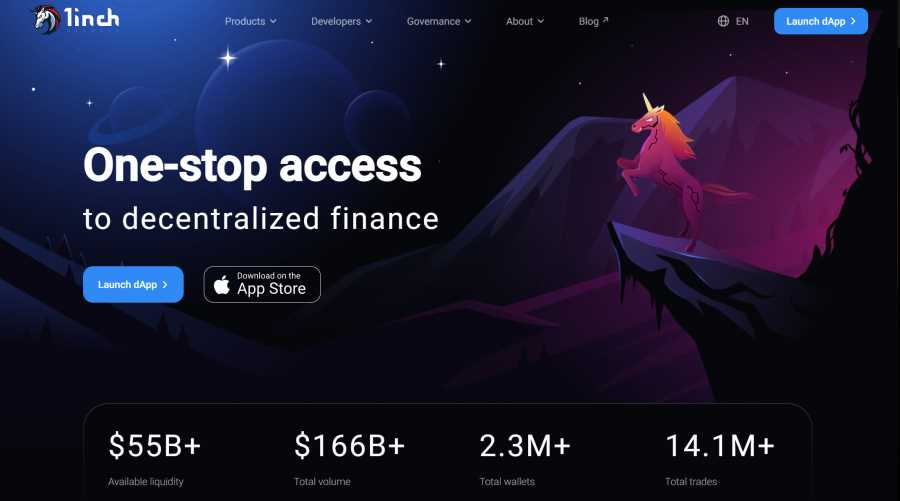

Welcome to the beginner’s guide to investing in 1inch, the decentralized exchange protocol built on Ethereum. Whether you are new to the world of cryptocurrency or a seasoned investor looking to diversify your portfolio, this step-by-step roadmap will help you navigate the process of investing in 1inch.

1inch is a decentralized exchange aggregator that sources liquidity from various decentralized exchanges to provide the best possible prices for users. It aims to lower costs and reduce slippage by splitting trades across multiple liquidity sources. With its efficient and cost-effective trading mechanism, 1inch has gained popularity among traders and investors in the decentralized finance (DeFi) space.

Before you dive into investing in 1inch, it’s important to understand the basics of decentralized finance and how it differs from traditional finance. DeFi is a rapidly growing sector of the cryptocurrency industry that aims to provide financial services and applications without the need for intermediaries such as banks. By leveraging the power of blockchain technology, DeFi platforms like 1inch offer users greater control over their assets and transactions.

To start investing in 1inch, you will need to follow a series of steps. Firstly, you should set up a cryptocurrency wallet that supports Ethereum and ERC-20 tokens, as 1inch is built on the Ethereum blockchain. Popular wallets like MetaMask and MyEtherWallet are compatible and easy to use. Once you have a wallet, you can fund it with Ethereum or other ERC-20 tokens to use for your investments.

