Are you ready to take full advantage of the incredible earning potential of 1inch Staking? Here are some expert tips to help you succeed:

Understanding the Basics

Before diving into the world of 1inch staking, it is important to have a basic understanding of what staking is and how it works.

Staking is a process that involves holding and locking up a certain amount of cryptocurrency tokens in a wallet to support the operations of a blockchain network. By staking your tokens, you can help secure the network, validate transactions, and earn rewards in return.

1inch staking is a decentralized way of earning rewards by providing liquidity to the 1inch Liquidity Protocol. By staking your tokens on 1inch, you are essentially becoming a liquidity provider, allowing users to swap tokens on the 1inch platform.

When you stake your tokens, they become locked and cannot be freely traded or moved until you decide to unstake them. However, in return for providing liquidity, you earn a share of the fees generated by the 1inch platform.

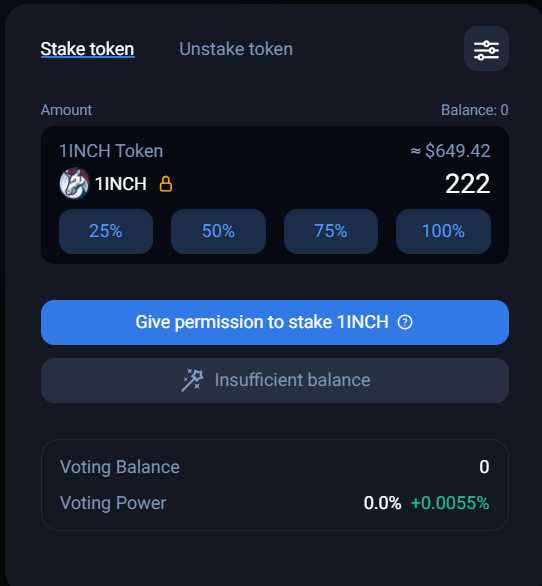

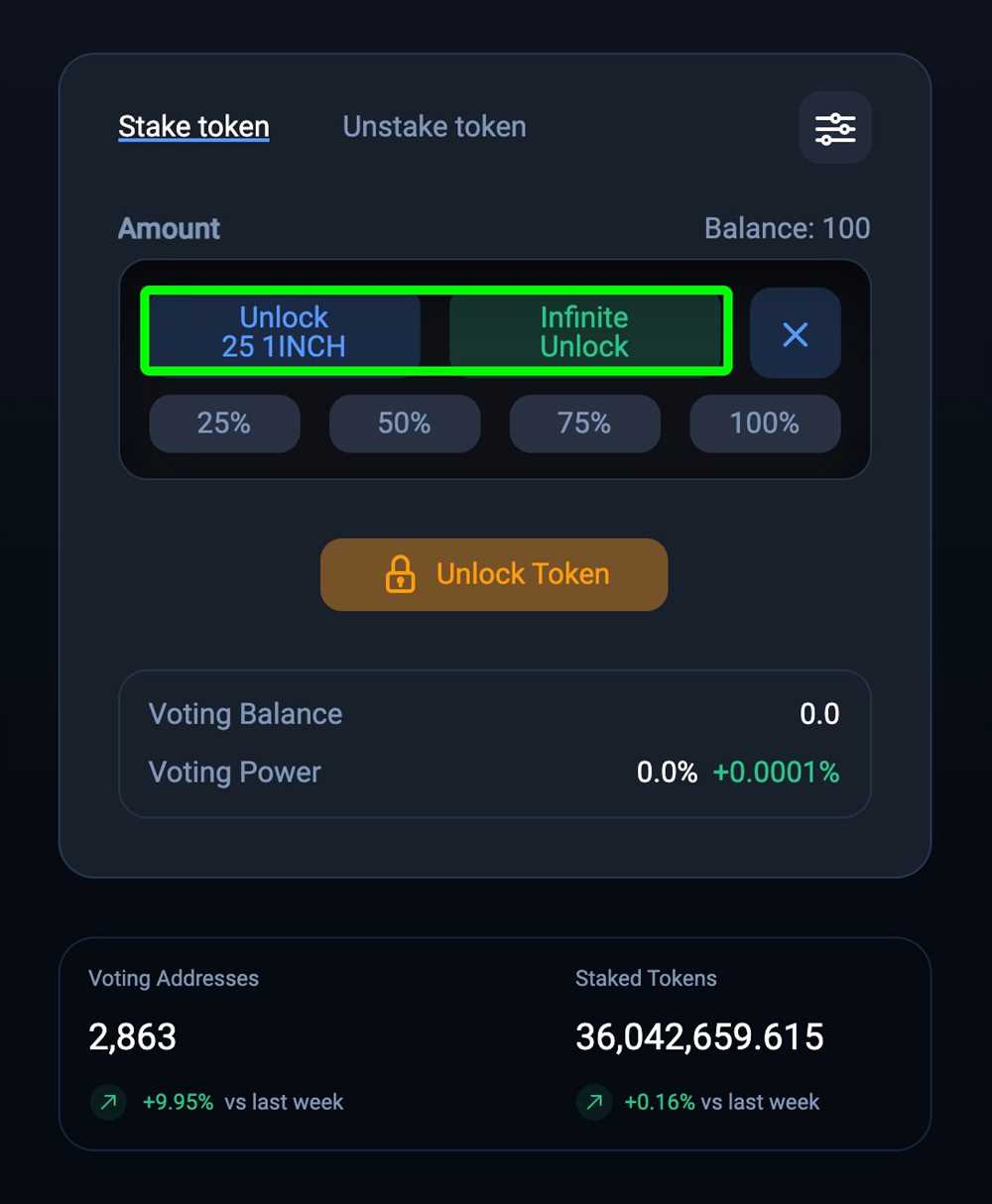

To get started with 1inch staking, you will need to have the supported tokens in your wallet and connect your wallet to the 1inch platform. Once connected, you can choose the amount of tokens you want to stake and confirm the transaction.

It is important to note that staking involves some level of risk, as the value of the tokens you stake can fluctuate and there may be smart contract risks associated with the platform. Therefore, it is always recommended to do your own research and understand the risks involved before staking.

