 2. High-Speed Trading | Enables fast and efficient trading through smart contract execution and off-chain order routing. |

| 3. Gas Fee Optimization | Minimizes transaction costs by selecting cost-effective trading routes based on gas prices and liquidity pools. |

| 4. Liquidity Provider Programs | Offers incentives for liquidity providers through various programs, allowing users to earn passive income. |

| 5. Intuitive User Interface | Designed with a user-friendly interface, making it easy to navigate and execute trades. |

| 6. Transparency and Security | Prioritizes transparency by providing detailed information about the aggregation process and implements robust security measures. |

Comparing 1inch.exchange with Other Decentralized Exchanges

When it comes to decentralized exchanges (DEXs), 1inch.exchange stands out in several ways that set it apart from other platforms in the market.

First and foremost, 1inch.exchange offers a unique feature called “DEX aggregation.” This means that it sources liquidity from multiple DEXs and finds the best prices for users, resulting in optimal trade execution. No other decentralized exchange currently offers this level of liquidity aggregation, making 1inch.exchange a top choice for traders.

Another aspect that makes 1inch.exchange stand out is its user-friendly interface and intuitive design. Many decentralized exchanges can be quite complex and overwhelming for new users, but 1inch.exchange simplifies the trading process and provides a seamless experience. Its clean interface and clear instructions make it easy for anyone to start trading cryptocurrencies.

In terms of security, 1inch.exchange also ranks high. It utilizes multiple security protocols, including smart contract audits and bug bounties, to ensure the safety of user funds. Additionally, 1inch.exchange does not require users to create an account or provide any personal information, further enhancing privacy and reducing the risk of data breaches.

Furthermore, 1inch.exchange boasts a wide range of supported tokens, allowing users to access a diverse array of cryptocurrencies. This extensive selection sets it apart from other decentralized exchanges that may have more limited token options.

Lastly, 1inch.exchange has a strong community and active development team behind it. The platform is constantly evolving and improving based on user feedback, ensuring that it stays up-to-date with the latest trends and developments in the decentralized exchange space.

Overall, when comparing 1inch.exchange with other decentralized exchanges, its unique DEX aggregation, user-friendly interface, robust security measures, extensive token support, and dedicated team make it a standout choice for both experienced and beginner traders.

Liquidity Aggregation

One of the key features that sets 1inch.exchange apart from other decentralized exchanges is its liquidity aggregation. This means that the platform sources liquidity from various decentralized exchanges and liquidity pools, allowing users to access a deeper pool of liquidity and get the best possible prices for their trades.

By aggregating liquidity from different sources, 1inch.exchange is able to provide users with more options and better prices for their trades. This is especially important in the decentralized exchange space, where liquidity can sometimes be fragmented across different platforms.

How does liquidity aggregation work on 1inch.exchange?

When a user wants to make a trade on 1inch.exchange, the platform splits the trade across multiple decentralized exchanges and liquidity pools to get the best possible execution price. This process is done automatically and is invisible to the user.

1inch.exchange uses a unique algorithm called Pathfinder, which takes into account factors such as slippage, gas prices, and liquidity depth to determine the most optimal trading route. This ensures that users get the best possible prices and minimize their trading costs.

Benefits of liquidity aggregation on 1inch.exchange

There are several benefits that liquidity aggregation provides on 1inch.exchange:

- Better prices: By aggregating liquidity from various sources, 1inch.exchange is able to provide users with access to a deeper pool of liquidity, resulting in better prices for their trades.

- More options: With liquidity aggregation, users have more options available to them for their trades. They can choose from a wider range of decentralized exchanges and liquidity pools, giving them more flexibility in executing their trades.

- Lower slippage: By splitting trades across multiple platforms, 1inch.exchange is able to reduce slippage and provide users with better execution prices. This is especially important for large trades where even small price differences can have a significant impact.

- Reduced trading costs: By finding the most optimal trading routes, 1inch.exchange helps users minimize their trading costs. This includes gas fees, which can be a significant factor in decentralized exchange trading.

Overall, liquidity aggregation is a key feature of 1inch.exchange that sets it apart from other decentralized exchanges. It provides users with better prices, more options, and lower trading costs, making it a top choice for decentralized trading.

Question-answer:

What is 1inch.exchange?

1inch.exchange is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges, allowing users to find the best rates across different platforms. It combines smart contract technology with an algorithm that splits trade orders between different exchanges in order to minimize slippage and reduce trading costs.

How does 1inch.exchange compare to other decentralized exchanges?

Unlike other decentralized exchanges, 1inch.exchange is an aggregator that pulls liquidity from multiple decentralized exchanges, rather than operating as a standalone exchange. This allows users to find the best rates and reduces the need for multiple accounts on different platforms. Additionally, 1inch.exchange employs a unique algorithm that splits orders across exchanges to minimize slippage and improve trading efficiency.

What is the advantage of using 1inch.exchange?

The main advantage of using 1inch.exchange is the ability to access liquidity from multiple decentralized exchanges through a single interface. This not only allows users to find the best rates for their trades, but also saves time and reduces gas fees by eliminating the need to manually search and switch between different platforms. The splitting algorithm used by 1inch.exchange also helps to minimize slippage and optimize trading efficiency.

How does 1inch.exchange ensure the security of users’ funds?

1inch.exchange itself does not hold or custody any user funds. Instead, it integrates with various decentralized exchanges and executes trades directly on these platforms. This means that users retain control over their funds and are not exposed to the security risks associated with centralized exchanges. Additionally, 1inch.exchange has implemented various security measures and smart contract audits to mitigate the risk of attacks or vulnerabilities.

What are the fees for using 1inch.exchange?

The fees for using 1inch.exchange vary depending on the specific trades and the decentralized exchanges involved. As an aggregator, 1inch.exchange sources liquidity from multiple platforms, each of which may have its own fee structure. Generally, users can expect to pay standard gas fees for Ethereum transactions, as well as any additional fees charged by the decentralized exchanges. However, 1inch.exchange strives to provide the best rates and minimize fees for users through its smart routing algorithm.