Decentralized Finance (DeFi) has taken the world by storm, revolutionizing the traditional financial industry. With the rise of blockchain technology and smart contracts, DeFi platforms enable users to access a wide range of financial services in a decentralized and trustless manner.

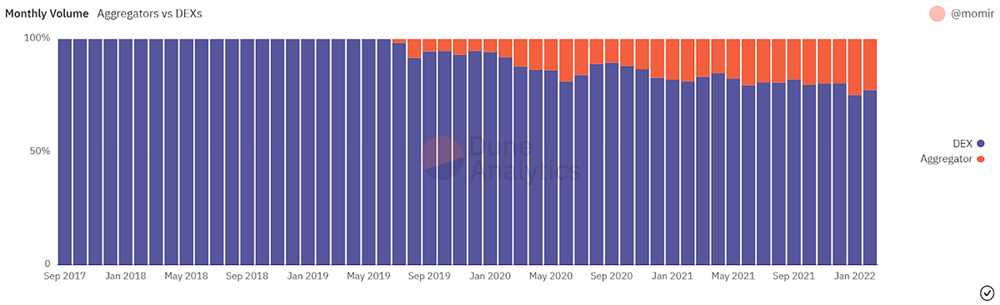

One of the key components of the DeFi ecosystem is decentralized exchanges (DEXs). These platforms allow users to trade cryptocurrencies directly from their wallets, without the need for intermediaries. However, the fragmented nature of the DEX landscape poses challenges for traders, as they have to manually navigate and execute trades across multiple platforms.

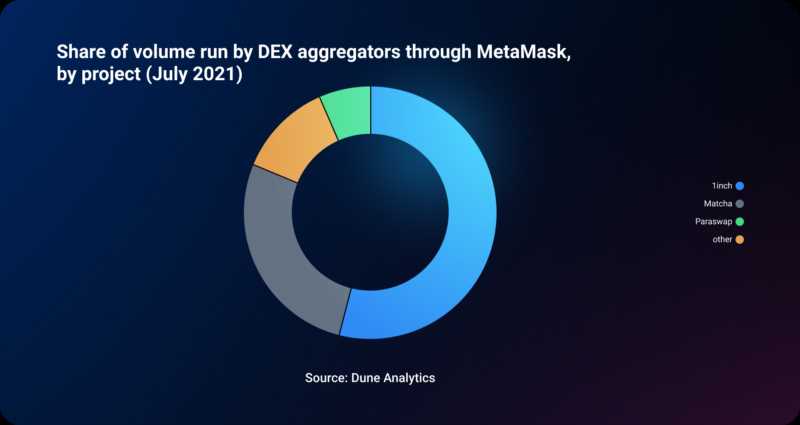

This is where DEX aggregators like 1inch Network play a crucial role. DEX aggregators are platforms that integrate with various DEXs to provide users with the best possible trading rates. By aggregating liquidity from multiple sources, DEX aggregators can offer traders better prices and lower slippage.

1inch Network is a prime example of a DEX aggregator that has gained significant recognition in the DeFi space. With its intelligent algorithm and efficient routing mechanism, 1inch Network automatically splits and routes trades across multiple DEXs to ensure users get the best possible rates. It also takes into account gas costs and liquidity pools to optimize trade execution and minimize costs for users.

Moreover, 1inch Network facilitates seamless integration with popular DeFi protocols, enabling users to access additional features such as yield farming, lending, and borrowing, all from a single platform. This integration further enhances the convenience and efficiency of trading on the 1inch Network.

In conclusion, the emergence of DEX aggregators like 1inch Network has revolutionized the way users interact with decentralized exchanges in the DeFi era. By offering better prices, lower slippage, and seamless integration with other DeFi protocols, DEX aggregators play a vital role in enhancing the overall trading experience for DeFi users.

The Evolution of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) has been rapidly evolving since its inception, revolutionizing the traditional financial system. DeFi refers to the use of blockchain technology and smart contracts to recreate and enhance various financial services and products, eliminating the need for intermediaries such as banks and brokers.

One of the early applications of DeFi was decentralized exchanges (DEX), which allowed users to trade cryptocurrencies without the need for a centralized authority. However, early DEXs faced issues such as low liquidity and limited trading pairs.

As the demand for DeFi grew, developers began creating platforms known as DEX aggregators. These aggregators, such as 1inch Network, combine liquidity from multiple DEXs to provide users with better rates and a wider range of trading options.

DEX aggregators leverage advanced algorithms to split orders across multiple DEXs and optimize trading routes. This ensures that users get the best possible prices and minimizes slippage. With the rise in popularity of yield farming and liquidity mining, DEX aggregators also provide users with opportunities to maximize their returns by earning additional tokens.

Furthermore, DEX aggregators enhance user experience by providing a single user interface that integrates multiple DEXs. This eliminates the need for users to switch between different platforms to find the best trading opportunities.