In conclusion, understanding the basics of staking and how it works is crucial before participating in 1inch staking. By becoming a liquidity provider on the 1inch platform, you can earn rewards while supporting the operations of the network.

Maximizing Returns

When it comes to staking your assets on the 1inch platform, there are several strategies you can employ to maximize your returns. Here are some tips to help you get started:

- Diversify your portfolio: By staking multiple assets, you can spread your risk and potentially increase your returns. Consider staking a variety of tokens to take advantage of different market conditions.

- Stay informed about market trends: To make informed decisions, it’s essential to stay up to date with the latest market trends. Keep an eye on news, social media, and other sources to gain insights into the market and potential staking opportunities.

- Manage your risk: While staking can offer significant returns, it’s essential to manage your risk effectively. Consider setting stop-loss orders, diversifying your staking across different platforms, and regularly reviewing your portfolio to ensure it aligns with your risk tolerance.

- Regularly review your staking strategy: The crypto market is dynamic, and what works today may not work tomorrow. Regularly review and adjust your staking strategy to adapt to changing market conditions and take advantage of new opportunities.

- Consider participating in liquidity mining programs: Some platforms offer liquidity mining programs where you can earn additional rewards by providing liquidity to trading pairs. Explore these programs to potentially increase your staking returns.

By employing these strategies and staying informed about the market, you can maximize your returns and make the most of the power of 1inch staking.

