The 1inch Exchange Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible rates for their trades. In this article, we will take a closer look at the key takeaways from the 1inch Exchange Protocol’s whitepaper and explore how it aims to revolutionize the world of decentralized trading.

One of the main challenges faced by decentralized exchanges is the fragmentation of liquidity across multiple platforms. This results in users having to manually search for the best rates and split their orders across different DEXs to achieve optimal execution. The 1inch Exchange Protocol addresses this issue by aggregating liquidity from various DEXs into a single interface, allowing users to access the best rates and execute trades seamlessly.

Powered by an algorithm known as the Pathfinder, the 1inch Exchange Protocol intelligently splits the user’s orders across multiple exchanges to ensure the best possible execution. The algorithm takes into consideration factors such as gas prices, trading fees, and slippage, optimizing the trade path for the user. This not only saves time and effort but also minimizes the overall costs associated with trading on decentralized exchanges.

The 1inch Exchange Protocol also incorporates a unique feature called “Chi GasToken,” which allows users to optimize their transaction costs by reducing the amount of gas fees paid. By utilizing Chi GasToken, users can significantly save on gas fees, especially in situations with high gas prices or congested networks. This feature further enhances the cost-efficiency of trading on the 1inch Exchange Protocol.

In addition to its efficient trading capabilities, the 1inch Exchange Protocol also prioritizes security and user control. It operates on a fully decentralized model, utilizing smart contracts on the Ethereum blockchain to execute trades. This ensures that users have full control over their funds and eliminates the need for intermediaries or custodial services.

In conclusion, the 1inch Exchange Protocol is an innovative solution that addresses the challenges faced by decentralized exchanges. By aggregating liquidity, optimizing trade execution, and offering cost-saving features, it provides users with a seamless and cost-efficient trading experience. With its commitment to security and user control, the 1inch Exchange Protocol sets a new standard for decentralized trading platforms.

Understanding the 1inch Exchange Protocol

The 1inch Exchange Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges (DEXs) to provide users with the best possible trade execution. The protocol achieves this by splitting a trade across multiple DEXs to minimize slippage and maximize the user’s profits.

One of the key features of the 1inch Exchange Protocol is its Pathfinder algorithm, which is responsible for finding the most efficient route across the different DEXs. The algorithm takes into account factors such as liquidity, fees, and gas costs to determine the optimal path for a trade.

Another important component of the protocol is its Chi GasToken mechanism, which helps reduce the gas costs of executing trades on Ethereum. By utilizing Chi GastToken, the protocol can increase the efficiency of transactions and provide users with cost savings.

The 1inch Exchange Protocol also incorporates a unique smart contract architecture that allows users to interact with the protocol directly through their wallets. This enables users to easily access and utilize the protocol’s features without the need for intermediaries.

Furthermore, the protocol takes advantage of on-chain liquidity protocols like Uniswap, Kyber Network, and Bancor, among others, to ensure a diverse and robust liquidity pool. By tapping into multiple DEXs, the protocol offers users a wide selection of tokens and competitive prices.

In summary, the 1inch Exchange Protocol is a decentralized exchange aggregator that leverages a unique algorithm, gas-saving mechanisms, and on-chain liquidity protocols to provide users with optimal trade execution. Its innovative features make it a powerful tool for traders looking to maximize their profits while minimizing slippage and gas costs.

Key Components of the 1inch Exchange Protocol

The 1inch Exchange Protocol is built to provide users with efficient and cost-effective decentralized trading. It consists of several key components that work together to ensure optimal trades for users.

1. Pathfinder

Pathfinder is a key component of the 1inch Exchange Protocol that determines the most efficient trading routes across various decentralized exchanges. It uses an algorithm to calculate the best path for a trade, taking into account liquidity and prices on different exchanges. This helps users get the best possible outcome for their trades.

2. Aggregation

Aggregation is another crucial component of the 1inch Exchange Protocol. It combines multiple orders from various exchanges into a single trade, reducing slippage and optimizing trade execution. The aggregation algorithm analyzes liquidity pools and order books to determine the most optimal trades for users.

3. Smart Contract Network

The smart contract network is the backbone of the 1inch Exchange Protocol. It is responsible for executing trades and ensuring the security and transparency of the process. The smart contract network also facilitates the integration of various decentralized exchanges and ensures interoperability between them.

4. Liquidity Protocol

The liquidity protocol is a component of the 1inch Exchange Protocol that sources liquidity from various decentralized exchanges. It aggregates liquidity pools to provide users with the best possible rates for their trades. The liquidity protocol also ensures the availability of liquidity for different trading pairs and reduces the risk of slippage.