The evolution of DeFi has not only led to the development of DEX aggregators but also to the emergence of various other DeFi applications. These include decentralized lending and borrowing protocols, prediction markets, stablecoins, and decentralized insurance platforms. Each of these applications brings its own unique benefits and contributes to the overall growth and adoption of DeFi.

|

|

|

|

|

Decentralized Lending |

Prediction Markets |

Stablecoins |

Decentralized Insurance |

These applications are collectively driving the adoption of DeFi by offering advantages such as lower fees, increased transparency, and greater access to financial services. They enable individuals to have more control over their funds and participate in the global financial system without the need for permission from centralized authorities.

As the DeFi ecosystem continues to evolve, we can expect to see further innovations and advancements. The role of DEX aggregators such as 1inch Network will continue to play a crucial role in providing users with efficient and seamless access to the growing DeFi landscape.

What Are Dex Aggregators and How Do They Work?

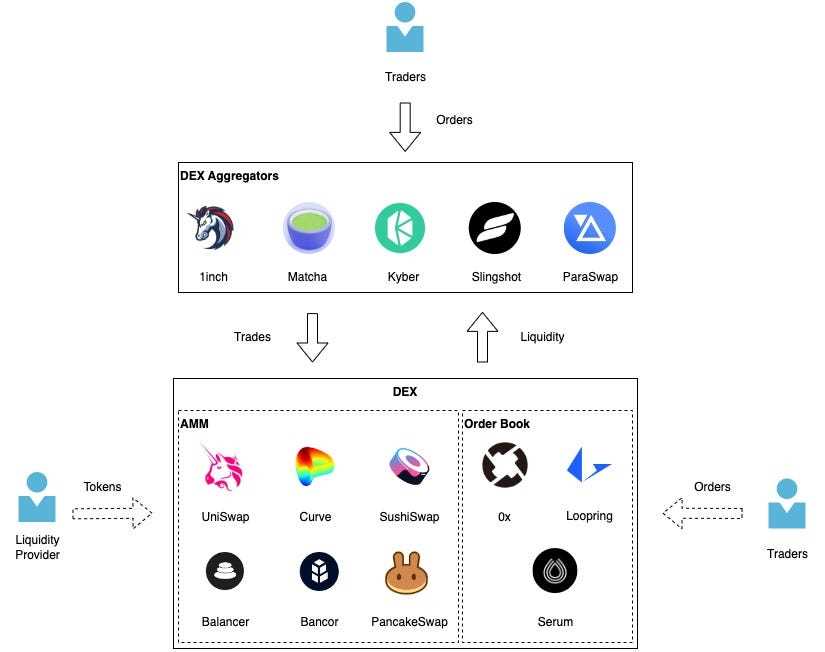

Dex aggregators are platforms or protocols that allow users to find and access the most optimal routes for trading cryptocurrencies across decentralized exchanges (Dexs). These platforms aggregate liquidity from multiple Dexs, allowing users to access a larger pool of liquidity, better prices, and reduced slippage.

When a user wants to make a trade, a Dex aggregator uses algorithms and smart contracts to search for the best possible trading route across different Dexs. The aggregator takes into account factors such as price, liquidity, and slippage to find the most efficient route for the trade.

The aggregator splits the trade into smaller parts and executes them across multiple Dexs simultaneously or sequentially. This allows users to access liquidity from different sources and get the best prices for their trades. The aggregator also ensures that the trades are executed in a way that minimizes slippage and fees.

Dex aggregators work by integrating with various Dexs through APIs (Application Programming Interfaces) and fetching data on available liquidity, prices, and trading pairs. They also leverage smart contracts to interact with multiple Dexs, execute trades, and settle transactions.

Overall, Dex aggregators provide users with a convenient and efficient way to access decentralized trading and benefit from the advantages offered by multiple Dexs. They simplify the process of finding the best prices and routes for trading cryptocurrencies, ultimately enhancing liquidity and reducing trading costs for users.

1inch Network: A Leading Dex Aggregator in the DeFi Space

The 1inch Network is a prominent decentralized exchange (Dex) aggregator in the decentralized finance (DeFi) space. With its innovative approach to liquidity aggregation, it has quickly established itself as a leading player in the industry.

The Need for Dex Aggregators

In the fast-growing DeFi ecosystem, the need for efficient and cost-effective trading solutions has become increasingly important. With multiple decentralized exchanges available, it can be challenging for traders to navigate and find the best prices for their trades. Dex aggregators like 1inch Network tackle this problem by combining liquidity from various Dex platforms into a single interface.

By leveraging smart contracts and algorithmic trading, 1inch Network scans multiple Dex platforms in real-time, searching for the best prices and optimal routes for users’ trades. This not only saves time but also minimizes slippage and reduces transaction costs.

