In the rapidly evolving world of decentralized finance (DeFi), one of the key challenges faced by users is the lack of efficient price discovery mechanisms. The decentralized nature of DeFi platforms often leads to fragmented liquidity across multiple exchanges, resulting in significant price differences for the same asset.

This is where 1inch, a decentralized exchange (DEX) aggregator, plays a crucial role in improving price discovery. By tapping into multiple liquidity sources, such as DEXs and centralized exchanges, 1inch is able to provide users with the best possible trade execution by finding the most optimal prices for their desired assets.

1inch achieves this by utilizing complex algorithms and smart contract technology to aggregate liquidity across different exchanges and platforms. This allows users to access deeper liquidity pools and ensures that their trades are executed at the most favorable prices available in the market.

Furthermore, 1inch also offers users the option to split their trades across multiple exchanges in order to minimize slippage and achieve better overall execution. This feature is particularly advantageous for larger trades, where even small price differences can have a significant impact on the final execution price.

Overall, 1inch plays a critical role in improving price discovery in the DeFi ecosystem by providing users with access to the best possible prices for their trades. By aggregating liquidity and utilizing advanced algorithms, 1inch helps users achieve better trade execution and maximize their returns in the highly competitive world of DeFi.

The Role of 1inch: Improving Price Discovery in DeFi

The decentralized finance (DeFi) space has experienced exponential growth in recent years, offering a wide range of financial services on the Ethereum network. However, one of the biggest challenges for DeFi platforms and users is the lack of reliable and efficient price discovery mechanisms.

What is Price Discovery?

Price discovery refers to the process by which the market determines the fair value of an asset. In traditional financial markets, price discovery is facilitated by central exchanges that match buy and sell orders to determine the asset’s price. However, in the decentralized and fragmented nature of the DeFi ecosystem, price discovery becomes more complex.

With numerous decentralized exchanges (DEXs) and liquidity pools scattered across different protocols, users face difficulties in obtaining accurate and up-to-date price information. This can lead to arbitrage opportunities, where users can exploit price discrepancies between different platforms, and ultimately result in market inefficiencies.

The Role of 1inch

1inch is a decentralized exchange aggregator and liquidity protocol that aims to solve the problem of fragmented liquidity and improve price discovery in the DeFi space. By integrating various DEXs and liquidity pools into one platform, 1inch offers users access to a large pool of liquidity and ensures the best possible prices for their trades.

1inch uses an algorithm called Pathfinder, which routes users’ trades through the most optimal paths to achieve the best prices. It considers factors such as liquidity, slippage, and gas fees to ensure that users get the most favorable trade execution. By aggregating liquidity from different sources, 1inch minimizes the impact of low liquidity on prices, thus improving price discovery in the DeFi ecosystem.

In addition to its exchange aggregation services, 1inch also provides an Automated Market Maker (AMM) called Mooniswap. Mooniswap is designed to enhance liquidity provision and reduce impermanent loss for liquidity providers. It achieves this by implementing a unique mechanism that prevents front-running and reduces the risk of price manipulation.

The Benefits of Improved Price Discovery

Improved price discovery in DeFi has several benefits for both users and the overall ecosystem. Firstly, it allows users to make more informed trading decisions by providing accurate and up-to-date price information. This reduces the risks associated with price manipulation and ensures fair and efficient markets.

Furthermore, improved price discovery facilitates more efficient arbitrage opportunities, which help to align prices across different platforms and reduce market inefficiencies. This benefits both traders and liquidity providers by maximizing profit opportunities and reducing trading costs.