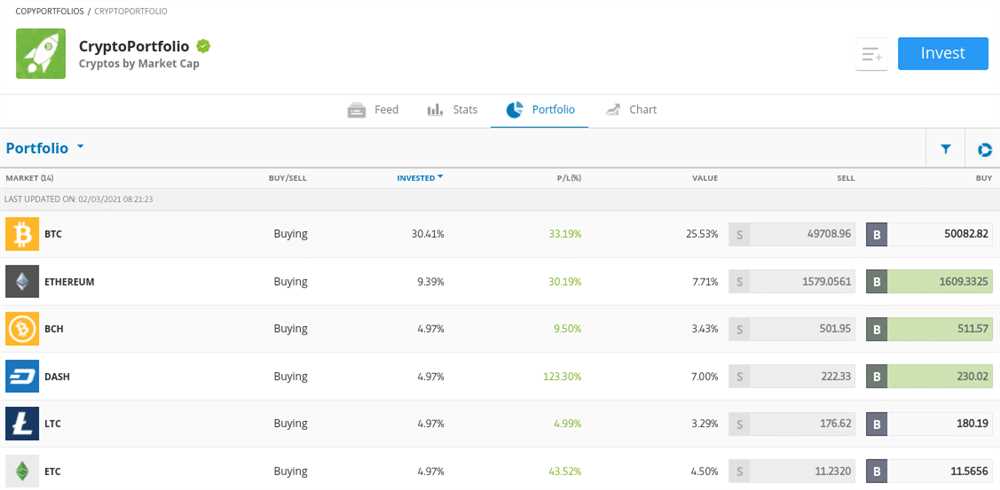

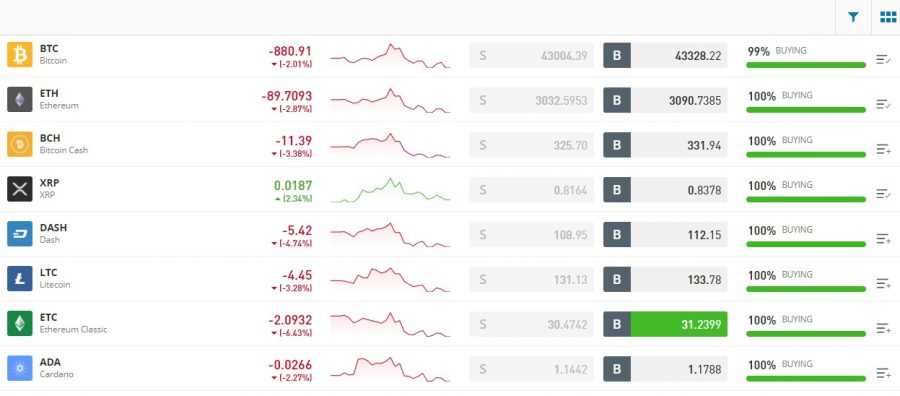

The next step is to choose a decentralized exchange (DEX) to trade on. 1inch can be accessed through various DEXs, including its own platform, as well as popular ones like Uniswap and SushiSwap. Each DEX offers a unique trading experience and set of features, so it’s worth exploring them to find the one that suits your needs best. Regardless of the DEX you choose, you will need to connect your wallet to the platform using the wallet’s browser extension or mobile app.

Why Invest in 1inch?

Investing in 1inch can be a lucrative opportunity for several reasons:

- Decentralized Finance (DeFi) Potential: 1inch is a decentralized exchange aggregator that operates on the Ethereum blockchain. It enables users to find the best trading routes across various decentralized exchanges to reduce slippage and maximize profits. As the DeFi space continues to grow, 1inch is well-positioned to capture a significant market share.

- Unique Technology: 1inch’s proprietary algorithm called Pathfinder allows users to execute trades at the best possible rates across multiple liquidity sources. This advanced technology makes 1inch stand out from other decentralized exchanges, attracting users and liquidity providers.

- Strong Community Support: 1inch has an active and passionate community of supporters who contribute to the project’s development and growth. The community actively participates in governance decisions, ensuring that the platform stays decentralized and focused on user needs.

- Innovative Features: 1inch continuously introduces new features and products to enhance the user experience. For example, 1inch Liquidity Protocol allows users to become liquidity providers and earn fees, while the 1inch Wallet provides a seamless and secure way to manage and trade cryptocurrencies.

- Experienced Team: The team behind 1inch comprises experienced professionals in the blockchain and finance industries. Their expertise and vision have contributed to the platform’s success, making them a reliable investment choice.

Investing in 1inch provides exposure to the booming DeFi market and the opportunity to support a cutting-edge decentralized exchange aggregator. However, as with any investment, it is crucial to conduct thorough research and consider your risk tolerance before making any investment decisions.

Understanding the Potential of 1inch

1inch is a decentralized exchange aggregator that aims to provide its users with the best possible prices for their trades across various decentralized exchanges (DEXs). By combining liquidity from multiple platforms, 1inch ensures that users get the most favorable rates and minimize slippage.

How Does 1inch Work?

1inch operates by utilizing smart contracts on the Ethereum blockchain. When a user wants to make a trade on 1inch, the platform splits the trade across multiple DEXs to find the best possible price. The algorithm takes into account factors such as liquidity, trading fees, and other variables to optimize the trade execution.

1inch also allows users to deposit their assets into liquidity pools to earn passive income through providing liquidity. This process is known as yield farming. By depositing assets into liquidity pools, users can earn rewards in the form of governance tokens or a share of the trading fees generated on the platform.

The Potential of 1inch

1inch has the potential to revolutionize the decentralized finance (DeFi) space by solving the liquidity fragmentation problem. By aggregating liquidity from different DEXs, 1inch provides traders with access to a larger pool of liquidity, which improves price efficiency and reduces slippage.

Additionally, 1inch’s algorithm optimizes trade execution to ensure that users get the best possible prices. This can be particularly beneficial for large trades, as splitting orders across multiple DEXs can help minimize slippage and reduce the impact on the market.

Furthermore, 1inch’s yield farming feature allows users to earn passive income on their assets. By providing liquidity to the platform, users can participate in the governance of the protocol and earn rewards. This incentivizes users to contribute to the ecosystem and helps to increase the overall liquidity on the platform.

Overall, 1inch has the potential to enhance liquidity and improve trading efficiency in the DeFi space. By aggregating liquidity from multiple DEXs and optimizing trade execution, 1inch aims to provide users with a seamless trading experience while also incentivizing them to participate in the ecosystem through yield farming.

| Advantages of 1inch | Disadvantages of 1inch |

|---|---|

| – Aggregates liquidity from multiple DEXs | – Relatively new platform with limited track record |

| – Optimizes trade execution for best prices | – Relies on the Ethereum blockchain, which may have scalability issues |

| – Provides opportunities for yield farming | – Competes with other DEX aggregators in the market |

| – User-friendly interface for easy trading | – Regulatory uncertainty in the DeFi space |

Step-by-Step Guide to Investing in 1inch

Investing in 1inch can be a lucrative opportunity for those looking to enter the world of decentralized finance (DeFi). This step-by-step guide will walk you through the process of investing in 1inch and help you get started.