Risk Management Strategies

When it comes to staking your assets, it is important to have a solid risk management strategy in place. With the volatile nature of the cryptocurrency market, taking measures to protect your investments is crucial. Here are some risk management strategies to consider when participating in 1inch staking:

| Strategy | Description |

|---|---|

| Diversify Your Stakes | By diversifying your stakes across multiple 1inch pools, you can spread the risk and reduce the impact of potential losses. This strategy allows you to have exposure to different assets and pools, providing a level of protection against any single asset or pool experiencing a significant decline in value. |

| Monitor Market Conditions | Keep a close eye on market conditions and trends. Stay updated on the latest news and developments in the cryptocurrency space. By staying informed, you can make more informed decisions about when to stake, unstake, or adjust your stakes. Being proactive and responsive to market changes is essential for effectively managing risk. |

| Set Realistic Expectations | It is important to set realistic expectations for your staking returns. While staking can be profitable, it is not without risk. Understand that there will be fluctuations and potential losses along the way. Setting realistic expectations will help you avoid making rash decisions based on short-term market movements. |

| Use Stop-Loss Orders | Consider using stop-loss orders to limit potential losses. A stop-loss order will automatically sell your staked assets if they reach a certain predetermined price. This strategy helps protect your investments by preventing further losses if the price of a particular asset drops below your comfort level. |

| Start with a Small Stake | If you are new to staking or unsure about the risk involved, it is advisable to start with a small stake. This approach allows you to test the waters and get a better understanding of the staking process and potential risks. It also minimizes the potential impact on your overall portfolio if things don’t go as planned. |

Remember, risk management is an essential part of any investment strategy. By diversifying your stakes, monitoring market conditions, setting realistic expectations, using stop-loss orders, and starting with a small stake, you can mitigate potential risks and increase your chances of success in unleashing the power of 1inch staking.

Staying Informed and Adaptive

When it comes to the world of cryptocurrency and staking, staying informed and adaptive is crucial for success. The market is constantly evolving, and it’s essential to keep up with the latest trends and news.

One way to stay informed is by following reliable sources of information. Whether it’s through blogs, forums, or social media, staying connected with the crypto community can provide valuable insights and updates on the latest developments in the industry.

It’s also important to keep an eye on the performance of your staked assets. Monitoring the market and understanding the factors that can affect the value of your assets will enable you to make informed decisions and adapt your staking strategy accordingly.

Additionally, staying adaptive means being open to new opportunities and adjusting your staking approach when necessary. The crypto market is highly dynamic, and what works today may not necessarily work tomorrow. By staying flexible and willing to adjust your strategy, you’ll be better positioned to take advantage of changing market conditions.

Furthermore, it’s essential to stay educated about the risks and challenges associated with staking. The crypto market can be volatile, and there are always potential risks involved. By understanding and managing these risks, you can mitigate potential losses and maximize your chances of success.

In conclusion, staying informed and adaptive is key when it comes to unleashing the power of 1inch staking. By staying connected with the crypto community, monitoring market performance, and being open to new opportunities, you’ll be well-positioned to navigate the ever-changing world of cryptocurrency and achieve success in your staking endeavors.

Question-answer:

What is 1inch Staking?

1inch Staking is a platform that allows users to stake their 1inch tokens and earn rewards in return. By staking their tokens, users participate in the governance of the 1inch network and help secure the platform.

How can I stake my 1inch tokens?

To stake your 1inch tokens, you need to connect your wallet to the 1inch Staking platform and choose the amount of tokens you want to stake. Once you confirm the transaction, your tokens will be staked and you will start earning rewards.

What are the rewards for staking 1inch tokens?

The rewards for staking 1inch tokens vary based on various factors such as the amount of tokens staked, the duration of the staking period, and the overall participation in the staking process. Generally, the more tokens you stake and the longer you stake them, the higher your rewards will be.

Is there a minimum amount of 1inch tokens required to stake?

Yes, there is a minimum amount of 1inch tokens required to stake. The exact minimum amount may vary depending on the current requirements set by the 1inch Staking platform. It is advisable to check the platform for the most up-to-date information on the minimum staking amount.