The Features and Benefits of 1inch Network

1inch Network offers a range of features and benefits that make it a preferred choice for traders in the DeFi space. Some of its key features include:

1. Best Price Execution: The 1inch Network dynamically splits users’ trades across multiple Dex platforms to ensure the best execution price for their transactions, maximizing their returns.

2. Intuitive User Interface: The platform’s user-friendly interface makes it easy for traders to navigate and execute trades seamlessly. The 1inch swap feature allows users to trade without leaving the platform.

3. Gas Optimization: 1inch Network intelligently routes trades to avoid high gas fees, ensuring cost-effective transactions for users.

The benefits of using 1inch Network as a Dex aggregator include:

a. Enhanced Liquidity: By aggregating liquidity from multiple Dex platforms, 1inch Network provides access to a larger pool of liquidity, resulting in improved trade execution and reduced slippage.

b. Lower Costs: The platform’s smart contract technology allows users to trade at competitive prices and lower transaction costs compared to using individual Dex platforms directly.

c. Time Savings: With 1inch Network, traders can save time by accessing multiple Dex platforms and obtaining the best prices in a single interface. This eliminates the need for manual price comparison across various platforms.

In conclusion, 1inch Network has emerged as a leading Dex aggregator in the DeFi space, providing traders with a seamless and cost-effective trading experience. Its innovative approach to liquidity aggregation, combined with its user-friendly interface and gas optimization, makes it a preferred choice for traders looking to maximize their returns and efficiency in the DeFi market.

The Significance and Future Potential of Dex Aggregators

Dex aggregators play a crucial role in the rapidly evolving world of decentralized finance (DeFi). As the demand for decentralized exchanges (Dex) continues to grow, the need for efficient and user-friendly ways to access liquidity across multiple platforms becomes more apparent. Dex aggregators address this need by combining the liquidity pools of various decentralized exchanges into a single interface, offering users access to a wider choice of tokens and better prices.

The significance of dex aggregators lies in their ability to improve trading efficiency and reduce costs for DeFi users. By connecting to multiple Dex platforms, aggregators enable traders to bypass the need for manual searching and execution on different exchanges. This not only saves time but also reduces the impact of slippage and potential front-running. Dex aggregators also provide users with a comprehensive overview of available liquidity, enabling them to make informed decisions based on real-time market conditions.

Furthermore, dex aggregators facilitate the integration of different DeFi protocols, enhancing interoperability within the decentralized ecosystem. By connecting various protocols, aggregators enable users to access a broader range of financial instruments, such as lending, borrowing, and staking, all through a single platform. This interoperability opens up new possibilities for users to maximize the potential of their assets and explore different investment strategies.

The future potential of dex aggregators is vast. As DeFi continues to gain traction and expand into new markets, dex aggregators are poised to become a vital infrastructure layer for accessing decentralized liquidity. With the pace of innovation in DeFi, new protocols and liquidity sources emerge regularly. Dex aggregators can adapt and integrate these new offerings, ensuring users have access to the latest opportunities and avoiding fragmentation of the DeFi landscape.

Moreover, dex aggregators can play a crucial role in improving overall user experience in DeFi. By providing a seamless and intuitive interface, aggregators can attract more users to the ecosystem, bridging the gap between traditional finance and decentralized finance. This user-friendly approach will be essential in driving mainstream adoption of DeFi and unlocking its full potential.

In conclusion, dex aggregators have significant importance and future potential in the DeFi space. They enhance trading efficiency, provide a comprehensive overview of liquidity, facilitate interoperability, and improve the user experience. As DeFi continues to evolve, dex aggregators are well-positioned to play a critical role in shaping the future of decentralized finance.

Question-answer:

What is the role of dex aggregators in DeFi?

Dex aggregators play a crucial role in DeFi by allowing users to access multiple decentralized exchanges (DEXs) through a single platform. They aggregate liquidity from various sources and provide users with the best available prices, reduced slippage, and savings on transaction fees.

How does the 1inch Network function as a dex aggregator?

The 1inch Network uses smart contract technology to aggregate liquidity from different DEXs such as Uniswap, SushiSwap, Balancer, and more. It splits a user’s order across multiple DEXs to find the best available prices, taking into account liquidity and gas costs. The routing algorithm ensures that users get the most optimal trading experience.

What are the advantages of using dex aggregators like 1inch?

Using dex aggregators like 1inch provides several advantages. Firstly, it allows users to access a wide range of liquidity from different DEXs, increasing the chances of finding the best prices. Secondly, it reduces slippage by splitting an order across multiple DEXs. Lastly, it helps users save on transaction fees by finding the most cost-efficient routes for their trades.

Can anyone use dex aggregators like 1inch?

Yes, anyone can use dex aggregators like 1inch. These platforms are open to anyone with an internet connection and a compatible wallet. Users can trade a wide range of tokens and access the benefits of aggregated liquidity, reduced slippage, and cost savings on transaction fees.