Step 1: Set up a Wallet

The first step in investing in 1inch is to set up a cryptocurrency wallet that supports the Ethereum blockchain. One popular option is MetaMask, which is a browser extension that allows you to manage your Ethereum assets securely.

Step 2: Acquire Ethereum

In order to invest in 1inch, you will need to acquire Ethereum (ETH). You can do this by purchasing Ethereum on a cryptocurrency exchange, such as Coinbase or Binance, or by exchanging other cryptocurrencies for Ethereum.

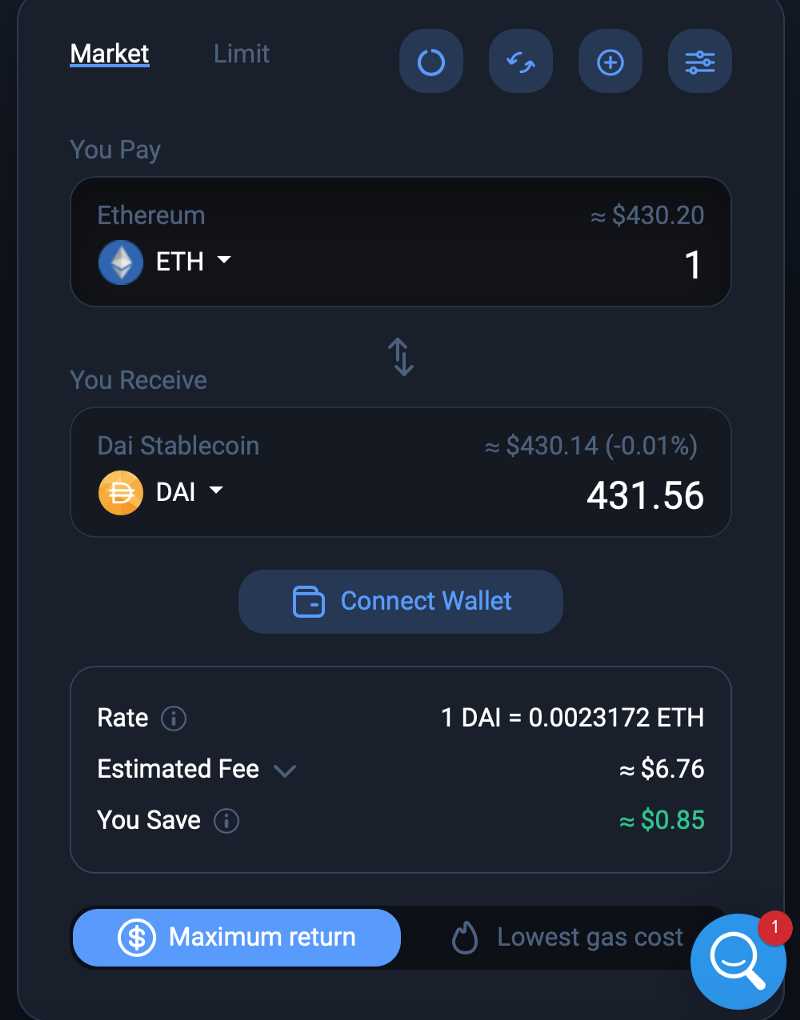

Step 3: Connect your Wallet to 1inch

Once you have acquired Ethereum, you will need to connect your wallet to the 1inch platform. To do this, visit the 1inch website and click on the “Connect Wallet” button. Select your wallet provider and follow the prompts to connect your wallet to 1inch.

Step 4: Choose the Investment Option

After connecting your wallet, you can explore the various investment options available on the 1inch platform. This includes liquidity pools, yield farming, and staking. Take the time to research each option and choose the one that best suits your investment goals and risk tolerance.

Step 5: Make an Investment

Once you have chosen an investment option, you can proceed to make your investment. Follow the prompts on the 1inch platform to enter the desired amount of Ethereum you wish to invest and confirm the transaction. Be sure to review the transaction details carefully before proceeding.

Step 6: Monitor and Manage your Investment

After making your investment, it is important to monitor and manage your investment regularly. Keep track of your earnings, check for any updates or changes in the market, and adjust your strategy if necessary. Stay informed about the latest developments in the 1inch ecosystem to make informed investment decisions.

Investing in 1inch can be a rewarding experience, but it is important to do your due diligence and understand the risks involved. By following this step-by-step guide, you can take the first steps towards investing in 1inch and potentially earning significant returns in the world of decentralized finance.

Question-answer:

Is investing in 1inch suitable for beginners?

Yes, investing in 1inch can be suitable for beginners as the platform offers a user-friendly interface and provides step-by-step instructions for investing.

What is 1inch?

1inch is a decentralized exchange aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates.

How can I start investing in 1inch?

To start investing in 1inch, you first need to create an account on a cryptocurrency exchange that supports 1inch. Then, you can deposit funds into your account and search for the 1inch token. Once you find it, you can purchase it using your deposited funds.

What factors should I consider before investing in 1inch?

Before investing in 1inch, you should consider factors such as the current market trend, the team behind the project, the competition in the industry, and any potential risks or drawbacks. It’s also important to have a clear investment strategy and to only invest what you can afford to lose.