The world of cryptocurrency is constantly evolving, with new projects and technologies emerging every day. One such project that has gained significant attention is 1inch, a decentralized exchange (DEX) aggregator that aims to provide users with the best possible trading prices across multiple DEX platforms. As 1inch continues to gain popularity, it is important to analyze its price history in order to identify trends, patterns, and potential predictions for the future.

Over the past few months, 1inch has experienced significant growth in its price, with fluctuations that have captured the attention of traders and investors alike. By analyzing the historical price data of 1inch, it becomes clear that there are certain trends and patterns that can be observed. For example, there have been periods of rapid price increases followed by periods of consolidation and stabilization. These patterns can provide valuable insights into potential future price movements.

Another important factor to consider when analyzing 1inch’s price history is the overall market sentiment towards the cryptocurrency industry. As the cryptocurrency market as a whole experiences periods of bullish and bearish sentiment, it is likely to have an impact on the price of individual cryptocurrencies like 1inch. By keeping an eye on the broader market trends, it becomes possible to make more accurate predictions about the future price movements of 1inch.

It is worth noting that analyzing price history alone is not enough to make accurate predictions about the future price movements of 1inch. Factors such as market demand, technological advancements, regulatory changes, and overall market sentiment all play a crucial role in determining the price of any cryptocurrency. Therefore, it is important to consider these factors alongside price history analysis in order to make informed investment decisions.

In conclusion, analyzing 1inch’s price history can provide valuable insights into trends, patterns, and potential predictions for the future. By closely monitoring price movements, market sentiment, and other relevant factors, investors and traders can make more informed decisions about their 1inch investments. However, it is important to remember that no analysis or prediction can guarantee future price movements, and investing in cryptocurrencies always carries a certain level of risk.

Historical Price Analysis

One of the key aspects of understanding the potential future performance of any cryptocurrency is analyzing its historical price data. By examining 1inch’s price history, we can identify trends and patterns that may inform future predictions.

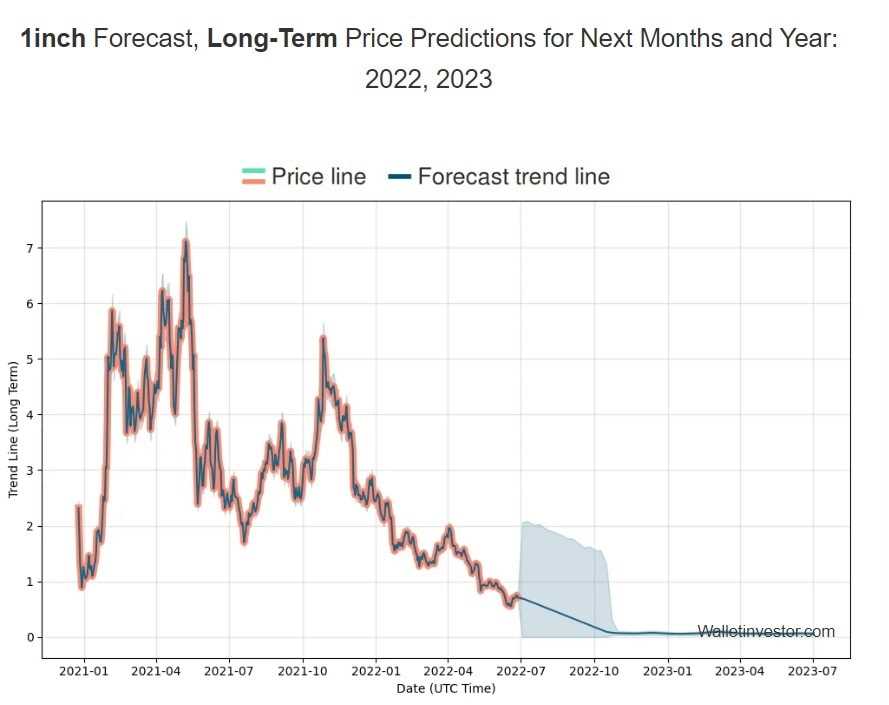

Over the past year, 1inch has experienced significant volatility in its price. It started the year 2021 at a relatively low price and quickly gained momentum, reaching an all-time high in May. However, it subsequently experienced a sharp decline before stabilizing at a lower price range.

During this period of volatility, several trends and patterns emerged. For example, 1inch’s price often followed the broader cryptocurrency market trends. When Bitcoin and other major cryptocurrencies experienced significant price movements, 1inch typically followed suit.

Furthermore, news events and market developments had a notable impact on 1inch’s price. Positive news, such as partnerships with major exchanges or new product launches, often resulted in price increases. Conversely, negative news or regulatory concerns could lead to price declines.

Another important aspect to consider is the trading volume and liquidity of 1inch. Higher trading volume generally indicates increased market interest and liquidity, which can contribute to price stability. When the trading volume is low, price fluctuations may be more pronounced due to fewer buy and sell orders being executed.

