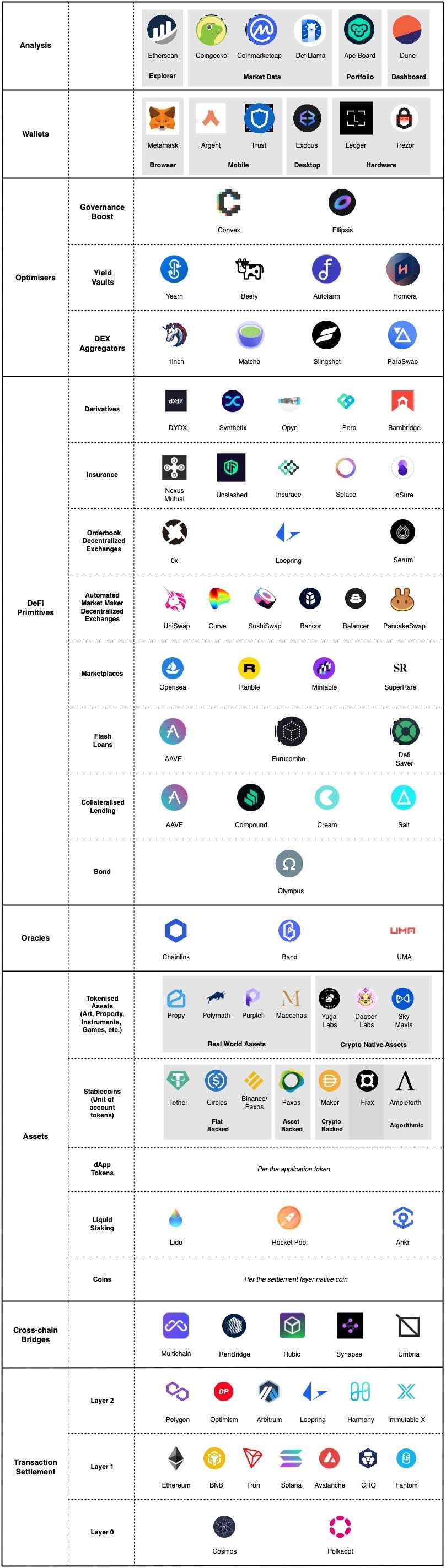

In the rapidly evolving world of decentralized finance (DeFi), 1inch has emerged as a leading platform for optimizing trades across multiple decentralized exchanges (DEXs). By aggregating liquidity from various sources, such as Uniswap, SushiSwap, and Balancer, 1inch allows users to find the best prices and execute trades with minimal slippage. While the platform’s primary focus is on enhancing the user experience, it also offers its native tokens, 1INCH, which play a crucial role in the ecosystem.

1INCH tokens serve as the utility and governance tokens of the 1inch platform. Holding 1INCH tokens provides users with a range of benefits, including the ability to vote on important decisions that impact the platform’s future direction, participate in various incentive programs, and earn rewards. Furthermore, owning 1INCH tokens grants users a say in the allocation of the platform’s resources, ensuring that the community collectively drives the development and growth of 1inch.

Moreover, the relationship between 1INCH tokens and other DeFi protocols extends beyond the 1inch platform itself. Thanks to interoperability with protocols like Compound, Aave, and MakerDAO, users can leverage their 1INCH tokens as collateral to access liquidity or earn interest on their holdings. This cross-protocol integration enhances the usability and utility of 1INCH tokens, allowing users to maximize the value and benefits derived from their holdings across the entire DeFi ecosystem.

Overall, the relationship between 1INCH tokens and other DeFi protocols is symbiotic, with each entity contributing to the growth and success of the other. As 1inch continues to innovate and expand its offerings, and as more DeFi protocols recognize the value of integrating with 1inch, the relationship will only become stronger, ultimately benefiting users and the broader DeFi community as a whole.

