1inch is a decentralized exchange (DEX) aggregator that enables users to find the best prices for trading various cryptocurrencies across different DEXs. One of the key factors that sets 1inch apart from other DEX aggregators is its unique fee structure, which offers users a more cost-effective and transparent trading experience.

Unlike traditional centralized exchanges, which often have complex fee structures and hidden charges, 1inch employs a simple and straightforward fee mechanism. When users make a trade on 1inch, they pay a fixed fee of 0.3% of the total transaction volume. This fee is automatically deducted from the user’s wallet and distributed to liquidity providers who contribute to the liquidity pools on 1inch.

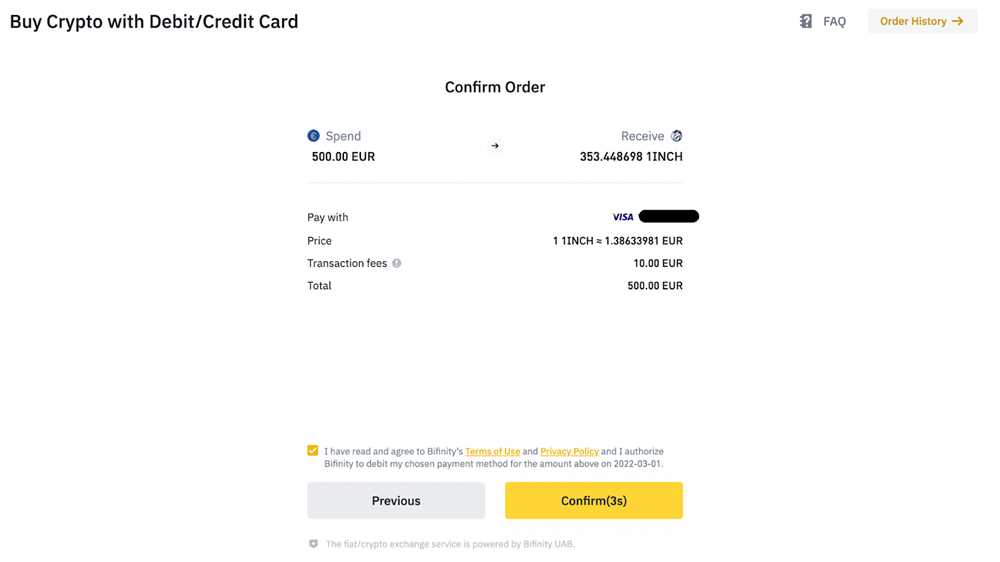

In addition to the 0.3% trading fee, 1inch also charges a gas fee for executing transactions on the Ethereum network. Gas fees are standard fees that users pay for interacting with the Ethereum blockchain and are not specific to 1inch. However, 1inch provides users with an estimated gas cost before confirming the transaction, allowing them to make an informed decision.

Another notable aspect of 1inch’s fee structure is the absence of any deposit or withdrawal fees. This means that users can freely deposit and withdraw their funds from 1inch without incurring any additional charges. This is in stark contrast to many centralized exchanges, which often impose hefty deposit and withdrawal fees.

In conclusion, 1inch offers a transparent and cost-effective fee structure that benefits both traders and liquidity providers. With its fixed trading fee, estimated gas cost, and lack of deposit/withdrawal fees, 1inch provides a more efficient and user-friendly trading experience in the decentralized finance (DeFi) space.

