If you’re an active trader in the world of decentralized finance (DeFi), you know how important it is to have access to the best rates and liquidity. That’s where the 1inch DEX aggregator comes in. With its advanced technology and powerful algorithm, 1inch ensures that you get the most out of your trades, maximizing your profits and minimizing your losses.

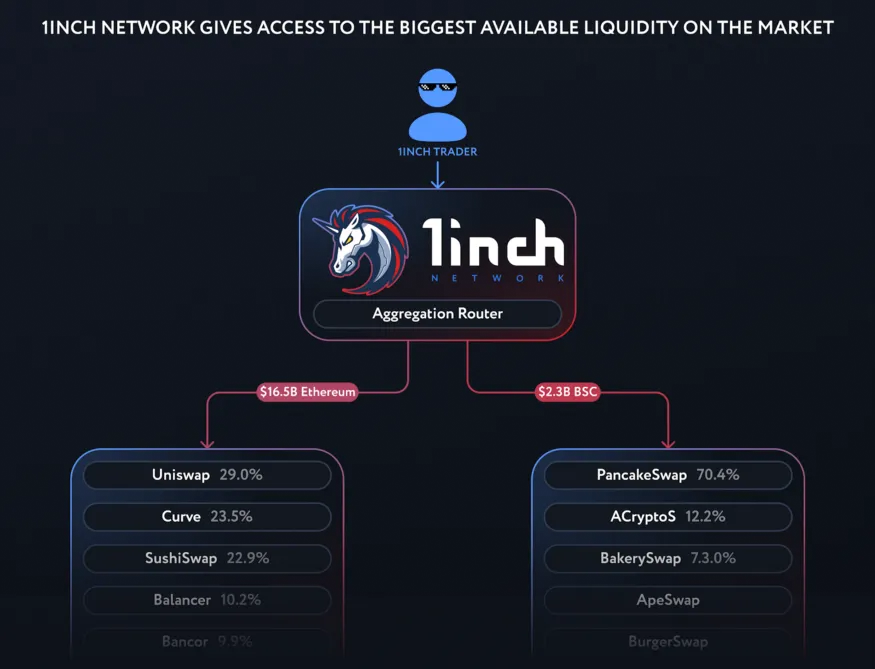

Unlike traditional centralized exchanges, 1inch connects to multiple decentralized exchanges (DEXs) simultaneously, allowing you to find the best prices and execute trades with just a few clicks. The platform searches across a wide range of DEXs, including Uniswap, SushiSwap, and more, to ensure that you get the best possible rates for your trades.

But 1inch is more than just a DEX aggregator. It also offers a range of advanced features and tools to optimize your trading strategy. With its smart contract technology, 1inch enables the execution of complex trades, such as flash swaps and limit orders, with ease. This gives you greater flexibility and control over your trading activities.

Furthermore, 1inch provides detailed analytics and insights into your trading performance, helping you make informed decisions and improve your strategy. You can easily track your trading history, monitor your portfolio performance, and identify trends and patterns to stay ahead of the market.

Whether you’re a beginner or an experienced trader, the 1inch DEX aggregator is a valuable tool for optimizing your trading strategy. With its advanced technology, access to multiple DEXs, and powerful features, you can trade more efficiently and profitably in the world of DeFi.

Optimize Trading Strategy

When it comes to trading, having an optimized strategy can make a significant difference in your overall success. While there are many factors to consider when developing a trading strategy, here are some key areas to focus on to help optimize your approach:

- Define Your Goals: Before you start trading, it’s important to have a clear understanding of your goals. Are you looking to make short-term gains or are you in it for the long haul? Understanding your objectives will help shape your trading strategy.

- Research and Analysis: Take the time to thoroughly research and analyze the market you are interested in trading. Stay updated on the latest news and events that could impact the market. Utilize different technical and fundamental analysis tools to evaluate potential trading opportunities.

- Diversify Your Portfolio: It’s important not to put all your eggs in one basket. Diversifying your portfolio can help minimize risk and maximize potential returns. Consider investing in different assets or markets to spread out your risk.

- Set Clear Entry and Exit Points: Establishing clear entry and exit points is crucial for any trading strategy. This will help you avoid emotional decision-making and allow you to stick to your plan. Use stop-loss orders to limit potential losses and take-profit orders to secure your profits.

