Introducing 1inch Exchange, the revolutionary platform that is transforming the way we trade cryptocurrencies. With its advanced automated trading features, 1inch Exchange has quickly become a game changer in the crypto market.

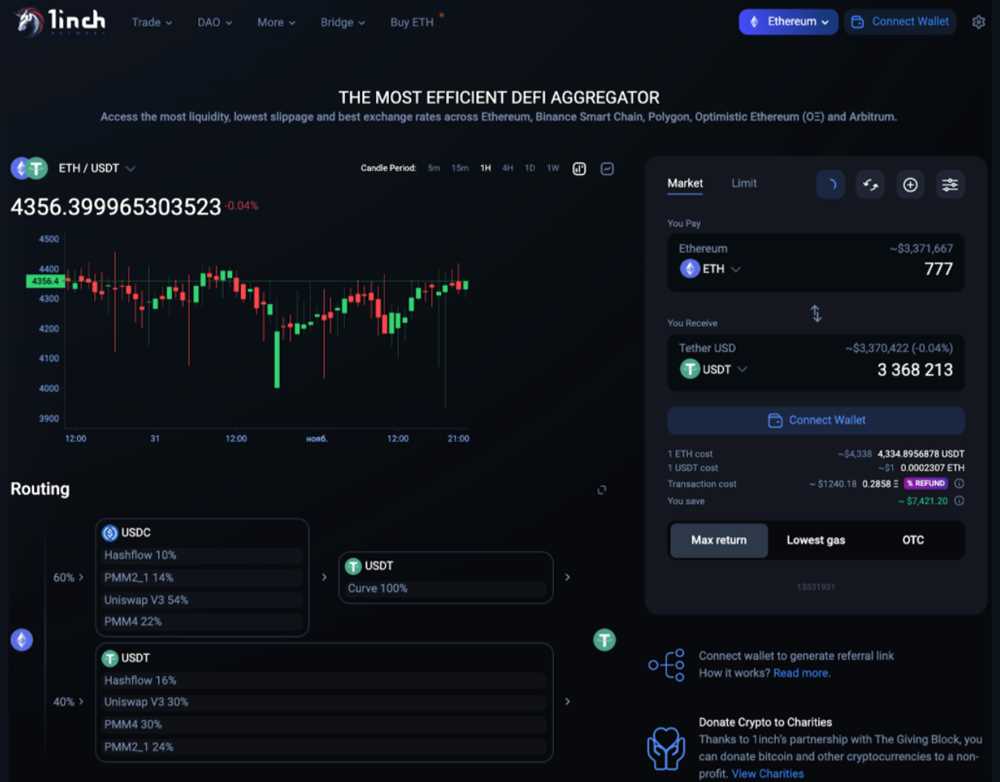

What sets 1inch Exchange apart from other exchanges is its intelligent routing algorithm. This algorithm scours multiple decentralized exchanges to ensure that you get the best possible price and lowest slippage when making a trade. With 1inch Exchange, you no longer have to worry about manually searching for the best prices or dealing with high transaction fees.

But that’s not all. 1inch Exchange also offers a range of powerful trading tools, including limit orders, stop-loss orders, and profit-taking orders. These tools allow you to automate your trading strategies, giving you more control over your investments and maximizing your profits.

With its user-friendly interface and robust security measures, 1inch Exchange is the perfect platform for both beginner and experienced traders. Whether you’re looking to buy, sell, or swap cryptocurrencies, 1inch Exchange has got you covered.

Join the revolution and experience the impact of automated trading on 1inch Exchange. Don’t miss out on this game-changing opportunity in the crypto market. Sign up now and take your trading to the next level.

The Impact of Automated Trading on 1inch Exchange

Automated trading has revolutionized the way cryptocurrency is bought and sold on the 1inch Exchange. With its advanced algorithms and software, automated trading has greatly enhanced the efficiency and effectiveness of executing trades, resulting in a game-changing impact on the crypto market.

Increased Speed and Accuracy

One of the key advantages of automated trading on the 1inch Exchange is the ability to execute trades at lightning-fast speeds. By eliminating the need for manual intervention, automated trading algorithms can enter and exit trades within fractions of a second, ensuring that users can take advantage of profitable opportunities without delay.

Moreover, automated trading also significantly improves the accuracy of trades. By using pre-defined rules and parameters, automated trading algorithms can execute trades with precision, eliminating human errors and emotions that can often negatively affect trading outcomes.

24/7 Market Monitoring

Another major impact of automated trading on the 1inch Exchange is the ability to monitor the market 24/7. Unlike manual trading, which requires constant presence and attention, automated trading algorithms can continuously analyze market conditions, detect patterns, and execute trades even when traders are asleep or away.

This constant monitoring ensures that users can take advantage of price movements and market opportunities at any time, maximizing their chances of making profitable trades.