Understanding the 1inch platform

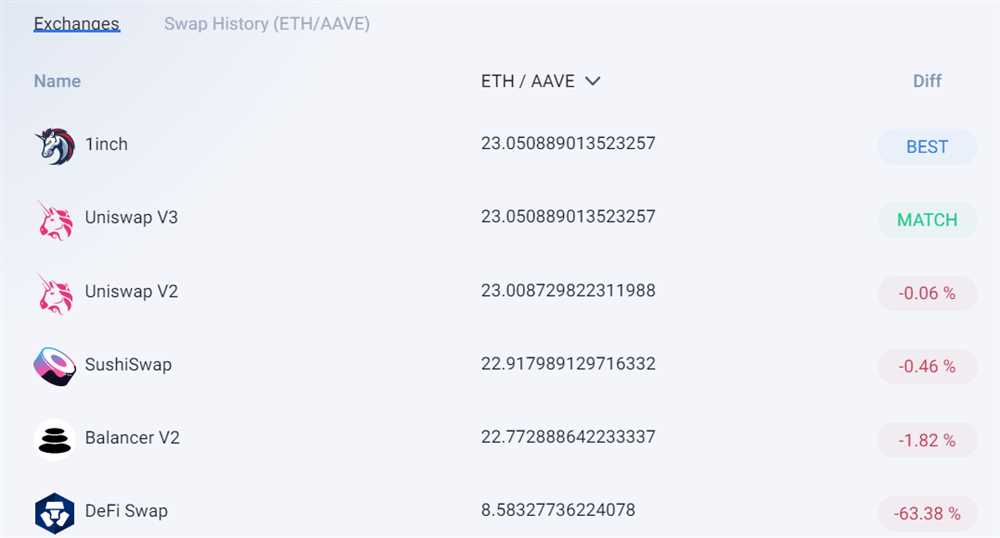

The 1inch platform is a decentralized exchange aggregator that provides users with the ability to swap tokens across multiple liquidity pools. It utilizes smart contract technology to find the best possible trading routes on various decentralized exchanges, such as Uniswap, SushiSwap, and Balancer.

1inch leverages complex algorithms and automated market makers (AMMs) to ensure that users receive the most optimal rates for their trades. By splitting large orders across multiple exchanges, it minimizes slippage and maximizes liquidity for users.

One of the key features of the 1inch platform is its ability to incorporate gas fees into the calculations for optimal trades. Gas fees refer to the cost of executing transactions on the Ethereum network. By factoring in gas fees, the platform ensures that users are aware of the total cost of their trades and can make informed decisions.

How does the 1inch platform work?

When a user initiates a trade on the 1inch platform, it searches various decentralized exchanges to find the best prices and optimal routes. The platform then splits the user’s trade across multiple liquidity pools, executing each part of the trade on the respective exchange with the best rate.

1inch also supports limit orders, allowing users to specify certain conditions for their trades, such as a maximum slippage percentage. This feature is particularly useful for traders who want more control over their trades and wish to avoid excessive slippage.

The platform provides users with a simple and intuitive interface, making it easy for both beginner and experienced traders to navigate. It also offers advanced features, such as the ability to customize slippage tolerance and gas limits, for more experienced users.

The benefits of using 1inch

By using the 1inch platform, users can benefit from the following:

- Best rates: 1inch employs smart contract technology to find the most favorable trading routes, ensuring users get the best possible rates for their trades.

- Liquidity optimization: The platform splits trades across multiple liquidity pools, maximizing liquidity and minimizing slippage.

- Gas fee optimization: 1inch incorporates gas fees into its calculations, allowing users to make informed decisions based on the total cost of their trades.

- Limit orders: Traders have the option to set limit orders and customize conditions for their trades, giving them more control over their trading strategies.

In conclusion, the 1inch platform is a powerful decentralized exchange aggregator that offers users a range of benefits, including optimal rates, liquidity optimization, gas fee transparency, and advanced trading features. It is a user-friendly platform suitable for both beginner and experienced traders.

Exploring the fee model of 1inch

When it comes to decentralized exchanges (DEXs), one important aspect to consider is the fee structure. 1inch, a popular DEX aggregator, has its own unique fee model that sets it apart from traditional exchanges. Let’s take a closer look at how fees work on 1inch.

Fees for trades

1inch charges two types of fees: protocol fees and gas fees. Protocol fees are set by individual DEXs and are a percentage of the transaction value. These fees go to the liquidity providers of the respective DEX. Gas fees, on the other hand, are paid to Ethereum miners to process and validate transactions on the network.

The protocol fees on 1inch vary depending on the DEX being used. Different DEXs have different fee structures, which means that the fees can vary from one trade to another. It’s important to note that the protocol fees are not collected by 1inch itself, but are passed on to the liquidity providers.

Fee discounts

1inch offers fee discounts for users who hold and stake its native token, 1INCH. By staking 1INCH tokens, users can earn a share of the fees generated on the platform. The more tokens a user stakes, the higher their fee discount will be. This incentivizes users to hold and use 1INCH tokens, creating a symbiotic relationship between the platform and its users.

The fee discounts provided by 1inch can significantly reduce the overall fees paid by traders, making it a cost-effective option for decentralized trading.