Understanding the Role of 1inch Tokens in DeFi

1inch tokens play a crucial role in the decentralized finance (DeFi) ecosystem, particularly in relation to other protocols. These tokens are native to the 1inch platform, a popular decentralized exchange aggregator. Understanding their role is important for anyone involved in DeFi and looking to take advantage of the opportunities it offers.

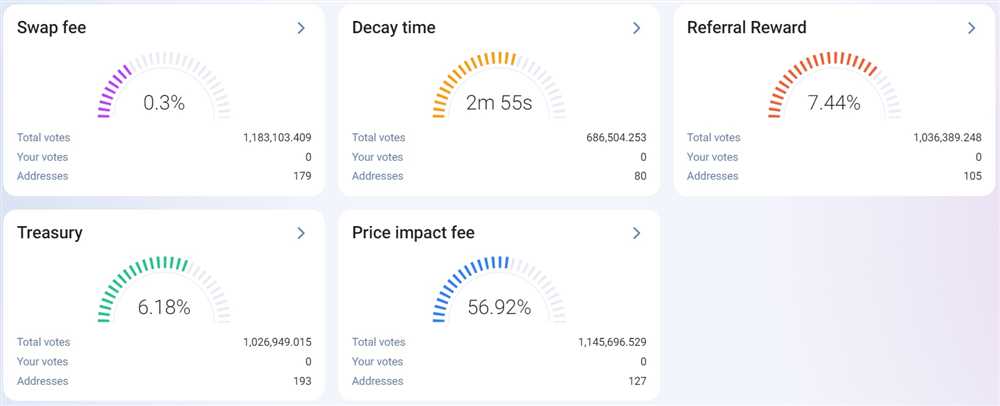

First and foremost, 1inch tokens, also known as 1INCH, serve as the governance token for the 1inch platform. This means that token holders have the right to propose and vote on changes to the platform’s protocol. They can participate in shaping the future of 1inch, which makes holding these tokens valuable.

In addition to their governance function, 1inch tokens also provide various utility within the DeFi ecosystem. Holders of these tokens can benefit from reduced fees on the 1inch platform. By using 1INCH tokens to pay for transactions, users can access discounted fees, maximizing their returns and reducing costs.

Furthermore, holding 1inch tokens can provide access to exclusive features and benefits on the 1inch platform. This could include priority access to new features, early access to partnerships and collaborations, or access to specialized tools and services. These additional benefits make 1inch tokens a valuable asset for users looking to optimize their trading and DeFi strategies.

Importantly, 1inch tokens also have a role in incentivizing liquidity provision and participation in the platform’s governance. By staking 1INCH tokens or providing liquidity to specific pools, users can earn additional rewards and incentives. This encourages active involvement in the platform and helps to foster a vibrant and engaged community.

Overall, 1inch tokens play a multi-faceted role in the DeFi ecosystem. They enable governance participation, provide utility and benefits, incentivize liquidity provision, and help shape the future of the 1inch platform. Their value extends beyond being a tradable asset, making them an essential element for anyone involved in DeFi.

The Synergy Between 1inch Tokens and Other DeFi Protocols

1inch tokens play a crucial role in the decentralized finance (DeFi) ecosystem, especially when it comes to their relationship and synergy with other DeFi protocols. These tokens enable users to access various services and benefits within the DeFi space, allowing for seamless interoperability and enhanced functionality.

1. Liquidity Aggregation

One of the key features of 1inch tokens is their ability to aggregate liquidity from different decentralized exchanges (DEXs) across various blockchains. This means that users can trade assets at the best possible rates, as the 1inch protocol automatically splits the orders across multiple DEXs to achieve optimal pricing.

2. Yield Farming and Staking

1inch tokens can also be utilized for yield farming and staking purposes within the DeFi ecosystem. By staking 1inch tokens in liquidity pools, users can earn additional tokens as rewards. These rewards can then be used for further yield farming or exchanged for other assets within the protocol.