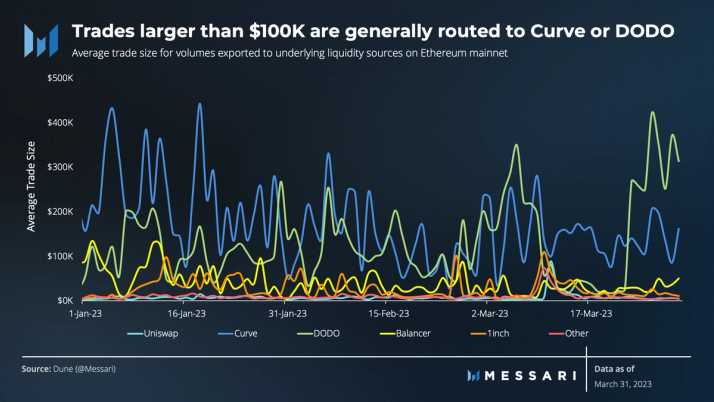

Liquidity and Market Depth

Automated trading on the 1inch Exchange has also contributed to increased liquidity and market depth. Through automated trading, a large number of buy and sell orders can be executed at any given time, ensuring that the market remains active and liquid.

This increased liquidity benefits traders by reducing slippage and ensuring that their orders are executed at the desired price. It also attracts more participants to the market, leading to a more vibrant and competitive trading environment.

In conclusion, automated trading has had a game-changing impact on the 1inch Exchange and the crypto market as a whole. It has increased speed and accuracy, enabled 24/7 market monitoring, and boosted liquidity and market depth. As a result, traders can enjoy enhanced trading experiences, increased profitability, and greater opportunities to capitalize on the ever-evolving crypto market.

Revolutionizing the Crypto Market

With the advent of automated trading on the 1inch Exchange, the crypto market is experiencing a revolution like never before. This innovative technology is changing the way traders navigate the volatile world of cryptocurrencies, bringing with it a new level of efficiency, speed, and profitability.

Unprecedented Efficiency

Automated trading on the 1inch Exchange eliminates the need for manual execution of trades, allowing users to set predefined parameters for their trading strategies. This automation not only saves time but also minimizes human error, as trades are executed swiftly and accurately. Traders can now take advantage of the 24/7 nature of the crypto market, without the need for constant monitoring and decision-making.

Enhanced Speed

The 1inch automated trading system analyzes market data and executes trades at lightning-fast speeds. With the use of advanced algorithms, trades can be executed in a matter of milliseconds, maximizing opportunities in the fast-paced crypto market. Traders no longer have to worry about missing out on profitable trades due to delays or human limitations.

Profitability at Its Best

Automated trading on the 1inch Exchange opens up a world of possibilities for traders, allowing them to capitalize on market movements more efficiently. With the ability to execute trades instantly and take advantage of market arbitrage opportunities, traders can maximize their profits and minimize their risks. The sophisticated algorithms and strategies employed by the 1inch automated trading system ensure that traders stay ahead of the curve and make informed decisions.

In conclusion, the impact of automated trading on the 1inch Exchange is truly game-changing. By revolutionizing the crypto market with unprecedented efficiency, enhanced speed, and unparalleled profitability, this technology empowers traders to navigate the complexities of the crypto market with confidence and success.

Enhancing Liquidity and Efficiency

One of the key benefits of automated trading on the 1inch Exchange is the enhancement of liquidity and efficiency in the crypto market. With automated trading algorithms, users can trade cryptocurrencies seamlessly and at high speed, resulting in improved liquidity and reduced slippage.

By leveraging the power of smart contracts and decentralized protocols, the 1inch Exchange ensures that trades are executed in a trustless and secure manner. This eliminates the need for intermediaries and central authorities, further enhancing the efficiency of the trading process.

Automated trading also allows for improved market-making strategies, as trades can be executed based on predefined conditions and market indicators. This enables market participants to take advantage of arbitrage opportunities and optimize their trading strategies, ultimately leading to increased liquidity in the market.

Additionally, automated trading on the 1inch Exchange provides users with access to a wide range of liquidity sources. With 1inch’s innovative aggregation algorithm, users can access liquidity from multiple decentralized exchanges, ensuring the best possible execution price for their trades.

Overall, the implementation of automated trading on the 1inch Exchange has revolutionized the crypto market by enhancing liquidity and efficiency. Traders can now execute trades faster, with improved market access and reduced trading costs, ultimately benefiting the entire crypto ecosystem.

Question-answer:

What is automated trading?

Automated trading, also known as algorithmic trading, is the use of computer programs and software to execute trading orders in financial markets. It involves the use of pre-defined rules and parameters to automatically trade assets, without the need for human intervention.

How does automated trading work on 1inch Exchange?

On 1inch Exchange, automated trading works through the use of smart contracts and decentralized finance protocols. Traders can connect their wallets to 1inch Exchange and use trading bots or algorithms to automatically execute trading strategies. These bots can take advantage of price discrepancies, liquidity pools, and other factors to help improve trading efficiency and maximize profits.

What are the advantages of automated trading on 1inch Exchange?

Automated trading on 1inch Exchange offers several advantages. Firstly, it allows for round-the-clock trading, as the bots can execute trades 24/7 without the need for human intervention. Secondly, it eliminates human emotions from trading, reducing the risk of making impulsive or irrational decisions. Additionally, automated trading can help capture opportunities that may be missed by manual traders, as the bots can quickly analyze market conditions and execute trades at high speeds.