- Monitor and Adapt: The market is constantly changing, so it’s essential to monitor your trades and adapt your strategy accordingly. Stay updated on market trends and adjust your approach as needed. Regularly evaluate the performance of your trades to identify any areas for improvement.

- Utilize Trading Tools and Platforms: Take advantage of trading tools and platforms, such as the 1inch DEX aggregator, to optimize your trading strategy. These tools can provide you with access to multiple decentralized exchanges, allowing you to find the best possible trade execution and optimize your trading strategy.

Remember, optimizing your trading strategy is an ongoing process. It requires continuous learning, monitoring, and adaptation. By following these steps and staying disciplined, you can increase your chances of success in the ever-changing world of trading.

Maximize Profit

When it comes to trading, the ultimate goal is to maximize profit. With 1inch DEX aggregator, you can achieve just that. This powerful tool allows you to find the best prices and liquidity across multiple decentralized exchanges, increasing your chances of making profitable trades.

Here are some strategies you can implement to maximize your profit using 1inch DEX aggregator:

- Take advantage of the best prices: 1inch DEX aggregator scans various decentralized exchanges to find the best prices for the tokens you want to trade. By using this tool, you can ensure that you always get the most favorable rates, reducing slippage and maximizing your profits.

- Utilize multiple liquidity sources: 1inch DEX aggregator searches for liquidity across a wide range of decentralized exchanges, ensuring that you have access to the largest pool of funds. By leveraging multiple liquidity sources, you can increase your chances of executing trades at the desired prices and avoid missing out on profitable opportunities.

- Optimize gas fees: Gas fees can significantly impact your trading profitability. 1inch DEX aggregator allows you to compare gas fees across different decentralized exchanges, enabling you to choose the most cost-effective option. By minimizing gas fees, you can maximize your overall profit margin.

- Implement smart contract interactions: 1inch DEX aggregator supports smart contract interactions, allowing you to execute complex trading strategies. You can combine different protocols, access advanced trading features, and take advantage of arbitrage opportunities to maximize your profit potential.

- Stay informed with data insights: 1inch DEX aggregator provides real-time data insights, helping you make informed trading decisions. You can access historical price charts, trading volume, and other relevant data to identify trends and optimize your trading strategy accordingly.

In conclusion, maximizing profit requires a combination of smart trading strategies and the right tools. 1inch DEX aggregator offers a comprehensive solution for optimizing your trading strategy, ensuring that you can make the most profitable trades possible.

Minimize Risk

When it comes to trading, minimizing risk is crucial to protect your investments and ensure long-term profitability. Here are some strategies to help you minimize risk when using the 1inch DEX aggregator:

Diversify Your Portfolio

One of the most effective ways to minimize risk is by diversifying your portfolio. Instead of putting all your eggs in one basket, spread your investments across multiple assets and trading pairs. This way, if one asset or trading pair experiences a significant price drop, your overall portfolio will not be overly affected.

Set Stop Loss Orders

To protect yourself from significant losses, consider placing stop loss orders. A stop loss order allows you to set a specific price at which your trade will automatically be executed if the price reaches that point. By setting a stop loss order, you can limit your losses if the market moves against you.

Research and Due Diligence

Before entering any trade, it is crucial to conduct thorough research and due diligence. Understand the fundamentals and technical aspects of the assets you are trading. Stay updated with market news and developments that could impact the price of the assets. By being well-informed, you can make better trading decisions and minimize the risk of making uninformed trades.

In addition to these strategies, always start with small investments and gradually increase your trading volume as you gain more experience and confidence. It is also essential to keep track of your trades and regularly review and adjust your trading strategy to adapt to changing market conditions.