Furthermore, 1inch tokens can be staked in governance protocols, allowing holders to participate in the decision-making process and vote on important proposals or changes within the ecosystem. This provides users with a sense of ownership and control over the development and direction of the protocol.

3. Cross-Protocol Integrations

1inch tokens are designed to integrate with various DeFi protocols, creating a synergistic relationship between different platforms. These integrations enable users to access additional services and features by leveraging the functionalities of other protocols.

For example, 1inch tokens can be used as collateral in lending and borrowing platforms, providing users with the ability to borrow funds or earn interest on their holdings. This cross-protocol integration expands the utility of 1inch tokens and enhances their value within the DeFi ecosystem.

4. Enhanced Liquidity Provision

By utilizing 1inch tokens, liquidity providers can further enhance their participation in the DeFi ecosystem. Liquidity providers can deposit their tokens into liquidity pools, earning fees and additional rewards in return.

Additionally, by utilizing 1inch tokens in liquidity provision, providers can benefit from the aggregation of liquidity across different DEXs, further optimizing their returns. This enhanced liquidity provision contributes to the overall efficiency and accessibility of the DeFi space.

In conclusion, the synergy between 1inch tokens and other DeFi protocols is crucial for the development and growth of the decentralized finance ecosystem. These tokens enable liquidity aggregation, yield farming, cross-protocol integrations, and enhanced liquidity provision, enhancing the overall functionality and utility of the DeFi space.

Exploring the Benefits of Integrating 1inch Tokens with DeFi Platforms

As the decentralized finance (DeFi) ecosystem continues to evolve and expand, integrating 1inch tokens with various DeFi platforms can offer several benefits. Here are a few advantages of incorporating 1inch tokens into DeFi platforms:

1. Enhanced Liquidity

By integrating 1inch tokens with DeFi platforms, users can benefit from increased liquidity. The 1inch token can be used as a medium of exchange within the platform, allowing users to easily swap between different assets. This enhanced liquidity can improve trading efficiency and reduce slippage, resulting in a better user experience.

2. Reduced Transaction Costs

Integrating 1inch tokens with DeFi platforms can also help reduce transaction costs. Users can utilize 1inch tokens to pay for transaction fees within the platform, potentially saving on gas fees and other transaction-related expenses. This can make DeFi more accessible to a wider range of users and encourage greater participation in the ecosystem.

3. Access to Exclusive Features

Integrating 1inch tokens can provide users with access to exclusive features and benefits within DeFi platforms. For example, users who hold a certain amount of 1inch tokens may be eligible for reduced fees, priority access to new features, or enhanced rewards. These additional perks can incentivize users to hold and use 1inch tokens, further driving their demand and utility.

4. Increased Token Utility

Integrating 1inch tokens with DeFi platforms can increase the overall utility of the token. By allowing users to use 1inch tokens for various purposes, such as governance voting, staking, or accessing premium services, the token becomes more valuable and versatile. This can attract more users and investors, leading to a potentially higher market demand for 1inch tokens.

- In conclusion, integrating 1inch tokens with DeFi platforms can enhance liquidity, reduce transaction costs, provide access to exclusive features, and increase token utility. These benefits can create a mutually beneficial relationship between 1inch tokens and DeFi protocols, driving adoption and growth within the ecosystem.

Question-answer:

What are 1inch tokens?

1inch tokens are the native tokens of the 1inch Network, a decentralized exchange aggregator and automated market maker. The tokens are utility tokens that provide various benefits to token holders, such as governance rights, discounts on transaction fees, and rewards.

How can I earn 1inch tokens?

There are several ways to earn 1inch tokens. You can provide liquidity to one of the supported automated market maker protocols, such as Uniswap or Balancer, and earn rewards in 1inch tokens. You can also stake your 1inch tokens in the 1inch staking program to earn additional tokens. Additionally, some DeFi platforms offer yield farming opportunities where you can earn 1inch tokens by providing liquidity or participating in certain activities.