Overall, the role of 1inch in improving price discovery in DeFi is crucial for the growth and maturation of the ecosystem. By aggregating liquidity and optimizing trade execution, 1inch enhances the overall trading experience and contributes to the development of a more transparent and efficient DeFi market.

| Key Takeaways |

|---|

| – Price discovery is a challenge in the decentralized nature of the DeFi ecosystem. |

| – 1inch is a decentralized exchange aggregator that improves price discovery by integrating various DEXs and liquidity pools. |

| – 1inch uses the Pathfinder algorithm to ensure the best prices for users’ trades. |

| – Improved price discovery benefits users by providing accurate price information and facilitating more efficient arbitrage opportunities. |

Enhancing Liquidity Pool Efficiency

One of the key benefits of the 1inch protocol is its ability to enhance liquidity pool efficiency in decentralized finance (DeFi). Liquidity pools are essential for decentralized exchanges (DEXs) as they provide the necessary liquidity for trading.

1inch achieves liquidity pool efficiency by aggregating liquidity from various sources, such as different decentralized exchanges, and routing trades to the most optimal path. This ensures that traders can access the best possible liquidity and price execution.

The protocol achieves this by utilizing its intelligent algorithm, known as the Pathfinder. The Pathfinder algorithm calculates the optimal trading route by considering various factors, including liquidity depth, price slippage, and gas fees. By analyzing these factors, 1inch can identify the most efficient path for trading.

Furthermore, 1inch also employs a gas optimization strategy to reduce transaction costs. Gas fees are a significant concern in DeFi, as they can be expensive, especially during times of high network congestion. The protocol optimizes gas usage by batching multiple trades into a single transaction, reducing the overall gas fees for users.

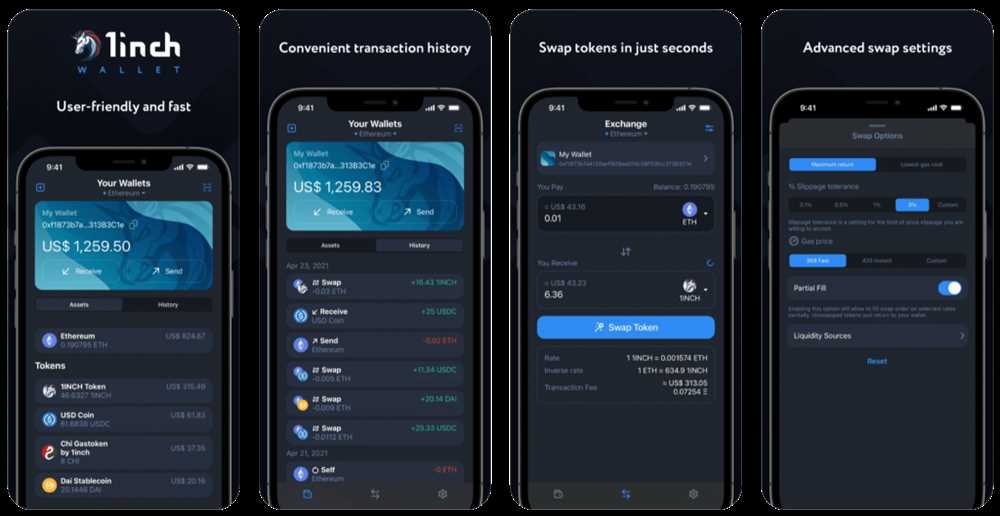

In addition to enhancing liquidity pool efficiency, the 1inch protocol also offers features like limit orders and stop loss orders to further improve the trading experience for users. These features allow traders to set specific price levels at which their orders should be executed, ensuring that they can capture desirable trading opportunities.

Overall, the 1inch protocol plays a crucial role in improving liquidity pool efficiency in DeFi. By aggregating liquidity and employing intelligent algorithms, the protocol ensures that traders have access to the best possible liquidity and price execution while minimizing transaction costs.

Increasing Transparency and Security

Transparency and security are two crucial factors in the decentralized finance (DeFi) space. With a range of different protocols and platforms available, it is essential for users to have access to reliable and accurate information about prices, fees, and overall market conditions. 1inch plays a significant role in increasing transparency and security in DeFi through its unique features and capabilities.

