Unlock the potential of decentralized finance with 1inch!

Are you curious about how liquidity protocols are revolutionizing the world of decentralized finance? Look no further than the 1inch aggregator! As one of the leading decentralized exchange protocols, 1inch is at the forefront of innovation, providing users with unprecedented access to the best prices and deepest liquidity across multiple platforms.

Discover the power of 1inch as we delve into the impact of liquidity protocols on its aggregator!

With our in-depth analysis, you’ll gain a deeper understanding of how liquidity protocols have transformed the way users interact with decentralized exchanges. Learn how 1inch harnesses these protocols to provide an unparalleled trading experience in terms of efficiency, security, and cost-effectiveness.

Unleash the full potential of your assets with 1inch today!

Don’t miss out on this opportunity to explore the impact of liquidity protocols on the 1inch aggregator. Join us on this journey and let us guide you through the ever-changing landscape of decentralized finance.

Overview of Liquidity Protocols

Liquidity protocols are an integral part of the decentralized finance (DeFi) ecosystem, providing the necessary infrastructure for efficient and secure trading of digital assets. These protocols enable users to access a wide range of liquidity sources, including decentralized exchanges (DEXs) and automated market makers (AMMs), thereby increasing the overall liquidity and reducing slippage.

Decentralized Exchanges (DEXs)

Decentralized exchanges are platforms that allow users to trade digital assets directly with each other, without the need for intermediaries or centralized authorities. They utilize smart contracts to ensure trustless and transparent transactions. DEXs offer various advantages over traditional centralized exchanges, such as enhanced privacy, reduced counterparty risk, and increased accessibility. Some popular DEXs include Uniswap, SushiSwap, and Balancer.

Automated Market Makers (AMMs)

Automated market makers are a type of decentralized exchange that relies on mathematical formulas and algorithms to determine the prices of assets and execute trades. They usually operate on liquidity pools, where users can deposit their assets and earn fees by providing liquidity. AMMs have gained significant popularity due to their ability to provide instant liquidity and reduce the need for order books. Popular AMMs include Uniswap and Curve Finance.

Overall, liquidity protocols play a crucial role in enabling efficient and secure trading in the decentralized finance space. By providing access to a wide range of liquidity sources, they enhance market efficiency, improve price discovery, and promote the growth of the DeFi ecosystem.

Key Features of Liquidity Protocols

Liquidity protocols are revolutionizing the way decentralized exchanges operate. They bring several key features that make them a valuable tool for traders and liquidity providers:

1. Automated Market-Making

Liquidity protocols use automated market-making algorithms to ensure constant liquidity on decentralized exchanges. These algorithms dynamically adjust the prices of assets based on the supply and demand in the market, allowing for seamless trading without relying on traditional order books.

2. Permissionless Participation

Liquidity protocols enable anyone to become a liquidity provider on decentralized exchanges. There are no restrictions or approval processes, allowing anyone with digital assets to contribute liquidity and earn fees. This opens up opportunities for individuals and institutions of all sizes to participate in the decentralized finance ecosystem.

3. Incentive Mechanisms

Liquidity protocols incentivize liquidity providers to contribute their assets by offering them rewards in the form of fees and governance tokens. These incentives encourage participation and ensure a constant supply of liquidity on decentralized exchanges, which in turn improves trading efficiency and reduces slippage.

4. Interoperability

Liquidity protocols are designed to be interoperable, meaning they can work seamlessly with other protocols and decentralized applications. This allows liquidity to flow freely between different platforms, enhancing the overall liquidity of the ecosystem and creating a more seamless user experience for traders.

5. Transparency and Security

Liquidity protocols are built on public blockchain networks, ensuring transparency and immutability of transactions. Smart contracts govern the operation of these protocols, eliminating the need for intermediaries, reducing counterparty risk, and providing a higher level of security for users.

These key features make liquidity protocols a powerful tool for traders and liquidity providers, enabling them to participate in decentralized exchanges with ease, earn rewards, and contribute to the growth of the decentralized finance ecosystem.

Exploring the 1inch Aggregator

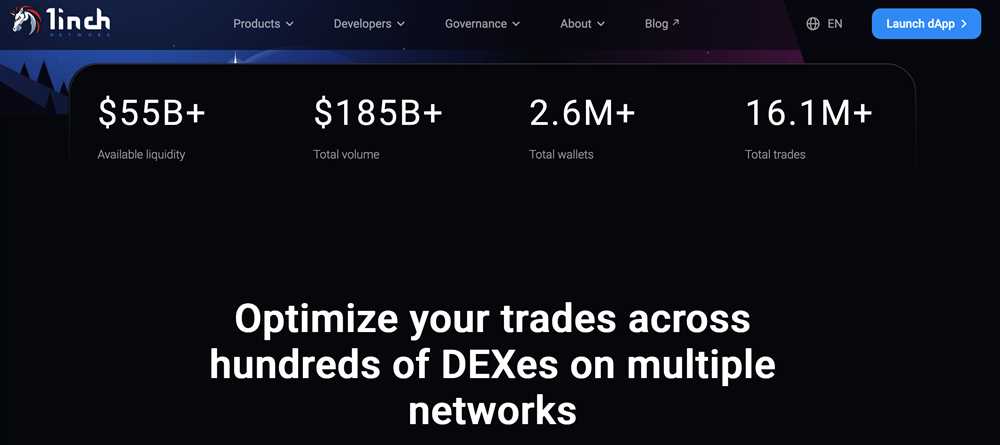

The 1inch Aggregator is a powerful decentralized exchange aggregator that allows users to find the best available trading rates across various liquidity protocols.