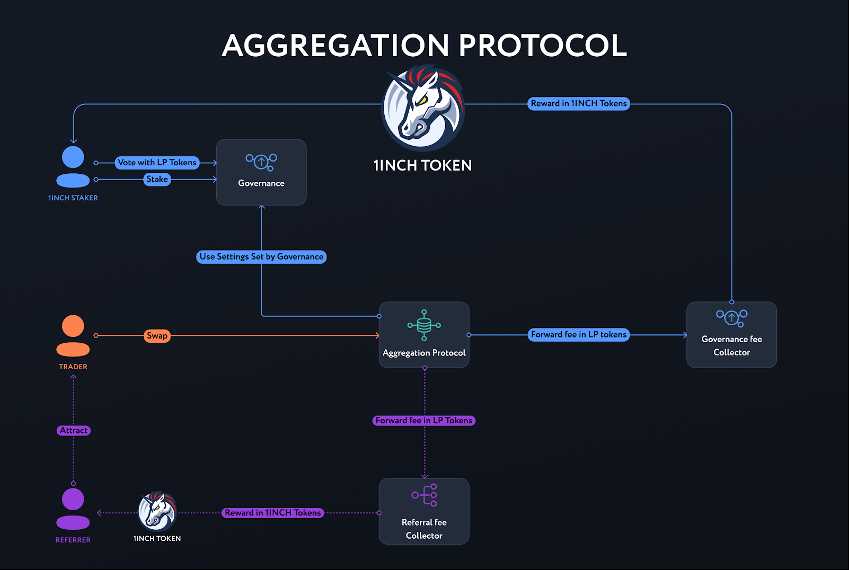

5. Governance and User Incentives

Governance and user incentives are integral to the functioning of the 1inch Exchange Protocol. The governance mechanism allows users to participate in the decision-making process for the protocol, ensuring decentralization and community involvement. User incentives, such as token rewards, encourage participation and engagement in the protocol.

| Component | Description |

|---|---|

| Pathfinder | Determines the most efficient trading routes across decentralized exchanges. |

| Aggregation | Combines multiple orders into a single trade, reducing slippage and optimizing execution. |

| Smart Contract Network | Executes trades and ensures security and transparency of the process. |

| Liquidity Protocol | Sources liquidity from decentralized exchanges and provides the best rates for trades. |

| Governance and User Incentives | Allows user participation in decision-making and provides incentives for engagement. |

The combination of these key components enables the 1inch Exchange Protocol to offer users efficient, cost-effective, and decentralized trading experiences. By leveraging the power of decentralized finance and blockchain technology, the protocol provides users with access to optimal trading routes and liquidity pools, all while ensuring security, transparency, and community involvement.

Benefits and Advantages of the 1inch Exchange Protocol

The 1inch Exchange Protocol offers several benefits and advantages for users looking to trade cryptocurrencies. Here are some of the key benefits:

1. Cost-efficient and Optimal Trades

By utilizing the 1inch Exchange Protocol, users can benefit from cost-efficient trades. The protocol aggregates liquidity from multiple decentralized exchanges, finding the most optimal trading paths and ensuring users get the best possible rates. This not only reduces slippage but also minimizes trading fees.

2. Enhanced Liquidity

1inch Exchange Protocol provides enhanced liquidity by accessing various decentralized exchanges. The protocol combines liquidity from different sources, allowing users to trade large amounts without experiencing significant price impact. This enables traders to execute orders with minimal disruptions and ensures better trade execution.

3. Reduced Single Exchange Risk

One of the primary advantages of the 1inch Exchange Protocol is that it reduces the risk associated with relying on a single exchange. By aggregating liquidity from multiple decentralized exchanges, the protocol disperses risk, mitigating the possibility of a single point of failure. This enhances the overall security and reliability of the trading process.

4. Gas Optimization

With the 1inch Exchange Protocol, users can optimize their gas costs by automatically routing trades through the most gas-efficient paths. This helps users save on transaction fees, especially during times of high network congestion when gas prices tend to surge. The protocol intelligently selects the most cost-effective routes, ensuring users get the best possible trade execution while keeping gas costs to a minimum.

In conclusion, the 1inch Exchange Protocol provides users with cost-efficient trades, enhanced liquidity, reduced single exchange risk, and gas optimization. These benefits make the protocol an attractive option for users looking to trade cryptocurrencies while minimizing costs and maximizing trade execution.

Question-answer:

What is the 1inch Exchange Protocol?

The 1inch Exchange Protocol is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide users with the best possible trading rates.

How does the 1inch Exchange Protocol work?

The 1inch Exchange Protocol uses smart contracts and algorithms to split user orders across multiple decentralized exchanges to maximize liquidity and minimize price slippage. It also employs an intelligent routing system to find the most efficient trading path for each trade.

What are the key advantages of using the 1inch Exchange Protocol?

The key advantages of using the 1inch Exchange Protocol include access to a wide range of liquidity sources, the ability to find the best trading rates, reduced slippage and fees, and increased transparency and security due to the use of smart contracts on the Ethereum blockchain.

How does the 1inch Liquidity Protocol work?

The 1inch Liquidity Protocol allows liquidity providers to deposit funds into liquidity pools and earn rewards in the form of fees generated by trading activity. These liquidity pools are used by the 1inch Exchange Protocol to source liquidity for trades.

What is the significance of the 1INCH token?

The 1INCH token is the native utility token of the 1inch Network. It has several use cases, including fee discounts, governance rights, and participation in the network’s liquidity mining program. Holders of the 1INCH token can also stake it to earn rewards.