In conclusion, the fee model of 1inch is designed to benefit both liquidity providers and users. By passing on protocol fees to liquidity providers and offering fee discounts through staking 1INCH tokens, 1inch ensures a fair and cost-effective trading experience on its platform.

Evaluating the benefits for users

When it comes to using the 1inch crypto platform, users can expect a range of benefits that make it a standout choice. One of the key benefits is the competitive fee structure that 1inch offers.

Unlike some other platforms that charge high fees for transactions, 1inch takes a different approach. It leverages its unique aggregator technology to find the best prices and liquidity across multiple decentralized exchanges. This means that users can enjoy lower fees compared to traditional exchanges, while still accessing a wide range of tokens.

In addition to lower fees, 1inch also offers users the convenience of a seamless user experience. The platform is designed to be user-friendly and intuitive, making it easy for both beginners and experienced traders to navigate. With a simple and straightforward interface, users can quickly execute trades, manage their portfolio, and access important data and analytics.

Another benefit for users is the security measures put in place by 1inch. The platform incorporates the latest security protocols and follows best practices to ensure the safety of users’ funds. This includes utilizing smart contract technology and partnering with reputable and audited decentralized exchanges to minimize the risk of hacks or security breaches.

Furthermore, 1inch aims to provide users with transparency and fairness. The platform provides detailed information on fees, rates, and token prices, allowing users to make informed decisions. Additionally, the governance token of 1inch, 1INCH, gives users the opportunity to participate in the decision-making process and shape the future of the platform.

In conclusion, the benefits for users of the 1inch crypto platform are substantial. From competitive fees to a user-friendly interface and robust security measures, 1inch offers a compelling and trustworthy platform for trading and accessing the world of decentralized finance.

Comparing 1inch fees with other crypto platforms

When it comes to choosing a crypto platform, the fees involved can be a crucial factor for many investors. In this article, we will compare the fee structure of 1inch with other popular crypto platforms to see how it stacks up.

1inch: 1inch is known for its low and transparent fees. It operates using a decentralized exchange (DEX) model, which means that trades are executed directly on the blockchain, eliminating the need for intermediaries and reducing costs. 1inch charges a nominal fee for its services, which is typically a small percentage of the transaction value.

Centralized exchanges: Centralized exchanges like Binance and Coinbase are known to charge higher fees compared to decentralized exchanges like 1inch. They typically charge both a trading fee and a withdrawal fee, which can add up for frequent traders. These exchanges also tend to have complex fee structures that can vary depending on factors such as trading volume and account type.

Other DEX platforms: There are several other DEX platforms in the market, such as Uniswap and SushiSwap. These platforms also operate on a decentralized model and offer competitive fee structures. However, it’s important to note that the fees can vary depending on network congestion and liquidity. Users may also incur additional gas fees when trading on these platforms due to the Ethereum network’s congestion.

Wallet fees: Some crypto wallets charge fees for using their services. These fees can vary depending on the wallet provider and the services offered. It’s important to consider these fees when selecting a wallet, especially if you plan to use it for trading purposes.

Conclusion: Overall, 1inch stands out for its low and transparent fee structure compared to other crypto platforms. While other DEX platforms also offer competitive fees, 1inch’s decentralized model and efficient execution make it an attractive choice for many traders. However, it’s always important to consider other factors such as liquidity, user experience, and security when choosing a crypto platform.

Question-answer:

What is the fee structure of 1inch crypto?

The fee structure of 1inch crypto consists of two parts – the network fee and the 1inch fee. The network fee is the fee required for processing the transaction on the Ethereum network. The 1inch fee is the fee charged by the 1inch platform for providing its services.

How much is the network fee for using 1inch crypto?

The network fee for using 1inch crypto varies depending on the current congestion of the Ethereum network. It is typically higher during times of high network activity and lower during times of low network activity.

What is the 1inch fee for using their services?

The 1inch fee for using their services is a percentage of the total transaction volume. The exact percentage varies depending on the specific trade, but it is typically around 0.3% to 0.5%.

Are there any other fees associated with using 1inch crypto?

Apart from the network fee and the 1inch fee, there are no other fees associated with using 1inch crypto. However, it is important to note that there may be additional fees imposed by third-party platforms or wallets used in the transaction.

Can I avoid paying the 1inch fee?

No, it is not possible to avoid paying the 1inch fee for using their services. The fee is necessary for the platform to continue providing its services and to cover the costs of operation.