It’s also worth noting that cryptocurrencies, including 1inch, are subject to market speculation and investor sentiment. The hype and speculation surrounding a particular coin can drive its price up, while fear and negative sentiment can lead to price drops. It’s crucial to keep these factors in mind when analyzing historical price data.

Based on the historical price analysis, it is clear that 1inch’s price is highly volatile and influenced by various factors. While trends and patterns can provide insights into potential future price movements, it’s important to exercise caution and consider other factors, such as market sentiment and news events, when making predictions about 1inch’s price.

Trends in 1inch’s Price

When analyzing the price history of 1inch, several trends emerge that can provide valuable insights for investors and traders. These trends help in understanding the past performance of the token, identifying patterns, and making predictions about its future price.

1. Upward Trend

One of the prominent trends in 1inch’s price history is the overall upward trajectory. Since its launch, the token has shown a tendency to gradually increase in value over time. This indicates a positive market sentiment and growing demand for the token.

2. Volatility

While 1inch’s price has experienced an upward trend, it has also exhibited periods of significant volatility. The token has gone through both short-term fluctuations and larger price swings in response to market conditions and external factors. Traders need to be aware of this high volatility and take it into account when making investment decisions.

3. Price Correlation with Market Sentiment

On closer examination, the price of 1inch appears to be correlated with overall market sentiment. During periods of positive market sentiment, the token’s price tends to rise, while negative market sentiment can lead to a decline in its value. This suggests that broader market trends and investor sentiment may influence 1inch’s price movements.

4. Event-Driven Price Movements

Another trend observed in 1inch’s price history is the impact of major events on its value. News regarding partnerships, product updates, regulatory changes, or market trends can significantly influence the token’s price. Traders should keep an eye on such events as they can lead to sudden price movements and create trading opportunities.

- Overall upward trend in 1inch’s price

- Periods of significant volatility

- Correlation with market sentiment

- Impact of major events on price movements

Understanding these trends and patterns in 1inch’s price history can be beneficial for investors and traders looking to make informed decisions. However, it is important to note that past performance is not indicative of future results, and additional analysis and research should be conducted before making any investment decisions.

Predictions for 1inch’s Future Price

After analyzing the price history of 1inch, several trends and patterns can be identified that may help predict the future price of the token. While it is important to note that cryptocurrency markets are highly volatile and subject to various factors, including market sentiment and overall market conditions, the following predictions provide some insights into potential future price movements for 1inch.

1. Continuation of Price Growth

Based on the historical price data, it is likely that 1inch will continue to experience price growth in the future. The token has shown significant upward price movements over time, suggesting a positive market sentiment and growing demand among investors. This trend may be driven by factors such as the increasing adoption of decentralized finance (DeFi) platforms and the growing popularity of 1inch’s protocol among traders and liquidity providers.

2. Volatility and Market Corrections

While the overall trend for 1inch appears to be positive, it is important to consider potential market corrections and volatility. Cryptocurrency markets are known for their high levels of volatility, and 1inch is no exception. It is possible that the token may experience periods of price consolidation or even short-term declines. These price corrections are normal market behavior and should be expected, especially after significant price rallies. Therefore, investors should be prepared for potential price fluctuations and consider them as part of the overall market dynamics.

Furthermore, external factors such as regulatory changes or negative news events can also impact the price of 1inch. It is essential for investors to stay updated on industry news and trends to anticipate and react to any potential market-changing events.

3. Long-term Price Potential

Considering the increasing adoption of DeFi platforms and the growing interest in decentralized exchanges, 1inch has significant long-term price potential. As more users and liquidity flow into the 1inch ecosystem, the demand for the token may increase, driving its price higher. Additionally, if 1inch continues to innovate and improve its protocol, it could further solidify its position in the market and attract more users and investors.

Ultimately, predicting the future price of any cryptocurrency is speculative and uncertain. It is important to conduct thorough research, analyze various factors, and consider multiple perspectives before making any investment decisions. While trends and patterns can provide insights, they are not guarantees of future price movements. Investors should exercise caution and carefully consider their risk tolerance and investment objectives before investing in 1inch or any other cryptocurrency.

Question-answer:

What is 1inch’s price history?

1inch’s price history refers to the historical price movements and fluctuations of the 1inch cryptocurrency token. It includes information on past prices, trends, patterns, and the factors that have influenced its price over time.

What are the current trends in 1inch’s price?

The current trends in 1inch’s price are constantly changing due to market dynamics. It is advisable to consult the latest market data and analysis to get an accurate understanding of the current trends in 1inch’s price.

Are there any patterns in 1inch’s price history?

There may be patterns in 1inch’s price history, such as price consolidations, breakouts, and recurring trends. These patterns can sometimes provide insights into future price movements, but it is important to note that past performance is not indicative of future results.

Can you provide predictions for the future price of 1inch?

Providing accurate predictions for the future price of 1inch or any cryptocurrency is extremely difficult. The cryptocurrency market is highly volatile and influenced by numerous factors. It is advisable to conduct thorough research, consider expert opinions, and assess market conditions before making any investment or trading decisions.