By connecting to numerous decentralized exchanges and liquidity protocols, the 1inch Aggregator ensures that users can always access the most favorable trading rates. This is achieved by splitting the user’s trading volume across several decentralized exchanges, enabling users to benefit from lower slippage and better prices.

One of the key features of the 1inch Aggregator is its ability to source liquidity from different protocols, including Uniswap, SushiSwap, Curve, Balancer, and many others. This broad range of liquidity sources ensures that users have access to the deepest and most liquid pools.

Moreover, the 1inch Aggregator constantly monitors the market and automatically routes trades to the most efficient paths, taking into account the liquidity and trading fees across different protocols. This automated routing system maximizes the trading efficiency and minimizes the overall cost for users.

In addition to its powerful trading capabilities, the 1inch Aggregator also provides users with a user-friendly interface that makes it easy to search, compare, and execute trades across multiple liquidity protocols. This eliminates the need for users to manually check each platform, saving time and effort.

Overall, the 1inch Aggregator revolutionizes the decentralized trading experience by offering users a seamless and efficient way to access the best available trading rates and liquidity across various decentralized exchanges and protocols.

The Role of the 1inch Aggregator

The 1inch Aggregator plays a crucial role in the world of decentralized finance (DeFi) by providing users with a seamless and efficient way to access liquidity across multiple decentralized exchanges (DEXs).

As the DeFi space continues to grow rapidly, liquidity fragmentation has become a significant challenge for traders and investors. DEXs, while offering numerous advantages over traditional centralized exchanges, operate as separate liquidity pools, making it difficult to find the best prices and execute trades efficiently.

This is where the 1inch Aggregator comes into play. It solves the liquidity fragmentation problem by sourcing liquidity from multiple DEXs and offering users the best available rates for their trades. Through its smart contract technology and sophisticated algorithm, the 1inch Aggregator ensures that users can access the deepest liquidity across various DEXs, ultimately resulting in better execution prices and reduced slippage.

Moreover, the 1inch Aggregator enables users to bypass the need to manually split their trades across multiple DEXs. Instead, users can simply input their trade details into the 1inch interface, and the Aggregator will split the trade across different liquidity sources to ensure the best outcome for the user.

Additionally, the 1inch Aggregator supports both popular and emerging liquidity protocols, allowing users to access a wide range of tokens and trading pairs. This ensures that users have access to the most comprehensive liquidity options available in the DeFi market.

Overall, the 1inch Aggregator plays a vital role in enhancing the efficiency and accessibility of decentralized finance by consolidating liquidity from multiple DEXs and providing users with the best possible trading experience. Whether you’re a professional trader or an individual investor, the 1inch Aggregator is a valuable tool that empowers you to make the most informed and profitable trading decisions in the fast-paced world of DeFi.

Benefits of Using the 1inch Aggregator

The 1inch Aggregator offers a range of benefits for users seeking to maximize their returns and optimize their trading experience. Here are some key advantages of utilizing the 1inch Aggregator:

- Improved Liquidity: The 1inch Aggregator combines liquidity from multiple sources, including popular decentralized exchanges (DEXs) such as Uniswap and SushiSwap. By tapping into these various liquidity pools, the aggregator offers users improved access to a larger pool of tradable assets and better trade execution.

- Optimal Pricing: With its smart contract technology and advanced algorithms, the 1inch Aggregator ensures that users receive the best possible pricing for their trades. By automatically sourcing liquidity from different exchanges, the aggregator identifies and executes trades at the most favorable prices, saving users time and reducing slippage.

- Reduced Fees: By utilizing the 1inch Aggregator, users can take advantage of its Fee Optimization feature, which dynamically calculates and compares transaction fees across different DEXs. This allows users to choose the most cost-effective route for their trades, minimizing fees and maximizing their trading profits.

- Higher Returns: The 1inch Aggregator also offers users the opportunity to earn additional income through its intuitive yield farming and liquidity staking functionalities. By participating in these programs, users can earn rewards in the form of tokens, further maximizing their returns on their crypto holdings.

- Enhanced Security: The 1inch Aggregator employs state-of-the-art security measures to protect user funds. With its non-custodial nature and integration with popular hardware wallets, such as Ledger and Trezor, users can securely manage their assets and execute trades without compromising their private keys.

- User-friendly Interface: The 1inch Aggregator boasts a user-friendly interface that is easy to navigate, even for beginners. With its intuitive design and clear information, users can easily monitor market trends, execute trades, and access additional features without any hassle.

By utilizing the 1inch Aggregator, users can enjoy the benefits of improved liquidity, optimal pricing, reduced fees, higher returns, enhanced security, and a user-friendly interface. This powerful tool empowers users to make informed trading decisions and maximize their potential in the fast-paced world of decentralized finance.

Question-answer:

What is a liquidity protocol?

A liquidity protocol is a software solution that allows users to provide and borrow assets in decentralized finance (DeFi) markets. It facilitates the efficient trading of assets by connecting buyers and sellers, thereby increasing liquidity and reducing slippage.

How does the 1inch aggregator impact liquidity protocols?

The 1inch aggregator is a decentralized exchange (DEX) aggregator that sources liquidity from various liquidity protocols. By using the 1inch aggregator, traders can access a wider pool of liquidity and achieve better rates for their trades. This has a positive impact on liquidity protocols by increasing the usage and adoption of their platforms.

What are the benefits of using the 1inch aggregator?

Using the 1inch aggregator provides several benefits to traders. Firstly, it offers access to a larger pool of liquidity from various decentralized exchanges, which helps to execute trades with minimal slippage. Additionally, the 1inch aggregator is designed to find the best available rates for trades, ensuring that traders get the most favorable prices for their transactions. Finally, the 1inch aggregator offers gas optimization features, helping to reduce transaction costs on the Ethereum network.