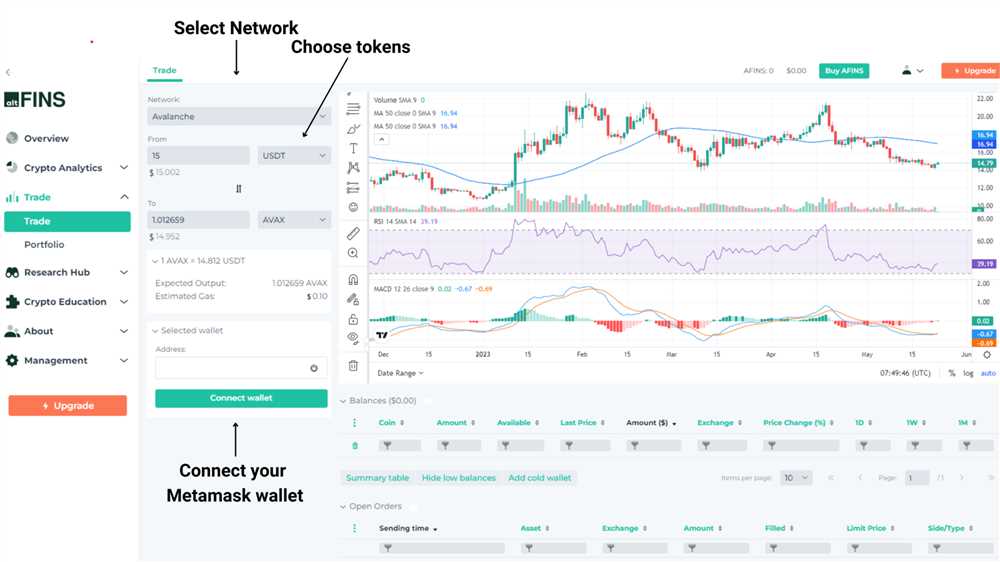

Access Wide Range of Tokens

With 1inch DEX aggregator, you gain access to a wide range of tokens, allowing you to diversify your trading portfolio and maximize your profit potential. Whether you are looking to trade popular cryptocurrencies like Bitcoin and Ethereum, or explore emerging tokens, the 1inch DEX aggregator gives you the opportunity to access various tokens from different decentralized exchanges.

By leveraging the power of the 1inch DEX aggregator, you no longer have to manually search for tokens across different exchanges. With just a few clicks, you can easily compare prices and liquidity for a specific token and execute your trades at the best available rates.

Token Selection Made Easy

1inch DEX aggregator provides a user-friendly interface that simplifies the process of selecting tokens for your trading strategy. You can search for tokens by name or symbol, or explore different categories such as stablecoins, decentralized finance (DeFi) tokens, or non-fungible tokens (NFTs).

Additionally, you can filter tokens based on their liquidity and trading volume, ensuring that you are trading in the most active markets. The 1inch DEX aggregator also provides information about the token’s price charts, historical trading data, and relevant news, empowering you to make informed trading decisions.

Discover New Investment Opportunities

With the 1inch DEX aggregator, you can also discover new investment opportunities by exploring tokens that are not available on traditional centralized exchanges. Decentralized exchanges often list tokens that represent new projects or innovative ideas, giving you a chance to invest in the early stages of their development.

Furthermore, the 1inch DEX aggregator supports the trading of tokens on various blockchain networks, including Ethereum, Binance Smart Chain, and Polygon. This allows you to tap into the growing ecosystem of decentralized finance and take advantage of cross-chain opportunities.

In conclusion, the 1inch DEX aggregator offers you access to a wide range of tokens, making it easier for you to optimize your trading strategy. Whether you are a seasoned trader or a beginner in the world of decentralized finance, the 1inch DEX aggregator provides you with the tools and information you need to make informed trading decisions and maximize your profit potential.

Start using the 1inch DEX aggregator today and unlock a world of opportunities!

Efficient Execution

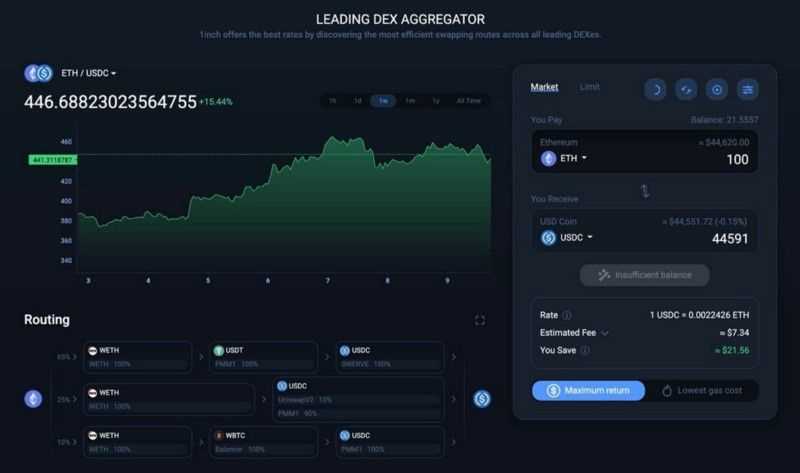

Efficient execution is crucial in optimizing your trading strategy with the 1inch DEX aggregator. By executing your trades quickly and at the best possible price, you can maximize your profits and minimize your risks.