1inch offers a comprehensive set of tools and functionalities that allow users to examine and analyze different decentralized exchanges (DEXs) and liquidity protocols. By aggregating liquidity from various sources, users can compare prices and find the best possible rates for their transactions. This helps to prevent slippage and ensures that users are getting the most favorable prices.

Furthermore, 1inch provides real-time and accurate information about fees and transaction costs across different platforms. Users can get a clear picture of the costs associated with their trades, allowing them to make informed decisions and avoid hidden fees or excessive charges.

1inch also enhances security in DeFi by employing cutting-edge technology and smart contract audits. By conducting thorough security assessments and working with security experts, 1inch ensures that its protocols and smart contracts are safe and robust. This helps to protect users’ funds from potential attacks or vulnerabilities.

In addition to its technical security measures, 1inch also addresses the issue of trust in DeFi. By providing a transparent and auditable source code, users can verify the integrity of the platform and have confidence in its operations. This level of transparency helps to build trust among users and creates a more secure environment for DeFi activities.

Overall, 1inch plays a vital role in increasing transparency and security in the DeFi space. Through its aggregation capabilities, real-time information, and security measures, 1inch helps users make better-informed decisions while protecting their funds from potential risks or vulnerabilities. By promoting transparency and security, 1inch contributes to the overall development and sustainability of the DeFi ecosystem.

Enabling Efficient Arbitrage Opportunities

Arbitrage plays a crucial role in efficient price discovery and liquidity provision in the decentralized finance (DeFi) ecosystem. 1inch is a leading decentralized exchange aggregator that enables traders to access the best possible prices for their trades across various decentralized exchanges.

The 1inch aggregator scans multiple decentralized exchanges to find the most favorable prices for a given trade. It combines liquidity from different exchanges and splits a trade into multiple smaller trades to take advantage of price discrepancies, reducing slippage and maximizing profits.

By enabling efficient arbitrage opportunities, 1inch helps improve price discovery in the DeFi space. Traders can take advantage of price differences between different exchanges and ensure that they are always getting the best possible prices for their trades.

Additionally, 1inch provides an opportunity for arbitrageurs to generate profits by exploiting price discrepancies. Arbitrageurs can buy assets at a lower price on one exchange and sell them at a higher price on another exchange, effectively bridging the gap between different markets and contributing to price equilibrium.

| Benefits of Efficient Arbitrage Opportunities |

|---|

| Improved liquidity provision |

| Lower slippage |

| Increased trading volumes |

| Enhanced price discovery |

Furthermore, efficient arbitrage opportunities drive competition among decentralized exchanges, pushing them to improve their pricing mechanisms and overall user experience. This leads to a more robust and efficient DeFi ecosystem, benefiting all participants.

Overall, 1inch plays a critical role in enabling efficient arbitrage opportunities in the DeFi space. By aggregating liquidity and optimizing trades, it helps traders achieve better prices, while also incentivizing arbitrageurs to contribute to price discovery and market efficiency.

Question-answer:

What is the role of 1inch in the DeFi ecosystem?

1inch plays a crucial role in the DeFi ecosystem by improving price discovery. It aggregates liquidity from different decentralized exchanges (DEXs) to provide users with the best possible prices for swapping assets.

How does 1inch improve price discovery in DeFi?

1inch improves price discovery in DeFi by connecting to multiple DEXs and searching for the best prices available. It compares the prices on different exchanges and routes the trades accordingly to ensure users get the most favorable rates.

Why is price discovery important in decentralized finance?

Price discovery is important in decentralized finance because it helps users find the best possible prices for their trades. By improving price discovery, 1inch enables users to save money by getting better rates and reduces the risk of price manipulation.

How does 1inch aggregate liquidity from different DEXs?

1inch aggregates liquidity by connecting to various DEXs through smart contracts and routing the trades through the most efficient paths. It splits the trade across different exchanges to ensure the best possible prices for users.