Benefits of Efficient Execution

When you execute your trades efficiently, you can take advantage of price discrepancies between different decentralized exchanges (DEXs), ensuring that you always get the best deal. This is especially important in the fast-paced world of cryptocurrency trading, where prices can fluctuate rapidly.

Efficient execution also helps you reduce slippage, which is the difference between the expected price of a trade and the price at which it is actually executed. By minimizing slippage, you can increase the accuracy of your trading strategy and achieve better results.

How to Achieve Efficient Execution

There are several strategies you can employ to optimize the execution of your trades:

- Trade on Multiple DEXs: By using the 1inch DEX aggregator, you can access liquidity across multiple DEXs. This allows you to find the best prices and execute your trades more efficiently.

- Set Limit Orders: Instead of executing market orders, which are executed at the current market price, you can set limit orders to specify the price at which you are willing to buy or sell. This gives you more control over the execution of your trades and can help you achieve better prices.

- Utilize Gas Optimization: Gas fees can significantly impact the cost and efficiency of your trades. By optimizing the gas fees you pay, you can reduce the cost of your transactions and execute trades more quickly.

By implementing these strategies and leveraging the features of the 1inch DEX aggregator, you can optimize the execution of your trading strategy and improve your overall trading performance.

Question-answer:

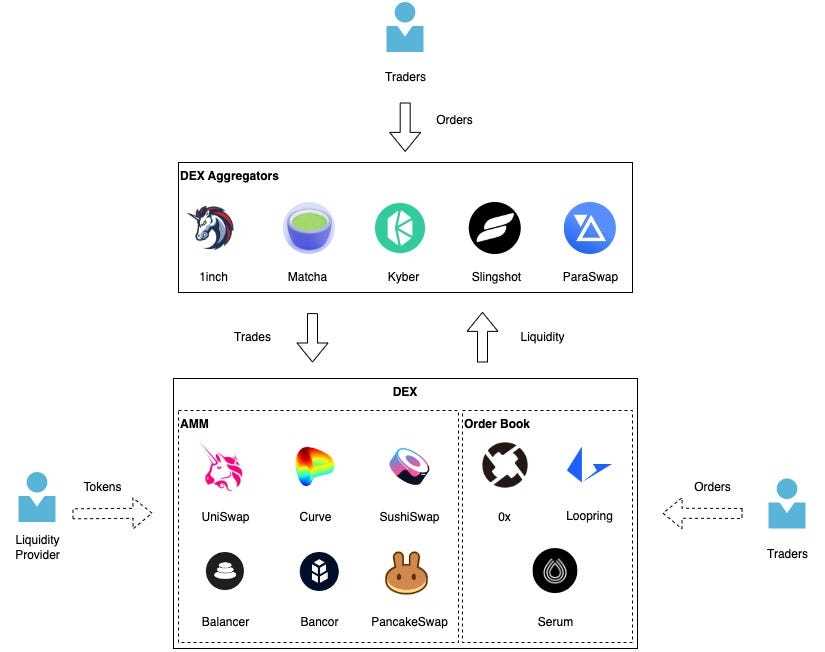

What is a DEX aggregator?

A DEX aggregator is a platform that allows users to access multiple decentralized exchanges (DEXs) through a single interface. It aggregates liquidity from various DEXs and provides the best possible trading rates and outcomes for users.

How does 1inch optimize trading strategies?

1inch optimizes trading strategies by splitting trades across multiple DEXs to find the best possible trading routes and rates. It compares prices on multiple exchanges and routes the trade accordingly to minimize slippage and maximize the amount of tokens received.

Can I use 1inch to trade any token?

Yes, you can use 1inch to trade any token that is available on the supported DEXs. 1inch aggregates liquidity from popular DEXs such as Uniswap, SushiSwap, Balancer, and many others, so you have access to a wide range of tokens for trading.

What are the benefits of using a DEX aggregator like 1inch?

Using a DEX aggregator like 1inch offers several benefits. Firstly, it saves time by allowing you to access multiple DEXs through a single interface. Secondly, it optimizes trading strategies by finding the best possible routes and rates. Lastly, it maximizes liquidity by aggregating liquidity from different DEXs, resulting in better trading outcomes for users.